虎虎生威:东南亚市场复苏之路 越南市场分析及热销股票 April 27, 2024

回顾2023年,根据《东南亚态势报告:2023》显示,失业和经济衰退是东南亚2023年面对的最大挑战。各国相继推出各种政策与措施,以提振经济,走出新冠的阴霾。而2023年,越南也交出了一份较满意的答卷,经济社会继续呈良好复苏态势,经济增长逐季提升,继续是世界经济亮点之一。

整体来看,全年GDP增速从2022年的8.02%放缓至5.05%,低于政府6.5%的限定目标。人均GDP为4284美元(约5710.12新元)。全球需求疲软、反腐力度加大、公共投资停滞等是其增速放缓的影响因素。虽然增速放缓,越南仍是地区乃至世界经济增速较快的国家之一。农业是越南经济发展的重要支撑和亮点,2023年农产品出口额超过530亿美元(约715.14亿新元)。服务业、工业等也在逐渐回升。

其他数据来看,2023年全民居民消费价格(Consumer Price Index, CPI)同比去年上升3.25%,表明物价仍在上涨。但同时,劳动生产率增长了3.65%,就业率为2.28%,也表明了上述的服务业、工业等在逐渐回暖。

热销股票

1. HOA PHAT 和发集团(HPG.VN)

HOA PHAT(和发集团)主要生产热轧钢卷、建筑钢材、优质钢材和钢坯、农产品等;出口国家遍布39个国家,使消费市场多元化,同时也帮助越南的贸易平衡。根据《越南报告》(Vietnam Report)和《越南网》(VietnamNet) 的数据显示,和发集团在越南十大企业中排名

第八,而且已连续两年在越南十大私营企业排行榜中排名第一。

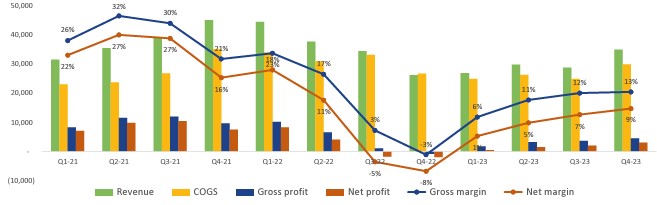

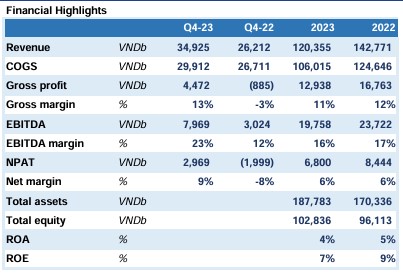

2023年,和发集团全年营收(Total Operating Revenue) 120.3万亿越南盾(约64.93亿新元),同比下降16%。而集团税后获利(Net Profit After Tax, NPAT) 6.8万亿越南盾(约3.67亿新元),完成了全年既定计划的85%。

产量方面,和发集团是越南和东南亚最大的粗钢生产商,2023年,其粗钢产量达670万吨。同时,该集团在越南的建筑钢材和钢管市场的占有率也居首位,并且也是越南前五大镀锌钢板的生产商。值得一提的是,和发集团是越南唯一一家能够生产热轧钢卷、预应力钢缆等多种优质钢材的企业。建筑钢材和优质钢材的销量在2023年达到378万吨,同比去年下降11%。

展望未来,越南经济复苏仍面临诸多困难,集团将持续做好现金流、生产和库存等管理,且密切关注其大型项目的投资进度,尤其是Dung Quat 2钢铁综合体项目。目前,该项目已完成了计划中的45%。一旦该项目投产,和发集团的粗钢年产量可将达到1400多万吨

技术分析(仅供参考):

截止2024年4月12日星期五:

闭市价(Closing Price):29950 VND

支撑位(Support):28300 – 29000 VND

压力位(Resistance):31100 – 31400 VND

区间波动

2. VietJet Aviation JSC 越捷航空(VJC.VN)

除了农业、服务业、工业等有显著的回暖,加上在全球航空客运复苏的背景下,2023年,越南旅游业、航空业也在强劲增长的阶段。其中,越捷航空是越南航空业的典型代表之一。越捷航空是越南一家低成本航空公司,是越南首家私营的航空公司。2024年1月,全球知名航空专业评测网站Airline Ratings将越捷航空选入2024年全球最安全航空公司的名单中

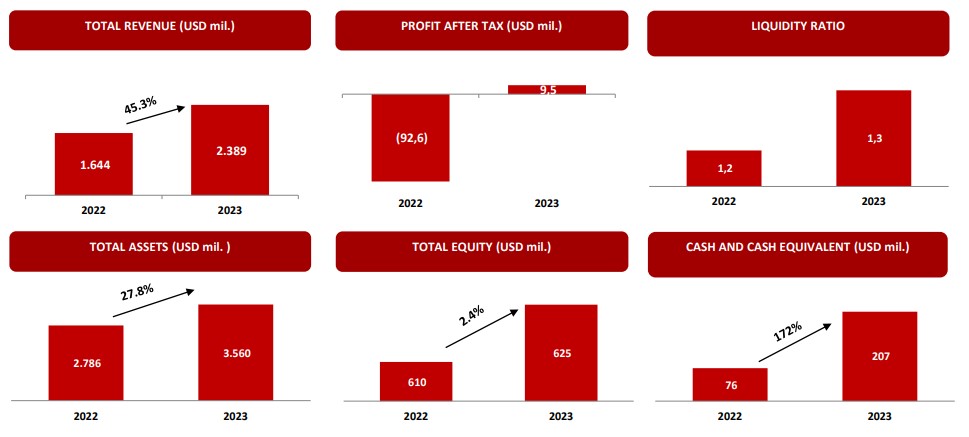

根据2024年4月刚发布的2023年审计报告显示,越捷航空全年营收达53.7万亿越南盾(约29.06亿新元),同比去年上涨62%。截至2023年12月31日,该公司的总资产(Total Asset)为86.9万亿越南盾(约47.03亿新元),资产负债率(Debt Ratio)为1倍。其流动性指数(Liquidity Index Ratio)为2~4倍,在航空业中处于良好水平。

除了发展国内航线,越捷航空更率先扩大国际航线。2023年,越捷航空共安全运营13.3万个航班,客运量达2530万人次。其中,国际游客的客运量较2022年同比增长183%,超760万人次。

未来,可持续发展(ESG)是越捷航空的长期战略目标。为满足运营需求,将继续组件新型、现代、安全和环境友好的机队,并举行一系列的措施和活动以减少二氧化碳的排放。同时,越捷航空也将持续提高地面服务的运营质量,并降低航空港的运营成本。人力资源也是其重要战略:越捷航空学院(VJAA)已成为国际航空运输协会(IATA)的培训合作伙伴。为继续扩大国际航线,国际航线网路也将持续广泛拓展,保证在满足国内运输需求的同时,国际航线网络也会得到扩展和满足。

技术分析(仅供参考):

截止2024年4月12日星期五:

闭市价(Closing Price):107000 VND

支撑价(Support):100000 – 100100 VND

压力价(Resistance):107400 – 108300 VND

区间波动

关于作者

Karmen Zeng

辉立证券环球市场部中文交易员

Karmen是辉立证券环球交易部中文团队的交易员。她主要负责各国股市的分析与交易,为客户提供更好的账户管理。她毕业于新加坡管理大学,获得应用金融学硕士学位,利用专业知识为中文团队添砖加瓦。