Online trading has made our trading experience a much more convenient and efficient one. It allows us to spend less time to get our bond quotes, and it allows us to manage our whole portfolio all in a single platform. Not only can we benefit from trading online, but it’s also easy to learn. Here’s a step by step guide on how to trade wholesale bonds online on our POEMS 2.0 trading platform.

How to trade bonds online

-

Open a trading account

You’ll need a trading account to trade bonds on POEMS. Not yet an account holder? Open an account here. Unsure on what type of account to open? You may contact our bond desk at +65 6212 1818 to learn more about our account types.

-

Log in to POEMS 2.0

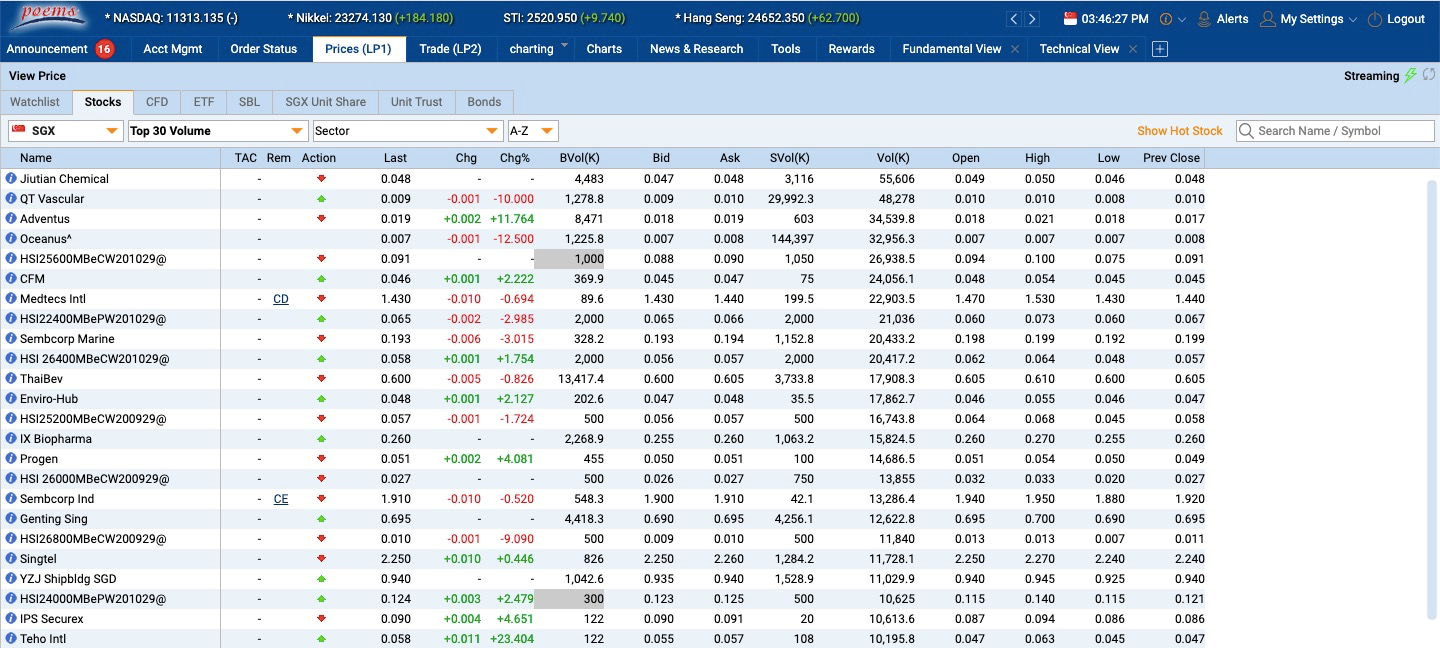

Upon set up of your trading account, you may now log in to the POEMS 2.0 trading platform here. You’ll be brought to a dashboard like this. If you’re not already on it, click on the ‘Prices (LP1)’ tab, and then select the ‘Bonds’ tab.

-

Find an issuer or bond

Under the ‘Bonds’ tab you’ll be able to view bond quotes and search for bond issuers, currencies and individual bonds. Our bond prices are refreshed daily based on indicative prices directly from our counterparties. On the screen, you’ll see important bond information displayed, including the issuer, coupon, call and maturity dates, yields, and most importantly bid and offer prices.

