Stock Market Today

| 26 April 2024

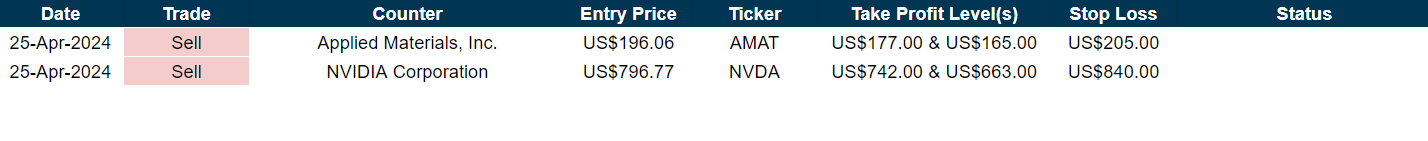

Trade of The Day

Applied Materials, Inc. (NASDAQ: AMAT)

Analyst: Zane Aw

(Current Price: US$196.06) – TECHNICAL SELL

Sell price: US$196.06 Stop loss: US$205.00 (-4.56%)

Take profit 1: US$177.00 (+9.72%) Take profit 2: US$165.00 (+15.84%)

NVIDIA Corporation (NASDAQ: NVDA)

Analyst: Zane Aw

(Current Price: US$796.77) – TECHNICAL SELL

Sell price: US$796.77 Stop loss: US$840.00 (-5.43%)

Take profit 1: US$742.00 (+6.87%) Take profit 2: US$663.00 (+16.79%)

Trades Initiated in the past week

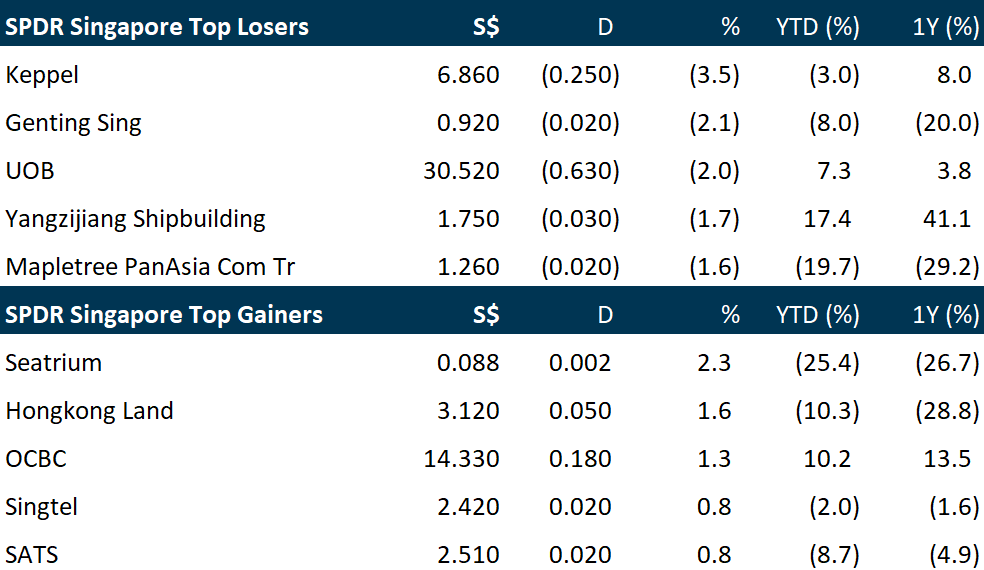

Singapore shares closed lower on Thursday (Apr 25). This came on the back of a steady close on Wall Street overnight, ahead of the release of key US inflation data on Friday that could have a bearing on interest rate policy next week. The decline in the benchmark index was contributed by almost half the components of the 30-stock blue-chip gauge closing in the red, including UOB that went ex-dividend, as well as six counters being unchanged. Shares of Keppel ended S$0.25 or 3.5 per cent lower at S$6.86, making it the worst-performing counter on the STI. The company reported lower revenue for the quarter ended Mar 31, and also went ex-dividend on Thursday.

Wall Street stocks retreated on Thursday following disappointing US economic data, as Facebook parent Meta and other large companies tumbled after earnings. The US economy grew 1.6 per cent in the first quarter, data showed, much slower than expected as consumer spending and exports decelerated. The Dow Jones Industrial Average finished at 38,085.73, down 1.0 per cent but about 330 points above its session low. The broad-based S&P 500 declined 0.5 per cent to 5,048.43, while the tech-rich Nasdaq Composite Index shed 0.6 per cent to 15,611.76.

