- Home

- CFD

Benefits of Trading

CFDs

Benefits of Trading

CFDs

Access a wide range of global markets and underlying assets

Trade equity CFDs at real market prices with no hidden spreads

Capture trading opportunities in both bull and bear markets

One account for all your trading needs—seamlessly access leverage and borrowing in one place

Access to wide of range of global markets and underlying assets.

Trade equity CFDs at real market prices with no hidden spreads.

Ability to capture trading opportunities in both bull and bear markets

One account for everything - access leverage and borrowing seamlessly in one place

Offered by POEMS

Equities

Direct Market Access(DMA)

Exchange-Traded Funds (ETFs)

Commodities

World Indices

Forex (FX)

Why Trade CFD With POEMS?

Access over 5000 CFD Contracts

No Minimum Deposit to Open An Account

Round the Clock Trade Support

Commissions Rates and Charges

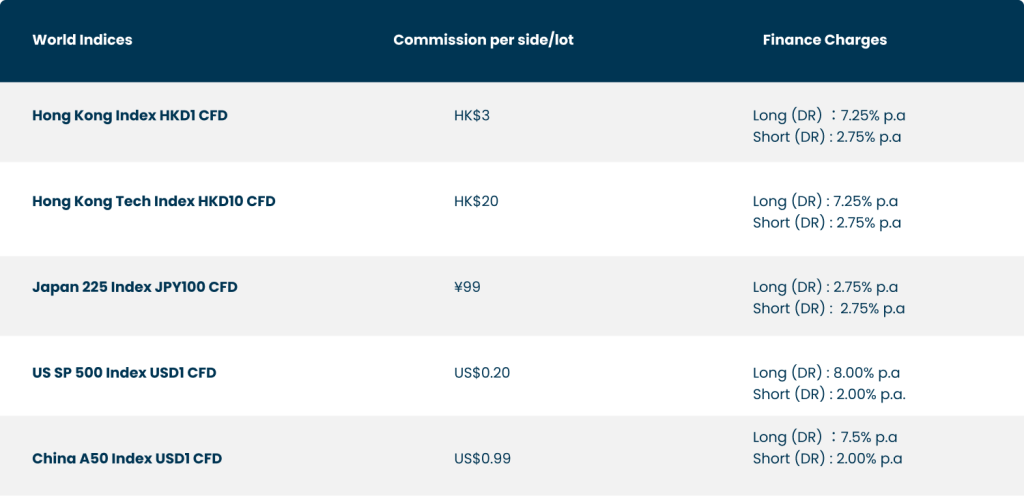

| World Indices | Commission per side/lot | Finance Charges |

| Hong Kong Index HKD1 CFD | HK$3 | Long Finance Charges (DR): 7.25% p.a. Short Finance Charges (DR): 2.75% p.a. |

| Hong Kong Index HKD5 CFD | HK$12.99 | Long Finance Charges (DR): 7.25% p.a. Short Finance Charges (DR): 2.75% p.a. |

| Japan 225 Index JPY100 CFD | ¥99 | Long Finance Charges (DR): 2.75% p.a. Short Finance Charges (DR): 2.75% p.a. |

| US SP 500 Index USD1 CFD | US$0.20 | Long Finance Charges (DR): 8.00% p.a. Short Finance Charges (DR): 2.00% p.a. |

| China A50 Index USD1 CFD | US$0.99 | Long Finance Charges (DR): 7.50% p.a. Short Finance Charges (DR): 2.00% p.a. |

