股市资讯 | 美科技巨头股普跌,搜狐(SOHU)二季度持续亏损,股价暴跌13%

美股

截至北京时间7月31日凌晨,美国股市周一下跌,科技股巨头领跌,投资者表现出对该行业倦怠的迹象。纳斯达克综合指数下挫1.4%,并创3月以来最大的三天跌幅,此前该指数触及纪录高位。

截止收盘,标普500指数收盘下跌16.22点,跌幅0.58%,报2802.60点;纳斯达克指数收盘下跌107.40点,跌幅1.39%,报7630.00点;道琼斯指数收盘下跌144.20点,跌幅0.57%,报25306.83点。

焦点股关注:

脸书Facebook (FB) 下跌了2.19%,该股较7月25日创下的高点下跌了20%以上。FANG板块下跌近3%,Netflix领跌;自Facebook上周发布令人失望的业绩以来,该板块累计下跌超过9%。

推特Twitter(TWTR)跌幅超过8%,两日跌幅接近30%,深陷技术性熊市。

奈飞Netflix (NFLX)跌5.5%,较6月创下的纪录高点跌超20%,进入技术性熊市。

亚马逊(AMZN)、谷歌(GOOG)母公司Alphabet、甲骨文(ORCL)、微软(MSFT)均跌超1%,苹果(AAPL)跌0.54%。

个股财报解读:

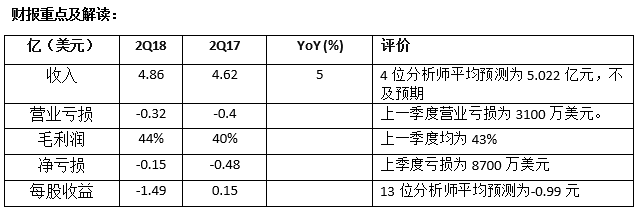

搜狐:二季度持续亏损,多项指标不及预期

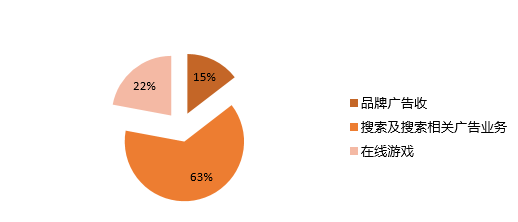

公司主营业务:在线及品牌广告业务,搜索及搜索相关广告业务,在线游戏

营收结构:

营收为4.86亿美元 ,较2017年同期增长5%,较上一季度增长7%。

品牌广告收入为6200万美元,较2017年同期下降29%,较上一季度增长9%。

搜索及搜索相关广告业务收入为2.70亿美元,较2017年同期增长45%,较上一季度增长23%。

在线游戏收入为9400万美元,较2017年同期下降23%,较上一季度下降11%。

股市反应:

由于营收及每股收益不及预期,周一搜狐股价低开17.33%,开盘价25.24美元,盘中震荡走高,临近收盘维持在26美元左右,截至收盘,回收部分跌幅,跌13.36%,报26.45美元。

业务展望:

搜狐预计2018年第三季度:

总收入在4.45亿美元至4.70亿美元之间。

在扣除归于少数股东的非美国通用会计准则净利润之前,非美国通用会计准则净亏损在4400万美元至5400万美元之间。

港股

北京时间7月30日,周一恒生指数低开0.6%,之后一度翻红,但腾讯等科技股下挫,拖累恒指再度走跌。

截至收盘,恒指跌0.25%,报28733.13点。国企指数跌0.01%,报11046.32点;红筹指数跌0.37%,报4328.05点。大市成交723亿港元。

沪港通资金流向方面,沪股通净流入25.4亿,港股通(沪)净流出为5.88亿。

深港通资金流向方面,深股通净流入1.46亿,港股通(深)净流入为6.1亿。

焦点股关注:

蓝筹股方面,碧桂园跌7.47%,报12.14港元,领跌蓝筹。石药集团跌2.58%,报20.8港元;舜宇光学科技跌1.88%,报136港元;吉利汽车跌2.93%,报17.88港元。

内房股近全线下跌,绿城中国跌6.47%,报9.39港元;雅居乐集团跌7.01%,报11.94港元;世茂房地产跌3.88%,报22.3港元;中国恒大跌1.82%,报21.55港元。

医药股普遍下挫,丽珠医药跌6.71%,报36.85港元;神威药业跌7.87%,报11.48港元;李氏大药厂跌4.17%,报8.28港元;三生制药跌5.01%,报17.08港元。

中国铁塔:中国铁塔香港IPO获8.4亿港元的孖展认购

综合6家券商数据报道称,中国铁塔首次公开募股(IPO)获得8.4亿港元的孖展认购,相当于面向散户发行规模34亿港元的25%;该新股将于周二中午截止认购

中国A股

北京时间7月30日,周一两市小幅冲高后,维持低位震荡,创指下跌幅度超2%,各板块轮动加剧,两桶油改革概念逆势走强,临近收盘,三大股指有小幅反弹,但市场人气依旧低迷,避险情绪持续上升。

截至收盘,沪指报2869.05点,跌0.16%,深成指报9181.94点,跌1.23%。

从盘面上,非汽车交运、两桶油改革、水泥居板块涨幅榜前列,酒店及餐饮、西藏、基因预测居板块跌幅榜前列。

宏观基本面:

中国7月官方非制造业PMI 54,预期 54.9,前值 55。

中国7月官方制造业PMI 51.2,预期 51.3,前值 51.5。

热点板块:

非汽车交运板块持续走高,全天领涨两市,晋西车轴(600495)、上海凤凰(600679)、祥和实业(603570)、深中华A(000017)涨停,中国中车(601766)、华铁股份(000976)、林海股份(600099)、今创集团(603680)、永安行(603776)等个股均有不同程度上涨。

两桶油改革概念逆势走强,表现活跃,四川美丰(000731)一度封涨停,石化机械(000852)、泰山石油(000554)、大庆华科(000985)等个股均有不俗表现。

来源:东方财富网,新浪财经,同花顺,21世纪经济报道,彭博,华尔街见闻,辉立证券