Supplementary Retirement Scheme (SRS)

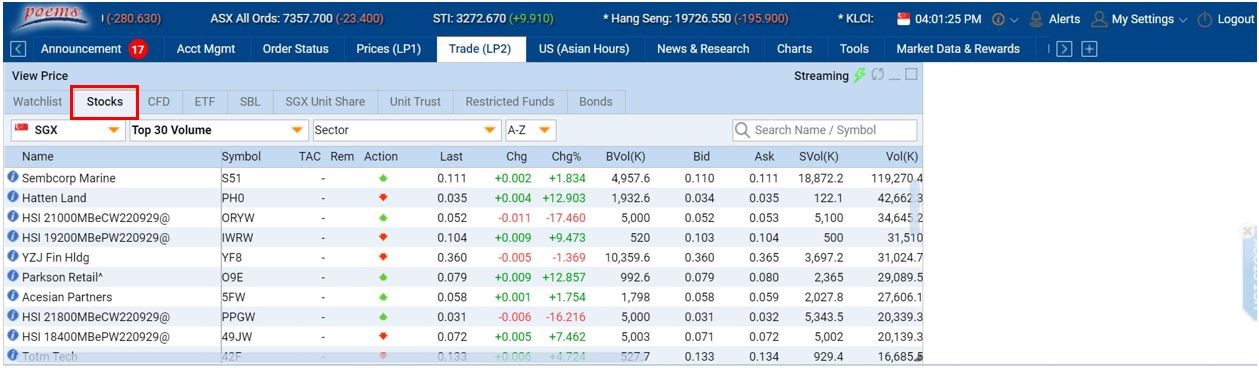

