研报 | 泰国酿酒(Thai Beverage)全线烈酒-创纪录的季度

2020年2月17日

买入 (升级)

收盘价 SGD 0.785 | 预测DIV SGD 0.025

目标价 SGD 0.950 | 总回报 24.2%

摘要

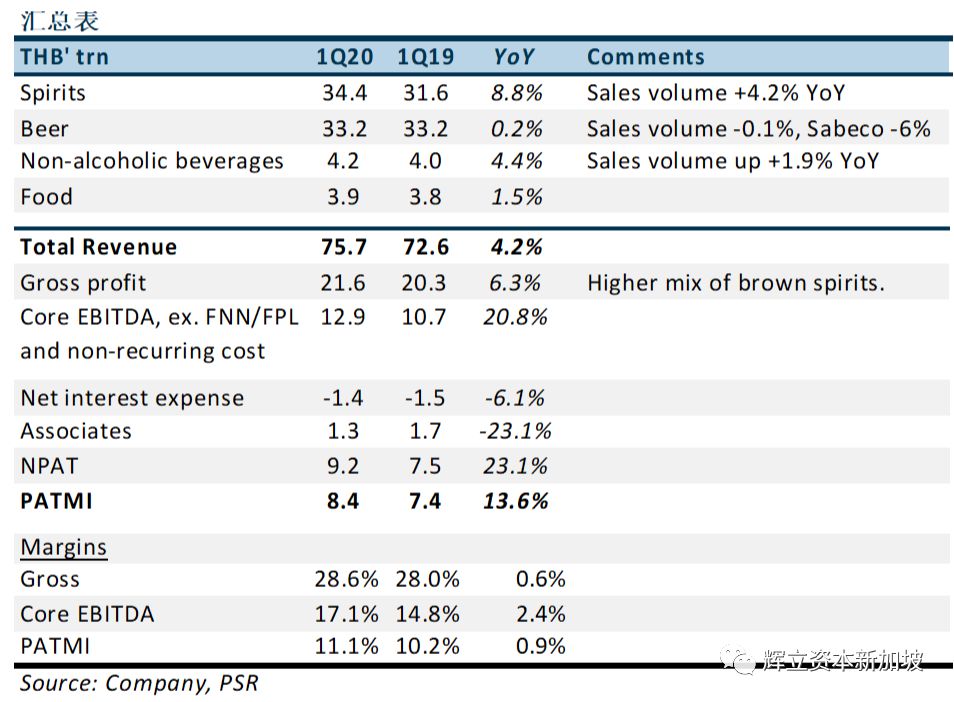

收入在我们的预期之内,但盈利超出了预期。啤酒业务令人失望,但烈酒业务表现良好。

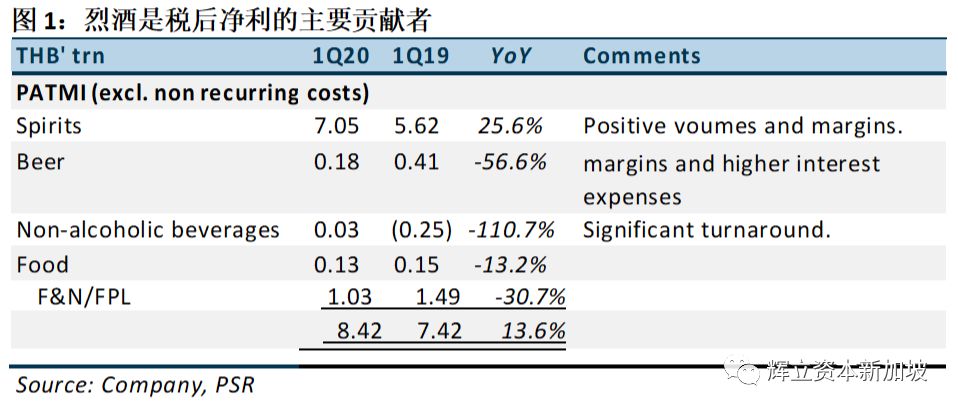

2020年一季度,烈酒部门净利润同比激增25%,原因是销量增加和利润率提高了。烈酒在集团的税后净利中占比84%。销量达到创纪录的8900万升。

啤酒销量令人失望。2020年一季度,Sabeco 的销量下滑6%,这是由于有关其所有权的某些传言所致。

我们将建议升级至买入评级。烈酒业务的销量和利润率均优于预期。Sabeco啤酒业务将在未来几个季度中复苏。我们将分类加总估值法派生的目标价提高至0.95新元 (先前目标价为0.80新元)。2020财年末的收益提高了6%。我们提高了对利润率的假设,并对NAB业务的盈利能力进行了建模

积极方面

烈酒业务的利润率扩张。2020年一季度的销量增长了4.2%。棕色烈酒的利润率和价格均有所提高,增长了6至7%。精选的棕色烈酒将于2019年12月至2020年2月期间提价。白酒的利润率部分地受到瓶子的变化而有所提高。由于上个季度的库存积压,缅甸的烈酒销量疲软,导致销量下降。

非酒精饮料(NAB) 实现逆袭。由于息税折旧摊销前利润(EBITDA)从-0.4% 大幅跃升至10.6%,致使利润率首次受到冲击。对传统渠道的关注,降低了广告和促销费用。SG&A 费用在今年一季度同比下降11%。

消极方面

Sabeco 啤酒的销量举步维艰。2020年一季度,Sabeco 的销量同比下降6%。这是由于某些假新闻的传播,打击了销量。在政府的新闻发布和有影响力人士的支持下,这一情况正在不断改善。国产啤酒表现良好,销量同比增长13.5%。

前景

我们对前景更为乐观。我们最初的担忧关注在泰国的消费支出上,尤其是农业收入。泰国的农业收入一直富有弹性,特别是在政府的支持下。烈酒不仅销量可观,消费者更在购买价格高昂,以及利润率更高的棕色烈酒。啤酒的销量令人失望,但我们预计,在度过了这段低谷后,销量将出现反弹。

Covid-19(新冠肺炎)的不幸爆发将抑制销量,特别是在贸易或店内消费的饮料方面。就泰国酿酒而言,啤酒最容易受到贸易消费的影响。另一类风险敞口是游客人数减少造成的销量损失。核心的棕色烈酒相对不受影响,因为消费主要是在家里和当地的消费者。

投资行动

通过分类加总估值法,升级至买入评级,派生的目标价为0.95新元。

我们正在升级评级建议,从减持升至买入。我们基于分类加总估值法派生的目标价上调至0.95新元 (先前目标价为0.80新元),这是因为2020财年末的收益提高了6%,以及低于同业的估值折扣。

本文为英文翻译版本,仅供参考,一切请以英文版本为准。如果有想了解更多全球股市资讯,请关注微信公众共 “辉立资本新加坡” (SGPSPL)。同时提供在线免费开设股票账户,一个账户轻松交易美股,港股,新加坡股,中国A股,越南股票,韩国股票,德国股票,马来西亚股票,泰国股票,印尼股票,菲律宾股票,日本股票,澳大利亚股票,台湾股票,加拿大股票,英国股票,法国股票,荷兰股票,葡萄牙股票,比利时股票,土耳其股票