辉立宏观经济分析: 美国大选: 市场和行业概览

选举日前后的历史市场表现

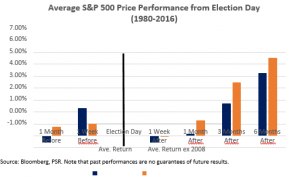

选举日前夕。在过去的选举年(1980-2016)期间,2008年除外,在选举日前一个月,S&P 500(标准普尔500)平均上涨了0.73%,而在选举日前一周的平均涨幅达到0.99%(图1)。考虑到新冠疫情卷土重来引发的市场动荡,财政刺激措施的延迟,以及对选举结果充满争议或延迟的风险,我们认为类似的规律今年将不会重演。这是自1980年以来,第二次在选举期间,进入到选举前一周,S&P500没有显示积极的表现。

选举日之后。市场表现往往在数周内保持相当低迷。这可能是因为选举之夜公布的结果,被认为是非官方的。由于结果需要在各州进行核实确认,所以结果的认证可能需要数周的时间才能出炉。在一场势均力敌的竞选当中,认证的过程甚至更为关键,并可能需要更长的时间,从而引发市场动荡。一些投资者在结果最终敲定之前,可能保持观望的态势。然而,如果我们扩大投资的视野,将会看到在那之后,市场往往会重新获得动力。S&P 500在选举日3个月后,其平均回报率为4.44%,而在选举日6个月后的回报率为6.52% (图1)。

建议。由于今年邮寄投票的激增,选举产生纠纷的风险更大。市场情绪可能会在短期内规避风险。

我们仍然相信,无论谁当选总统,都会有财政刺激措施,尽管这可能会推迟到2021年2月。我们还对到2021年中,开发出新冠肺炎疫苗抱有希望,目前有11只潜在疫苗处于第3阶段试验。这可能会缓解人们对新冠病毒卷土重来的担忧,并恢复股市的风险情绪。我们仍然看好2021年的市场。

图1:S&P 500在选举日前一个月至选举日后一个月的表现趋于低迷,然后在3-6个月后才会恢复动力。

特朗普获胜可能比拜登获胜更多地推动市场走高,然而尽管如此,投资者应该长期投资于…

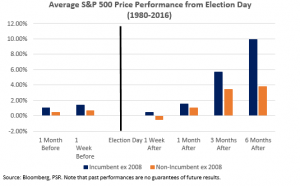

在过去的选举年间(1980-2016),S&P 500在现任总统连任中,其回报率往往高于非现任总统当选(图2)。这意味着如果特朗普连任,可能对市场更有利,特别是考虑到他倾向有利于商业的减税措施及放松监管。然而,无论谁赢出这场竞选,我们认为投资者都应该继续投资。从历史上来看,非现任总统获胜,选举日的3个月后其平均回报率仍为3.47%,而在选举日结束的6个月后,平均回报率为3.77%(图2)。

图2:现任总统往往比非现任总统带来更高的回报

选举日的行业表现 (1992-2016)

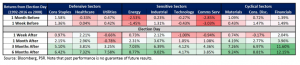

我们在图3总结了,在过去选举年度(1992-2016年,2008年除外)不同行业的历史回报。我们省略了2008年,因为那一年的回报受到全球金融危机的严重影响。

图3:自选举日起,各行业的历史表现

由于不确定性,可能会在选举日之前进行风险规避。在过去的选举年间,防御板块的表现往往优胜于敏感和周期性板块。这可能反映了投资者对选举结果的不安。各板块的回报普遍疲软。能源和通信服务等敏感板块往往表现不佳。

短期内,市场可能依然低迷。大选后的数周内,市场表现往往较为低迷。走势较强的板块包括医疗保健,工业和金融。

从长远的投资角度来看,多头有望获利。如果投资者采取的是,在大选3-6个月后较长的投资时期的策略,那么他们将受益于所有板块转为看涨的投资情绪。传统上,周期性板块表现优异,其中金融,材料和非必需消费品板块的表现最为强劲。

拜登领导下的赢家和输家

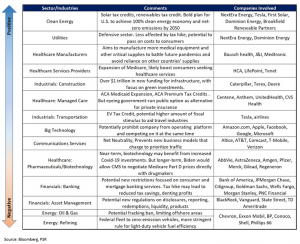

在选举日来临之际,我们在图4总结了拜登获胜对各板块和行业的影响。特朗普获胜预计将支持维持现状,并延续其第一个任期以来的政策。

图4:拜登领导下的潜在赢家和输家

如果有想了解更多全球股市资讯,请关注微信公众号 “辉立资本新加坡” (SGPSPL)。同时提供在线免费开设股票账户,一个账户轻松交易全球股票和ETF

美股,港股,新加坡股,中国A股,越南股票,韩国股票,德国股票,马来西亚股票,泰国股票,印尼股票,菲律宾股票,日本股票,澳大利亚股票,台湾股票,加拿大股票,英国股票,法国股票,荷兰股票,葡萄牙股票,比利时股票,土耳其股票

如果本文是英文翻译版本,一切请以英文为准