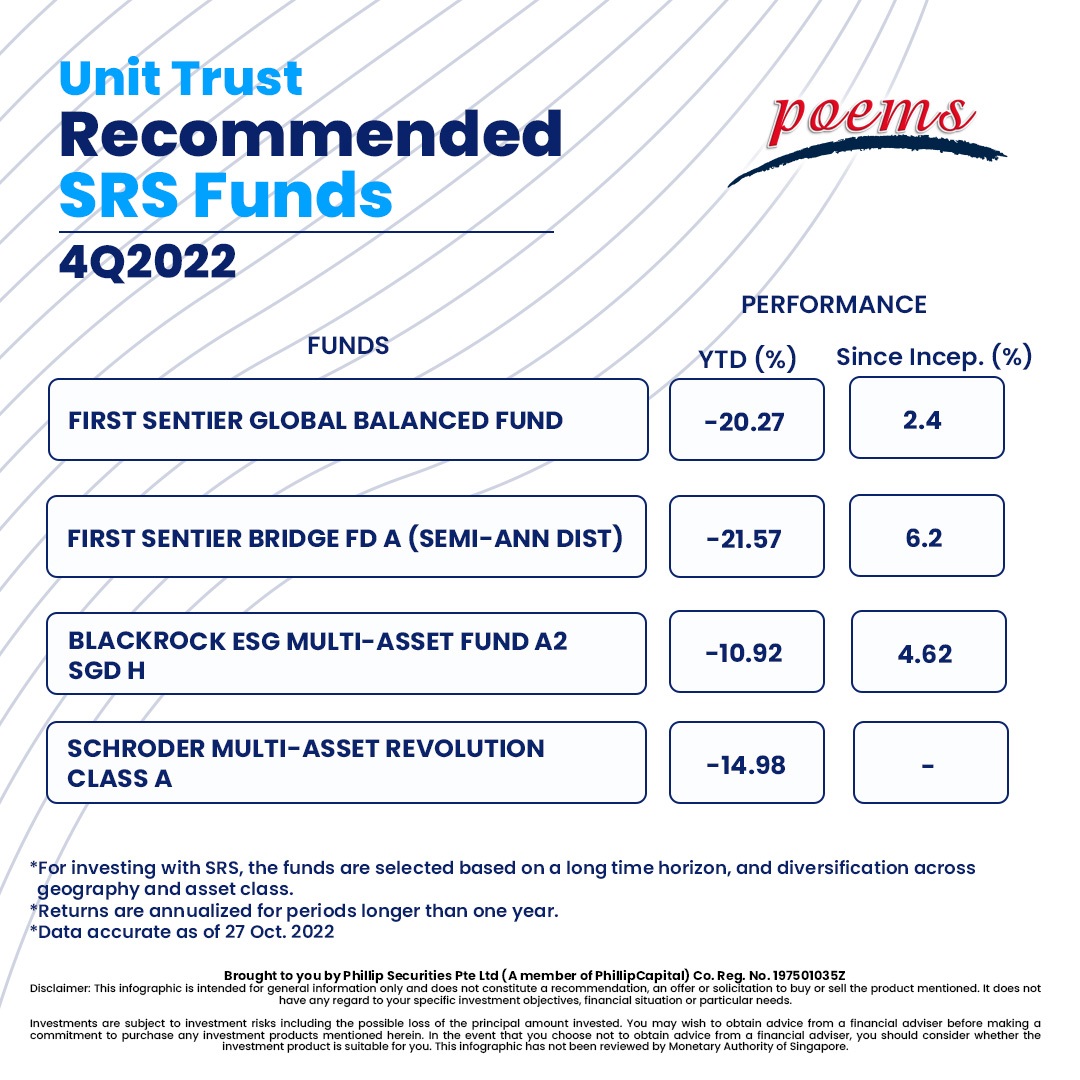

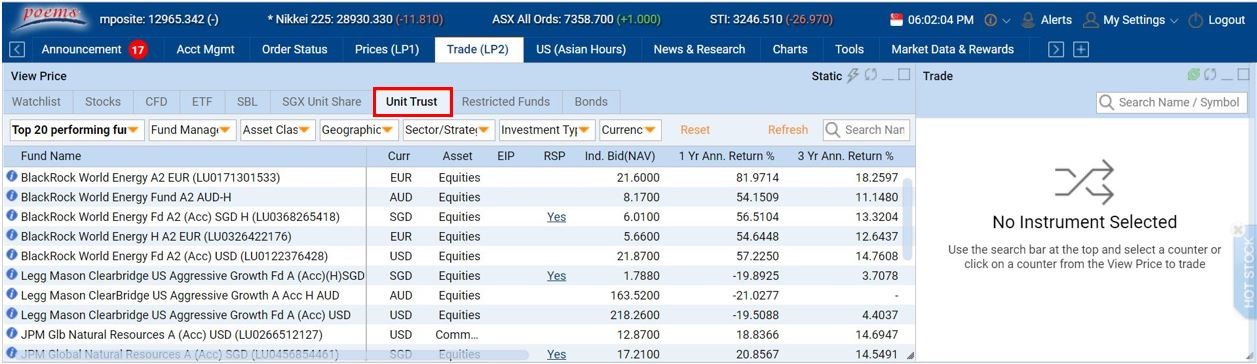

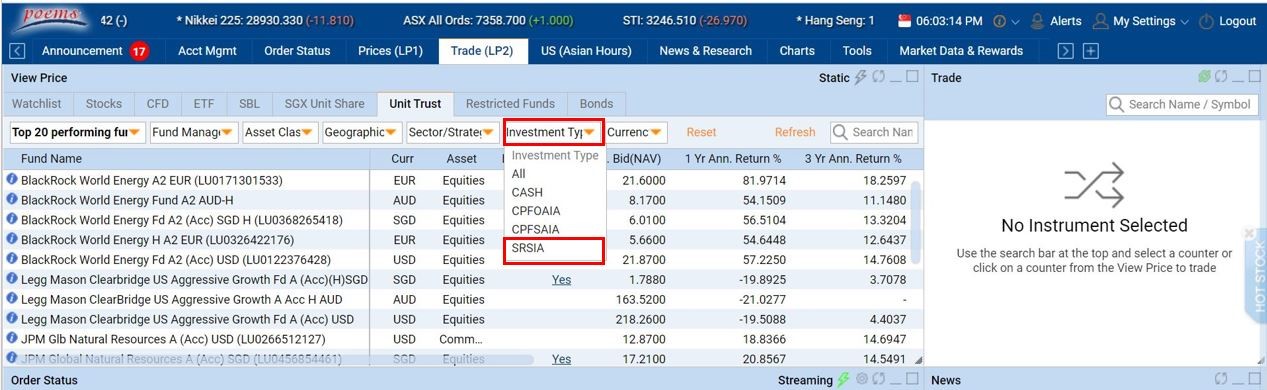

