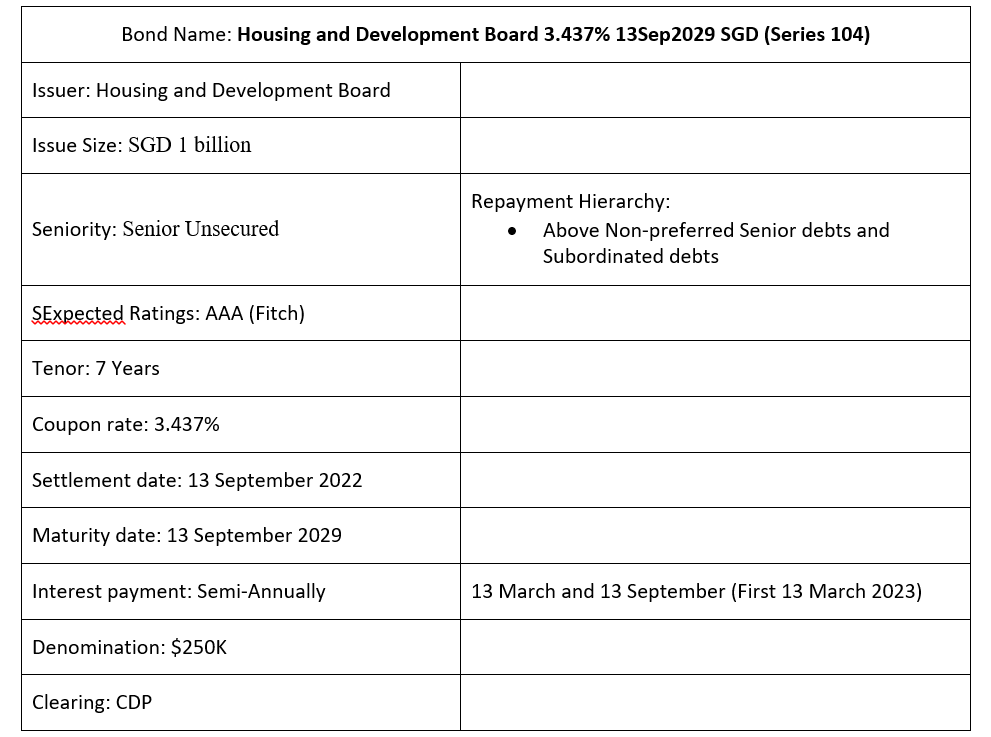

The Housing and Development Board (HDB) has just announced the issuance of its 7-year senior bonds at a final price guidance of 3.437%. Do note that these bonds are not green bonds but just regular senior unsecured bonds. The proceeds from these note issuance will be used to finance the development programmes of HDB, its working capital requirements and the refinancing of its existing borrowings. The bonds are tagged with a 7-year tenor and will mature on 13 Sep 2029. The bonds have a semi-annual coupon payment scheduled every 13 March and 13 September each year, with the first payment on 13 March 2023.

HDB, a statutory board of the Ministry of National Development (MND), was established on 1 February 1960. Its mission is to provide Singaporeans with affordable, quality housing and a great living environment. Some principal activities of HDB include: developing public housing and related facilities; allocation of properties and managing public housing and related facilities. In terms of credit ratings, HDB has a credit rating of AAA by (Fitch) and the expected rating for this issuance will be rated AAA.

In FY2021, HDB’s net assets increased from $15.35bn in FY2020 to $15.36bn in FY2021. The net deficit stood at $2.31bn. This deficit will be covered by the government grant of $2.34bn that will be provided this year. The Ministry of Finance (MOF) is also the lender of last resort to the HDB for its funding requirements; and the MOF has funded HDB’s past deficits. Cash and cash equivalent decreased from $76.1m in FY2020 to $62.8m in FY2021.

Currently, the Singapore Savings Bond average 10-year yield for the October issuance in 2022 is recorded at 2.75%, but the average yield if the investor were to hold it for 7 years is 2.68%. Investors who have excess cash to park for 7 years and are relatively risk averse may consider this issuance from a higher capital preservation perspective.

Bond Overview