宇通客车 (600066.CH) – 行业洗牌利好龙头扩张

投资概要

因为行业政策变动影响,宇通客车2017 年的业绩下滑超过两成,补贴政策退坡、账期拉长,以及产品促销削弱了公司盈利能力。不过公司市占率逆势上升,坏账有望转回有利于2018年公司业绩回暖,海外市场也值得期待。我们下调目标价,但维持增持评级。

2017年业绩下滑逾两成

宇通客车2017 年实现营业收入 332.22 亿元,同比减少 7.33%;归母淨利润 31.29 亿元,同比减少 22.62%;每股收益1.41元,每股派息0.5元。业绩低于预期的主要原因是客车行业受到新能源车补贴政策退坡打击。

行业萧条期,市占率大幅提高

财政部2016年12月30日下发通知,将纯电客车的国家补贴下调了20万元每辆,地方补贴不得高于国补的一半,并增加了满足三万公里运营里程的申领条件。受行业政策变动影响,7米及以上客车的全国年销量下降了14%至167588辆,宇通客车产品主要覆盖大中型客车市场,销量也被拖累,但好于行业平均,同比仅下滑5.24%,至67268辆。市占率反而得以提升,在大型客车市场佔有率为28.8%,提升2.9 个百分点;中型客车市场佔有率为 44.2%,提升 4.9 个百分点;在大中型新能源客车市场佔有率提高3.4个百分点至28.3%。

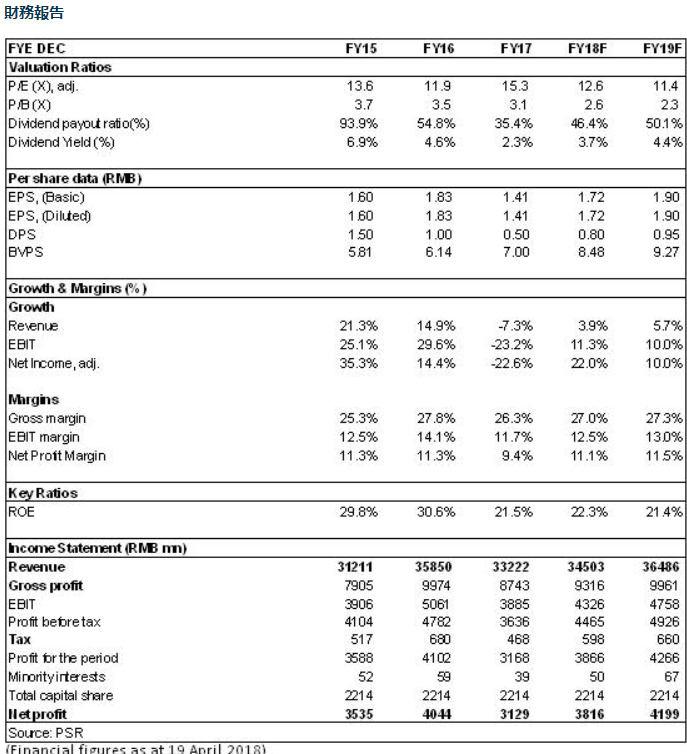

四季度量升利减

2013年以来,由于新能源车行业的特殊性,第四季度旺季现象明显,导致宇通客车全年业绩中第四季度淨利润平均占比接近一半。2017年因前三季销量低迷,四季度公司为完成年初制定的销售目标进行了较大力度的促销活动,削弱了盈利能力,四季度销量大幅增长12%的基础上,淨利润反而同比下滑31%。全年毛利率录得26.32%,较上期收窄 1.5个百分点。

三费攀升strong>

三万公里申领条件使公司应收账款中的国家补贴资金回款週期拉长,对公司的资金和应收账款计提都产生了重大影响。公司 2017 年利息支出 3.33 亿元,比上年同期的 0.88 亿元飙升了 279%,财务费用因此增加79%至4.9亿元;应收账款坏账准备计提 5.07 亿元,比上年同期的 3.61 亿元增长了 40.44%。最终淨利率 9.54%,较上期降低了1.9 个百分点。不过,随着2018年申领条件减少至2万公里,公司的国补回款週期有望缩短,坏账将部分转回,资金压力将得到缓解,2018年业绩有望回暖。

补贴新政下,行业洗牌利好龙头扩张strong>

2018年国家新能源客车补贴政策的进一步调整,提高了行业入门难度,加速优胜劣汰,行业格局将继续优化,利好宇通汽车这样的行业龙头继续扩大市场佔有率。技术方面,公司的核心技术如节能水准处于领先地位,整车安全与控制技术、整车轻量化技术、车联网服务平台等多项核心技术取得突破进展,大大提高了产品竞争力,与 2016 年相比,整车平均能耗降低 5%以上。海外高端产品专桉顺利推进,2017年公司新能源客车出口量同比增加18%至8412辆。与国外同行相比,公司的新能源产品技术成熟度、规模化优势显着,且已经通过当地认证,具备品牌和技术优势,未来值得期待。

投资建议

总体上,虽然2018年产品单价或继续承压,但随着行业格局进一步优化,产品经过时间的检验,技术实力强、产品优质、综合性价比高的企业将在未来新能源客车市场中居于主导地位,海外市场也有望成为公司业绩的另一增长点。

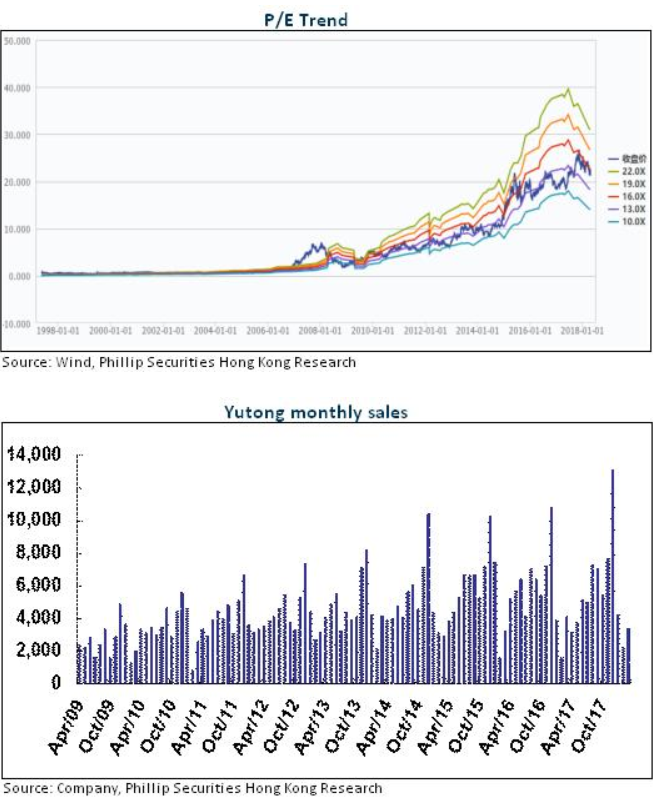

我们预计公司2018/2019年的每股盈利分别为1.72,1.9元人民币,我们给予公司的目标价25人民币元,对应2018/2019年各14.5/13.2倍预计市盈率,增持评级。(现价截至4月19日)

风险

新能源汽车发展不及预期

宏观经济下滑影响客车需求

海外市场风险

关键字:新加坡股票研报,新加坡股,新加坡研报,宇通客车 (600066.CH),新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,新能源汽车,补贴新政