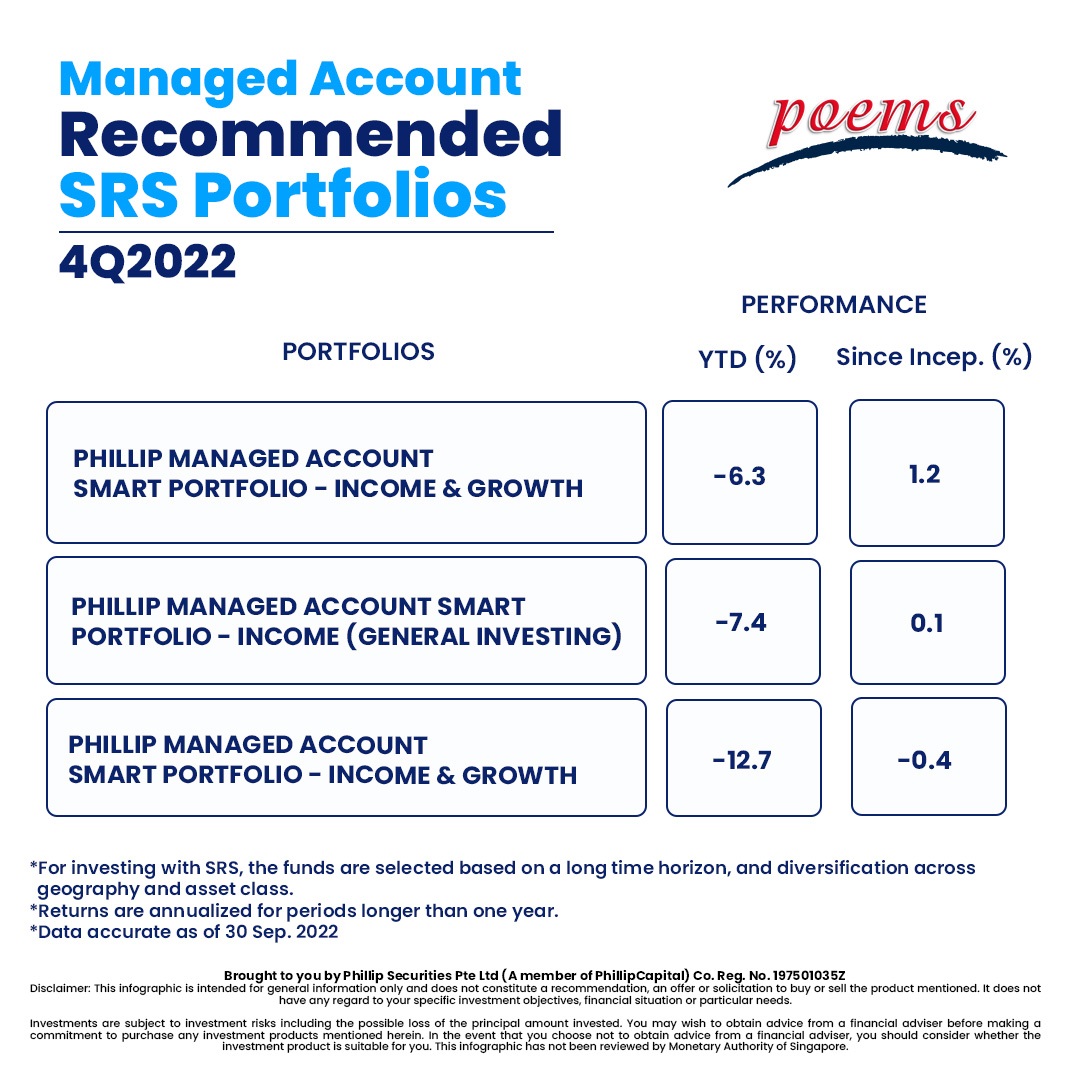

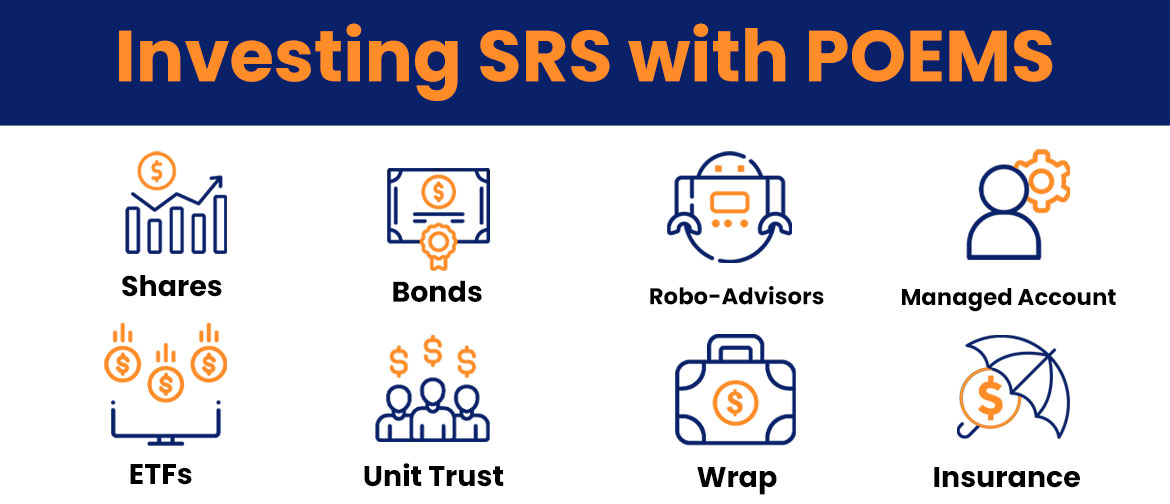

Benefit of investing SRS with POEMS:

We have the widest range of financial products on SRS

What is SRS?

