大华银行有限公司(UOB): 费用增长将抵消2020年净息差的收缩

2019年11月4日

增持 (维持)

收盘价: SGD 26.6 | 预测DIV: SGD 1.3

目标价: SGD 27.8 | 总回报: 9.6%

摘要

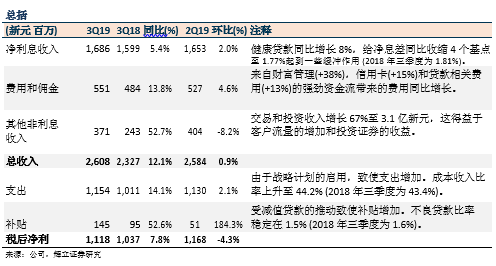

2019年三季度的营收和税后净利符合我们的预期。

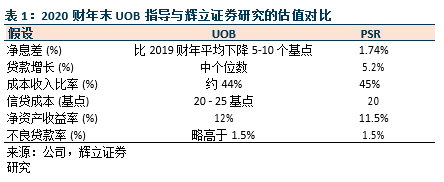

由于利率下降和竞争激烈的定价环境,净息差同比下降4个基点,环比下降至1.77%。预计到2020财年,净息差将收缩5-10个基点。

贷款增长保持强劲,同比增长 8%,而贷存款比率健康增长89% (2018年三季度为86%)。

费用收入同比激增14%,这是因为财富管理,信用卡和贷款相关等费用的强劲增长。

针对减值资产的津贴增加了53%。整体资产质量稳定,不良贷款率处于1.5%的健康水平(2018年三季度为1.6%)。

维持增持评级,并下调目标价至27.80新元 (先前目标价为28.60新元)。下调目标价是因为我们将2020财年末的盈利减少了2.3%。我们将2020财年末的净息差下降4个基点至1.74%,以及将信用成本增加4个基点。

积极方面

贷款保持强劲增长,同比增长8%。尽管住房贷款连续第二个季度出现同比下降1%的收缩,但UOB在新订单中仍保持其市场份额,其中多数来自二次再融资市场。从地理上看,贷款增长来自新加坡(同比增长6%),泰国 (同比增长16% ) 和大中华区(同比增长15)。展望未来,由于全球逆风抑制了商业信心,贷款增长预计将从当前水平放缓至2020财年的中个位数水平。我们预计2020财年的贷款同比增长5.3%。

费用收入同比激增14%,这是因为财富管理,信用卡和贷款相关费用的强劲增长所致。受东南亚日益富裕的支持,AUM同比增长10%,达到1220亿新元,其中60%来自东南亚的海外客户。财富管理受到新资金净流入到单位信托,银行保险以及外汇合约的推动。UOB的AUM缓慢而稳定的增长,正印证其在当今动荡的环境下的一种防御特征。

消极方面:

由于利率下降和竞争激烈的定价环境,净息差同比下降4个基点,环比下降至1.77%。UOB 指导2020财年的净息差将收缩5-10个基点,原因是内部预测整个2020财年,其基准利率将下降30-50个基点。然而,美联储降息所带来的影响,可通过调整融资成本,使之与贷款定价相匹配来得到缓冲。因此,我们将对2020财年末净息差的预测,下调4个基点至1.74%,比2019财年预测净息差保持不变在1.80%,下降了6个基点。

受减值贷款的推动,补贴增加了53%。当前的资产质量保持良好,全年信贷成本预计将保持在20-25个基点的指导区间内。然而,管理层预计在2020财年,ECL将略有增长,因为宏观经济疲软,而随着UOB更新其ECL模型,总体的拨备将增加。2020财年的信贷成本预计不会超过25个基点。本季度的不良贷款率保持在1.5%的健康水平 (2018年三季度为1.6%)。

管理层预计商业信心将受到全球逆风的压制,但因为公司在东南亚地区实施多元化业务,从中长期来看,对东南亚仍保持乐观。

前景

维持增持评级,下调目标价至27.80新元 (先前目标价为28.60新元)。下调目标价是因为我们将2020财年末的净利润下降了2.3%。我们将净息差削减了4个基点至1.74%,并将信贷成本假设提高了4个基点。我们的目标价是基于1.3倍的目标市净率,源自戈登增长模型 (ROE假设:11%,COE:9.3% (贝塔系数:1.2倍),增长率:2.0%)。我们预计2020财年的每股收益为1.27新元,受股息收益率4.8%的支持。

本文为英文翻译版本,仅供参考,一切请以英文版本为准。如果有想了解更多全球股市资讯,请关注微信公众共 “辉立资本新加坡” (SGPSPL)。同时提供在线免费开设股票账户,一个账户轻松交易美股,港股,新加坡股,中国A股,越南股票,韩国股票,德国股票,马来西亚股票,泰国股票,印尼股票,菲律宾股票,日本股票,澳大利亚股票,台湾股票,加拿大股票,英国股票,法国股票,荷兰股票,葡萄牙股票,比利时股票,土耳其股票