研报 | 华润医药 (3320.HK) – 半年报点评:製药业务高速增长,分销龙头地位稳固

2018年8月28日

投资概要

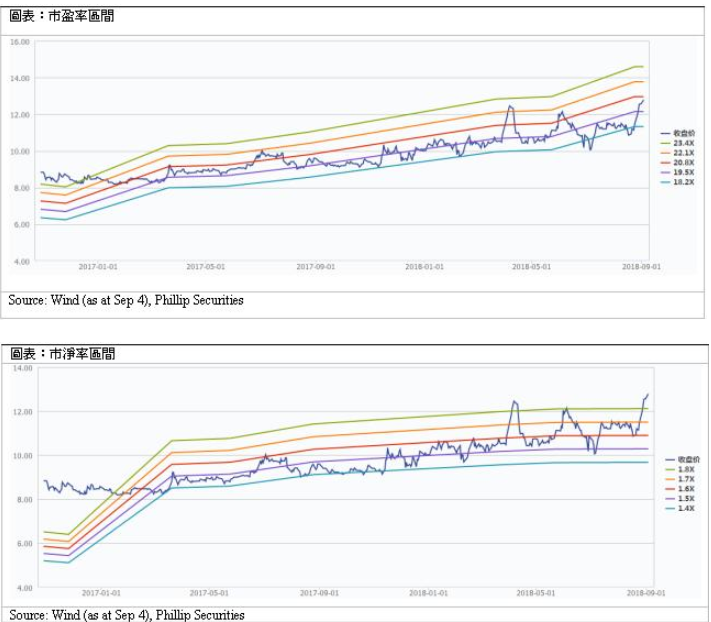

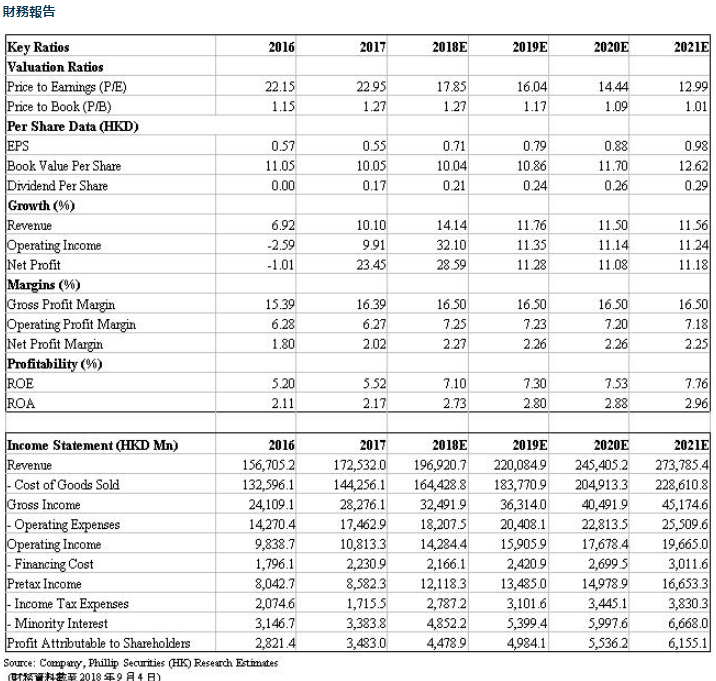

上半年,公司分销、製药、零售三大业务收入分别同比增长10.2%/32.9%/16.7%。公司的销售网路持续优化,製药板块彷创结合,重点佈局生物药领域,通过外延并购等方式推动化药和中药板块发展。由于两票制的影响将在2018年下半年消除,预计业绩增长更加正面,因此我们上调目标价至15.2港元,对应2018年目标市盈率19倍。(现价截至9月4日)

公司概况

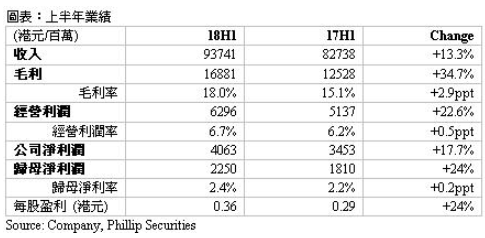

半年报财务表现。公司上半年实现收入93,741百万港元,同比增长13.3%。毛利16,881百万港元,同比增长34.7%,毛利率升2.9个百分点至18%。经营利润增长22.6%至6,296百万港元,经营利润率上升0.5个百分点。费用显着上升,销售费用占收入比率从17H1的6.7%升至9%,主要是受两票制影响,使销售费用上涨。归母淨利润同比上升24.3%,淨利率上涨0.2个百分点。