Top gainers & losers

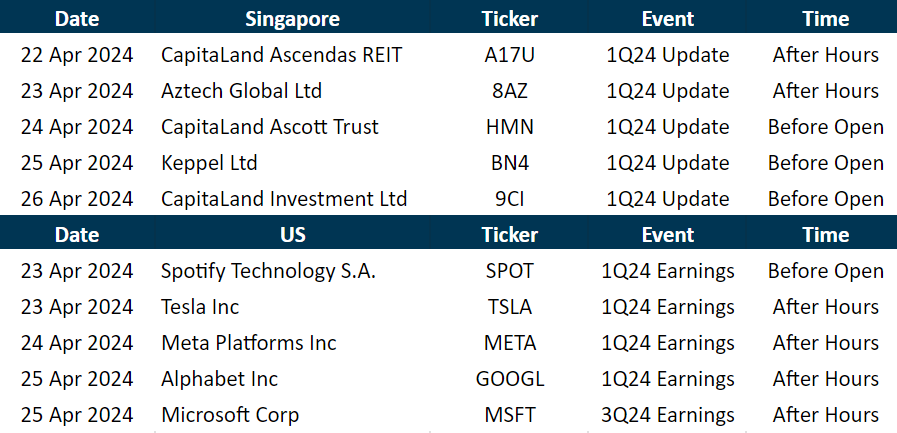

Events Of The Week

SG

The cut-off yield on the latest Singapore six-month Treasury bill (T-bill) fell slightly to 3.74 per cent, according to auction results released by the Monetary Authority of Singapore on Thursday (Apr 25). This compares with the 3.75 per cent offered in the previous six-month auction, which closed on Apr 11. Demand was down in the latest tranche. The auction received a total of S$14.4 billion in applications for the S$6.6 billion on offer, representing a bid-to-cover ratio of 2.18.

Mapletree Industrial Trust (MIT) on Thursday (Apr 25) posted a distribution per unit (DPU) of S$0.0336 for the fourth quarter ended Mar 31, up 0.9 per cent from S$0.0333 in the corresponding year-ago period. Unitholders can expect to receive the distributable payout on Jun 10, after book closure on May 6. Its distributable income for the quarter rose 4.4 per cent to S$95.2 million from S$91.2 million, due to higher net property income and higher distribution declared by its joint venture, Mapletree Rosewood Data Centre Trust. Revenue for the three months was S$178.7 million, up 4.4 per cent on year from S$171.1 million in Q4 FY2023. Net property income also climbed in tandem, rising 2.2 per cent year on year to S$131.8 million, from S$128.9 million.

Financial services company iFast Corp on Thursday (Apr 25) posted a 387.4 per cent spike in net profit to S$14.5 million for its first quarter ended Mar 31, 2024, up from S$3 million previously. This was driven by contributions from iFast’s ePension business unit, as well as improvements in its core wealth management platform business, the group said in a bourse filing. Revenue for the quarter rose 53.1 per cent to S$78.8 million, from S$51.5 million a year earlier. Earnings per share stood at 4.89 Singapore cents for the quarter, up from 1.02 cents previously. An interim dividend of 1.3 Singapore cents per ordinary share was declared for the quarter, up from one cent the year before. The dividend will be paid on Jun 7, 2024.

Suntec Real Estate Investment Trust’s (Suntec Reit) distribution per unit (DPU) for the first quarter ended March declined 13 per cent year on year to S$0.01511, in the absence of the Reit’s capital distribution that concluded in end-2023. The distribution will be paid out to unitholders on May 30 after the record date on May 6. Distribution for the quarter stood at S$44 million, down 12.5 per cent from the prior year. Suntec Reit’s manager on Thursday (Apr 25) said DPU for the quarter was 1.8 per cent lower on an operational basis, which would exclude factoring in last year’s capital distribution. Based on this, distributable income from operations would have been 1.1 per cent lower on the year. Both the declines in operational DPU and distributable income were also due to higher financing costs, as well as vacancies at the Reit’s overseas assets, namely 55 Currie Street in Adelaide, Southgate Complex in Melbourne and The Minster Building in London.

