If you wondered if there was a product blending the features of private equity while also having the properties of fixed income, Azalea Asset Management’s Astrea Bonds may be the thing for you.

Who is Azalea?

But before we dive deeper, what is Azalea Asset Management, and what are Astrea Bonds? Azalea is a wholly-owned subsidiary of Seviora and indirectly owned by Temasek Holdings (Private) Limited. Azalea Group focuses on investing in private equity (“PE”) and developing and innovating new investment platforms and products to make PE accessible to a broader group of investors.

Azalea offers Astrea Bonds and Altrium PE Funds. Altrium PE funds are Azalea’s flagship private equity fund-of-funds product, where accredited investors can co-invest with Azalea and enjoy privileged access to quality private equity funds globally.

What are Astrea Bonds?

Traditionally, retail investors may not have the opportunity to delve into the PE space due to the high barrier of entry, such as the huge initial capital outlay that is required. However, this hurdle can be overcome through Astrea Bonds. The bonds provide bite-size investment lots and are asset-back securities that are designed to provide investors with exposure to PE funds. Astrea bonds are backed by cash flows generated from a portfolio of PE funds, and the underlying cash flow stream is then used to service interest payments to bondholders and ultimately redeem the principal amount that the bondholders had invested previously.

Structure of Astrea Bonds

Additionally, Astrea bonds often incorporate multiple tranches within each issuance, such as Class A and Class B, with Class A being prioritized for repayment, thus offering a lower yield. While Class B bonds, on the other hand, tend to offer a slightly higher yield, these bonds are subordinated in the repayment hierarchy as compared to Class A bonds.

Embedded Structural Safeguards

Within Astrea Bonds, typically a few structural safeguards are in place to provide assurance and protection for its bondholders. These structural safeguards include:

Reserve Accounts: Where its Priority of Payments requires cash to be set aside in these Reserve Accounts over the duration of the bond issuance. These reserve amounts will then be accumulated for the redemption of the different Classes of Bonds on their Scheduled Call Date.

Sponsor Sharing: Upon the Performance Threshold being met, instead of the Sponsor retaining all of the remaining cash flow, Sponsor Sharing will be triggered, where 50% of such cash flow will be allocated to the Reserves Accounts (until the Reserves Accounts Cap is met) to enable a faster build-up of reserves for the redemption of the different Classes of Bonds on their Scheduled Call Date.

Maximum Loan to Value (LTV) Ratio: The structure must be maintained at 50% or less at all times. If the LTV ratio exceeds 50%, the cash flow payment from the funds will be diverted to the reserve account rather than to the sponsor.

Credit Facility: In the event of cash flow shortfalls, credit facilities are in place to fund expenses and interest payments, including unpaid accrued interest and capital calls.

Apart from the structural safeguards that are in place in each series, Astrea Bonds also follow a cashflow waterfall structure where:

When the investments in the portfolio are sold, cash distribution will first flow into

- Payment of Key Expenses

- Interest Payment for Bondholder’s (semi-annually)

- Setting aside into the reserve accounts

- Payment of other expenses

- Last would be the sponsors/owners of the equity

Therefore, despite the complex structure of Astrea Bonds, bondholders come in near the top of the priority of payment—just after funding expenses while usually also carrying an investment grade. This shows that Azalea puts its bondholders’ interest as its top priority when it comes to repayment, and this is something that many investors may find attractive.

Current Astrea Bonds series that are available in the market

Astrea V

Astrea V bonds that were previously announced back on 10 June 2019 not only have enjoyed strong cash distributions of approx USD$1.5bn (which is approx 114% of the initial portfolio NAV), but the portfolio has also enjoyed a fair value gain of USD$815m. Additionally, Class A Reserves have been fully reserved as of June 2023 (12 months ahead of its schedule), and these Reserves have been utilized for the full redemption of Class A1 & A2 Bonds on 20 June 2024. In addition, the performance threshold for this fund was met when the Sponsor received cumulative cashflow exceeding 50% of its equity in the transaction. Class A-1 Bondholders also received a bonus redemption premium of 0.5% of the principal amount. Astrea V Class B bonds that are scheduled for maturity on 20 June 2029 were also partially redeemed (58% of the total US$140m) on 20 June 2024.

Astrea VI

Announced back on 8 March 2021, Astrea VI portfolio has also enjoyed strong cash contributions of over US$1bn (which is approx 70% of the initial portfolio NAV) and has also seen fair value gains of US$442m. As of the last distribution date, the reserves have accumulated 75% of Class A bond size. Astrea VI’s LTV ratio is also comfortably below the range of 50% at 26.9%. Astrea VI’s performance threshold was also met as of 18 September 2022. Thus, this would accelerate the cash flow moving into the reserve, which provides another layer of comfort for Astrea VI noteholders.