製药业务。公司的製药业务实现分部收益16,874.5百万港元,同比增长32.9%。毛利率为63.7%,较17H1水准上升3.6个百分点,主要得益于产品组合的持续优化,以及生产流程的改进。按产品划分,1) 化药录得收益港币8,039.1百万元,较上年同期快速增长50.9%,主要受益于抗感染药物、输液产品、以及慢病与专科用药的收益增加;2) 中药录得收益港币7,496.5百万元,同比增长19.9%,主要因为多个品类的中药OTC产品、心脑血管等领域中药处方药、以及中药配方颗粒的收益增加;3) 生物药业务实现收益港币88.5百万元,受销售模式调整影响较上年同期增长39.1%;4) 营养保健品受益于产品品类的不断丰富,录得收益港币306.9百万元,同比增长93.6%。

分销业务。上半年医药分销业务实现分部收益港币77,601百万元,同比增长10.2%;毛利率为7.4%,较17H1水准提升1.0个百分点,主要是得益于近年来向医疗机构直销收益佔分销业务收益的比例持续增加。上游方面,公司继续加快对于优质产品的引进,拓展进口增值服务,不断优化产品结构,并大力推动医疗器械分销业务专业化快速发展。下游网路方面,公司加快分销业务在西部空白省份的网络佈局,并通过加强渗透基层市场,进一步提高下游终端掌控力。截至上半年末,公司的医药分销网络已覆盖至全国27个省、直辖市及自治区,客户中包括二、三级医院5,857家,基层医疗机构38,954家,以及零售药房28,916家。零售业务。医药零售业务录得收益2,470.4百万港元,同比增长16.7%,毛利率为16.3%,较17H1水准下降0.9个百分点,主要因为利润率相对较低的高值药品直送业务(DTP)快速增长。公司进一步整合品牌、产品及资讯系统等方面的零售资源,丰富和优化产品品类,并积极开展DTP、慢病管理等创新业务模式。目前公司共有812家零售药房,DTP药房94家,覆盖中国超过50个城市。

研发管线。公司的研发储备集中于心血管系统、抗肿瘤、消化道和新陈代谢、中枢神经系统、免疫系统等领域。上半年研发支出为港币649.0百万元,同比增加63.5%,占製药业务收入比重为3.8%。现有创新药在研项目37个,一个抗肿瘤药物处于II期临床阶段,一个呼吸系统用药已在中国、美国啓动临床申报,处于注册审批阶段的项目共19个。聚乙二醇重组人促红素注射液等四个产品获得临床批件,白消安注射液等三个产品获得生产批件,进一步丰富了製药业务的产品綫。公司积极推进一致性评价工作,重点开展的一致性评价专项项目超过40个,多个项目已开展了生物等效性临床试验。7月公司的苯磺酸氨氯地平片(5mg)通过了一致性评价。

提升生物药实力。公司对旗下生物药业务相关的研发、生产、营销等资源进一步整合。6月,华润医药与华润生物医药公司分别以其持有的在研产品以及现金共同出资,对昂德生物药业进行重组,增资后,华润医药与华润生物医药共同持有昂德生物的51%股权。昂德生物成立于2001年,原为东阿阿胶的全资子公司,在重组蛋白类生物药的研发、生产能力方面具备较好基础。华润医药注入的两个产品均为糖尿病领域重组蛋白产品,极具市场潜力,预期将与昂德生物自有在研产品(地特胰岛素)形成完善的产品组合,同时借助集团层面的资金、技术、营销管道资源等优势,协同销售。公司重视生物药领域佈局,目前有注射用重组人促红素、瑞替普酶等在产产品,并且具有高潜力在研产品,重点佈局抗肿瘤、免疫、心脑血管等领域。同时,华润医药还将通过收购、产品引进、国际化合作等形式加快获得优质品种,提升公司在生物药业务的整体实力。

外延并购推动化药和中药板块发展。公司在中药、化学药治疗领域实施多个外延併购项目,丰富产品组合,拓展业务佈局。1) 中药板块。公司将以现金或资产方式收购或认购江中集团51%或以上的股权。江中集团持有江中药业43.03%的股份。江中药业为中国领先的OTC产品生产企业,在胃肠、口咽品类有较高的品牌知名度和市场份额,未来可在品牌、产品、生产、研发、销售管道等多个方面与华润的製药业务实现协同价值。2) 化药板块。5月,华润双鹤宣佈收购湘中製药45%股权,以加强对精神、神经专科药物产品綫的佈局,并加强对精神专科医院的销售能力 。8月,华润双鹤宣佈进一步收购湘中製药40.65%股权,交易完成后,华润双鹤合计持有湘中製药85.65%股权。公司一系列外延收购将加强公司对产业链的掌控能力,增强在化药和中药板块的实力。

估值与风险

我们上调目标价至15.2港元。我们预测18/19年收入增速为14%/12%,对应每股盈利为0.71/0.79港元,基于19倍目标市盈率,目标价15.2港元。下行风险包括:研发失败风险;分销业务增长不及预期;政策风险。

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合