美股市场近期分析及投资机会分享

动荡的市场

在投资者还没来得及为2018年10月初创下的历史新高欢呼之前,市场的动荡接踵而来,为投资者创造了一种梦魇般的情景——或许这是市场以惊骇的方式来庆祝万圣节的到来吧!所有3个指数——标准普尔500指数,道琼斯指数和纳斯达克综合指数,全部进入调整区间;从高点暴跌近10%。随着美国中期选举,美国联邦公开市场委员会 (FOMC) 会议以及G20 峰会都将在2018年11月举行,市场经历着过山车式的洗礼可能不会很快停止。

美国中期选举

将于2018年11月6日举行的美国中期选举,将决定由谁来控制美国国会;这可能会对现行政策产生影响。总体而言,共和党和民主党对美国总统唐纳德·特朗普的减税和“医疗保健法”等政治把戏持反对意见。如果共和党人继续掌权,特朗普将继续实施与他“让美国再次强大起来”的竞选口号一致的政策。但如果民主党获胜呢?如果两党观点两极分化,在国会占有席位,那人们还能期待什么呢?我们可以预期的是,无论谁获胜,美国股市都将继续颠簸起伏,直到2018年底。

利率

利率一直是占据各媒体头条的主要话题之一,并且一直在稳步上升。这有助于创造一个蓬勃发展的股市,但也给特朗普带来了一个问题,因为他不得不面对利率上升的影响。特朗普将最近的市场抛售归咎于美联储,并对美联储违背他的意愿1表示失望。尽管特朗普表示不满,但在联邦公开市场委员会会议结束后,预计在2018年12月将再次加息0.25%。美联储认为,随着核心通胀率回到目标水平,加息是必要的。

提高利率的重要性

利率上升最直接的影响将是个人、企业或是政府的借贷成本。当利率上升,你的借贷成本就会增加,使你的住房贷款,个人贷款和保证金融资变得更加昂贵。企业和政府为项目和扩张融资,也将会承担更高的利息成本。当这种情况发生时,投资者可能会将投资组合转向能提供有吸引力收益的债务工具上。在风险规避的情况下,资金将流出股票,这将对股市产生负面影响。因此,利率上升将在整个美国经济和世界其他地区产生涟漪效应。

王牌还是外卡?

特朗普在处理外交关系的方式上受到广泛批评。以下事件值得关注:

1. 尽管2018年6月在新加坡举行的特-金峰会和平结束,但特朗普在Tweeter上发出的战争威胁与争取和平的努力存在冲突。

2. 特朗普可能与中国国家主席习近平握手,但却通过升级贸易战对他冷眼相待。

3. 美国似乎与沙特关系良好,但围绕记者贾迈勒·哈沙吉死亡的事件给两国关系增添了不确定性。

特朗普的外交政策还面临着更多的不确定性。这位经常不可预测的总统可能会采取更多的举措,这可能会让市场为之颤动。

结论

考虑到其中的风险和不确定性,我们可以得出的结论是,市场很有可能处于调整期,甚至是熊市。一旦出现重大危机或事件,就可能引发股市大幅下泻。这种情况会在何时发生是不可预测的,但从投资策略的角度来看,做好准备并使投资组合多样化,包括帮助你度过动荡时期的工具,是有意义的。

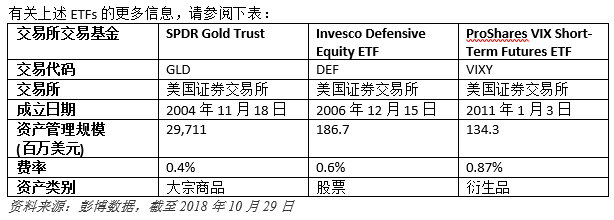

投资者可能会考虑采取防御性策略,即是将较少依赖股市状况的工具添加到其投资组合中。那些希望采用这种方式的投资者可能会关注交易所交易基金(ETFs) ,比如黄金ETFs 和包含防御性股票的ETFs。

从历史上看,黄金一直是对冲通胀和不确定性的绝佳方式。考虑到美联储的通胀目标和市场的不确定性,将黄金纳入投资组合可能是一个不错的多样化策略。道富财富黄金指数基金(GLD.US) 为你提供直接的黄金风险敞口,因为标的资产包括存放在安全保险库中的金条。

除了追踪黄金的ETFs 外,在这种动荡时期喜欢投资股票的投资者,可能会考虑景顺防御性股票ETF (DEF.US)。这只ETF 采用了一种独特的策略,通过多种途径寻找在熊市中表现良好的股票,同时在上涨趋势中也有增长的潜力。投资者可以利用这只ETF 作为一种战术手段,在预期熊市的情况下,缩减贝塔系数和波动性。

喜欢更激进方式的投资者可能会关注追踪波动率指数(即所谓的VIX 指数)的波动率ETF。当不确定性和恐惧氛围加剧时,VIX 指数往往会飙升,与股市走势相反。ProShares VIX 短期期货ETF (VIXY.US) 是最受欢迎的ETFs 之一,用于对冲动荡时期的风险。

对于那些风险偏好较高的投资者,杠杆和反向ETFs 可用于根据市场走势来形成直接交易,或可作为对冲工具或者加速器。

那些打算在不确定性的市场上利用其波动性、杠杆和反向ETFs的投资者应该注意到,由于交易和展期成本较高,这些ETFs的持有时间不应超过几天。

如果你对上述的ETFs感兴趣,你可通过我们进行交易!这些ETFs,你可通过POEMS 2.0 以及POEMS 手机app 2.0 进行交易。

还没有账户吗?交易这些ETFs 的价格低至12美元*。今天找我们开户吧!

截至2018年10月29日,信息准确

*适用条款及细则

参照:

https://www.bloomberg.com/news/articles/2018-10-11/trump-escalates-fed-assault-laments-high-rate-he-s-paying

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合