US

Ford Motor posted first-quarter earnings on Wednesday (Apr 24) that beat Wall Street’s expectations, bolstered by a strong performance in its commercial vehicle division and an increase in its hybrid vehicle sales. The company said it expects to achieve the higher end of its projected annual guidance of US$10 billion to US$12 billion in earnings before interest and taxes. Ford shares rose more than 3 per cent in after-market trading on the news. Still, Ford is grappling with what CEO Jim Farley called “a huge drag not just on Ford, but on our whole industry”: electric vehicle (EV) production. The carmaker recorded a US$1.3 billion operating loss for its EV and software division in the first quarter. More broadly, executives expect this section of the company to sustain a pre-tax loss of between US$5 billion to US$5.5 billion for the year. In the near term, hybrids are a top priority for Ford to ease customers into a battery-powered future, and the auto company aims to increase hybrid sales by 40 per cent this year and quadruple them in the coming years.

S&P Global on Thursday (Apr 25) beat Street estimates for its first-quarter profit, as hopes of a “soft landing” spurred investors to spend more on data and analytics products. With growing expectations of the US Federal Reserve avoiding a recession, investors are increasingly spending more on analytics and data-related products. This trend bodes well for companies like S&P Global who provide such offerings. Revenue from S&P’s Ratings segment, which provides credit ratings, research and analytics to investors, jumped 29 per cent to US$1.06 billion in the quarter from a year earlier. It helped the company post its record quarterly revenue of US$3.49 billion. The company reported an adjusted diluted profit of US$4.01 per share for the three months ended Mar 31, compared with analysts’ expectations of US$3.66 per share. The New York-based firm also raised its full-year revenue growth as well as adjusted profit forecast on growing optimism of a rebound in the economy and increased confidence in strong demand for its services. The company now forecasts a full-year adjusted profit of US$13.85 to US$14.10 per share, compared with its earlier expectations of US$13.75 to US$14.00 per share.

Snap beat Wall Street’s expectations for quarterly revenue and user growth on Thursday, as improvements to its advertising system delivered results faster than anticipated. Shares of Snap spiked 25 per cent to US$14.32 in after-market trading. The owner of photo messaging app Snapchat has been working over the past year to improve how it targets ads to users and simplify the way people interact with the ads. The company has historically struggled to compete against much larger rivals like Facebook owner Meta Platforms for digital ad revenue. Revenue during the first quarter ended March 31 was US$1.2 billion, up 21 per cent from the prior-year quarter and beating the analyst consensus estimate, which was US$1.12 billion according to LSEG data. In a letter to shareholders, Snap said its business was improving faster than it expected due to the upgrades of its ad system and higher demand for features that help brands drive sales or website clicks.

Microsoft on Thursday said earnings in the last quarter beat expectations as the tech titan continued to see its aggressive push into artificial intelligence boost revenues and profit. The company led by CEO Satya Nadella said sales in the January to March period rose by 17 per cent from a year earlier to US$61.9 billion, with net profit up by 20 per cent to US$21.9 billion. The results were cheered by Wall Street investors who pushed up the share price by about four per cent in after hours trading, consolidating Microsoft’s position as the world’s biggest company by market capitalisation. Microsoft has been hugely rewarded by investors since it aggressively pushed into rolling out generative AI, starting with its US$13 billion partnership with OpenAI, the creator of ChatGPT in 2023. The company has made its Copilot AI chatbot available as an add-on to some of its key products such as Office 365, and the coding assistant GitHub. The embrace of AI has boosted sales of its key cloud services, such as Azure, which have become the core of Microsoft’s business under Nadella’s leadership.

Intel, the biggest maker of personal computer (PC) processors, tumbled in late trading after giving a lacklustre forecast for the current period, indicating that it’s still struggling to return to the top tier of the chip industry. Sales in the second quarter will be about US$13 billion, the company said on Thursday (Apr 25). That compares with an average analyst estimate of US$13.6 billion, according to data compiled by Bloomberg. Profit will be 10 US cents a share, minus certain items, versus a projection of 24 US cents. The outlook signals that a push by chief executive officer Pat Gelsinger to revitalise Intel is going to take more time and money. Once the world’s dominant chipmaker, the company is lagging behind rivals such as Nvidia and Taiwan Semiconductor Manufacturing in revenue and technological know-how.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Suntec REIT – Higher-for-longer interest rate continue eroding DPU

Recommendation: BUY (Maintained), Last Done: S$1.10

Target price: TP: S$ 1.41, Analyst: Liu Miaomiao

- Gross revenue for 1Q24 inched up 1% YoY to S$109.8mn and NPI contracted by 3.8% YoY to 73.4mn underpained by the stronger-performing Suntec Center, forming 23%/22% of our FY24 estimate respectively. DPU decreased by 13% in 1Q24 to S$1.51 cents, in the absence of capital distribution (FY23: S$5.8mn), and was within our expectations. If the capital top-up is excluded, DPU will decline slightly by 1.8% YoY.

