资讯 | 阿里巴巴财报超预期,北向资金连续3日净流入A股

资讯摘要

美股周四小幅收跌,道指收跌128点。市场正评估公共卫生事件的发展状况、美股财报及经济数据。美国上周首请失业救济人数增至21万、1月CPI上涨0.2%。

美股资讯

北京时间2月14日凌晨,美股周四小幅收跌,道指收跌128点。市场正评估公共卫生事件的发展状况、美股财报及经济数据。美国上周首请失业救济人数增至21万、1月CPI上涨0.2%。

截止收盘,道指收盘下跌128.11点,或0.43%,报29423.31点;纳指跌13.99点,或0.14%,报9711.97点;标普500指数跌5.51点,或0.16%,报3373.94点。

周四盘中纳指与标普指数(3373.9399, -5.51, -0.16%)一度转涨,纳指最高上涨至9748.32点,标普500指数最高上涨至3385.09点,均刷新了盘中最高历史纪录。

特斯拉(804, 36.71, 4.78%)股价反弹收高4.8%,重新站上800美元。该公司计划发行约20亿美元的股票,所筹资金将用于改善资产负债表。

思科(47.32, -2.61, -5.23%)股价大跌5.2%,该公司宣布整体营收再次下降。在第四财季,思科盈利超出预期,但营收同比下降4%。

3M(159.76, -2.57, -1.58%)、陶氏(48.3, -1.08, -2.19%)化学及辉瑞(36.93, -0.81, -2.15%)制药等普遍走低。

周三美股收高,三大股指均创历史最高收盘与盘中纪录。进入2020年以来,标普500指数已经十次刷新历史高位。

市场仍在关注公共卫生事件的发展及其对经济活动的影响。国际货币基金组织(IMF)总裁周四称,相信中国经济能快速反弹。IMF总裁格奥尔基耶娃表示,疫情为中国经济带来了“一定的下行风险”,但她相信中国经济一定能快速反弹。

美联储官员讲话受到关注。今天发表讲话的美联储官员包括达拉斯联储行长罗伯特-卡普兰(Robert Kaplan)及纽约联储行长约翰-威廉姆斯(21.62, 0.07, 0.32%)(John Williams)等。

焦点个股

特斯拉宣布,公司打算发行约20亿美元的股票,所筹资金将用于改善资产负债表。此外该公司宣布将在北美召回15000辆Model X SUV,原因是一项潜问题可能导致车辆失去转向助力,从而使转向更加困难并增加撞车风险。

思科宣布第二财季收入为120亿美元,较上年同期下降4%,预期119.7亿美元;利润为28.8亿美元,调整后每股收益为77美分,预期76美分。

巴克莱2019财年税前利润不及预期,并表示,尽管英国监管机构在调查该公司首席执行长Jes Staley与Jeffrey Epstein的关系,但公司董事会仍充分信任Staley。

阿里巴巴第三财季营收同比增长38%。财报显示,中国零售市场移动月活跃用户数量达8.24亿,较2019年9月底劲增3900万。阿里巴巴集团收入同比增长38%至人民币1614.56亿元。云计算业务单季收入首次超过人民币100亿元。

蔚来(4.03, -0.04, -0.98%)公布了2020年1月份的销量,总交付车辆为1598辆,同比下跌11.5%,环比下跌近50%。

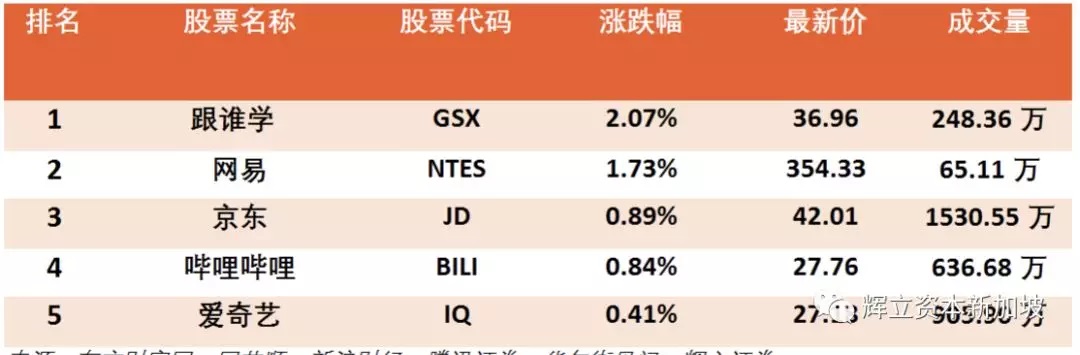

热点中概股

来源:东方财富网、同花顺、新浪财经、腾讯证券、华尔街见闻、辉立证券

港股资讯

北京时间2月13日,美联储主席鲍威尔重申经济扩张信心,提振了风险偏好。周三美国三大股指齐创历史新高。

周四,港股恒指高开低走收跌0.34%,消费、医药股领跌蓝筹,光伏太阳能等前期热点板块回调,科技网络股逆市上涨。

热点板块

特斯拉概念股多数回调,赣锋锂业(33.9, -0.35, -1.02%)跌1.02%,舜宇光学、比亚迪(45.3, -0.30, -0.66%)电子(16.18, -0.14, -0.86%)、洛阳钼业(3.79, -0.02, -0.53%)等集体走低。光伏股多数回调,其中,兴业太阳能(0.64, -0.09, -12.33%)跌12%,顺风清洁能源(0.125, -0.02, -11.35%)跌11%,保利协鑫跌近6%。

