股市资讯 | 本周美股财报纷纷“亮相”,是否能一扫股市阴霾(附财报发布时间表) 港元触红线 香港金管局四次出手!中国金融业加速对外开放

美国股市

新浪美股讯 北京时间14日凌晨,美股周五收跌,JP摩根成为表现最差的道指成份股。本周美股三大股指均录得较大涨幅。投资者正在权衡银行财报,并关注中美贸易摩擦的最新进展和西方国家对叙动武的可能性。

美东时间4月13日16:00 (北京时间4月14日04:00),道指跌122.91点,或0.5%,报24,360.14点;标普500指数跌7.69点,或0.29%,报2,656.30点;纳指跌33.60点,或0.47%,报7,106.65点。

尽管美股周五收跌,但本周主要股指仍然录得涨幅。截至周五收盘,本周道指累计上涨1.8%,标普500指数累计上涨2%,纳指累计上涨约2.8%。

中美贸易摩擦新进展

据媒体报道,白宫希望通过公布新的关税名单以及阻止中国向美国进行科技投资的方法来增大对中国的压力,以迫使中国中国作出贸易让步。美国最早将在下周公布将加征关税的1000亿美元中国商品的详细名单。中国正在考虑通过团结欧洲等盟友来对抗美国。

与此同时,美国总统已命令高级助手研究重新加入泛太平洋(601099)伙伴关系协定(Trans-Pacific Partnership,TPP)的可能性,这可能对中国构成进一步的挑战。

周五公布的数据显示,中国对美国的贸易盈余大幅攀升,表明全球最大两个经济体之间的贸易不平衡关系进一步失衡。中国对美贸易盈余增长的背景,甚至是中国于13个月以来首次录得月度贸易赤字。

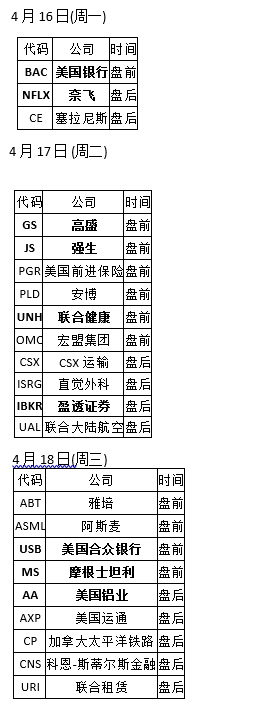

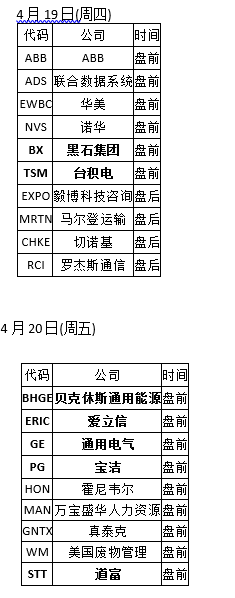

本周可重点关注的财报有(加粗):

市场紧张情绪受美对叙利亚动武的局势影响

叙利亚局势方面,美国正在与盟国研究对叙利亚政府采取统一军事行动的广泛计划,以此回应叙利亚政府对平民发起的疑似化学武器攻击。上周初,特朗普在推特上暗示可能即将对叙动武,使全球股市震动。

但美国国防部长吉姆-马蒂斯(Jim Mattis)追随特朗普发表了关于叙利亚局势的更温和言论,称美国必须小心从事,避免将支持叙利亚的俄罗斯与伊朗也卷入一场更大的冲突中。另据BBC报道,俄罗斯驻联合国大使上周四警告称,鉴于叙利亚驻扎有俄罗斯军队,空袭叙利亚可能引发美俄战争。

美东时间13日晚间,美国总统特朗普宣布,已下令美军联合英国、法国对叙利亚政府军事设施进行“精准打击”,以作为对日前叙东古塔地区发生“化学武器袭击”的回应。

特朗普在13号晚上的电视讲话中还称,美国军队不会无限期地留在叙利亚。目前美军2000人在叙利亚西北部帮助库尔德人打击极端组织。

据半岛电视台援引叙利亚国家电视台称,叙利亚已经对美国、英国、法国的空袭进行了反击。

美国副总统彭斯14日在秘鲁首都利马说,美国政府已经做好再次军事打击叙利亚的准备,并将应对叙利亚及其盟国可能采取的报复行动。

香港股市

4月13日消息,美股周四收高,道指一度上涨超过400点。美国总统特朗普表示或不立即对叙利亚动武,安抚了市场对地缘政治关系的担忧情绪。4月13日开盘,港股恒生指高开0.8%,之后持续走低,一度跌近0.4%,午后维持震荡,截止收盘,恒生指数跌0.07%,报30808.38点。