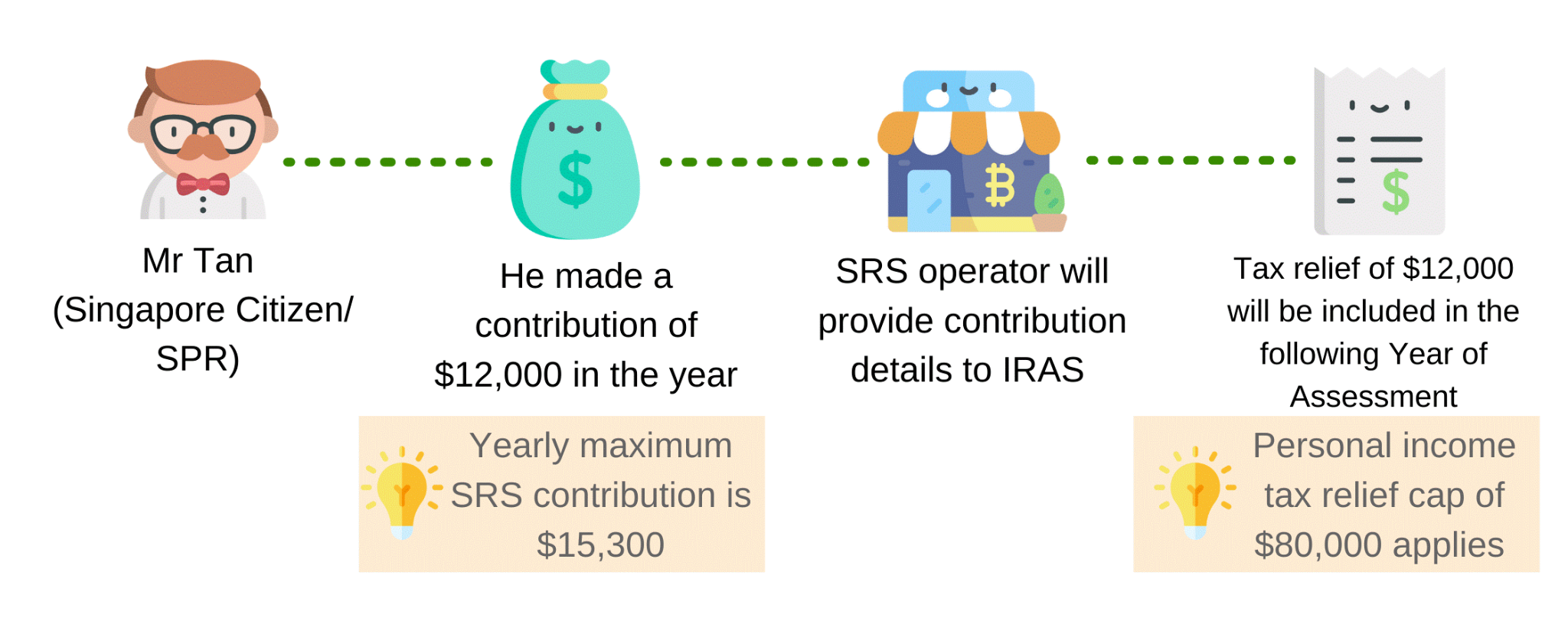

Introduced on 1 April 2001, the Supplementary Retirement Scheme (SRS) is part of the Government’s multi-pronged strategy to address the financial needs of a graying population. It is a voluntary scheme that complements the CPF. Participants can contribute S$15,300 (Singapore Citizen/Singapore Permanent Resident) or S$35,700 (foreigner) annually to SRS at their own discretion. The contributions may be used to purchase various investment instruments. The SRS offers attractive tax benefits. Contributions to SRS are eligible for tax relief, investment returns are accumulated tax-free (with the exception of Singapore dividends), and only 50% of the withdrawals from SRS are taxable upon retirement.

Contributions to SRS accounts only earn 0.05% when kept in banks. Investing is an effective way to put your money to work and potentially build wealth. Why not invest to plan well for your retirement?

At a Glance

- Enjoy tax savings for every dollar saved into the account

- Accumulate tax-free gains from investing SRS funds

- Freedom to invest SRS to boost retirement savings

- Flexibility to withdraw funds anytime

- 50% tax concession on withdrawals

How SRS gives you tax savings

Who is eligible to open an SRS account

Singapore Citizens, Singapore Permanent Residents (SPRs) and foreigners who derive any form of income in Singapore may make SRS contributions in the current year. You must:

- be at least 18 years of age

- not an undischarged bankrupt

- not have a mental disorder and

- be capable of managing yourself and your affairs

How to set up SRS account

Step 1: open a SRS account with one of 3 bank operators:

- DBS Group Holdings Ltd

- Overseas-Chinese Banking Corporation (OCBC) Ltd

- United Overseas Bank (UOB) Ltd

Step 2: Update SRS information with POEMS. Click here for steps.