内房股集体反弹,其中,宝龙地产(5.06, 0.33, 6.98%)涨7%,旭辉控股涨逾4%,富力地产(12.76, 0.32, 2.57%)、融创、奥园、新城发展(8.61, 0.20, 2.38%)等涨2%。中信证券(16.38, -0.16, -0.97%)表示,房价表现平稳,一系列对行业需求的限制性政策,客观上没有加码的必要。我们认为,现在是政策趋势偏松的时间窗口。如考虑新业务价值,我们相信2020年初已经是地产龙头估值历史底部。

小米午后爆发,一度飙升逾5%,收盘涨3.56%,报价13.38港元。小米发布新品小米10,起售价3999元。小米集团CEO雷军披露,小米集团在2019年营收突破2000亿。今年研发投入将达到100亿元,去年为70亿元。雷军表示,我们希望,打破价格的限制,不计成本地冲击高端手机市场,打造出米粉心中的梦幻之作。

阿里巴巴:2020财年第三季度营收1614亿元,市场预期1592.09亿元;归母净利润523.09亿元,市场预期为303.35亿元;移动月活跃用户数量达8.24亿,环比增3900万;云计算收入同比增加62%至107.21亿元。

阿里巴巴:三月疫情对财务会有直接影响,增长率会放缓,不排除是较大幅度的放缓,但是现在还不知道;淘宝、天猫、本地生活服务也可能会出现收入增长为负。

全天涨幅最大的5支港股通

来源:东方财富网、同花顺、新浪财经、腾讯证券、华尔街见闻、辉立证券

中国A股资讯

北京时间2月13日,早盘指数短线下挫,随后指数拉升全线翻红。临近上午收盘,经过短暂翻红后,指数再度走弱。总体上,市场情绪小幅回暖,板块个股涨跌参半,赚钱效应一般。午后, 指数再度走弱,深证成指跌幅一度扩大至1%。尾盘,三大股指一度回暖,深成指短暂翻红,随后指数依旧弱势。总体上,板块轮动加快,资金观望情绪依旧浓厚,个股跌多涨少。

截止收盘,沪指报2906.07点,跌0.71%,成交额为3345亿元(上一交易日成交额为2975亿元);深成指报10864.32点,跌0.7%,成交额为5365亿元(上一交易日成交额为4925亿元);

从盘面上看,光伏、农业、芯片居板块涨幅榜前列,在线教育、口罩、云办公板块跌幅榜前列。

截至A股收盘,统计数据显示北向资金合计净流入7.91亿元。其中沪股通净流入8.07亿元,深股通净流出0.16亿元。统计发现,北向资金连续3日净流入,净流入额分别为10.44亿元,14.85亿元,7.91亿元,合计33.20亿元。

热门板块

光伏板块恒强,北玻玻璃、通威股份(18.030, 1.64, 10.01%)、捷佳伟创(72.420, 6.58, 9.99%)、金辰股份(27.190, 0.68, 2.57%)、爱康科技(1.680, 0.15, 9.80%)、迈为股份(206.460, 6.95, 3.48%)等多股走高。

消息面上,国内2020年光伏政策陆续落地,行业需求将充分释放。其次,行业龙头积极布局平价上网大周期,未来行业集中度将持续提升。最后,光伏下游市场的应用场景、商业模式不断扩展和创新,户用、分布式等场景的需求具有较大空间。

芯片板块拉升,北京君正(111.850, 10.17, 10.00%)、晶方科技(90.800, 3.92, 4.51%)、华微电子(7.690, 0.28, 3.78%)、国科微(59.900, 1.62, 2.78%)、上海贝岭(20.200, 0.72, 3.70%)、台基股份(23.340, 2.12, 9.99%)等个股拉升跟涨。

北向资金净流入7.91亿元,连续3日净流入。天齐锂业、五粮液、上海机场分别获净买入5.53亿元、2.58亿元、2.38亿元。汇顶科技、京东方A、贵州茅台分别遭净卖出2.78亿元、2.68亿元、1.93亿元。

全天涨幅最大的5支沪港通

来源:东方财富网、同花顺、新浪财经、腾讯证券、华尔街见闻、辉立证券