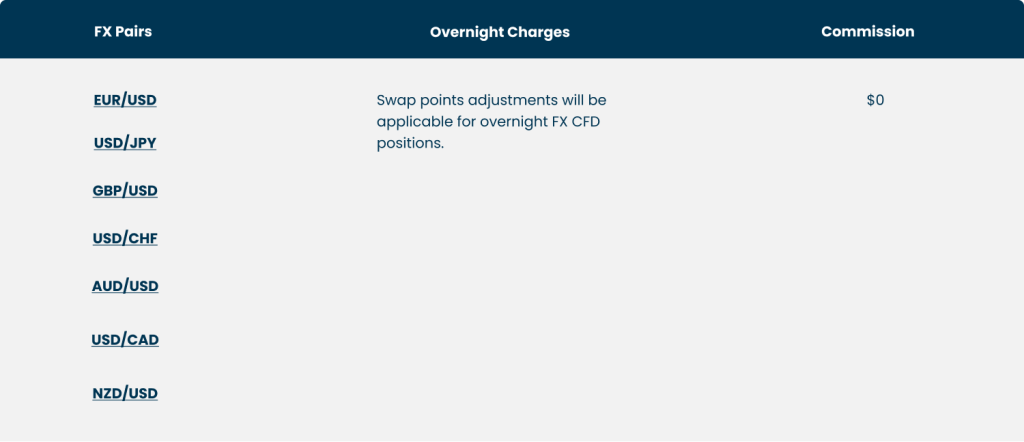

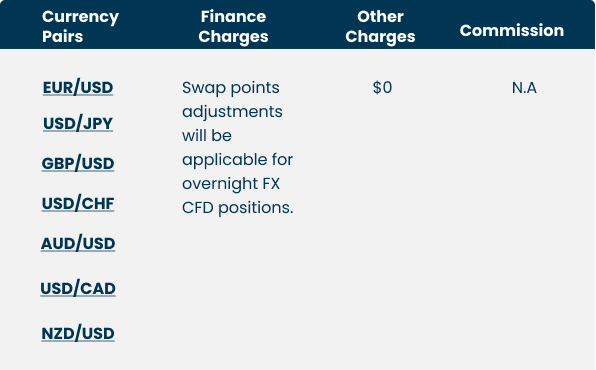

| FX Pairs | Overnight Charges | Commission |

| EUR/USD USD/JPY GBP/USD USD/CHF AUD/USD USD/CAD NZD/USD | Swap point adjustments will be applicable for overnight FX CFD positions. | $0 |

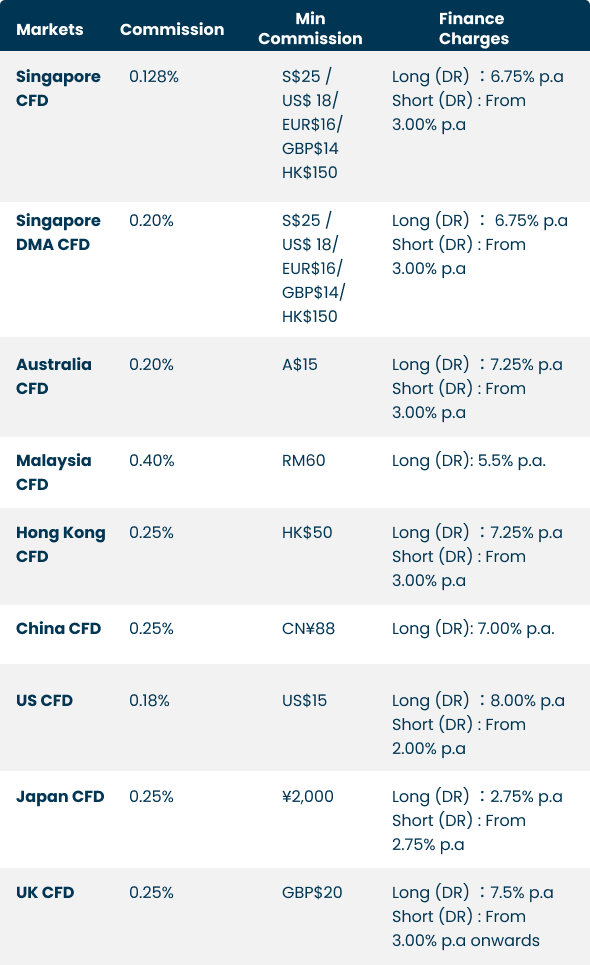

| Markets | Commissions | Min Commission | Finance Charges |

| Singapore CFD | 0.128% | S$25 / US$18/ GBP$14/ EUR$16/ HK$150 | Long Finance Charges (DR): 6.75% p.a. Short Finance Charges (DR): From 3.0% p.a. onwards (rate differs for different stocks) |

