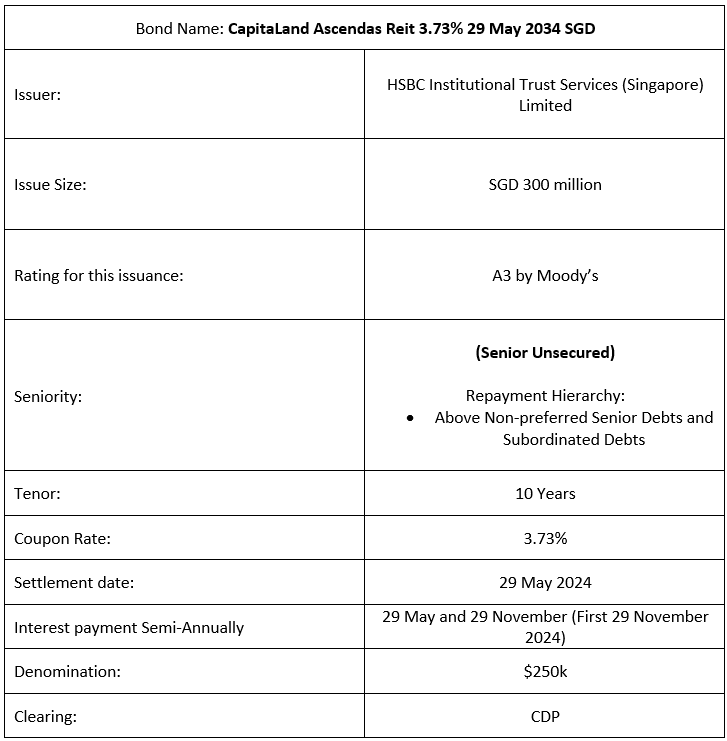

CapitaLand Ascendas REIT (CLAR) recently announced the issuance of its Senior Unsecured Green notes at final price guidance of 3.73% with a 10-year maturity period. These bonds come with a semi-annual coupon payment scheduled on the 29th of May and the 29th of November each year, with the first coupon payment commencing on the 29th of November, 2024. This bond is expected to have a rating of A3 (Moody’s), and because it is a green bond, 100% of the proceeds from this issuance will be used towards financing and refinancing in whole or in part, the Eligible Projects undertaken by the Group in accordance with the CapitaLand Ascendas REIT green finance framework.

Company Overview

CapitaLand Ascendas REIT is Singapore’s first and largest listed Business Space and Industrial Real Estate Investment Trust (REIT). Over time, CLAR has since expanded its footprint to become a global REIT with a core focus on technology and logistics properties strategically located within developed markets. The REIT’s diversified portfolio encompasses 229 properties across three key segments: Business Space and Life Sciences, Logistics, and Industrial and Data Centres. CLAR’s properties are geographically dispersed across Singapore, Australia, the United States, and the United Kingdom/Europe. CLAR is listed on the mainboard of the Singapore Exchange (SGX: A17U), and as of 20th May 2024, CLAR has a total market cap of $12.083bn and carries a credit rating of A3 from Moody’s.

1Q2024 Business Update

Not many financials are being shared in the latest quarter business update. Still, the divestment of the three logistics properties in Australia was completed for $64.2m (at a premium to valuation). Although there was a slight fall in Portfolio occupancy (from the previous 94.2% in FY2023 to 93.3% in 1Q2024), mainly from a decline in United States, Australia, and UK/Europe occupancy, their occupancy level remains relatively healthy. CLAR’s rental reversion has also reflected a bump up from 11.1% in 1Q2023 to 16% in 1Q2024. 92.8% of CLAR’s total invested properties are also unencumbered (previously 92.4%).

Suppose we were to look at CLAR’s capital management. In that case, CLAR aggregate leverage remains at a comfortable level with just a slight pick from 37.9% in the previous quarter to 38.3%, and weighted average all-in debt cost pushed up slightly from 3.5% to 3.8% owing to the higher rate environment. In terms of its total debt, CLAR has fixed 82.6% of it to reduce its exposure to interest rate fluctuation, and its adjusted interest coverage had also tapered off slightly, 3.7 times to 3.6 times, respectively. CLAR has $530m of borrowing that is due to be refinanced in FY2024, and if we look at FY2023 cash and cash equivalent, the latest business update does not provide the numbers. CLAR’s cash and cash equivalent stood at $221m, meaning there is a shortfall. However, CLAR should not face any issues in refinancing this obligation as its net property income for the year would be able to plug the gap, or CLAR could utilize its good credit, which could provide them with good access to wider funding options at competitive rates to refinance the shortfall.

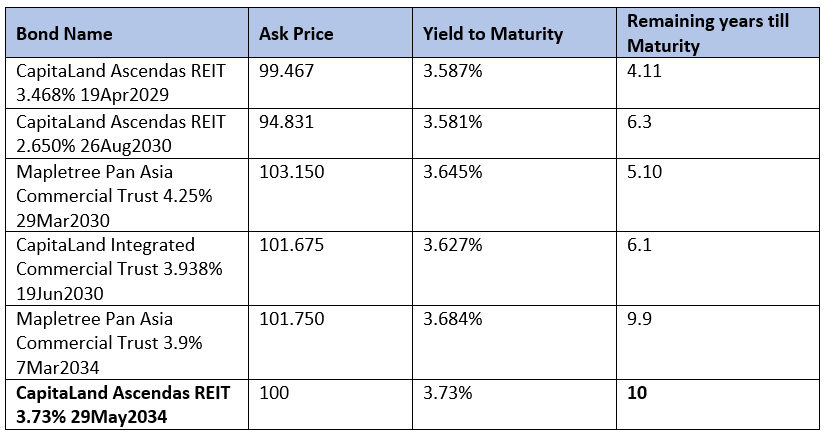

Regarding the new 10-year CLAR’s 3.73% issuance, it provides a reasonable coupon rate compared to some of the bonds out there with approximately a similar duration. Additionally, this new issuance also has an expected credit rating of A3.

Bond Comparable

Bond Overview