- Home

- Bonds Trading

- Bond Financing

Bond Financing

With Bond Financing, you may use assets such as cash, shares, Exchange Traded Funds (ETFs), unit trusts, or bonds as collateral to purchase bonds with financing. This allows you to free up cash and optimize your portfolio to achieve your financial goals earlier.

How Does Bond Financing Work?

Using your existing portfolio as collateral, you may purchase bonds with financing to increase your portfolio yield without any additional cash outlay.

| Existing 80% Loan to Value portfolio receiving 5% coupon p.a. | S$250,000 |

| Annual coupons received | S$12,500 |

| Available loan amount if purchase 80% Loan to Value bonds | S$1,000,000 |

| Purchase 2 more bonds for S$500,000 @ 5% coupon p.a. on financing | |

| New total portfolio receiving 5% coupon p.a. | S$750,000 |

| Annual coupons received | S$37,500 |

| Less financing charges of 3.2% on $500,000 loan | S$16,000 |

| Net coupons received | S$21,500 |

By purchasing bonds with higher coupon rates than our bond financing rate, you will be able to profit from the difference in rates and increase your bond portfolio yield. This is called Positive Carry, which takes advantage of our low bond financing rates.

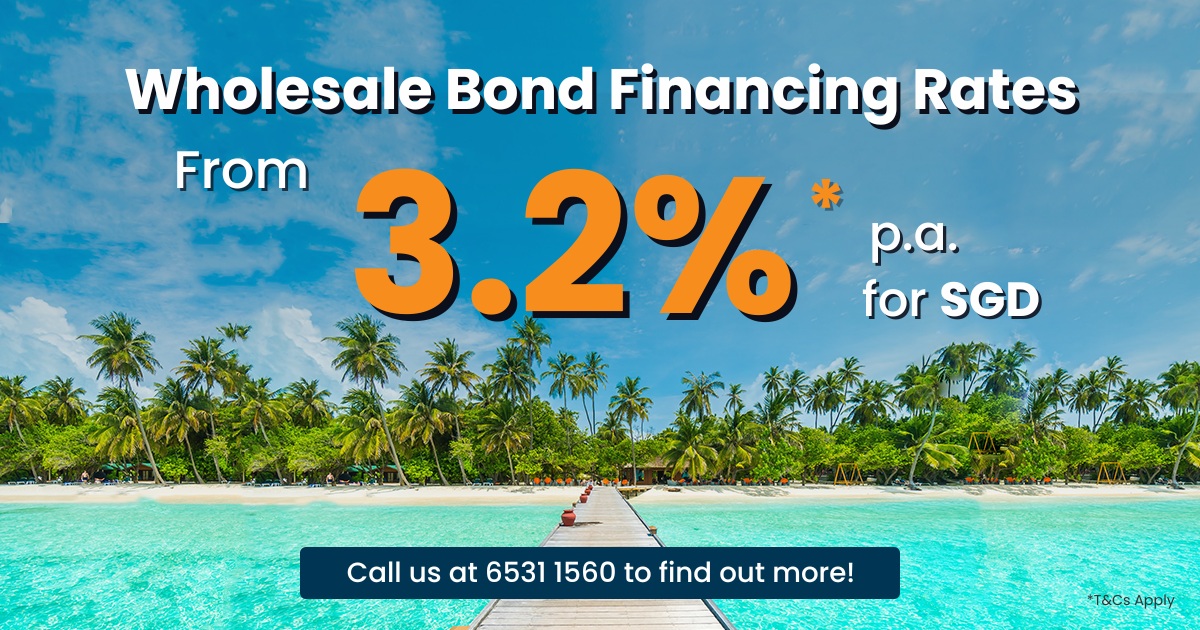

Financing Rates

Our Bond financing rates are as follows:

| Bond Portfolio | SGD Financing Rates |

| SGD 250,000 and above | 3.2% p.a. |

| Below SGD 250,000 | 4% p.a. |

PSPL may at any time at its sole discretion change the interest rates set out based on prevailing interest rate environment and quality & concentration of securities in your portfolio

Terms & Conditions

- Financing rate is applicable only for Wholesale bond trades placed with our bond desk using a designated bond margin account.

-

Customers will need to maintain net assets of at least S$200,000 or its equivalent at all times in their bond margin account (including before placement of first trade); net assets are calculated as follows:

- the value of securities net of the debit balance in your bond margin account; or

- the sum of the credit balance and securities (if any) in your bond margin account.

- Financing rate stated applies only for borrowings denominated in SGD.

- Customers need to inform our bond dealers that a relevant buy trade is to be funded using financing.

- Financing rate applies only for designated margin accounts as confirmed by our bond dealers. For all other margin accounts, our prevailing interest rate will apply, you may refer to our product info sheet for more information on our prevailing interest rate.

- All designated bond margin accounts are subject to the concentration limit of 1 lot or 25% issuer financing cap on a portfolio basis.

- Financing rate is subject to change based on the prevailing interest rate environment.

- Notwithstanding anything herein contained, Phillip Securities Pte Ltd (PSPL) reserves the right at any time in its absolute discretion to (i) amend, add and / or delete any time of these Terms & Conditions without prior notification (including eligibility and qualifying terms and criteria), and all customers shall be bound by such amendments, additions and / or deletions when effected, or (ii) vary, withdraw, or cancel any items or the preferential bond financing rate without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the application of the preferential bond financing rate shall be final and binding on all margin account holders.

- By requesting for a specific margin account to be a designated bond margin account, customer acknowledges that he/she has read and consented to these Terms & Conditions.

Financing Rates

We offer over 100 bonds to finance. Find out if a bond is available for financing by using Margin Finder:

Margin Finder

Note:

- Grade S = 80% Financing

- Grade A = 70% Financing

- Grade B = 50% Financing

- Grade E = 30% Financing (in Cash Plus & Margin Accounts only)

- Warrants will be non-marginable 6 months to their expiry.

How Much Can I Borrow

The amount of loan you are able to get depends on several factors such as the grading of your collateral, the grading of securities you intend to purchase, as well as your approved loan amount.

To find out how much you can borrow based on your collateral and purchases, please view the table below:

Step 1: Choose your collateral type

Step 2: Choose your grade of purchase.

Greater Investment Power

The multiplier table below illustrates how much you can leverage to purchase shares, ETFs and bonds based on different types of collateral

| Step 2 |

||||||

| Step 1 Step 1 |

Collateral Type (Cash, Shares, ETFs, Bonds) |

80% Financing PURCHASE |

70% Financing PURCHASE |

50% Financing PURCHASE |

30% Financing PURCHASE |

No Financing PURCHASE |

|---|---|---|---|---|---|---|

| CASH (S$10,000) |

S$50,000 | S$33,330 | S$20,000 | S$14,290 | S$10,000 | |

| 80% Financing (S$10,000) |

S$40,000 | S$26,670 | S$16,000 | S$11,430 | S$8,000 | |

| 70% Financing (S$10,000) |

S$35,000 | S$23,330 | S$14,000 | S$10,000 | S$7,000 | |

| 50% Financing (S$10,000) |

S$25,000 | S$16,670 | S$10,000 | S$7,140 | S$5,000 | |

| 30% Financing (S$10,000) |

S$15,000 | S$10,500 | S$6,000 | S$4,280 | S$3,000 | |

|

Example 1: Client deposits S$10,000 cash and wishes to purchase “80% Financing” shares

|

Example 2: Client deposits S$10,000 cash and S$10,000 “80% Financing” shares to purchase “50% Financing” shares

|

You can use your “80% Financing”, “70% Financing”, “50% Financing” or “30% Financing” shares as collateral to purchase “No Financing” shares.

How Do I start using Bond Financing?

Step 1: Open A Margin Account

To open a Margin Account, visit any of our Phillip Investor Centres in Singapore with your NRIC, or apply for one online here.

The account takes about 1 week to open upon applying.

Step 2: Deposit Your Collateral

After your Margin Account has been opened, you may transfer cash or existing securities into it to use as collateral.

- To transfer securities from other Phillip Securities Trading Accounts into your Margin Account, kindly contact your FA/TR for assistance. Don’t have their contact? Kindly give our customer hotline a call at (+65) 6531 1555 to inquire.

- To transfer in securities from other counter-parties into your Margin Account, kindly contact your FA/TR for assistance.

- To transfer in your securities from CDP into your Margin Account, visit any of our Phillip Investor Centres here with your NRIC

Risks

Leverage Risk

As Bond Financing involves the use of leverage, your portfolio may experience higher volatility due to magnified gains and losses.

Margin Calls

When your collateral value falls below the required maintenance margin, you may be subjected to a margin call. This means you may potentially lose more than your initial investment in the event of adverse price declines or in cases of bond defaults.

Learn more on the required maintenance margin and margin calls in our Information Sheet.

Get Started Today

Open an Account EnquiryFor assistance, call 6212 1818 | Visit our Phillip Investor Centres