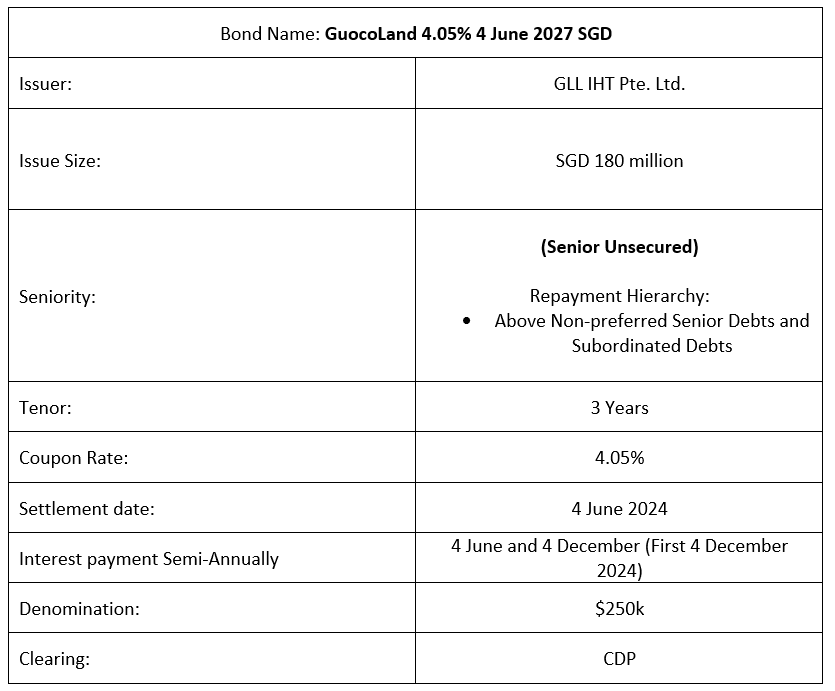

Guocoland Limited recently announced the issuance of its Senior Unsecured notes at final price guidance of 4.05% with a 3-year maturity period. These bonds come with a semi-annual coupon payment scheduled on the 4th of June and the 4th of December each year, with the first coupon payment commencing on the 4th of December 2024. This new issuance is non-rated and falls under its SGD 3 billion Multicurrency Medium Term Note Programme. The proceeds from this issuance will be used to finance the group’s general working capital and corporate requirements. These notes are non-rated.

Company Overview

GuocoLand Limited (“GuocoLand”) is a leading real estate group that focuses on Property Development, Property Investment also a small portion of Hotel operations. It owns, invests in, and manages a portfolio of quality commercial and mixed-use assets, providing stabilized, recurring rental income with potential for capital appreciation. GuocoLand has operations in different geographical markets, including Singapore, China, and Malaysia while also being a publicly listed company on the Singapore Exchange (SGX) under the ticker F17. As of 27th May 2024, GuocoLand has a market capital of $1.78bn.

1HFY24 Financial

GuocoLand’s 1H24 performance has reflected stronger in their latest financial with its revenue coming in higher +61% YoY backed by stronger contributions from both the property development and property investment segments. Property Development business recorded an increase of +67% YoY (from $550.3m in 1H2023 to $917.9m in 1H2024) due to higher progressive sales recognition from its Singapore residential development (e.g Meyer Mansion, Midtown Modern & Lentor Modern). For its Property Investment business, it also showcases positive numbers +46% YoY (from $74.7m in 1H2023 to $109.4m in 1H2024) due to the progressive commencement of leases at Guoco Midtown as well as the positive rental reversions at Guoco Tower.

Looking at the company’s liquidity, the group’s cash and cash equivalent has gone up by +1.67% YoY (from $993.5m in 1H2023 to $1.01bn in 1H2024) and has a debt/total asset of 0.45 times. This is slightly higher than the previous 0.43 times in the previous quarter, as the bump-up was due to the financing for the Lentor Mansion project. Although with the current $1.01bn of cash equivalent, this amount cannot repay the debts expiring in 12mth, which amounts to $2.66bn. However, their current high-end residential projects, like Meyer Mansion, Midtown Modern, and Lentor Modern, are nearly sold out. As construction is finished, these projects will bring in more cash inflow for the company. Additionally, the upcoming project Lentor Mansion has already achieved 75% sales during launch day and is slated for completion in 2027. Hence, with such a demand for its development. Once this project is fully sold, this would be another revenue stream that will be flowing in for the group as well.

With that being said, although Guoco’s debt matrix may seem to have pushed up slightly. As mentioned above, the ongoing sales proceeds from its property development should enable Guoco to meet its debt obligations.

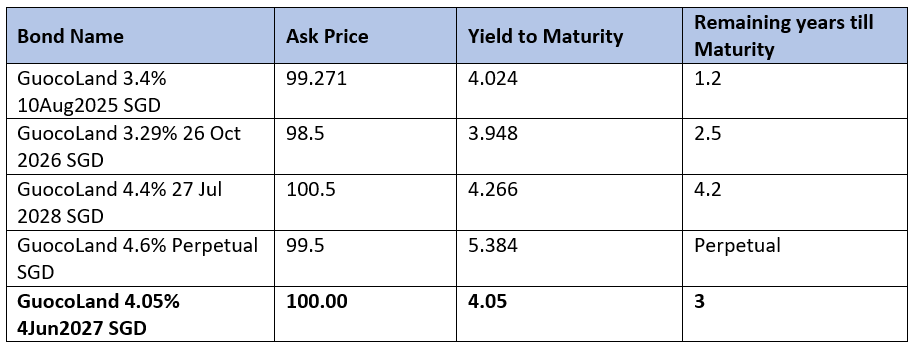

Current GuocoLand’s bonds in the Market

Bond Overview