| Singapore DMA CFD | 0.20% | S$25 / US$18/ GBP$14/ EUR$16/ HK$150 | Long Finance Charges (DR): 6.75% p.a. Short Finance Charges (DR): From 3.0% p.a. onwards (rate differs for different stocks) |

| Australia CFD | 0.20% | AUD 15 | Long Finance Charges (DR): 6.50% p.a. Short Finance Charges (DR): From 3.0% p.a. onwards (rate differs for different stocks) |

| Malaysia CFD | 0.40% | RM60 | Long Finance Charges (DR): 5.5% p.a. |

| Hong Kong CFD | 0.25% | HK$50 | Long Finance Charges (DR): 7.25% p.a. Short Finance Charges (DR): From 3.0% p.a. onwards (rate differs for different stocks) |

| China CFD | 0.25% | CNY88 | Long Finance Charges (DR): 7.0% p.a. |

| United Kingdom CFD | 0.25% | 20 GBP | Long Finance Charges (DR): 7.50% p.a. Short Finance Charges (DR): From 3.00% p.a. onwards (rate differs for different stocks) |

(DR): Daily rate, (p,a): per annum

For a full list of CFD products and their commission rates, click here

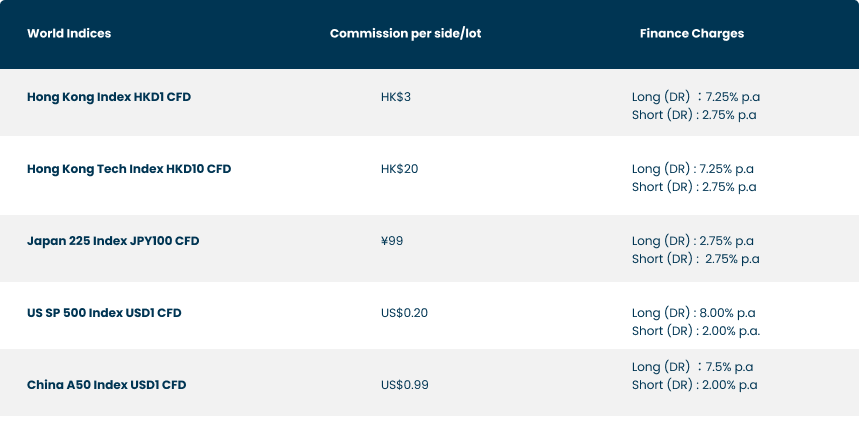

| World Indices | Commission per side/lot | Finance Charges |

|---|---|---|

| Hong Kong Index HKD1 CFD | HK$3 | Long (DR): 7.25% p.a Short (DR): 2.75% p.a |

| Hong Kong Tech Index HKD10 CFD | HK$20 | Long (DR): 7.25% p.a Short (DR): 2.75% p.a |

| Japan 225 Index JPY100 CFD | ¥99 | Long (DR): 2.75% p.a Short (DR): 2.75% p.a |

| US SP 500 Index USD1 CFD | US$0.20 | Long (DR): 8.00% p.a Short (DR): 2.00% p.a |

| China A50 Index USD1 CFD | US$0.99 | Long (DR): 7.5% p.a Short (DR): 2.00% p.a |