- High rental reversion continued in FY24 with Singapore office generated 11.4% for 1Q24 and Suntec City Mall contributing 21.7%. We expect rental reversion of mid-teens for retail and high-single-digit for office in FY24.

- We reiterate our BUY recommendation with a lower DDM-TP of S$1.41 (prev: S$1.47) and FY24e-25e DPU forecasts of S$6.2 to S$7.49 cents after factoring in the higher-for-longer interest rate and longer-than-expected leasing downtime of oversea properties. We expect FY24e DPU to be eroded by the high interest rate since only hedged 57% of its borrowing to fixed-rate. Nevertheless, earings will be supported by high rental reversions of the Singapore side and divestment of strata office assets in Suntec reduce to lower interest expense.

Spotify Technology S.A. – Raised prices and subscribers still grew

Recommendation : BUY (Upgraded); TP: US$340.00, Last Close: US$281.23

Analyst: Jonathan Woo

- 1Q24 revenue was within expectations, while PATMI was above due to lower-than-expected costs. 1Q24 revenue/PATMI was at 23%/33% of our FY24e forecasts.

- Growth driven by a combination of subscriber gains and price increases (ARPU 5% YoY). Leveraging scale for meaningful cost benefits through better royalty agreements, improving gross margin 240bps YoY to 27.6%.

- We raise our FY24e PATMI by 26% on lower costs and higher operating leverage while keeping our revenue forecast unchanged. SPOT continues solidifying its position as the industry leader in audio streaming with its growing subscriber base, lower cost structure, and pricing power. We upgrade to BUY from ACCUMULATE with a raised DCF target price of US$340 (prev. US$270) to reflect our assumptions. Our WACC/growth rate of 7.5%/4% remains unchanged.

CapitaLand Ascott Trust – Occupancy to improve with ADRs stabilising

Recommendation: BUY (Upgraded), Last Done: S$0.90

Target price: S$1.04, Analyst: Darren Chan

- No financials were provided in this business update. 1Q24 gross profit rose 15% YoY due to stronger operating performance and contributions from new properties. It was 7% higher YoY on a same-store basis.

- 1Q24 portfolio RevPAU rose 6% YoY to S$135, in line with pre-COVID 1Q19 levels. 1Q24 average portfolio occupancy was stable YoY at 73%, and it was at 88% of pre-COIVD levels.

- Upgrade from ACCUMULATE to BUY with an unchanged DDM-TP of S$1.04 due to the recent share price performance. FY24e DPU is slightly lowered by 2% on higher interest costs assumptions. CLAS remains our top pick in the sector owing to its mix of stable and growth income sources and geographical diversification, which provide resilience amidst global uncertainties. Growth in RevPAU going forward will be driven by portfolio occupancy as ADR stabilises. The current share price implies an FY24e/25e dividend yield of 6.6/6.8%.

JPMorgan Chase & Co – NII continues to rise, guidance maintained

Recommendation: Buy (Maintained), Last done: US$193.08, TP: US$231.19, Analyst: Glenn Thum

- 1Q24 PATMI was 24% of our FY24e forecast and met our estimates. JPM recorded higher NII, asset management and investment banking income offset by lower principal transactions income and higher expenses. DPS is raised 15% YoY to US$1.15 and dividend payout ratio increased to 26% (1Q23: 24%), 1Q24 common stock net repurchases maintained at US$2bn.

- NII rose 11% YoY from the impact of balance sheet mix and higher rates, while loans grew 3% YoY. Principal transactions were down 11% YoY while asset management and investment banking rose 20% and 18% respectively. JPM has maintained its FY24e NII guidance of US$90bn and share buybacks of US$2bn per quarter.

- Maintain BUY with an unchanged target price of US$231.19. Our FY24e estimates remain unchanged. We assume 2.07x FY24e P/BV and ROE estimate of 20.2% in our GGM valuation. Stable NII and a recovery in both asset management and investment banking income will sustain earnings.

