Company Overview

OUE Real Estate Investment Trust (OUE REIT) is a S$5.8bn AUM Singapore-centric diversified REIT with exposure to office (48%), hospitality (36%), and retail (16%). Key assets include One Raffles Place, OUE Bayfront, OUE Downtown Office, Mandarin Gallery, Hilton Singapore Orchard, and Crowne Plaza Changi Airport. Major shareholders include Temasek (9.31%), OCBC (1.25%), and Prudential (0.75%). The REIT is rated BBB- (S&P).

FY2025 Credit Performance Highlights

Reported operating metrics declined in FY2025, with revenue falling 7.4% YoY to S$273.6mn and NPI declining 6.2% YoY to S$219.6mn. This was primarily due to the absence of contributions from Lippo Plaza Shanghai following its divestment in December 2024, rather than operating weakness. Excluding this asset, underlying performance remained stable, with like-for-like revenue and NPI increasing 0.1% YoY and 1.6% YoY, respectively, supported by steady Singapore office demand and stable hospitality operations.

Portfolio quality continues to underpin cash-flow resilience. Core assets such as One Raffles Place, OUE Bayfront and OUE Downtown Office anchor the portfolio in prime CBD locations, while hospitality exposure is provided by Hilton Singapore Orchard and Crowne Plaza Changi Airport. Portfolio occupancy remained high at 95.4%, reflecting the defensive nature of centrally located Singapore assets and sustained tenant demand. The income mix is supportive, with the commercial segment contributing approximately 64% of total revenue, providing stable, contracted cash flows with positive rental reversions. Hospitality earnings are structurally de-risked through long-term master lease agreements incorporating minimum rent floors of S$67.5mn per annum, materially limiting downside volatility and enhancing cash-flow predictability for bondholders.

The most meaningful credit improvement in FY2025 came through lower funding costs. Finance costs declined 17.6% YoY to S$87.8mn, reflecting a more favourable interest-rate environment and proactive balance-sheet optimisation. This translated into a 13.9% YoY increase in amount available for distribution to S$123.8mn, signalling stronger cash retained after interest and improved cash-flow conversion despite lower reported revenue.

Balance-sheet metrics strengthened further following deleveraging. Aggregate leverage declined to 38.5% from 39.9% in FY2024, supported by debt repayment using divestment proceeds. Total debt stood at approximately S$2.17bn, while the weighted average cost of debt fell to 3.9% p.a. from 4.7% a year earlier. Fixed-rate exposure increased to 79.2%, reducing near-term rate sensitivity, and interest coverage improved to 2.4x, providing a reasonable buffer within the BBB- rating category.

Liquidity risk remains well contained. Debt maturities are well staggered, with no more than 18.5% of total debt maturing in any single year, limiting refinancing pressure. Funding is diversified between bank borrowings (53.9%) and MTNs (46.1%), while balance-sheet flexibility is preserved by 83.0% unsecured debt and 87.0% unencumbered assets, supporting continued access to funding even under stressed market conditions.

Credit view: We remain constructive on OUE REIT’s credit profile. The portfolio continues to generate resilient cash flows, while lower funding costs and disciplined capital management have materially improved debt sustainability. The leverage has improved to 38.5% and the improvement in interest coverage, high fixed-rate exposure and strong liquidity buffers mitigate downside risks.

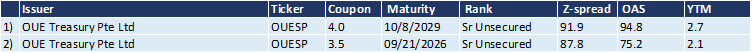

Overview of OUE’s Outstanding SGD Bonds