新加坡银行业每月快讯:消费疲软被商业贷款抵消

2019年7月2日

增持 (维持)

星展集团控股 :增持 (维持)

彭博代码:DBS SP

收盘价:SGD 26.40 | 预测DIV:SGD 1.20

目标价:SGD 29.00 | 总回报:14.39%

华侨银行集团:增持 (维持)

彭博代码:OCBC SP

收盘价:SGD 11.46 | 预测DIV:SGD 0.45

目标价:SGD 12.70 | 总回报:14.75%

大华银行集团:增持 (维持)

彭博代码:UOB SP

收盘价:SGD 26.42 | 预测DIV:SGD 1.28

目标价:SGD 30.90 | 总回报:21.80%

摘要

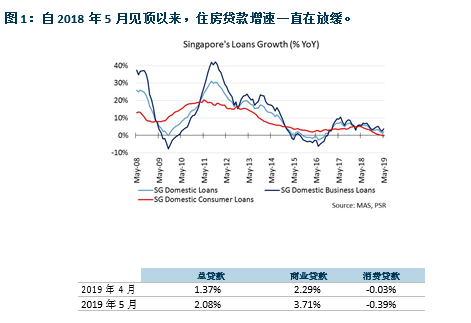

新加坡贷款同比增长稳定在2.08%。受住房贷款持续疲软拖累,消费贷款(同比下降0.39%) 出现数十年来的第二次收缩。国内存款同比增长7.4%,受定期存款同比增长22.0%的支撑,为12年来最快的增速。CASA 存款继续收缩,同比增长为 -1.1%。3个月SIBOR 稳定在2.002%,而3个月SOR 下跌22 个基点至1.833%。对新加坡银行业维持增持评级。虽然贸易战在短期内影响了投资者情绪,但我们相信,银行的基本面保持不变,能够抵御风险,实现持续增长。

新加坡的贷款增长不温不火,同比增长2.08% (4月同比增长1.37%)

新加坡金融管理局(MAS)的最新统计数据显示,5月份贷款增长缓慢,同比增长2.08%。商业贷款同比增长3.71%,抵消了消费贷款同比收缩0.39%的影响(图1)。B&C 贷款增长保持强劲,同比增长12.9%,原因是现有项目的贷款减少。我们预计,房地产降温措施,将在2019年底冲击B&C 贷款的增长。消费贷款(图1) 连续第二个月收缩,这是受持续疲软的住房贷款同比增长下降0.39%的冲击,以及房产降温措施和高利率的影响。我们假设,由于房产降温措施以及全球贸易和地区贷款放缓所带来的不利影响,新加坡银行业在2019财年末的贷款增长将放缓至4-6% (2018年:7-11%) 。

存款 – 随着CASA增长萎缩,流动性状况趋紧

定期存款继续飙升,同比增长22.0%,超过了总存款同比7.4%的增长,因为各银行继续通过提供有吸引力的利率来争夺存款,使3个月的SIBOR 高于2% 的水平,这是在2004-2006年美联储上一次加息周期中出现的水平。CASA 存款同比收缩1.1%,为3年来增速最慢的水平(图2)。当利率高企时,新加坡元定期存款通常会受到投资者的强烈追捧,他们会把资金转向更高收益的投资。

随着定期存款在存款组合中所占的比例较高,资金成本上升,使各银行想要充分管理好成本,以实现NIM的扩张,这将是一个持续的挑战。然而,我们预计定期存款的竞争将在2019下半年逐渐减弱,因为预期美国在2019年将不再加息,这使得资金的压力有所缓解。

投资行动

对新加坡银行业维持增持评级。虽然贸易战在短期内影响了投资者情绪,但我们相信,银行健康的基本面保持不变,能够抵御风险,实现持续增长。

尽管地区增长放缓,但经营环境依然稳定。资产质量良好,尽管中小企业投资组合因贸易流动放缓而可能面临一些压力。增加银行业务的多元化,使收费收入(贷款,信用卡,财富管理等) 更为稳定,以减少因收入流波动(交易收入,投资收益等)产生收益所占的比例。更好的成本管理和较低的拨备也应能提升净资产收益率。凭借其强劲的资本充足率支撑,银行业提供了颇具吸引力,约为5%的股息收益率。

由于预计今年至少会有一次降息,我们预计NIM的下行风险将在2020财年显现,因为贷款重新定价至较低利率,需要一些时间才能实现。

UOB 仍是我们的首选,主要是因为与其他同业相比,它在贸易战影响方面的敞口相对较小。截至2019年一季度,UOB来自大中华区和香港贷款的税前利润为10% (DBS: 29% 和OCBC: 19%)。

研报为翻译版本,仅供参考。如果有出入,一切请以英文版本为准。

本文为英文翻译版本,仅供参考,一切请以英文版本为准。如果有想了解更多全球股市资讯,请关注微信公众共 “辉立资本新加坡” (SGPSPL)。同时提供在线免费开设股票账户,一个账户轻松交易美股,港股,新加坡股

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合