研报 | 昇崧集团(Sheng Siong):仍在抢占市场份额

2019年5月2日

增持 (升级)

收盘价:SGD 1.03 | 预测DIV:SGD 0.037

目标价:SGD 1.30 | 总回报:29.8%

摘要

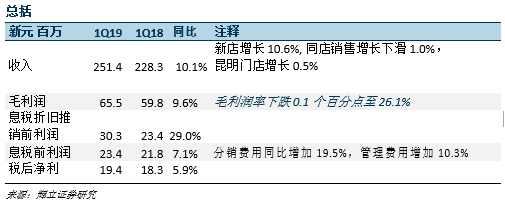

2019年一季度的收入超出我们的预期。税后净利低于预期,因为运营支出略高于预期。与去年相比,毛利润率相对持平。今年新增3家门店,店面总面积增加了3% 。我们的预测保持不变。评级从买入升级至增持,而目标价不变仍为新元1.30。门店的持续扩张和市场份额的增长为增长的双重驱动因素。

积极方面

销售增长健康。2019年一季度的销售同比增长为10.1%,高于我们预测的7%。 增长完全是由新店增长支撑,因为同店销售同比收缩1%。

新增3家门店。2019年5月,昇崧新开了3 家门店 (或者新增面积15,780 平方英尺)。这将使店面总面积增加3%。这3家门店是从已放弃的现有网点中,重新招标的接近招标价的店面。另外6家新店最近被HDB招标了。这些门店可能包括非价格因素作为要求的一部分。

消极方面

同店销售令人担忧。同上季度一样,同店销售是其薄弱环节。这一季度收缩了1%。这与零售商场内的超市相比,录得的同店销售额下降接近2%*。

运营支出呈上升趋势。2019年一季度的运营支出占销售额的17.7%,略高于我们预测的17.5%。新开门店需要时间来扩大规模。据公司称,由于退税的时机选择,毛利润率略有下降。今年一季度,新鲜产品在销售组合中的贡献,实际上比去年同期更高。

*使用基于凯德商务信托2019年一季度公布的数据。

前景

尽管消费者信心疲软,但昇崧在超市销售中所占的市场份额却一直在提高。截至2019年2月底,新加坡的超市销售额迄今收缩近2%。昇崧可凭借其10%的销售增长,抢占市场份额。我们对其前景仍然保持乐观。2019年在零售领域实现近11%的增长,这将有助于支撑增长。另一个增长动力将是增加每平方英尺的销售额。

升级至增持评级,目标价不变仍为新元1.30。

我们的目标价是基于对25倍市盈率的预测。该公司正在扩展其门店数量,增加市场份额,目前通过其8700万新元的净现金资产负债表,能提供25%的净资产收益率。

本文为英文翻译版本,仅供参考,一切请以英文版本为准。如果有想了解更多全球股市资讯,请关注微信公众共 “辉立资本新加坡” (SGPSPL)。同时提供在线免费开设股票账户,一个账户轻松交易美股,港股,新加坡股

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合