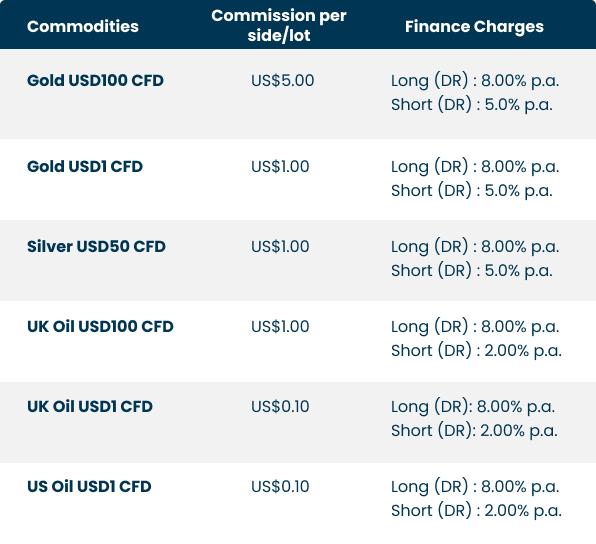

| Commodities | Commission per side/lot | Finance Charges |

|---|---|---|

| Gold USD100 CFD | US$5.00 | Long (DR): 8.00% p.a Short (DR): 5.0% p.a |

| Gold USD1 CFD | US$1.00 | Long (DR): 8.00% p.a Short (DR): 5.0% p.a |

| Silver USD50 CFD | US$1.00 | Long (DR): 8.00% p.a Short (DR): 5.0% p.a |

| UK Oil USD100 CFD | US$1.00 | Long (DR): 8.00% p.a Short (DR): 2.00% p.a |

| UK Oil USD1 CFD | US$0.10 | Long (DR): 8.00% p.a Short (DR): 2.00% p.a |

| US Oil USD1 CFD | US$0.10 | Long (DR): 8.00% p.a Short (DR): 2.00% p.a |

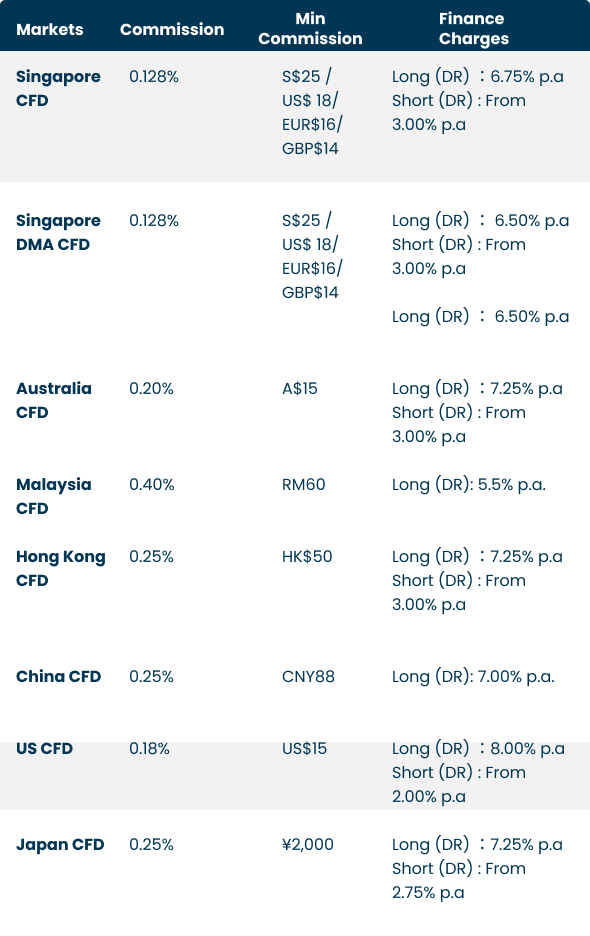

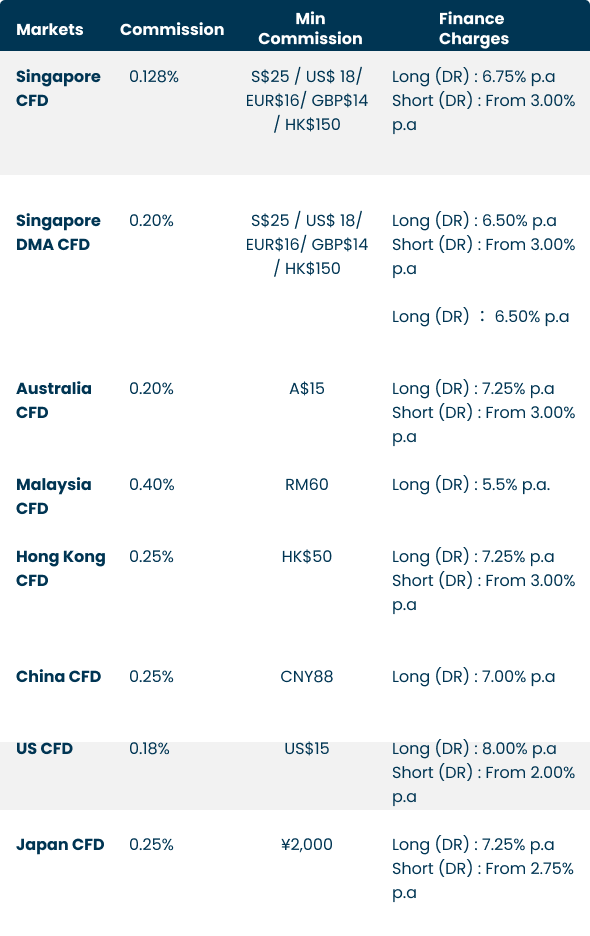

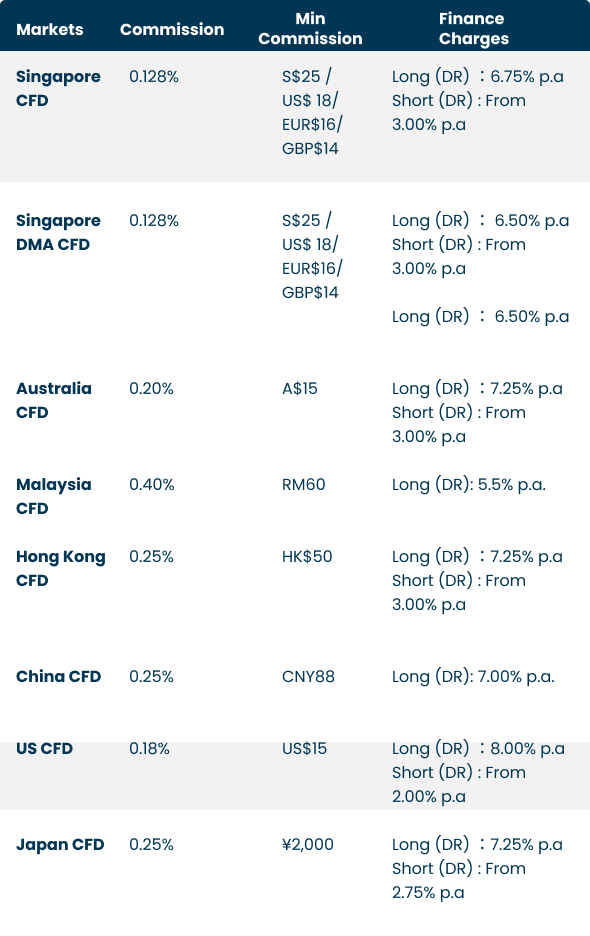

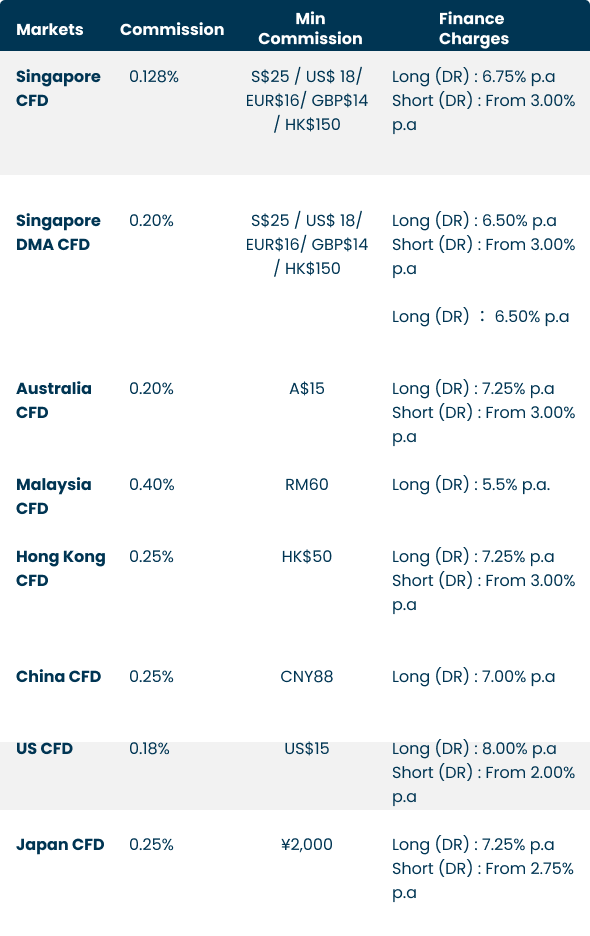

| Markets | Commission | Min Commission | Finance Charges |

|---|---|---|---|

| Singapore CFD | 0.128% | S$25 / US$18 / EUR$16 / GBP$14 / HK$150 | Long (DR): 6.75% p.a Short (DR): From 3.00% p.a |

| Singapore DMA CFD | 0.20% | S$25 / US$18 / EUR$16 / GBP$14 / HK$150 | Long (DR): 6.50% p.a Short (DR): From 3.00% p.a |

| Australia CFD | 0.20% | A$15 | Long (DR): 7.25% p.a Short (DR): From 3.00% p.a |

| Malaysia CFD | 0.40% | RM60 | Long (DR): 5.5% p.a |

| Hong Kong CFD | 0.25% | HK$50 | Long (DR): 7.25% p.a Short (DR): From 3.00% p.a |

| China CFD | 0.25% | CNY88 | Long (DR): 7.00% p.a |

| US CFD | 0.18% | US$15 | Long (DR): 8.00% p.a Short (DR): From 2.00% p.a |

| Japan CFD | 0.25% | ¥2,000 | Long (DR): 7.25% p.a Short (DR): From 2.75% p.a |

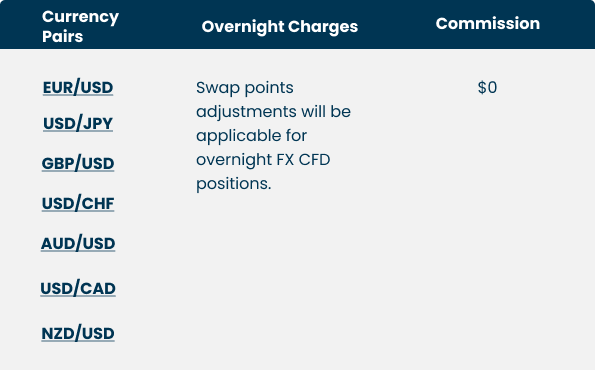

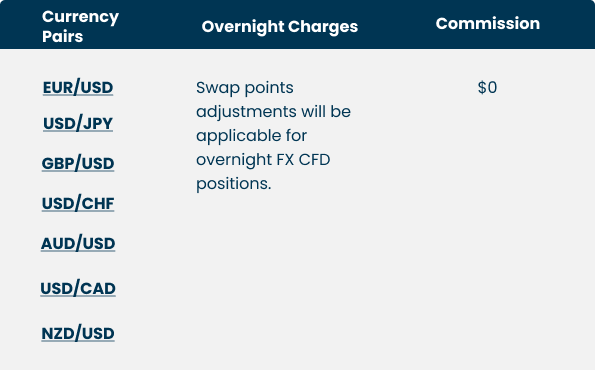

| FX Pairs | Overnight Charges | Commission |

|---|---|---|

| EUR/USD | Swap points adjustments will be applicable for overnight FX CFD positions. | $0 |

| USD/JPY | ||

| GBP/USD | ||

| USD/CHF | ||

| AUD/USD | ||

| USD/CAD | ||

| NZD/USD |

(DR): Daily rate, (p,a): per annum

For a full list of CFD products and their commission rates, click here

(DR): Daily rate, (p,a): per annum

For a full list of CFD products and their commission rates, click here

Why Short Sell with CFDs?

Importance Notice

CFDs may not be suitable for customer whose risk tolerance is low. Customers are advised to understand the nature and risks involved in margin trading. Any CFD offered is not approved or endorsed by the issuer or originator of the underlying security the issuer or originator is not privy to the CFD contract. Phillip Securities Pte Ltd reserves the right to amend the published information without prior notice. You are advised to read carefully and understand the Risk Disclosure Statement and CFD Risk Fact Sheet before undertaking transactions in CFDs. As CFD is a Specified Investment Product (SIP), retail customers are subject to the relevant assessment for trading/investing in SIPs. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Copyright © 2025. Brought to you by Phillip Securities Pte Ltd (A member of PhillipCapital) Co. Reg. No. 197501035Z. All Rights Reserved.