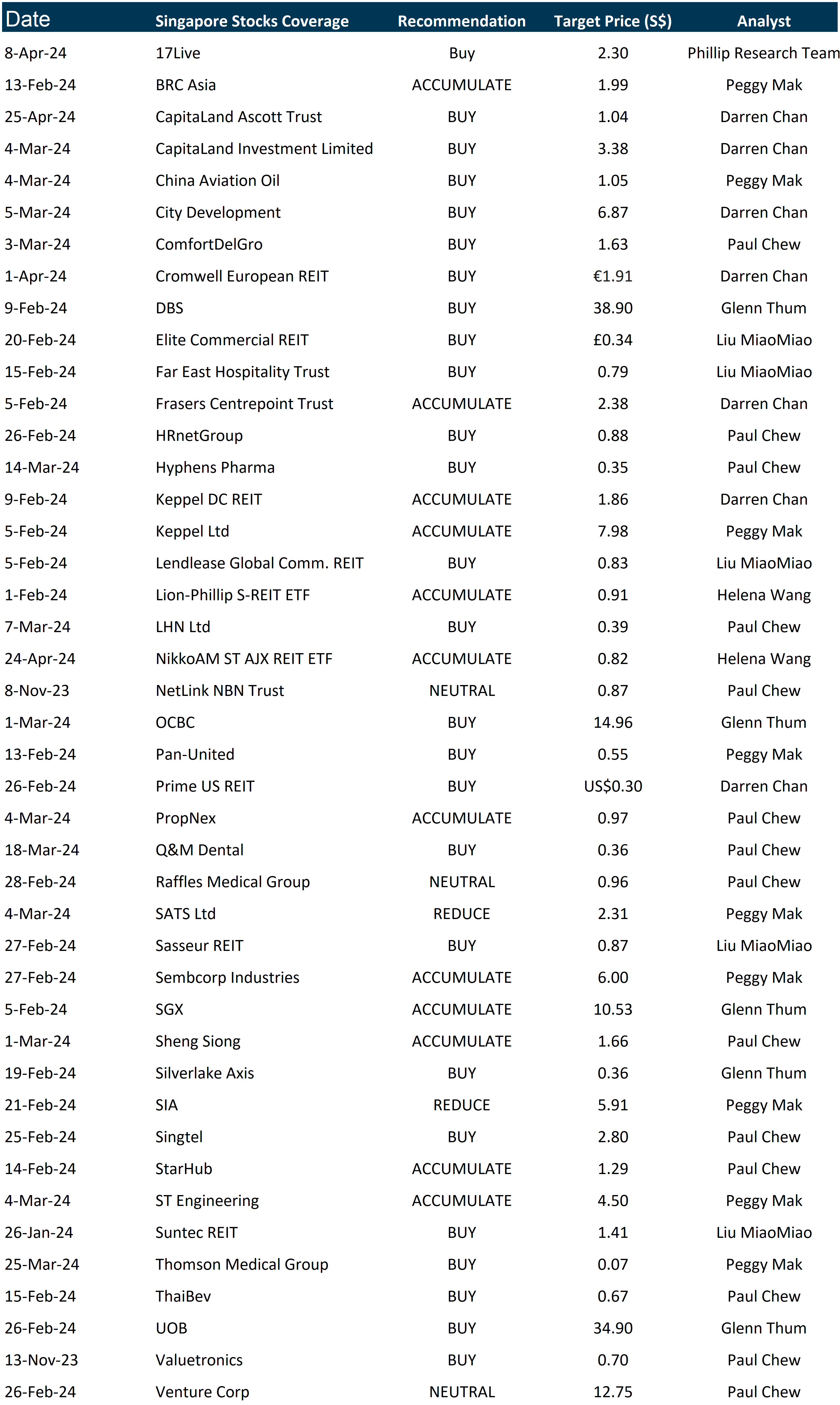

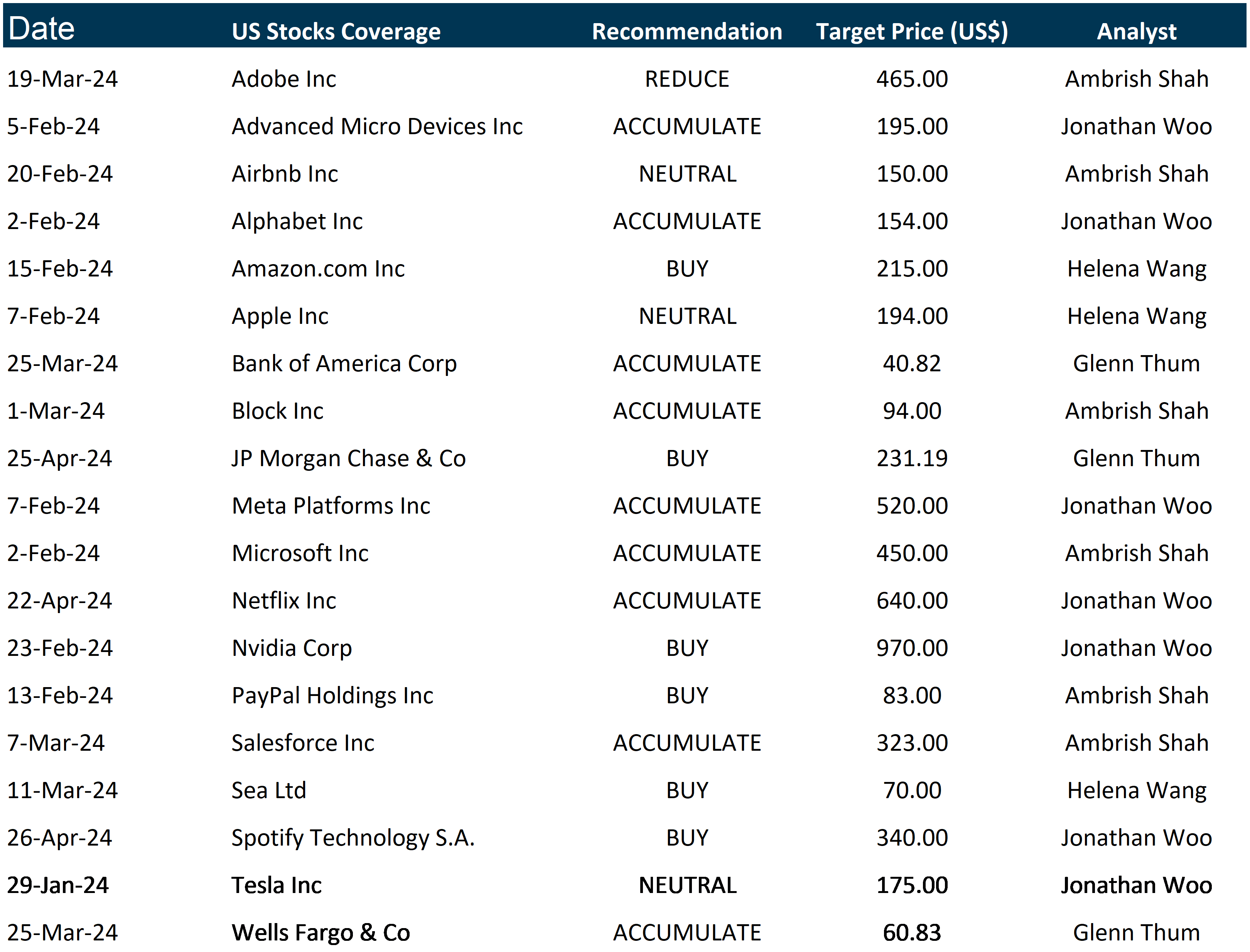

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Corporate Insights by Hyphens Pharma International Limited

Date & Time: 30 Apr 2024 | 12pm -1pm

Register: https://tinyurl.com/3z5hhbet

Corporate Insights by Cromwell European REIT [NEW]

Date & Time: 7 May 2024 | 12pm -1pm

Register: https://tinyurl.com/3fac8j6z

Corporate Insights by AIMS APAC REIT [NEW]

Date & Time: 8 May 2024 | 12pm -1pm

Register: https://tinyurl.com/y43mtys4

Corporate Insights by ESR-LOGOS REIT [NEW]

Date & Time: 9 May 2024 | 12pm -1pm

Register: https://tinyurl.com/2p9pzwbw

Corporate Insights by United Hampshire US REIT [NEW]

Date & Time: 15 May 2024 | 12pm -1pm

Register: https://tinyurl.com/2jnb3mp9

Research Videos

Weekly Market Outlook: Strategy & Stock Picks SG and US Market, Tech Analysis & More!

Date: 22 April 2024

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials