Advanced Order Types

Trade with precision and leverage market movements effectively with a host of advanced order types available on the award-winning POEMS suite of trading platforms.

Learn how to utilise Advanced Order Types in your trades:

- How to Use Advanced Order Types to Invest: Part I

- How to Use Advanced Order Types to Invest: Part II

Available across all markets on Poems platform.

What is a Limit Order?

A Limit Order is an order to buy or sell a stock at a specific price or lower / higher.A Buy Limit Order can only be executed at the limit price or lower, and a Sell Limit Order can only be executed at the limit price or higher. A Limit Order can only be filled if the stock's market price reaches the limit price. While limit orders do not guarantee execution, they help ensure that an investor does not pay more than a pre-determined price for a stock.

Frequently Asked Questions (FAQ)

Learn more about Market Orders

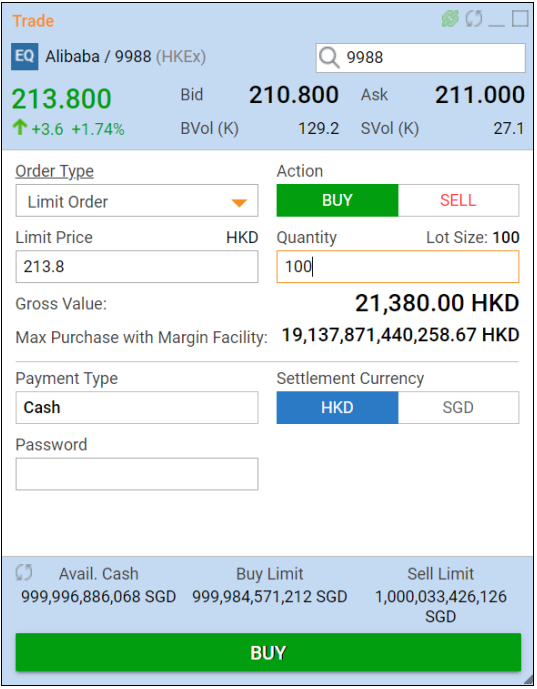

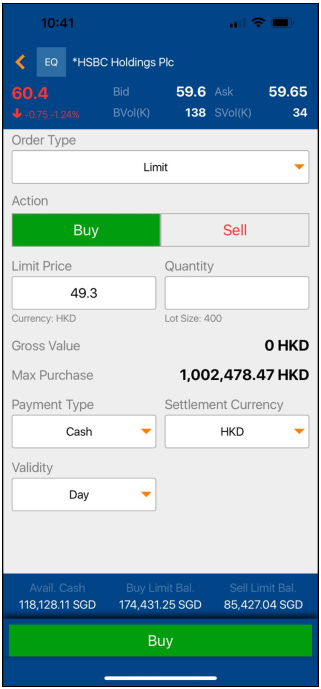

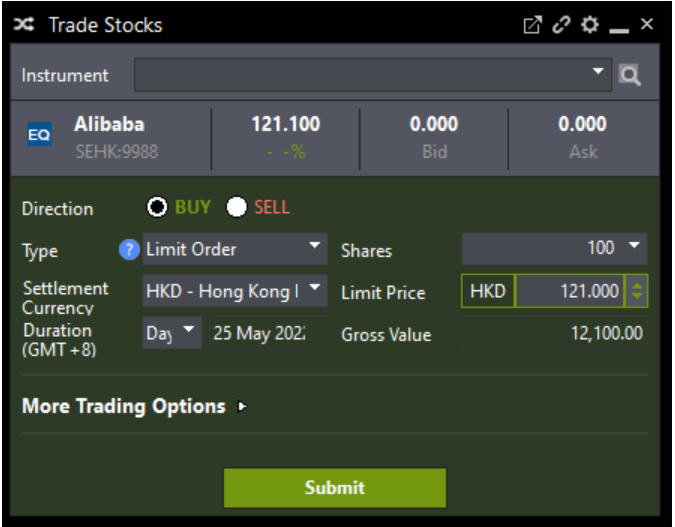

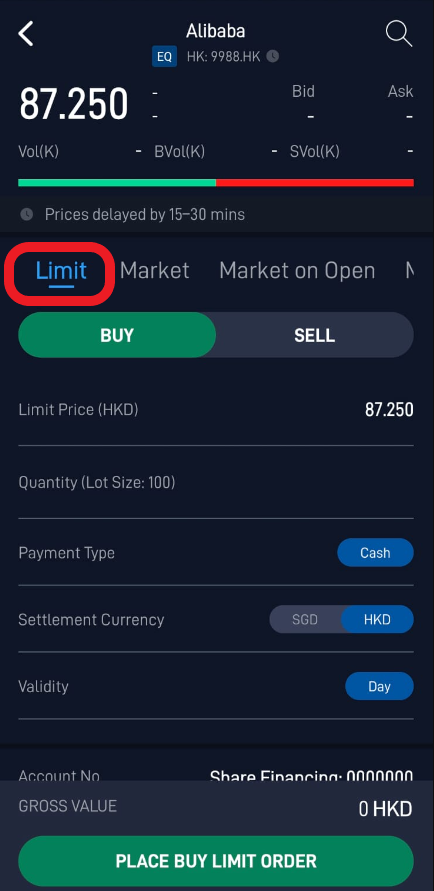

Step 2: Key in your Limit Price, Quantity and other required information

Step 3: Confirm your trade details, then click on the “Buy” or “Sell” / “Submit” button to submit your order

award-winning suite of platforms or open a live trading account today

Try Demo Open An Account

Available in selected exchanges on POEMS 2.0, POEMS Mobile 2.0, POEMS Mobile 3 and POEMS Pro

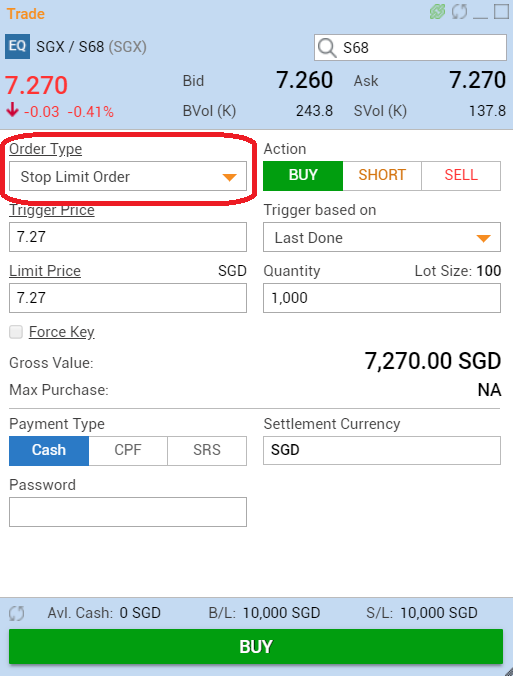

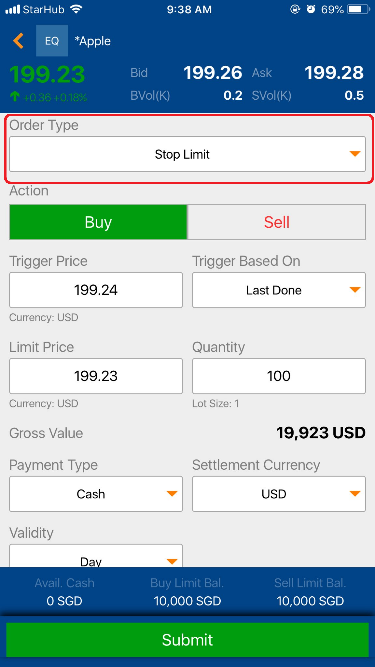

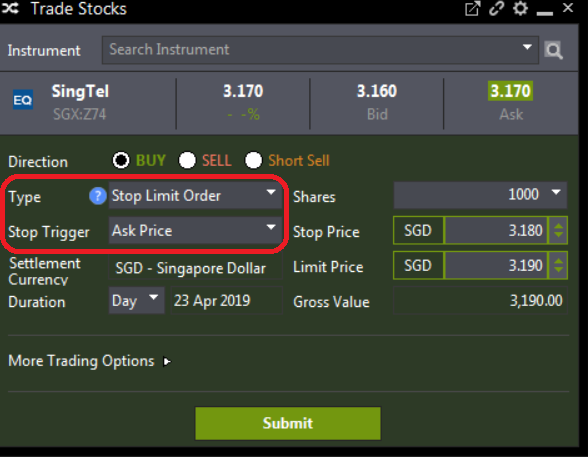

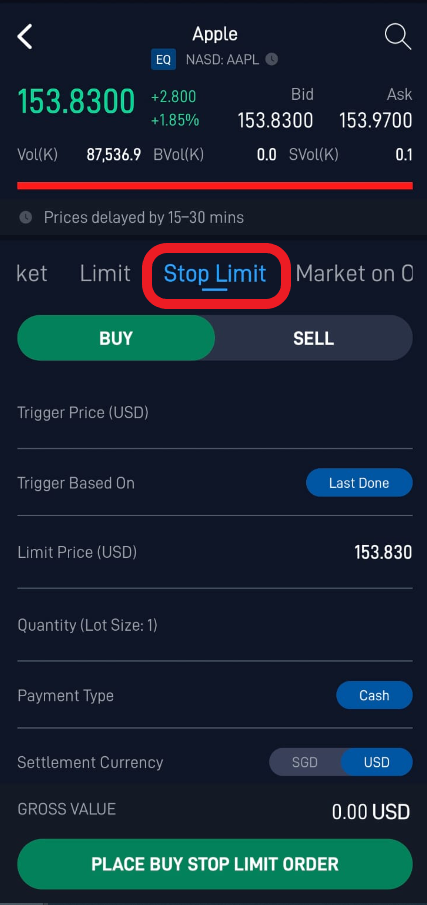

What is a Stop Limit Order?

A Stop Limit order is an order to buy or sell a stock once the price of the stock reaches a specified price, known as the Trigger Price. Once the trigger price is reached, a Stop Limit order becomes a limit order that will be executed at a specified price (or better).Are Stop Limit Orders available on POEMS?

POEMS 2.0, POEMS Mobile 2.0, POEMS Mobile 3 and POEMS ProStop Limit orders are supported for orders on SGX, NASDAQ, NYSE, AMEX

Frequently Asked Questions (FAQ)

|

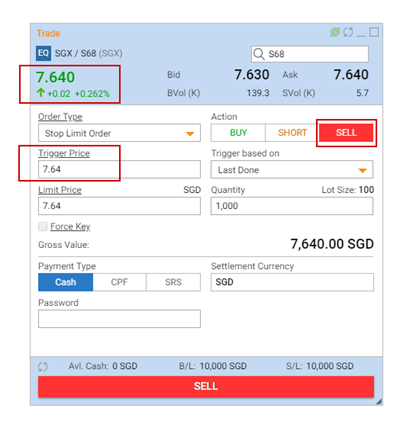

Sell Stop Limit This is the Stop Limit order when you have a long position on a security. In this case, the trigger price is placed below current market price of the security. |

|

|

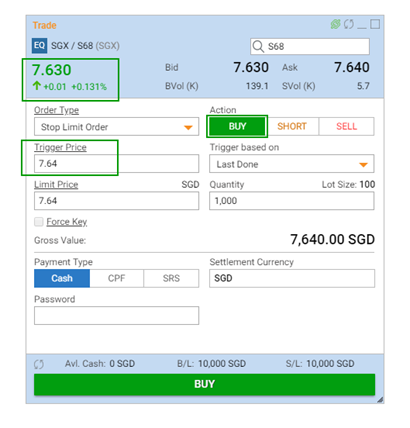

Buy Stop Limit This is the Stop Limit order when you have a short position on a security. In this case, the trigger price is placed above current market price of the security. |

|

The disadvantage is that there will be no guarantee that the order will be filled in the event the price gaps through the limit price. In such an event, the order will not be filled.

Example: Assume that stock SGX is trading at $6.81 and an investor wants to BUY once it begins to show an upward momentum. The investor places a Stop Limit order to BUY with trigger price at $6.83 and limit price at $6.84. If the price of SGX reaches the trigger price of $6.83, the order is activated and turns into a limit order. As long as the order can be filled under $6.84 (the limit price), then the trade will be done/part done. If the stock gaps above $6.84, the order may not be filled.

As with all limit orders, a Stop Limit order may not be executed if the stock’s price moves away from the specified limit price, which may occur in a fast-moving market.

Short-term market fluctuations in a stock’s price can activate a Stop Limit order, so trigger price and limit price should be selected carefully.

US Stop Limit Buy (Sell) order placed prior to market opening through POEMS Trading Platforms (POEMS 2.0, POEMS Mobile 2.0, POEMS Mobile 3, POEMS Pro) will be elected and effected as a Limit Order if the opening price is above (below) the Buy (Sell) trigger price.

For US Stop Limit Order, the default stop trigger on POEMS Trading Platforms is based on the last done price. For SG Stop Limit Order, the default stop trigger on POEMS Trading Platforms is the bid/ask/last done price.

Step 2: Key in your Limit Price, Trigger Price, Quantity and other required information

Step 3: Confirm your trade details, then click on the “Buy” or “Sell” / “Submit” button to submit your order

Alternatively, submit a Stop Limit Order in just ONE CLICK with OB Trader (available for free on POEMS Pro)!

award-winning suite of platforms or open a live trading account today

Try Demo Open An Account

Available in selected exchanges on POEMS 2.0, POEMS Mobile 2.0, POEMS Mobile 3 and POEMS Pro

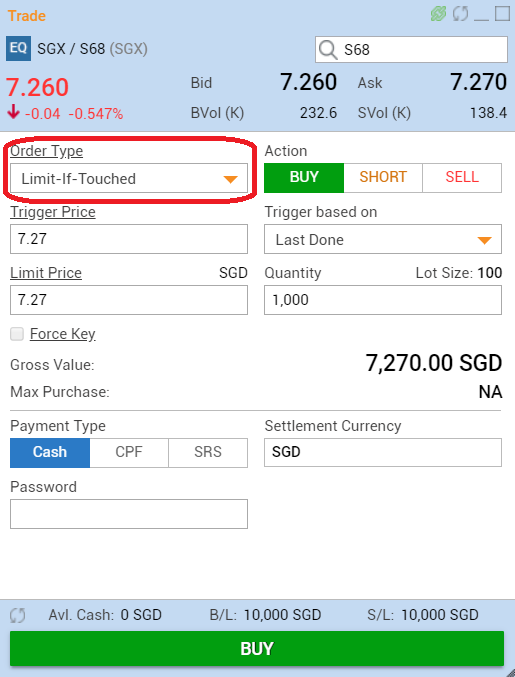

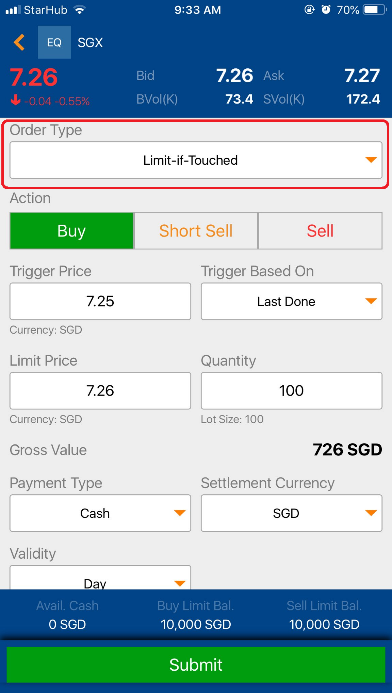

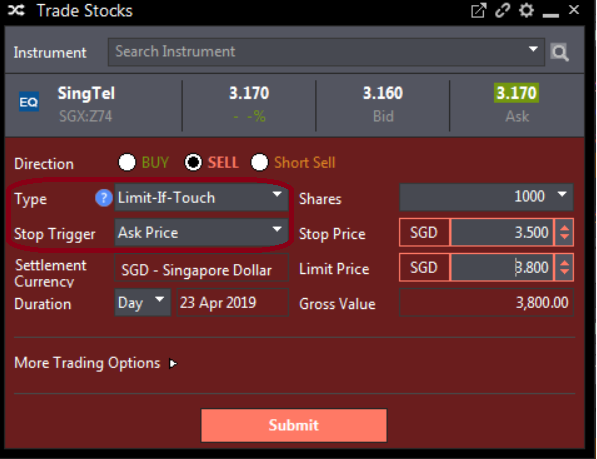

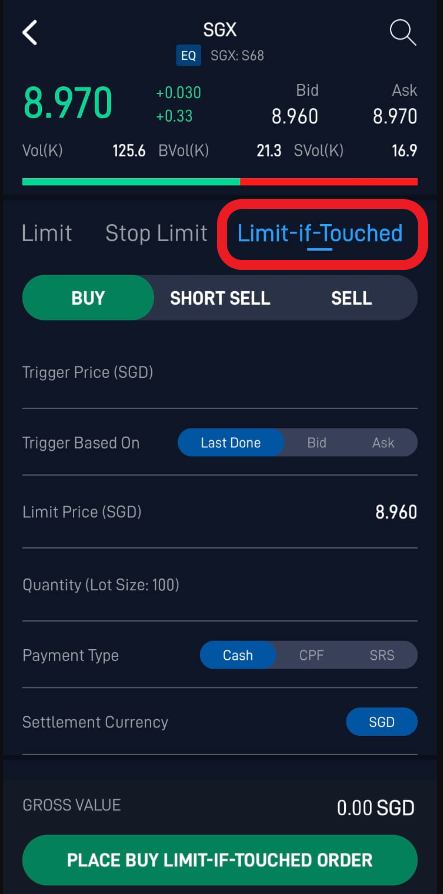

What is a Limit-if-Touched (LIT) order?

A Limit-if-Touched is an order to buy (or sell) a contract at a specified price or better, below (or above) the market. This order is held in the system until the trigger price is touched. An LIT order is similar to a Stop Limit order, except that an LIT sell order is placed above the current market price, and a Stop Limit sell order is placed below.A LIT order is similar to a Limit order except that a LIT Buy order allows the trader to ensure market support (trigger price) is reached before entering a Limit Buy order with such a price that the buy order has a high probability to be filled, while a limit buy order may or may not be filled when last done price is traded at this price.

Are Limit-if-Touched orders available on POEMS?

POEMS 2.0, POEMS Mobile 2.0 and POEMS Mobile 3LIT Orders are currently supported for orders on SGX only.

POEMS Pro

LIT Orders are supported for orders on SGX, NASDAQ, NYSE, AMEX.

Frequently Asked Questions (FAQ)

Example 2: An investor enters a Limit-if-Touched sell order at $3.45 for 10 lots of ABC shares with trigger price $3.50. The price of ABC shares starts rising from an opening price of $3.30 and reaches $3.50 intraday. Upon the price of ABC shares reaching $3.50, the Limit-if-touched order is triggered, and is converted into a limit sell order of $3.45 for 10 lots of ABC shares to make sure the sell order has a high probability to be done.

- For Advanced Orders, customers are to ensure that their trading accounts have sufficient buy or sell trading limits to allow orders to be submitted when the Stop Limit Order’s triggering conditions are met. Otherwise, the order triggered may be rejected due to insufficient trading limit.

- Please take note that the Trigger Price cannot exceed 30 bids from the Last Done Price and the Limit Price cannot exceed 30 bids from the Trigger Price.

- There is no guarantee that the Stop Limit Order/Limit-if-Touched Order will be filled in the event the price exceeds the Limit Price.

- Please note that Advanced Orders can only be triggered during the market open phase. Overnight Advanced Orders may get rejected by the exchange after the market is open if the limit price is outside of the allowed price range when the Advanced Order is triggered.

Step 2: Key in your Limit Price, Trigger Price, Quantity and other required information

Step 3: Confirm your trade details, then click on the “Buy” or “Sell” / “Submit” button to submit your order

award-winning suite of platforms or open a live trading account today

Try Demo Open An Account

Available across all markets on POEMS Pro

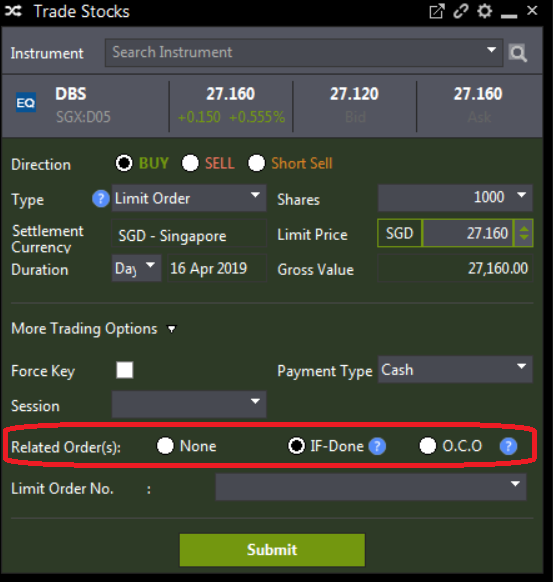

What is an If-Done order?

It is an order that is structured of two or more steps that must occur in a specified sequence. Only after the first step in the sequence is completed, then will the second step be activated. This related order can be used if you are unable to continuously monitor the market but want to participate in the market movements in your favour and/or exit a move against you. Currently, only Limit Orders can be used for an If-Done related order.Frequently Asked Questions (FAQ)

Step 2: Key in your Limit Price, Quantity and other required information

Step 3: Under “More Trading Options”, select the “IF-Done” option and key in other necessary information

Step 4: Confirm your trade details, then click on the “Submit” button

award-winning suite of platforms or open a live trading account today

Try Demo Open An Account

Available in SGX only on POEMS Pro

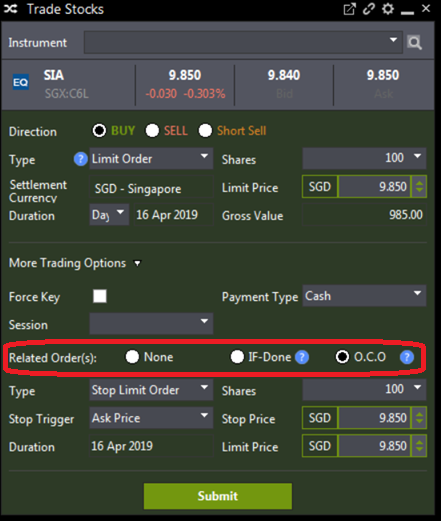

What is a One-Cancels-The-Other (OCO) Order?

It is an order that allows the submission of 2 orders simultaneously to either take profit or cut loss. If one part of the order is executed, the other is automatically cancelled. OCO orders are generally used by traders for volatile stocks that trade in a wide price range.Frequently Asked Questions (FAQ)

Step 2: Key in your Limit Price, Quantity and other required information

Step 3: Under “More Trading Options”, select the “O.C.O” option and key in other necessary information

Step 4: Confirm your trade details, then click on the “Submit” button

award-winning suite of platforms or open a live trading account today

Try Demo Open An Account

Available in US and HK market on POEMS 2.0, POEMS Mobile 2.0, POEMS Mobile 3 and POEMS PRO.

What is a Market order?

A Market Order is an order placement with a defined quantity but without a price. It will be traded at the best price currently available in the market.Market orders will automatically convert the order to an aggressive limit order within a certain limit “in the money”. Please note that it is a client’s responsibility to check if the order is filled in the market after order entry. Particularly when market changes quickly. For stocks not actively traded, market orders often are executed at different price level and at price too high or too low.

Although these limit prices are set at a level intended to balance the objectives of execution certainty and minimized price risk, there exists a remote possibility that an execution will be delayed or may not take place.

If you experience or suspect any errors with your order, you should contact Phillip Securities Pte Ltd immediately.

*Disclaimer

The advance order is a convenient online transaction method provided by Phillip Securities Pte Ltd for customers. Phillip Securities Pte Ltd provides as stable service as possible, but we cannot guarantee its absolute reliability. If the advanced order is not executed due to network interruption, server abnormality and other physical factors or any others factors , Phillip Securities Pte Ltd will not be liable for any loss or damage caused thereby.

Frequently Asked Questions (FAQ)

This will be magnified for illiquid counters that have large bid and ask spreads. There is a lack of control in terms of price precision.

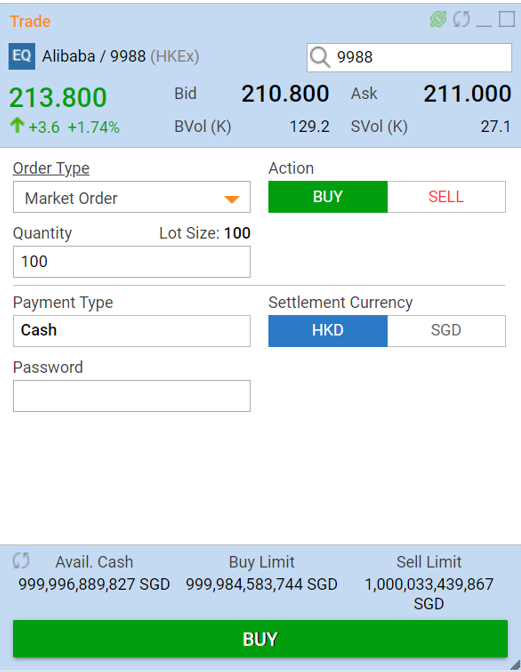

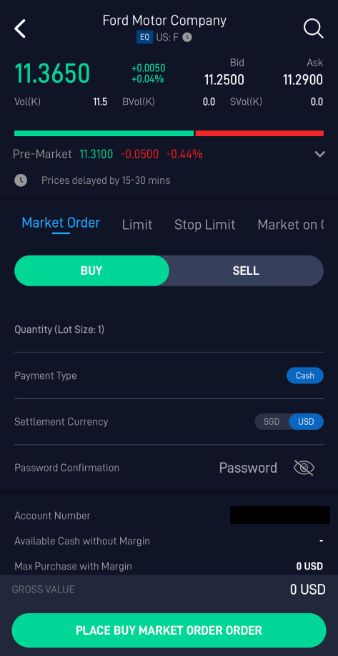

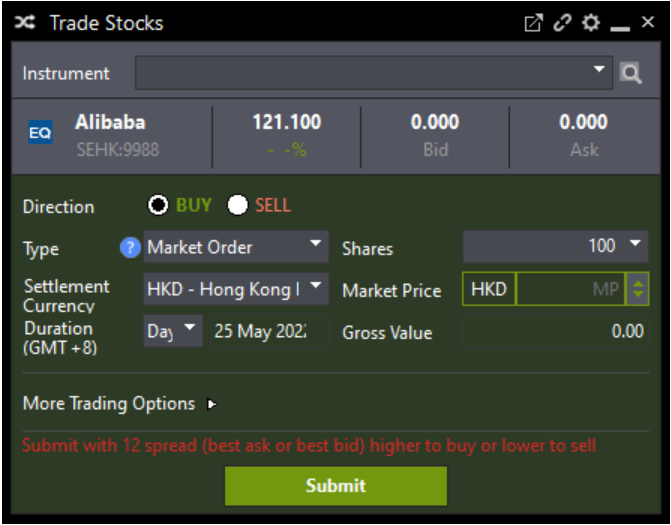

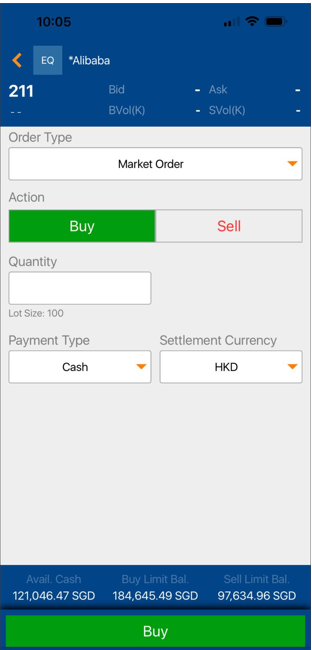

Step 2: Key in your desired Quantity and other required information

Step 3: Confirm your trade details, then click on the “Buy” or “Sell” button to submit your order

award-winning suite of platforms or open a live trading account today

Try Demo Open An Account

Available in US and HK market on POEMS 2.0, POEMS Mobile 2.0, POEMS Mobile 3 and POEMS PRO.

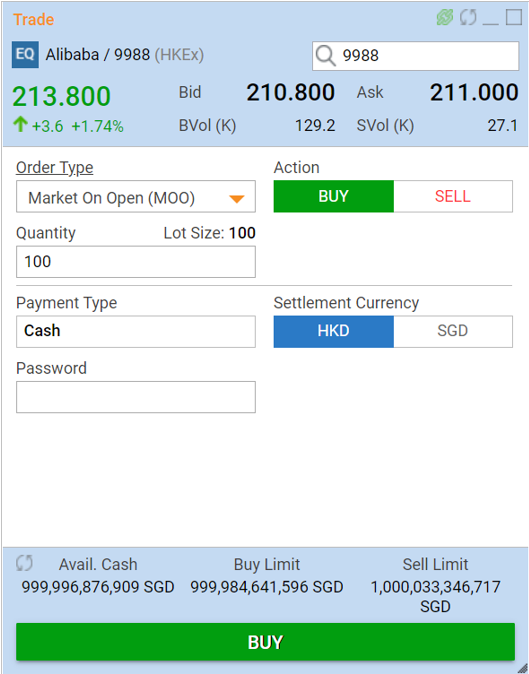

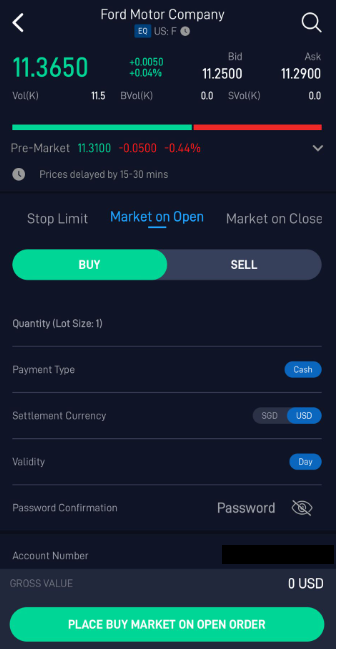

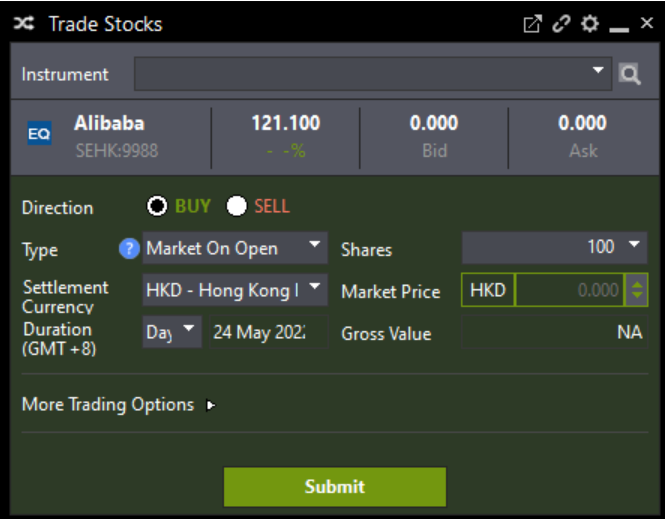

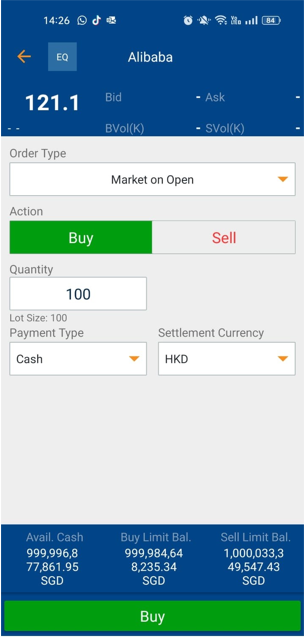

What is a Market-On-Open (MOO) Order?

A MOO Order is an order placement with a defined quantity but without a price. It is placed before a market is opened and it will try to match at the opening price during the Random matching period. It is an order to execute at the day’s opening price. But it does not guarantee a filled order. Order that is not done during the matching will be cancelled and will not carry forward to continuous trading session.*Disclaimer

The advance order is a convenient online transaction method provided by Phillip Securities Pte Ltd for customers. Phillip Securities Pte Ltd provides as stable service as possible, but we cannot guarantee its absolute reliability. If the advanced order is not executed due to network interruption, server abnormality and other physical factors or any others factors , Phillip Securities Pte Ltd will not be liable for any loss or damage caused thereby.

Hong Kong

What is the cut-off time to place/cancel a MOO Order?

Order has to be submitted and accepted before 9.20am to participate in the random matching.

Singapore/Hong Kong Time

Pre-opening Session

09:00am – 09:15am

No-cancellation Period

09:15am – 9:20am

Random matching Period

09:20am – 09:22am

US

What is the cut-off time to place/cancel a MOO Order?

All order entries/withdrawals after cut off time may be accepted/rejected by the exchange for balancing of the opening/closing order.

All order entries/withdrawals after cut off time will be rejected.

All order entries/withdrawals after cut off time will be rejected.

Although these limit prices are set at a level intended to balance the objectives of execution certainty and minimized price risk, there exists a remote possibility that an execution will be delayed or may not take place.

If you experience or suspect any errors with your order, you should contact Phillip Securities Pte Ltd immediately.

What is the cut-off time to place/cancel a MOO Order?

Order has to be submitted and accepted before 9.20am to participate in the random matching.| Singapore/Hong Kong Time | Pre-opening Session | 09:00am – 09:15am |

| No-cancellation Period | 09:15am – 9:20am | |

| Random matching Period | 09:20am – 09:22am |

US

What is the cut-off time to place/cancel a MOO Order?

All order entries/withdrawals after cut off time may be accepted/rejected by the exchange for balancing of the opening/closing order.

All order entries/withdrawals after cut off time will be rejected.

All order entries/withdrawals after cut off time will be rejected.

Although these limit prices are set at a level intended to balance the objectives of execution certainty and minimized price risk, there exists a remote possibility that an execution will be delayed or may not take place.

If you experience or suspect any errors with your order, you should contact Phillip Securities Pte Ltd immediately.

Frequently Asked Questions (FAQ)

NYSE – 2mins before market opens (by 09:28 ET)

US MOO orders can be placed on the trading day itself from 9pm(10pm) onwards till the respective cut-off below

NYSE – 9:28pm(10:28pm)

NASDAQ – 9:28pm(10:28pm)

AMEX – 9:29:55pm(10:29:55pm)

This will be magnified for illiquid counters that have large bid and ask spreads. There is a lack of control in terms of price precision. In turns, it may lead to overtrading.

Step 2: Key in your desired Quantity and other required information

Step 3: Confirm your trade details, then click on the “Buy” or “Sell” button to submit your order

award-winning suite of platforms or open a live trading account today

Try Demo Open An Account

Available in US and HK market on POEMS 2.0, POEMS Mobile 2.0, POEMS Mobile 3 and POEMS PRO.

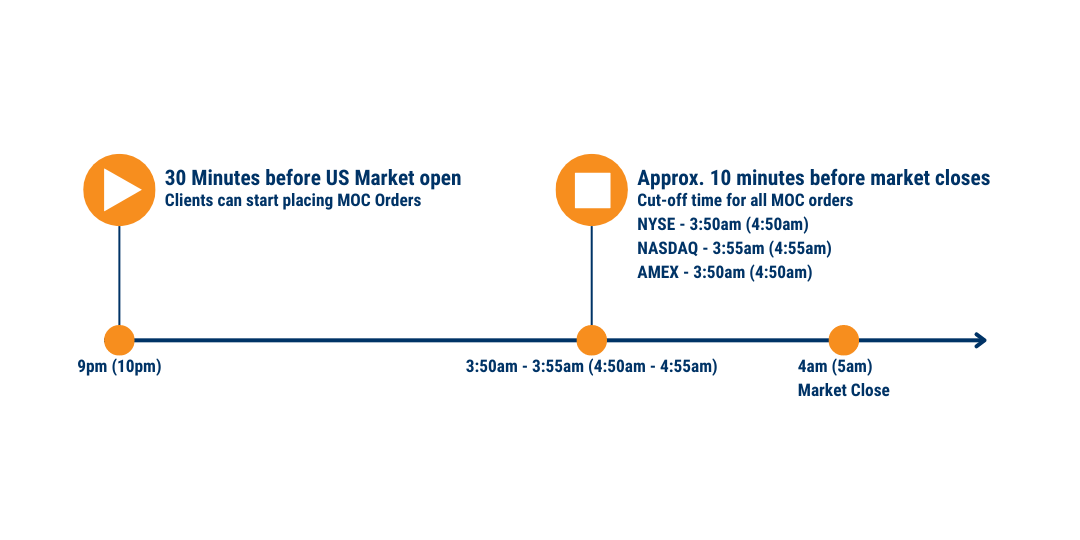

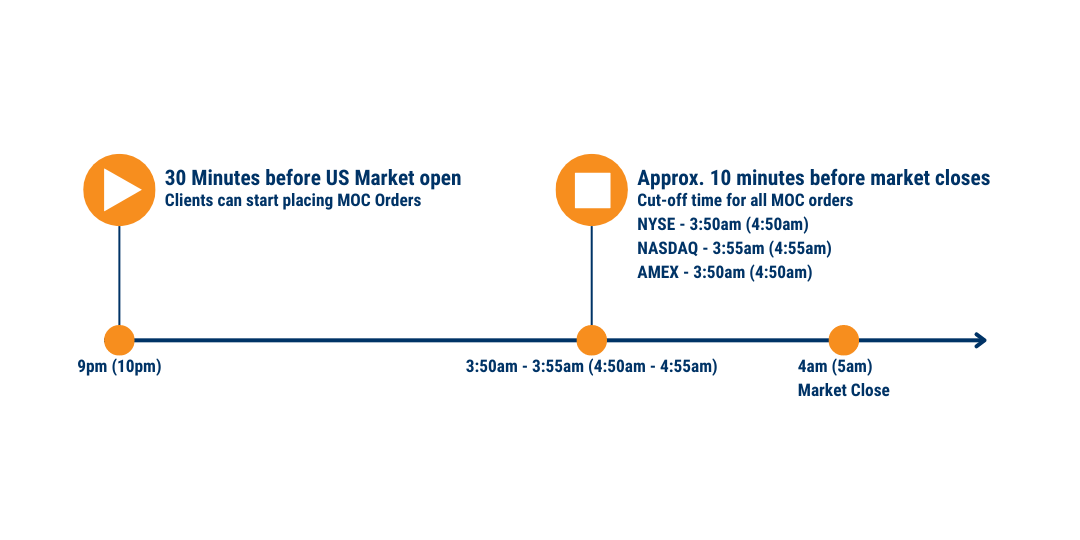

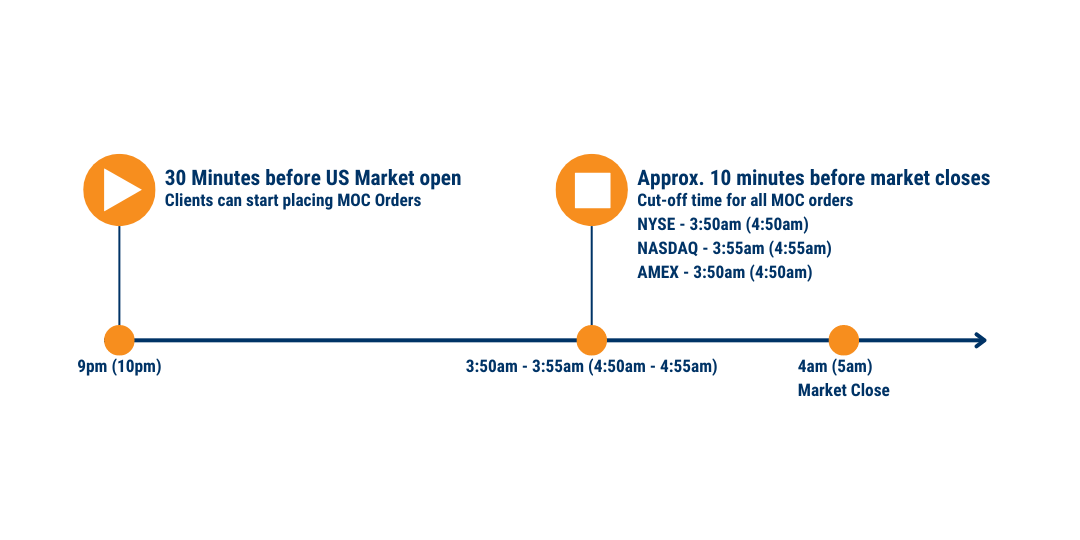

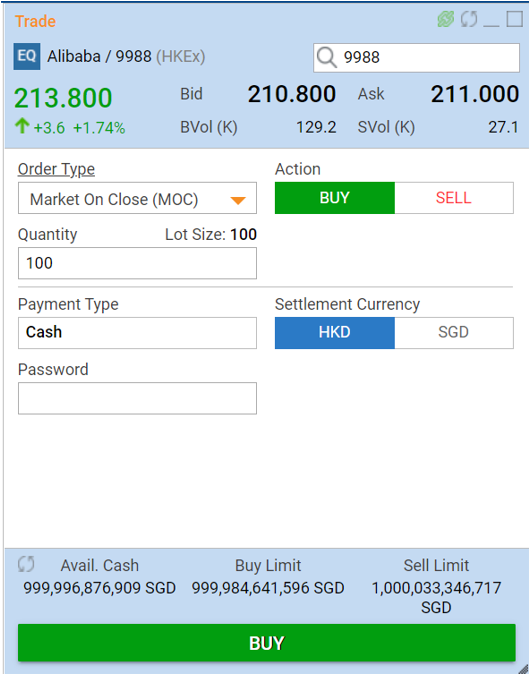

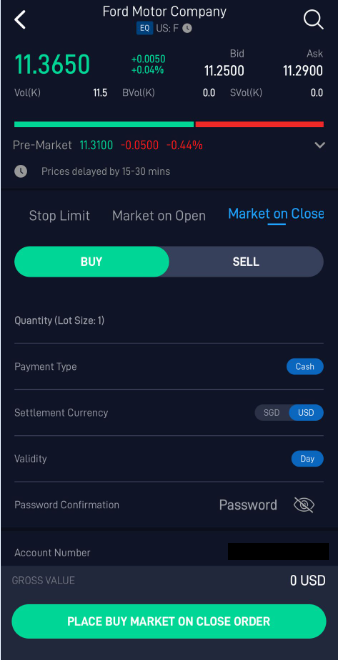

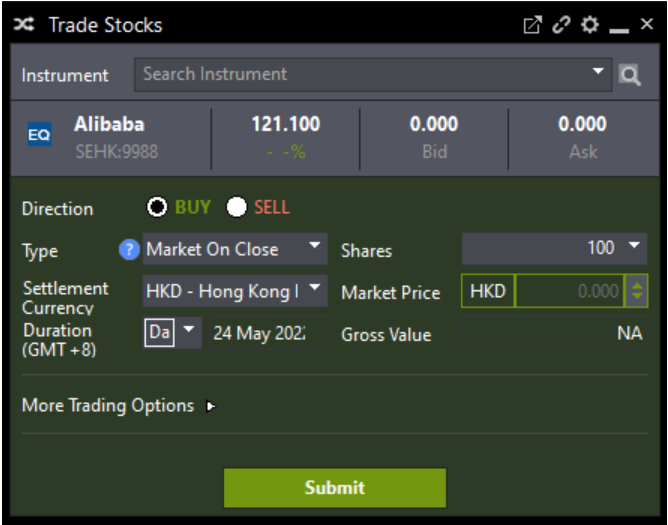

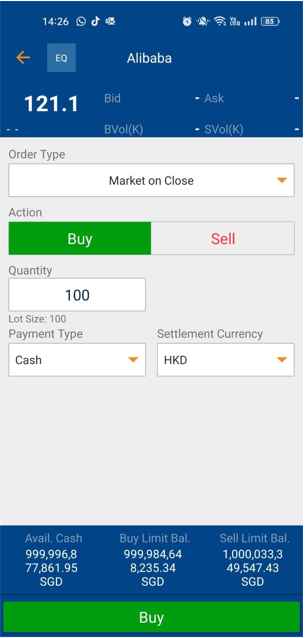

What is a Market-On-Close (MOC) Order?

A MOC order is an order placement with a defined quantity but without a price. It is placed during the market trading session and will be executed at the closing. It is an order to execute at the day’s closing price. But it does not guarantee a filled order. Order that is not done during the matching will be cancelled and will not carry forward to next day.*Disclaimer

The advance order is a convenient online transaction method provided by Phillip Securities Pte Ltd for customers. Phillip Securities Pte Ltd provides as stable service as possible, but we cannot guarantee its absolute reliability. If the advanced order is not executed due to network interruption, server abnormality and other physical factors or any others factors , Phillip Securities Pte Ltd will not be liable for any loss or damage caused thereby.

Hong Kong

What is the cut-off time to place/cancel a MOC Order?

Order has to be submitted and accepted before 4.08pm to participate in the random matching.

Singapore/Hong Kong Time

No Cancellation Period

04.06pm – 04.08pm

12.06pm – 12.08pm

Random Closing Period

04.08pm – 04.10pm

12.08pm – 12.10pm

US

What is the cut-off time to place/cancel a MOC Order?

All order entries/withdrawals after cut off time may be accepted/rejected by the exchange for balancing of the opening/closing order.

All order entries/withdrawals after cut off time will be rejected.

All order entries/withdrawals after cut off time will be rejected.

Although these limit prices are set at a level intended to balance the objectives of execution certainty and minimized price risk, there exists a remote possibility that an execution will be delayed or may not take place.

If you experience or suspect any errors with your order, you should contact Phillip Securities Pte Ltd immediately.

What is the cut-off time to place/cancel a MOC Order?

Order has to be submitted and accepted before 4.08pm to participate in the random matching.| Singapore/Hong Kong Time | No Cancellation Period | 04.06pm – 04.08pm | 12.06pm – 12.08pm |

| Random Closing Period | 04.08pm – 04.10pm | 12.08pm – 12.10pm |

US

What is the cut-off time to place/cancel a MOC Order?

All order entries/withdrawals after cut off time may be accepted/rejected by the exchange for balancing of the opening/closing order.

All order entries/withdrawals after cut off time will be rejected.

All order entries/withdrawals after cut off time will be rejected.

Although these limit prices are set at a level intended to balance the objectives of execution certainty and minimized price risk, there exists a remote possibility that an execution will be delayed or may not take place.

If you experience or suspect any errors with your order, you should contact Phillip Securities Pte Ltd immediately.

What is the cut-off time to place/cancel a MOC Order?

All order entries/withdrawals after cut off time may be accepted/rejected by the exchange for balancing of the opening/closing order.

All order entries/withdrawals after cut off time will be rejected.

All order entries/withdrawals after cut off time will be rejected.

Although these limit prices are set at a level intended to balance the objectives of execution certainty and minimized price risk, there exists a remote possibility that an execution will be delayed or may not take place.

If you experience or suspect any errors with your order, you should contact Phillip Securities Pte Ltd immediately.

Frequently Asked Questions (FAQ)

US MOC orders can be placed on the trading day itself from 9pm(10pm) onwards till the respective cut-off below

NYSE – 3:50am(4:50am)

NASDAQ – 3:55am(4:55am)

AMEX – 3:50am(4:50am)

This will be magnified for illiquid counters that have large bid and ask spreads. There is a lack of control in terms of price precision. In turns, it may lead to overtrading.

Step 2: Key in your desired Quantity and other required information

Step 3: Confirm your trade details, then click on the “Buy” or “Sell” button to submit your order

award-winning suite of platforms or open a live trading account today

Try Demo Open An Account

Available in selected exchanges on POEMS 2.0, POEMS Mobile 2.0, POEMS Mobile 3 and POEMS Pro

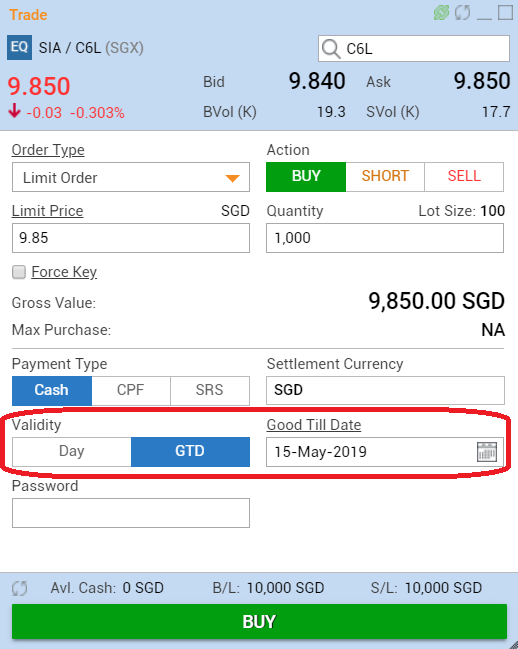

What is a Good-Till-Date (GTD) Order?

A GTD Order is a type of order that is active until its specified date, unless it has already been fulfilled or cancelled.If they haven’t been executed, all orders are cancelled at the end of the trading day on the date specified on the order, so GTD orders are used to cover longer periods of time. GTD orders are commonly used by long term investors who may want to buy or sell a lot of securities at a set price.

Are Good-Till-Date (GTD) orders available on POEMS?

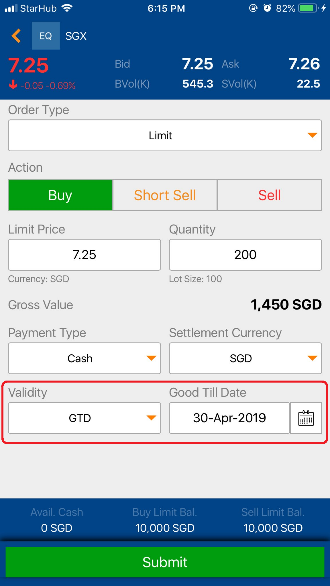

POEMS 2.0, POEMS Mobile 2.0 and POEMS Mobile 3

GTD Orders are currently supported for orders on SGX and US markets only.

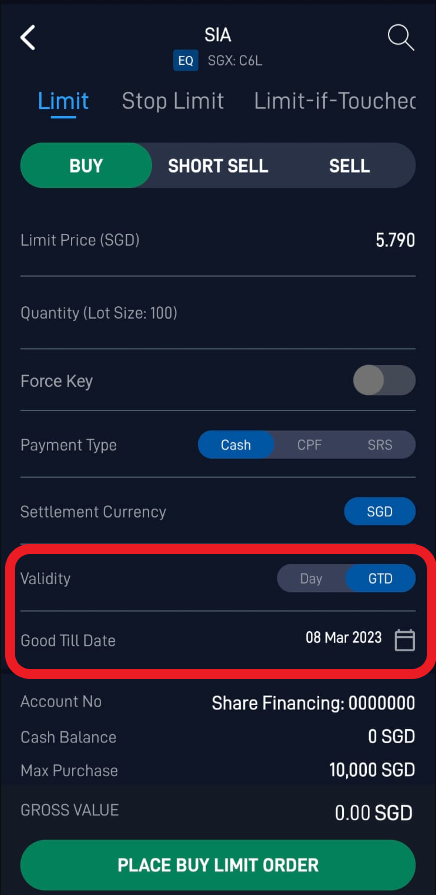

POEMS Pro

GTD Orders are supported for orders on SGX, HK, US and BURSA markets.

Frequently Asked Questions (FAQ)

A GTD order that is filled will be displayed as “Done” under the Order Status. You may refer to the table below to check the status of your GTD orders on the respective POEMS platforms.

| Platform | Current Day | Next Day |

|---|---|---|

| POEMS 2.0 | Today’s Orders > Trade Done | Past Orders > GTD Orders (Past 7 days) |

| POEMS Mobile 2.0 | Today Orders | Order History > GTD (Past 7 days) |

| POEMS Mobile 3 | Today > Orders | Trade > Orders > GTD (Past 7 days) |

| POEMS Pro | Order Status > All Orders | Order Status > All Orders |

GTD orders submitted through POEMS 2.0, POEMS Mobile 2.0 and POEMS Mobile 3 can be amended/withdrawn via all POEMS platforms at any time.

However, for GTD orders submitted through POEMS Pro, we recommend that these orders are amended/withdrawn via POEMS Pro. In cases of urgency, these orders can be amended/withdrawn through all platforms during trading hours only.

To add on, POEMS Pro advanced GTD orders that are yet to be triggered to limit order are only visible and manageable through POEMS Pro. Once triggered to limit order, such orders will be reflected and can be managed across all platforms.

- No charge if order price is within force-key range upon order entry even if order prices are outside the force-key range on subsequent days reload.

- There are force-key charges if order price is outside of force-key range upon order entry, force-key fee charges will not be calculated again on subsequent days reload

- For each force key entered, there will be a deduction of 20 reward points. Depending on the number of rewards points you have accumulated, the following apply:

*You need to have a balance of at least 101 rewards points so you can use up to 25 force keys.Rewards Points Entitlements 0 – 100 No force key 101 – 1000 25 force keys per month* 1001 onwards 50 force keys per month**

**You need to have a balance of at least 1,001 rewards points so you can use up to 50 force keys

Step 2: Key in your Limit Price, Quantity and other required information

Step 3: Under “Validity” / “Duration”, select “GTD” and indicate your desired GTD

Step 5: Confirm your trade details, then click on the “Buy” or “Sell” / “Submit” button to submit your order

award-winning suite of platforms or open a live trading account today

Try Demo Open An Account

Available in SGX only on POEMS Pro

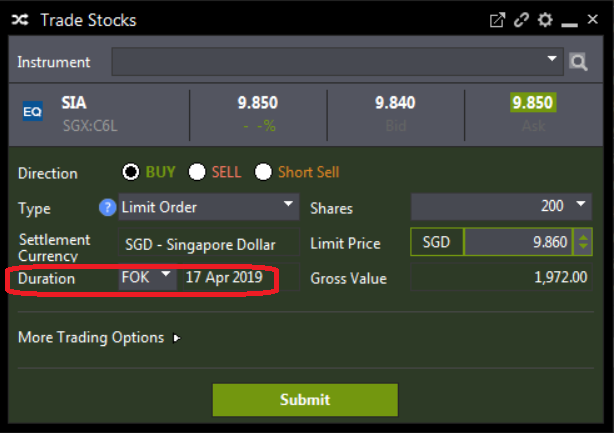

What is a Fill-Or-Kill Order?

A Fill-Or-Kill (FOK) order is an order to buy or sell a stock that must be executed immediately in its entirety; otherwise, the entire order will be cancelled (i.e., no partial execution of the order is allowed).Frequently Asked Questions (FAQ)

Step 2: Select your desired order type

Step 3: Key in your Limit Price, Quantity and other required information

Step 4: Under “Duration”, select “FOK”

Step 5: Confirm your trade details, then click on the “Submit” button

award-winning suite of platforms or open a live trading account today

Try Demo Open An Account

Available in SGX only on POEMS Pro

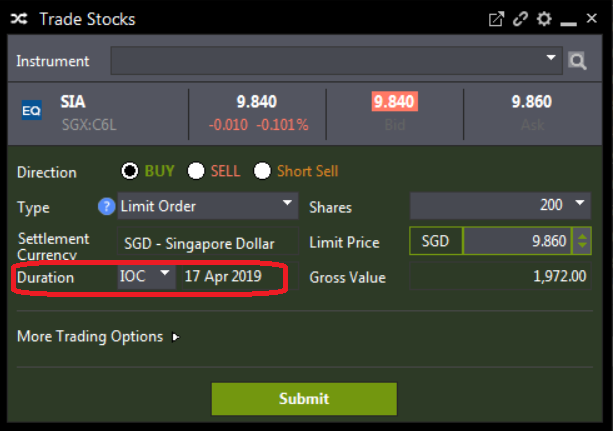

What is an Immediate-Or-Cancel (IOC) Order?

An Immediate-or-Cancel (IOC) order is an order to buy or sell a stock that must be executed immediately. Any portion of the order that cannot be filled immediately will be cancelled. This order is different from Fill-Or-Kill (FOK) order whereby this order allows partial filling, while Fill-Or-Kill (FOK) order does not allow partial filling.Frequently Asked Questions (FAQ)

Step 2: Select your desired order type

Step 3: Key in your Limit Price, Quantity and other required information

Step 4: Under “Duration”, select “IOC”

Step 5: Confirm your trade details, then click on the “Submit” button

award-winning suite of platforms or open a live trading account today

Try Demo Open An Account