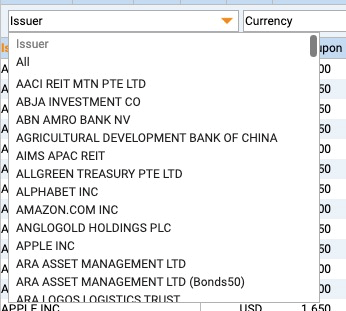

To search for bonds via their issuers, click on the issuer dropdown at the top left corner to scroll through the list sorted by alphabetical order. You may narrow the list further by selecting a specific currency on the currency dropdown list to the right beside.

To search for individual bonds, you may scroll through the list on the screen or sort using the various criteria such as coupon rates, yields or issuer names. Alternatively, you may use the dynamic search bar on the top right by typing the bond name or issuer. A list of bonds will appear dynamically based on your input.

-

Placing a bond order

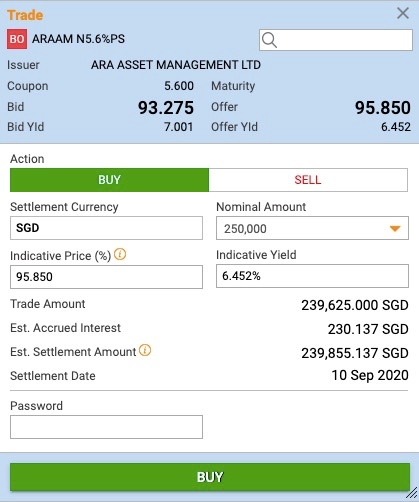

Once you’ve found the bond you’re looking to trade, simply double click it or right click and select trade and the trade window will appear. Here, you’ll be able to input your order details including to buy or sell, your desired price or yield, and the nominal amount or number of lots to trade. Once your details are inputted, you’ll be able to see the settlement details of the trade, including the settlement amount and accrued interest payable or receivable. Your trade is ready to be placed by keying in your password and clicking the bottom buy or sell button. **Note for Bonds50 the nominal amount will be 50,000 as they trade in a smaller minimum denomination. Learn more here!

-

Withdrawing your order

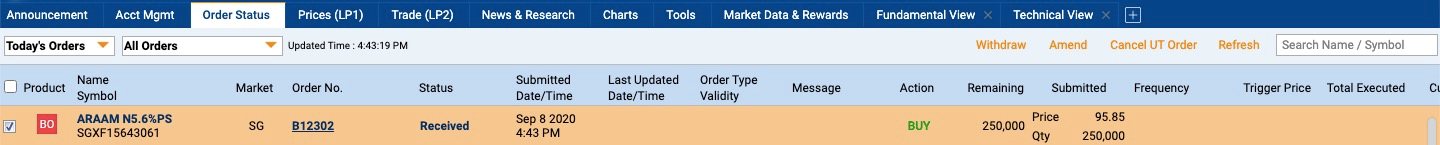

After submitting your order, it will be routed to our bond desk for execution. Meanwhile, you’ll be able to view your order under the ‘Order Status’ tab. Here you’ll be able to withdraw your order by selecting your order via the left side checkbox and clicking on withdraw at the top right corner. You will not be able to amend bond orders.

-

Confirmation of your order completed

When the bond desk has successfully executed your bond order, you’ll receive a confirmation in your ‘Order Status’ tab and to your email. If your order was not successful, no notification will be sent on the platform, however you may receive a notification from your respective financial advisors about the order.

-

Contract settlement

Depending on your trading account credit terms, you may or may not be eligible to purchase bonds without prefunding on your account. If your account has been prefunded prior to a bond purchase, the funds will be automatically deducted from your trading account on the settlement date. Otherwise, you will need to deposit the funds into your trading account for payment accordingly. Deposits can be done via Electronic Payment for Shares (EPS) or cheque deposits. For sell trade settlements, sales proceeds will be credited into your trading account automatically.

-

POEMS Mobile App

Unfortunately, we do not currently have bonds trading facilities on our POEMS Mobile Application (downloadable on Google Play or the App Store). Development is underway and we look forward to providing investors will even more convenience with their bond trades.

Bottom Line

And that’s the whole process of trading wholesale bonds online. Try it out, get your bond quotes and place your trades online. Of course, we don’t have to check bond prices as often as people do for stocks because it’s less volatile, but it’s always good to have the option of viewing bond prices at our convenience online. And while we are available online, we will always be available offline to serve all of our clients.