股市资讯 | 昨日热点板块,债转股概念受追捧(附名单)

港股

北京时间6月25日,美股上周五收升,港股ADR升近90点。昨日央行降准,市场分析人士认为利好内银股、内房股,而中美经贸摩擦,并未好转。昨日早盘,恒指走势反复,盘中一度大幅跳水。午后恒指跌幅不断扩大,一度扩大至1.5%,更是失守29000点关口。

截至收盘,恒生指数跌1.29%,报28961.39点;国企指数跌1.15%,报11208.9点;红筹指数跌1.16%,报4366.96点。大市成交1073.09亿港元。

沪港通资金流向方面,沪股通净流出23.83亿,港股通(沪)净流人3.27亿。

深港通资金流向方面,深股通净流出12.95亿,港股通(深)净流入9.07亿。

宏观基本面:

港元HIBOR(香港银行同业拆借利率)持续走升,隔夜利率涨29个基点至1.80357%;7天利率涨49个基点至2.43%;14天利率上涨28个基点至2.37054%,为2008年以来最高。

焦点股关注:

东江环保(00895)H股遭央视批评,现价急跌17.91%;A股(深:002672)跌停板,现价15.68元。央视新闻直播间昨日报道中央环保督察“回头看”,点名批评东江环保背后的猫鼠同盟。

腾讯控股(00700)昨日大跌2.16%,报价388.8港元。腾讯昨早宣布,已就近期掌握的一些关于“黑公关”的线索向公安机关正式报案,并将配合公安机关依法打击.至昨日下午,腾讯最新表示,多名“黑公关”涉案人员已被警方刑拘,部分嫌疑人潜逃境外。

美股

截至北京时间6月26日凌晨,美股周一收跌,科技股领跌。道指一度下跌及500点。美国总统特朗普重新发出贸易威胁,使贸易战风险骤然提高。

截止收盘,道指跌328.09点,或1.33%,报24,252.80点;标普500指数跌37.81点,或1.37%,报2,717.07点;纳指跌160.81点,或2.09%,报7,532.01点。

道指盘中一度下跌近500点,最低下跌至24,084.39点。道指成份股波音(BA)与英特尔(INTC)均大幅下跌。波音收跌2.29%,英特尔收跌3.41%。

衡量市场恐慌程度的CBOE波动指数(VIX)一度大涨42.4%,最高攀升至19.61点。

宏观基本面:

美国5月芝加哥联储全国活动指数下降0.15,预期0.3,前值0.34。

美国商务部报告称,美国5月新屋销售增速超预期,得益于南部地区新屋销售的强劲表现。5月新屋销售环比上涨6.7%至68.9万户,为2017年11月以来最高。其中南部地区新屋销售上涨17.9%至40.9万套,为2007年7月以来最高;东北部地区则下降10%,西部地区下降8.7%。以5月的销售速度来看,需要5.2个月的时间来清除市场上的房屋供应量,较4月的5.5个月有所下降。

焦点股观察:

哈里-戴维森(HOG)股价收跌5.97%,此前该公司表示,欧盟对该公司出口摩托车的关税税率已从6%上调为31%,这将使该公司从美国出口到欧盟的摩托车平均成本提高约2,200美元。

Education Realty Trust(EDR)股价收高1.3%,此前该公司表示已达成一个最终的并购协议,已同意新近成立的Greystar Student Housing Growth and Income Fund提出的包括承担债务在内的现金交易要约,交易价值约46亿美元。

电视台运营商Gray Television(GTN)大涨16%,此前该公司宣布已达成协议,将收购由员工控股的当地媒体公司Raycom Media,交易价值36.5亿美元,其中包括承担1亿美元债务。

通用电气公司(GE)收跌2.3%,此前有报道称,这家企业集团即将以30亿美元的价格将其工业引擎部门出售给私募股权公司Advent International。

中国A股

北京时间6月25日,昨日两市高开低走,尾盘沪指再度跳水,跌超1%;创业板指早盘持续高位震荡,午后翻绿。央行昨日正式宣布降准,并鼓励银行实施债转股项目,债转股概念股受追捧。人民币兑美元跌势扩大,航空股受挫,中国国航(601111)午后跌停。

截止收盘,沪指报2859.34点,跌幅1.05%,深成指报9324.83点,跌幅0.90%。

盘面上,采掘服务、白酒、债转股、自由贸易港、次新股、海工装备等板块涨幅居前,机场航运、钢铁、煤炭、银行、水泥、券商等板块跌幅居前。

宏观基本面:

人民币贬值幅度加大,昨日在岸人民币和离岸人民币一度全部跌超400点。

焦点股关注:

1、受人民币贬值影响,航空股全线大跌,中国国航(601111)跌停,南方航空(600029)跌9.74%、东方航空(600115)跌10.01%、吉祥航空(603885)跌5.07%、春秋航空(601021)跌5.47%、华夏航空 (002928) 跌3.67%。

消息面上,在岸人民币兑美元跌幅持续扩大,失守6.54关口,刷新年内新低,较上一交易日官方收盘价跌去400余点;此前离岸人民币兑美元一度跌破6.55关口。

2、白酒股表现活跃,古井贡酒(000596)、伊力特(600197)、今世缘(603369)、酒鬼酒(000799)、五粮液(000858)、迎驾贡酒(603198)、洋河股份(002304)、金种子酒(600199)等涨幅居前。

消息面上,五粮液暂缓接受核心产品普五订单,多家一线酒企淡季忙调价。7月1日起,洋河将同时上调海之蓝、天之蓝、梦之蓝出厂价及终端供货价。

债转股:集体大涨(附名单)

消息面上,央行上周日宣布,从2018年7月5日起,下调国有大型商业银行,股份制商业银行,邮政储蓄银行,城市商业银行,非县域农村商业银行,外资银行人民币存款准备金率0.5个百分点。但同时指出,今次降准要定向支持市场化法治化“债转股”和小微企业融资。

债转股概念是指国家组建金融资产管理公司,收购不良资产,把原来与企业间的债权债务关系,转变为金融资产管理公司与企业间的控股(或持股)与被控股的关系,债权转为股权后,原来的还本付息就转变为按股分红。

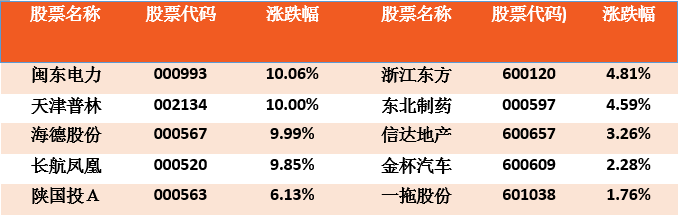

昨日,债转股板块涨1.07%,共有17家公司股票上涨。

来源:东方财富网,新浪财经,同花顺,21世纪经济报道,彭博,华尔街见闻,辉立证券