新加坡股票研报 | 凯德商用新加坡信托(CapitaLand Mall Trust)

凯德商用新加坡信托

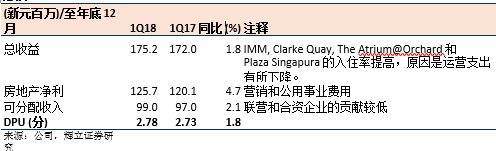

2018年一季度的房地产净利和每单位分红在我们预测范围内。

较高的入住率和较低的运营支出支持DPU的同比增长1.8%。

整体承租销售仍然低迷,但有几个分部门的表现出色。

Sembawang 购物中心(SSC) 以2017财年1.97倍的估值出售,给我们一个正面的惊喜。

维持中性评级,考虑到撤资收益,目标价上调至新元2.05 (原先为新元2.03)。

积极方面

入住率的提高和运营支出的减少支撑着DPU,而在租赁销售方面仍然面临着充满挑战的运营环境。这些都是在租赁和承租销售同比平稳回升的背景下发生的。我们很高兴看到从2017财年开始,负租金的回归 (-1.7%) 缓和。尽管如此,鉴于承租的入住成本提高了18.7%,我们认为承租销售需要改善才能使这一趋势持续下去。

SSC以2017财年1.97倍的估值出售给Lian Beng,这是一个正面的惊喜。这意味着退出上限利率为c.2.6%。我们认为,买家支付巨额溢价的意愿,可以归结为SSC拥有999年的租期。在CMT的投资组合中,其他购物中心的租赁期限从60-99年不等。截至2017财年,SSC 占集团投资物业总额的2%以下。

2018财年没有更多的债务到期。2018年一季度,管理层对价值6.05亿新元的贷款和为期6年的MTN进行了再融资。这些贷款将于2018年到期。再融资是以较低的利率进行的 (尽管使用的贷款期限较短,从1-4年不等)。2018年不再有债务到期,因此今年几乎没有再融资风险。

消极方面

整体的承租销售仍然疲软,同比下跌0.2%。这与2017财年的同比变化持平。GRI (F&B,时尚,美容和健康) 这三个最大的贸易部门继续努力实现有意义的销售增长。这些部门在2017财年中,贡献了GRI的55%。

前景

尽管利率普遍上升,但2018财年的融资成本仍将保持稳定,因到期的贷款将以较低的利息成本和较短的贷款期限重新融资。从SSC获得的撤资收益也可以用来进一步削减债务,以及用于Funan的再开发资本支出。在2018/2019财年末,我们假设从撤资所得拿出300万/600万新元追加到DPU中,以弥补来自SSC的收入损失。我们对DPU 的预测维持不变。承租销售的增长还不足以让我们预见到更有意义的租赁回升。

投资活动

维持中性评级,上调目标价至新元2.05 (原先为新元2.03)。

考虑到SSC撤资的因素,我们调整了预测。目标价的上涨是考虑到撤资所得的1.22亿新元,以及在没有SSC租赁收入的情况下,我们假设从2018财年到2020财年,将有现金追加DPU。

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,新加坡证券交易所(SGX),CapitaLand Mall Trust