蓝筹股方面,金沙中国有限公司涨2.06%,报44.55港元,领涨蓝筹。中银香港涨1.48%,报37.65港元;汇丰控股涨1.06%,报76.2港元。

博彩股上涨,永利澳门涨4.32%,报30.2港元;新濠国际发展涨5.47%,报26.05港元;澳博控股涨4.32%,报7.25港元;美高梅中国涨2.25%,报20.45港元。

医药股普遍下跌,复星医药跌5.38%,报47.45港元;中国中药跌4.09%,报6.33港元;石药集团跌4.15%,报20.8港元;泰凌医药跌3.36%,报2.3港元。

港元告急!香港金管局出手托市

12日,美元兑港元触及7.85的弱方兑换保证红线,这也是联系汇率以来,港元首次触及7.85关键水平。12日晚间,香港金管局入市承接港元沽盘,买入8.16亿港元,13日开市前和收市后,又先后买入24.42亿港元和30.38亿港元,14日凌晨再次买入33.68亿港元,4次合计买入96.64亿港元。

为确保联系汇率制度的正常运作和港元稳定,香港金管局总裁陈德霖近日连番表态:“有足够能力维持港元汇率的稳定和应付资金大规模流动的情况,大家无须担心。”

美银美林预计,美元兑港元将在今年余下时间维持在7.85水平,因香港利率将持续低于美国的借贷成本;3个月期港元Hibor到年底涨至1.6%;香港金管局将在未来一到两个月购入约800亿港元(约102亿美元)。

高盛表示,此次香港金管局出手捍卫联汇制度频率会更高。

德国商业银行驻新加坡经济学家周浩则分析认为,将在未来几天看到香港金管局的更多干预,因为流动性充裕致市场对港元的预期仍相当悲观。因对港元的需求依然疲弱,这种干预不太可能推动汇率大幅上涨。

中国股市

4月13日,沪深股市高开低走,沪指在5日均线下方收出日线“两连阴”。

截至下午收盘时间,上证综指报3159.05点,跌0.66%;深证成指报10687.02点,跌0.37%;创业板指尾盘时翻绿,报1824.59点,跌0.13%,日线收出“四连阴”。

沪深两市较前一交易日缩量超过300亿元,总计成交3963.56亿元,其中,沪市成交1636.52亿元,深市成交2327.04亿元。

盘面上,计算机板块领跑。彩讯股份(300634)、信息发展(300469)、恒锋信息(300605)、真视通(002771)、荣之联(002642)纷纷涨停,新北洋(002376)、海联讯(300277)、榕基软件(002474)、蓝盾股份(300297)等多只个股涨幅超过6%。

近期持续弱势的煤炭及钢铁周期板块,在4月13日小幅反弹,逆市上涨。煤炭股中,安源煤业(600397)涨停,陕西黑猫(601015)、金能科技(603113)、安泰集团(600408)、云煤能源(600792)、山西焦化(600740)涨幅在2%以上。钢铁股中,鄂尔多斯(600295)、太钢不锈(000825)涨逾3%。

医药、食品饮料及家电三大消费板块领跌。

房地产、银行、券商等权重板块普遍表现低迷。

金融业加速对外开放。

中国领导人在博鳌论坛上宣布中国将大幅放宽包括金融业在内的市场准入限制后,近日,央行行长易纲在博鳌亚洲论坛上表示,中国将扩大金融业对外开放,提升国际竞争力。未来,将出现外资控股的券商与国内券商同台竞争的局面。外资机构的参与带来增量资金入场,这将有助于提升A股的活跃度。同时,互通机制的完善,将加速A股国际化布局。

国金融对外开放已经进入快车道,纵观易行长的演讲,传递出我国今年金融政策两大要点,有序扩大外资持股比例,进一步放开国内资本市场互联互通。

易纲表示,上半年,中国将取消银行和金融资产管理公司的外资持股比例限制,内外资一视同仁;允许外国银行在我国境内同时设立分行;将证券公司、基金管理公司、期货公司、人身险公司的外资持股比例的上限放宽到51%,3年以后不再设限;不再要求合资证券公司境内股东至少有一家是证券公司。

同时,完善内地和香港两地股市互联互通的机制,从今年5月1日起把互联互通每日的额度扩大4倍。

此外,还有5项措施在今年年底前推出,包括大幅度扩大外资银行的业务范围;不再对合资券商的业务范围单独设限,内外资一致;经中英双方共同努力,目前沪伦通准备工作进展顺利,将争取于2018年内开通“沪伦通”。

关键词:股票,香港股市,港股,恒指,香港IPO,交易港股,美股,中国A股,股市资讯, 美国上市, 阿里巴巴股票,行业板块,银行股,特斯拉,暗盘,上市,高盛,美国IPO, 蚂蚁金服,蚂蚁金融,高盛,黑石,中方博鳌论坛,华尔街,特朗普的推特,股市警报

来源:东方财富网,新浪财经,同花顺,21世纪经济报道,彭博,华尔街见闻,辉立证券