Astrea 7

Lastly, Astrea 7 is the latest bond that was issued within the line of Astrea Bonds products. Astrea 7 was announced back on 18 May 2022; due to the market decline on that issuance year, Astrea 7’s portfolio saw a fair value gain of US$29m. Nonetheless, the portfolio has generated healthy cash contributions of over US$600m (which is approx 33% of the initial portfolio NAV), as of the last distribution date. The reserves have also accumulated 41% of Class A bond size alongside an LTV ratio that is below the range of 50% at 36.2%.

Credit Rating Upgrades on the Astrea Bonds

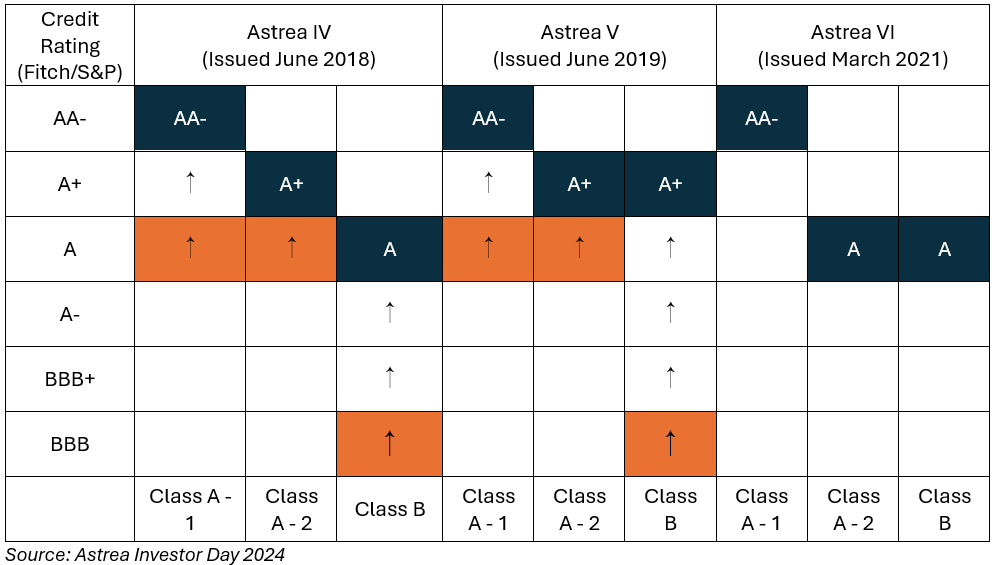

Orange field = Rating at issuance, Blue Field = Current Rating

Despite the challenging macro conditions, Astrea Bonds has experienced several credit rating upgrades for its issuance (as the reserves start to accumulate for its mandated call dates) due to structural safeguards embedded within the bonds.

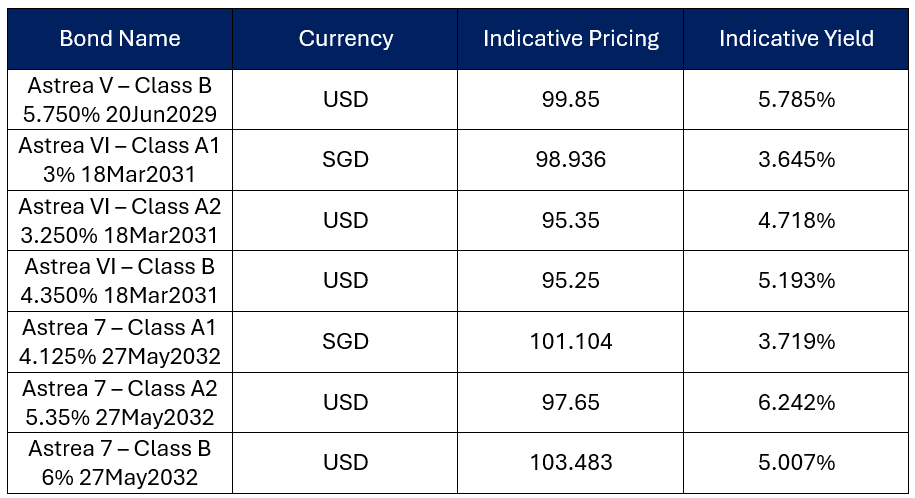

Current Astrea Bonds available in the market (As at 27th June 2024)