研报 | 云南白药 (000538.SZ) – 回档现买入时机

投资概要

近期市场波动加剧,公司股价回落,出现买入机会。我们重申公司基本面情况良好,一季度营业收入同比增长7.26%,淨利润同比增速11.18%,经营活动产生的现金淨流量同比增加137.75%。公司销售人效在溷改后改善明显。同时,建议关注公司医疗业务进展。我们预测2018年EPS为3.4元/股,维持33倍目标市盈率,目标股价112.0元。(现价截至6月27日)

公司概况

行业增速放缓,惟龙头强者恒强。中国商务部发佈的《2017年药品流通行业运行统计分析报告》显示,医药批发企业增速放缓,前100位药品批发企业主营业务收入同比增长8.4%,下降5.6个百分点。云南省医药公司的批发业务年营收144.9亿元,在药品批发企业排名中,名列第16位,是区域龙头流通企业。未来,国家各项医改政策相继发佈实施,药品流通行业将进入深度调整期,区域性药品流通企业将加速跨区域并购,实现强者恒强。

溷改之后销售人员效率提升。2010-2016年,销售人员人均效率有所下降。2017年,公司控股股东云南白药控股有限公司引进民营企业新华都和江苏鱼跃作为战略投资者,进一步加深溷合所有制改革。2017年销售人员效率已见提高,销售人员人均收入贡献同比上升9.62%(2016年增速4.19%),人均淨利润同比增速达到2.38%(2016年增速1.6%)。随着溷改效果进一步显现,预计公司有望保持良好的运营效率。

医疗业务值得期待。公司公佈的投资者访谈显示,顺应云南省要把云南建设成健康生活目的地的地区战略,公司作为云南省和昆明市的龙头医药健康企业,有望得到政府政策的支援和倾斜。公司拓展医疗业务的思路包括,寻找例如高等院校端的医疗资源,或结合白药的品牌特点,向骨伤科诊疗方向拓展。建议关注相关进展。

估值和风险

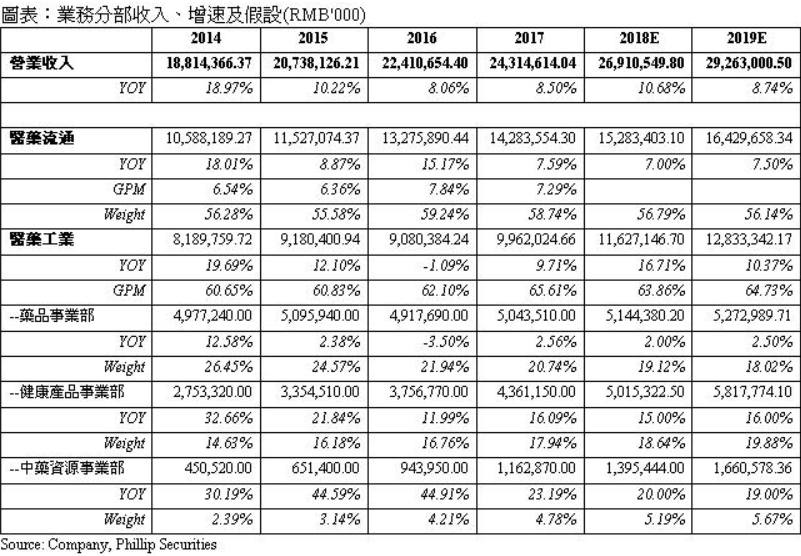

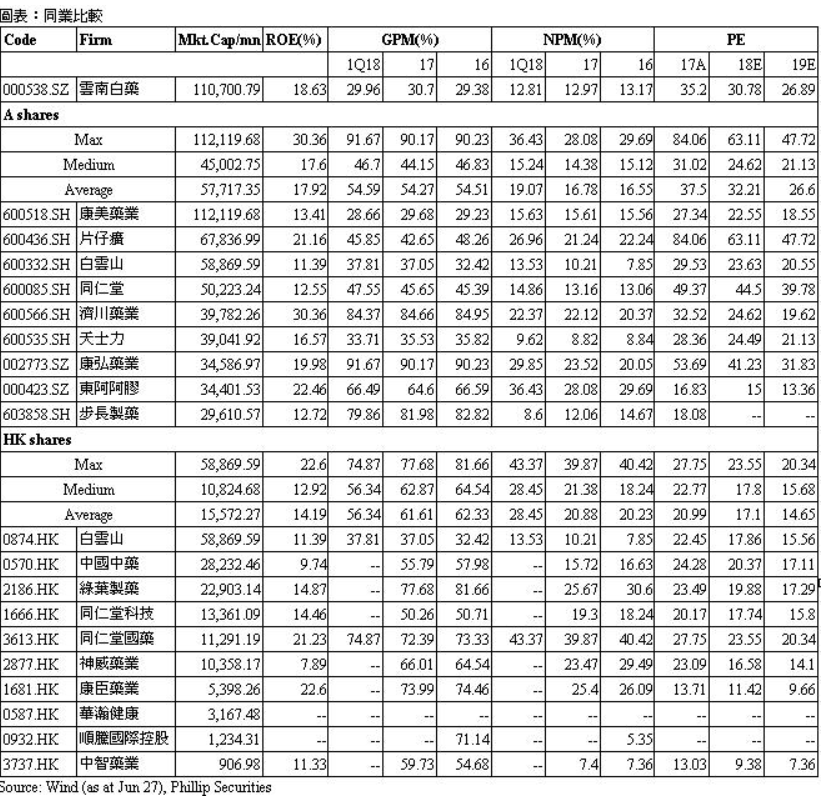

我们的模型显示目标价为112.0元。我们预测未来各分部业务增速,假设2018年EPS预测至3.4元/股,维持33倍目标市盈率,目标股价112.0元。风险包括:销售费用上升;流通业务受两票制影响;健康产品竞争激烈;溷改效果不及预期

关键字:新加坡股票研报,新加坡股,新加坡研报,云南白药 (000538.SZ) ,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,新能源汽车,补贴新政