农夫山泉赴港上市,看这几张图就够了

事件:农夫山泉计划9月8日正式登录港交所

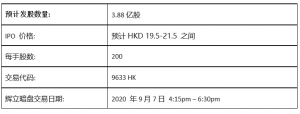

2020年8月25日,农夫山泉正式开始招股,公司预计于9月8日以“9633”为股票代码在港交所主板挂牌上市,中金公司和摩根士丹利担任联席保荐人。

农夫山泉在港交所发布公告称,计划在本次IPO中发行3.882亿H股,招股区间为每股19.50港元至21.50港元,募资规模至多为83.5亿港元。

公司介绍:中国饮料行业的龙头企业,核心产品饮用水稳占市场第一位

业务:

农夫山泉是中国包装饮用水及饮料的龙头企业,产品覆盖包装饮用水,茶饮料,功能饮料及果汁饮料等类别。

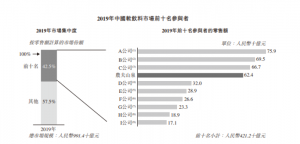

根据弗若斯特沙利文报告,2012年至2019年,农夫山泉连续八年保持中国包装饮用水市场占有率第一的领导地位。在功能饮料,茶饮料及果汁饮料的市场占有率保持在中国前三位。

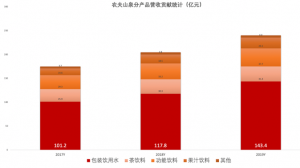

下图是农夫山泉各个产品的市场排名和收益情况:

来源:农夫山泉招股书

行业前景与竞争:软饮料行业农夫山泉保持在第一梯队,收入增速远超行业平均水平

根据弗若斯特沙利文报告,中国软饮料市场集中度相对较低。按2019年零售额计算,前十名参与者合共仅占42.5%的市场份额,其中前四大参与者零售额显著高于其他参与者,合共占27.7%的市场份额。

2017年至2019年,农夫山泉的收入分别为174.91亿元、204.75亿元和240.21亿元,年复合增长率为17.2%。其中,2018年和2019年的收入分别较前一年上涨17.1%及17.3%,这一增速远高于同期中国软饮料行业5.0%及6.6%的增速以及全球软饮料行业2.7%及3.4%的增速。

公司优势:核心产品贡献超55%的收益与毛利,市占率稳占第一

农夫山泉的软饮料产品主要涉及产品图示的四种饮料产品,其中包装应用水持续为农夫山泉贡献超过55%的收益。

来源:招股书

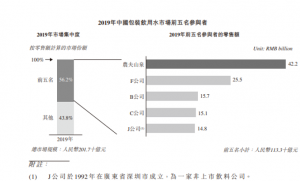

根据弗若斯特沙利文报告,中国包装饮用水市场相对集中,按2019年零售额计算,前五名参与者合共占56.2%的市场份额。其中,排名第一的农夫山泉领先优势较为明显,其2019年零售额领先排名第二参与者达1.5倍多。

来源:招股书

毛利率方面,2017年至2019年农夫山泉的整体毛利率分别为56.1%、53.3%和55.4%,而包装饮用水和茶饮料两大品类的毛利率则高于平均水平。2019年,包装饮用水和茶饮料的毛利率分别为60.2%和59.7%,即以550ml瓶装水每瓶2元的建议零售价计算,农夫山泉每售出1瓶就能获得1.2元的毛利。

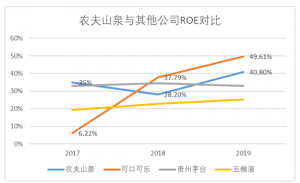

估值情况:农夫山泉当前市盈率在可口可乐和茅台之间

营收方面,2017-2019年间,农夫山泉的营业收入从174.9亿元增长至240.2亿元,期间年复合增长率为17%。净利润方面的增长更为可观。2017-2019年间,公司净利润从33.8亿元增长至49.5亿元,年复合增长率达到21%。

2019年,农夫山泉的ROE达到40.8%,超过茅台和五粮液,仅低于可口可乐。从3年ROE水平来看,农夫山泉盈利能力是与可口可乐、茅五一个级别的,都拥有超强的资金利用效率。

来源:招股书

按照招股价19.5港元至21.5港元计算,农夫山泉的市值为2181.71亿至2405.47亿港元,按照公司2019年的净利润测算 (约55.98亿港元),公司的估值市盈率在39 – 42倍之间,略高于当前港股软饮料行业的平均市盈率(约35),同时市盈率在可口可乐(22倍)和茅台的市盈率(49倍)之间。

港股 Pre IPO: 交易农夫山泉,快人一步

根据新加坡金融管理局规定,参加香港新股打新(IPO),需满足一次性申请200k 新币以上。

,如果您想参与新股打新(ipo), 如果错过新股申购,不用担心,辉立证券证券提供暗盘交易。让你快人一步,交易农夫山泉股票。不懂什么是暗盘和交易细节?下文五个问题与解答帮您全面了解暗盘交易。

Q1:暗盘交易是什么?

通常暗盘交易都是在新股上市前一天,不过不是通过交易所的系统,而是通过券商内部的系统进行撮合报价。关于暗盘价和上市价的关系,尽管暗盘的涨跌从一定程度上体现了新股的受追捧程度,但暗盘价并不能全面反映市场需求,买卖盘透明度不高,因此暗盘价并不能被视作该股的走势指标。

Q2: 辉立暗盘交易细则

新加坡/北京时间:

全天交易:04.15pm – 06.30pm

半天交易:02.15pm – 04.30pm

Q3: 辉立暗盘是否有实时价格?

暗盘是有实时价格的,且无需单独订阅。

Q4: 交易佣金是多少?

与您当前使用账户交易港股佣金相同

Q5: 结算细节是如何?

通过暗盘进行的交易也将遵循香港结算周期规则。在暗盘交易中成交的订单,交易日期将是新股上市日期,同时也有资格享有合并协议和对敲。结算日期:从交易当天算起的后两个市场交易日(T+2)。

结算货币:港币或新币。

相关文章:

蚂蚁官宣沪港两地上市,相关概念股一览

“9618”,京东送给自己的“生日礼物”—辉立暗盘,上市前一天交易京东股票

辉立暗盘交易细则

在香港,辉立证券是第一个为客户提供暗盘交易渠道的券商,交易时间一般为新股上市前一个交易日的下午4点15至下午6点半,半日市的交易时间为下午2点15至下午4点半

了解更多,请访问 辉立暗盘交易页面

如果有想了解更多全球股市资讯,请关注微信公众号 “辉立资本新加坡” (SGPSPL)。同时提供在线免费开设股票账户,一个账户轻松交易全球股票和ETF

美股,港股,新加坡股,中国A股,越南股票,韩国股票,德国股票,马来西亚股票,泰国股票,印尼股票,菲律宾股票,日本股票,澳大利亚股票,台湾股票,加拿大股票,英国股票,法国股票,荷兰股票,葡萄牙股票,比利时股票,土耳其股票

如果本文是英文翻译版本,一切请以英文为准