Company Overview

Keppel REIT is a Singapore-listed REIT with a S$9.5bn portfolio value of predominantly Grade-A office assets across Singapore (78%), Australia (18%), South Korea (3%), and Japan (1%). The portfolio is anchored by landmark Singapore CBD assets, including Marina Bay Financial Centre (MBFC), Ocean Financial Centre (OFC), and One Raffles Quay (ORQ). The REIT is sponsored by Keppel Corporation and is rated BBB (S&P).

3Q25 Credit Performance Highlights

Operating performance remains resilient, supporting steady, recurring income and debt service capacity. 3Q25 NPI rose 8.6% YoY to S$161.3mn, driven by stronger contributions from 255 George Street and improved occupancy at 2 Blue Street in Australia. The uplift in recurring income improves cash-flow visibility and underpins Keppel REIT’s ability to service interest and manage upcoming maturities.

Portfolio quality remains a core strength, with prime CBD exposure and sticky tenant demand supporting rents through the cycle. The S$9.5bn AUM is concentrated in Grade-A CBD offices, with portfolio valuations suggesting yields of ~3.15–3.55% for core Singapore assets. Tenant quality is solid, with the top 10 tenants contributing ~30% of rental income, and leasing metrics remain constructive, occupancy improved to 96.3% (3Q25), and WALE is 4.7 years (top 10 tenants 8.9 years). Leasing momentum is evident in ~12% positive rental reversions on new/renewed leases and a 74.9% retention rate, while new Singapore leases were signed at S$12.85 psf pm versus expiring S$11.35–S$12.15, pointing to embedded rental uplift in core CBD locations. The Top Ryde City acquisition (A$393.8mn; entry yield ~6.7%) adds modest diversification via suburban retail and ~1.5% DPU accretive, but it remains small (<5% of AUM), keeping the overall portfolio office-led.

Funding is manageable with moderate leverage and an improving refinancing posture, though coverage is not wide. Leverage stands at 42.2%, providing headroom to the MAS 50% cap, while the cost of debt is ~3.45%, and ~65% of borrowings are fixed-rate. ICR is 2.6x and stress-tested to ~1.9x under a +100bps shock, still workable for an IG REIT, but leaving less margin for prolonged funding-cost pressure. Debt is well laddered, with a 2.7-year weighted average term to maturity, and management is already in active discussions to refinance 2026 MTNs/loans, which is important given the ~S$640mn in 2026 maturities. The sustainability-linked share of borrowings (~82%) also helps broaden lender appetite, though it does not remove repricing risk if rates stay higher for longer.

Looking ahead, the key swing factor is the Singapore office cycle as new CBD supply (e.g., Solitaire on Cecil, Skywaters) enters in 2026–27. If vacancy rises or leasing incentives re-expand, rental reversions and occupancy could normalise from current strong levels, which would matter given Keppel REIT’s office concentration and only moderate coverage buffers. The second watchpoint is the 2026 refinancing execution and the cost of debt repricing. Successful early refinancing would preserve liquidity and reduce event risk, while a higher terminal cost of debt would keep ICR tight and cap spread upside.

Credit view: We maintain a positive stance on Keppel REIT. The credit is supported by a high-quality CBD office franchise, steady operating metrics, and a reasonable liquidity buffer with proactive refinancing intent. While the 2026 maturity hump and potential office-cycle moderation are clear watchpoints, Keppel REIT’s asset quality, tenant stickiness, and leasing momentum should continue to support a stable BBB profile, with spreads likely remaining well supported unless funding costs reprice materially higher or office fundamentals weaken more sharply than expected.

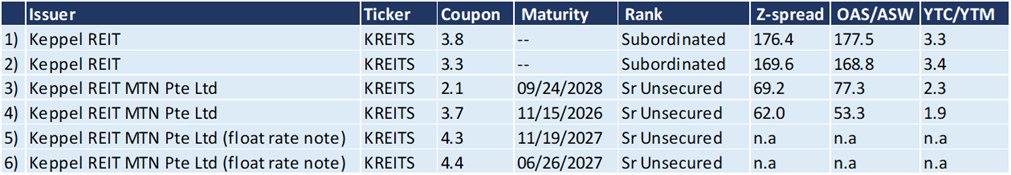

Overview of Keppel REIT’s Outstanding SGD Bonds