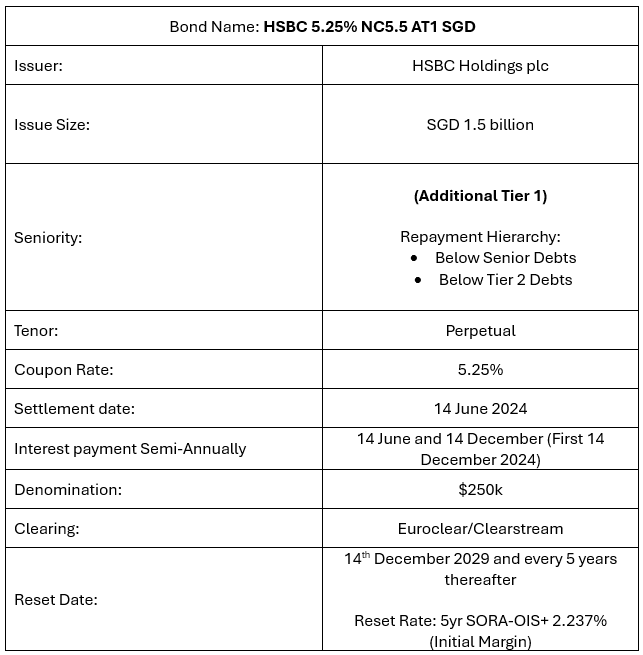

HSBC recently announced the issuance of its NC5.5 Additional Tier 1 perpetual notes at 5.25%. These bonds will be first callable from 14 June 2029 to 14 December 2029 and every interest payment date thereafter. In the event the notes are not recalled by 14 December 2029, the bonds will then be reset at the prevailing 5-year SORA-OIS plus the initial margin of 2.237% and resettable at every fifth-anniversary date thereafter. These bonds come with a semi-annual coupon payment scheduled on every 14th June and 14th December each year, with the first coupon payment commencing on 14th December 2024. The expected rating for this issuance is Baa3/BBB (Moody’s/Fitch).

(Risk associated with this issuance)

Do note that these bonds’ interest payments are non-cumulative (if the issuer skips a coupon payment in a period, the missed coupon payments do not accumulate for future payouts) and are denoted as contingent convertible securities (CoCo Bonds) which will be subjected to Loss Absorption Trigger Event Conversion. Therefore, if HSBC’s CET 1 ratio falls below 7%, these securities will be automatically and irrevocably converted in whole and not in part into the Issuer’s Ordinary Shares at the Conversion Price.

Conversion Price: SGD4.6481 per Conversion Share (equivalent to GBP 2.70 based on an exchange rate of GBP 1.00 = SGD 1.7215), subject to certain limited anti-dilution adjustments (including Alteration to Nominal Value Event; Bonus Issue Event; Extraordinary Dividend Event; Rights Issue Event)

Company Overview

Headquartered in London, HSBC ranks among the globe’s largest banking and financial services institutions, serving roughly 42 million customers worldwide. With a presence in 62 countries and territories across Europe, Asia, the Middle East, Africa, North America, and Latin America, HSBC operates through its diverse divisions: Wealth and Personal Banking (WPB), Commercial Banking (CB), and Global Banking & Markets (GBM).

As of 6th June 2024, HSBC Bank has a market cap of US$166.65bn with credit ratings of A+/A3/A- by (Fitch/Moody’s/S&P) respectively.

1Q2024 Business Update

In HSBC 1Q2024 results, the bank recorded its Net Interest Income (NII) fell by -2% YoY reflecting deposit migration, while Non-Interest Income (Non-NII) increased by +6% YoY due to a rise in trading income of $1.3bn, mainly in GBM. As a result, Revenue was up +3% YoY from $20.2bn in 1Q2023 to $20.8bn in 1Q2024 underpinned by higher customer activity in their Wealth products in WPB, and in Equities and Securities Financing in GBM.

Expected Credit Losses (ECL) exposure has gone up in FY23, notably due to mainland China commercial real estate sector exposures and rising interest rates/inflationary pressures. But in 1Q24 HSBC improved its ECL management from $1bn in 4Q23 to $0.7bn in 1Q24 and reduced its China real estate exposure (mainly in Hong Kong) back to $0.1bn from $0.5bn previously.

In terms of its credit position, HSBC’s CET1 ratio improved by 0.4% from 14.8% in 4Q2023 to 15.2% in 1Q202. Its capital generation efforts, such as the sale of the Canadian banking business, enabled HSBC to announce $8.8 billion of capital distributions this quarter. This also includes a share buyback of up to $3 billion, which is expected to have an impact of around 40 basis points on our CET1 ratio in the second quarter. This illustrates the prudency that HSBC is currently managing for its credit position, but this is slightly higher than the medium-term target range of 14% to 14.5% that the management is expecting.

Comparable bonds

Bond Overview