辉立宏观观测报告 | 寻找10年期国债收益率的上限

10 年期美国国债收益率突破了3 %的关键水平

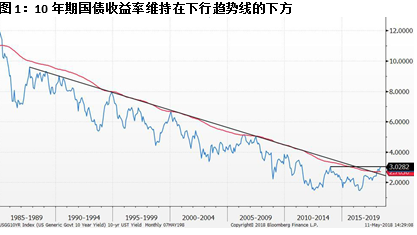

2018年4月24日,10 年期美国国债 (UST) 的收益率自2013年12月以来,首次接近突破3%的关键阻力位。10年期UST 的3%收益率,在很大程度上被市场参与者视为决定30年期债券市场牛市终结的关键水平。

自从险破3%以来,10 年期的UST 收益率已下降了50个基点至2.95%左右,并围绕3%作水平波动。随着美联储继续计划提高其联邦基金利率,我们认为10年期的UST收益率也将跟随这种上升的利率环境而同步走高。

到2020年,随着联邦基金利率的提高,国债收益率也将上升

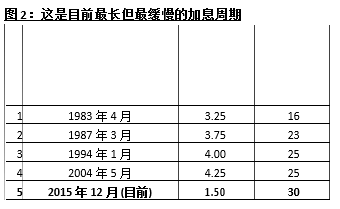

目前的加息周期是自2015年12月开始,现已进入第30个月,这是自1980年以来最长的周期之一。然而,这也是美联储基金利率中最慢的加息之一,自周期开始以来,仅增长了1.50%。

平均以言,联邦基金利率在一个周期内会增长3.20%。因此,我们预计,当联邦基金利率达到3.45%时,当前的周期将结束。根据美联储的点阵图,这将在2020年底实现。

实际10年期收益率与GDP增长率相关

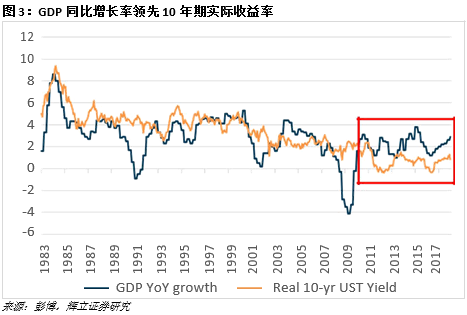

从10年期的票面收益率中剔除通胀 (PCE 核心) ,我们观察到10年期的实际收益率与GDP的同比增长率同步。实际上,从历史上看,10年期实际收益率往往高于GDP增长率,这反映出投资者承担了美国主权风险的溢价。

然而,在2009年全球金融危机 (GFC) 之后,这种相关性被打破了。美联储 (FED) 的量化宽松计划 (QE) 人为地抑制了10年期的实际收益率。这使得10年期的收益率水平低于GDP增长率,如图3红色框所见。历史上第一次,10年期实际收益率在2012年和2016年被推至负值,因为美联储为要将利率维持在零水平,以试图刺激通胀。

解除量化宽松计划终于在2017年10月落实。随着量化宽松的解除,我们认为,10年期的收益率应会缩小差距,并回到历史水平,即高于美国GDP的同比增长率。

从长期来看,10年期的票面收益率应达到4.7%

在全球金融危机发生前,10年期实际收益率的平均溢价比GDP增长率高出93个基点。据美联储称,长期GDP增长预计约为1.8%。加上93个基点的溢价,和长期核心PCE通胀率为2%的估计,将为我们得出以下的10年期票面收益率公式。

1.8% + 0.9% + 2.0% = 4.7%

长期 风险 长期PCE 10年期

GDP 增长率 核心

溢价 票面利率

通胀率

因此,我们可以得出的结论是,如前所述,如果我们通过全面的加息周期,10年期国债的票面收益率应达到4.7%的估计水平。

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,新加坡证券交易所(SGX),辉立宏观观测报告