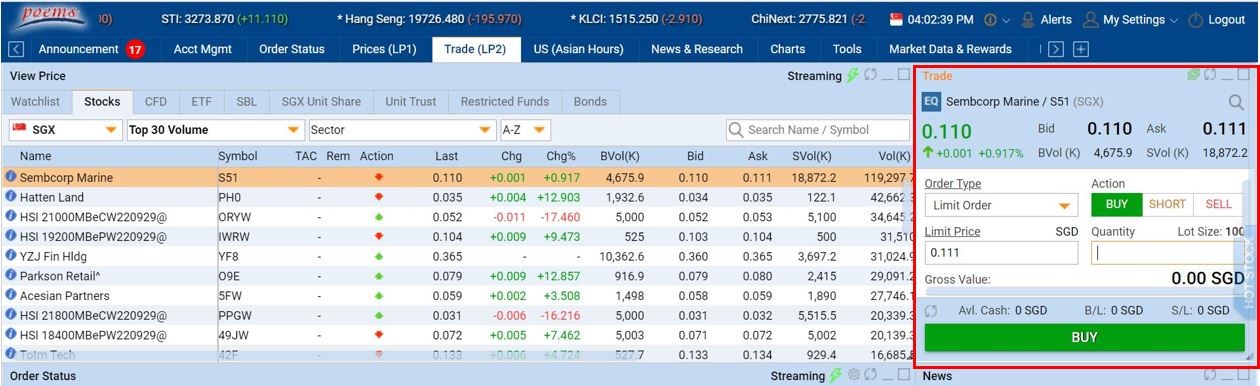

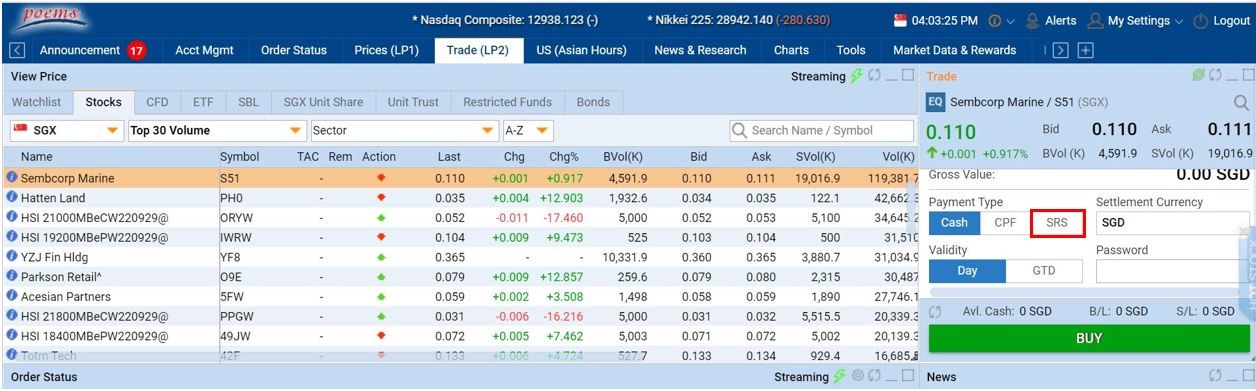

Step 3: log into POEMS to invest Stocks, bonds, unit trusts

Have any questions?

Call us at 6531 1555 or email us at talktophillip@phillip.com.sg. Alternatively, let us know your questions here and we will get back to you shortly.

Frequently Asked Questions

- Open a CPF Investment Account or SRS account with any of the three local banks (DBS, UOB, OCBC).

- Link your CPFIS/SRS Account to your trading account via POEMS 2.0 or POEMS 3:

- Log in to POEMS 2.0 > My Settings > My Account > Bank A/C information

- Log in to POEMS 3 > Me Tab > Bank A/C Information

- Before investing, check and ensure that you have computed the investable amount / have sufficient holdings before making the order submission.

- Please link your CPF or SRS account before 6pm for it to be updated within the same working day.

You may refer to Central Provident Fund Board (CPFB) or your agent bank’s website for guidance.

No, a CPF Investment Account (CPFIA) cannot be used for a joint trading account.

Contra is not supported by the banks. The bank may affirm your BUY position for a settlement if you have sufficient investable amount but the SELL position will be revoked to cash settlement and is subjected to buy-in by SGX unless you have sufficient holdings in your account to satisfy your delivery obligations.

Bank matrix for buy & sell on the same day with no holdings.

| Trade side | DBS | OCBC | UOB |

| Buy | Remains as CPF/SRS trade | Revoke to cash | Remains as CPF/SRS trade |

| Sell | Revoke to cash | Revoke to cash | Revoke to cash |

For CPF, you may refer to the SGX website for the list of CPF Approved Stocks.

For SRS, please refer to your SRS Operator for more details.

- CPF/SRS bank details is not linked to your trading account

- You have exceeded the investment limit

- You have insufficient funds/holdings in CPF/SRS Account

- Buying and selling within the same day

- Your CPF/SRS bank account is closed

- Settlement currency in not in SGD

You can check your investible CPF savings by logging in to my cpf digital services with your Singpass and/or check with your CPF/SRS operating bank.

Contracts that are partially or fully revoked will be on cash settlement. If you do not have sufficient cash or shares to meet your payment or delivery obligations, the affected contract will be forced-liquidated or be subjected to buying-in accordingly.

Your CPF/SRS bank makes the decision to partially/fully revoke CPF/SRS trades based on investment limit/holding etc. For further enquiries, we advise you to check with your operating bank.

No, as this is subjected to the bank’s decision which is final and not debatable. For further enquiries, we will advise you to check with your operating bank.

For payments using 2 different settlement modes (e.g. Cash, CPF or SRS), there will be 2 contracts created and each contract is subjected to standard brokerage fees and charges.