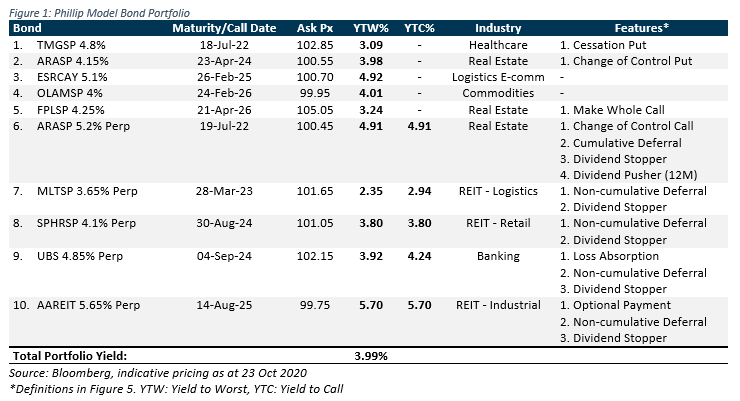

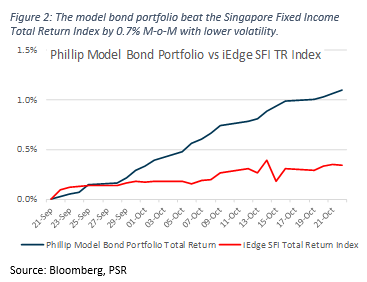

The Phillip Model Bond Portfolio outperformed the benchmark for the month and displayed lower volatility in returns throughout. The total portfolio return was 1.1% vs the Singapore Fixed Income index total return of 0.3% (Figure 2). In the portfolio, the FPLSP 4.25% bond showed the biggest price appreciation of 2.9%, while ARASP 4.15% bond lagged with -1.3% (Figure 4). In terms of portfolio return, 0.8% gains was from price appreciation while 0.3% was gained in yield.

Strategy Commentary

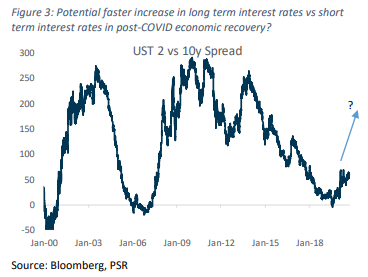

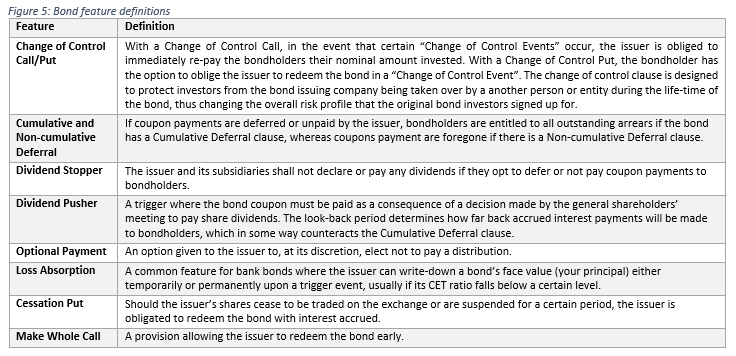

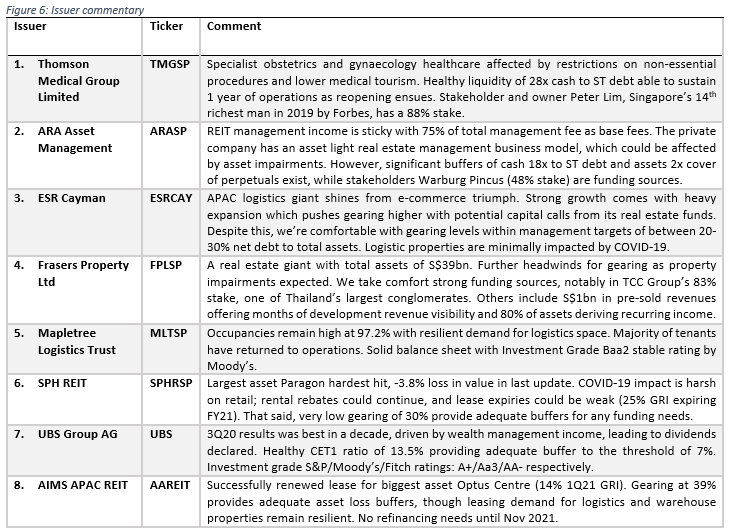

To outperform the benchmark iEdge SFI Total Return Index on a total return basis with lower volatility, the strategy considers both issuer and bonds. For issuers, we picked a range of sectors for diversification. Sectors include healthcare, real estate development, logistics and e-commerce, retail and industrial REITs, and banking. More importantly, we focused on issuers with established stakeholders to ensure price stability. As issuers grapple with cash flow concerns and bank moratorium expiries, shown by 2 bond exchange programs the past month, established stakeholders can provide financial stability during such periods of stress. Recent examples of such support include GSH Corp management buying its own bonds to refinance upcoming maturities, and Centurion Corp stakeholders participating in the bond exchange offer. In these cases, bond prices were stabilised by the support. For our bond picks, we focused on yields, relative value, and tenors. We limited yields to above 3% for the portfolio’s yield attractiveness, and performed sector relative valuations for bond value attractiveness. Our bond tenors are kept short in light of potential bear steepening, where long term interest rates rise faster than short term interest rates. The Fed only holds short term interest rates low, and the anticipated post-COVID economic recovery could push long term rates higher (Figure 3), which could lead to long-tenor bonds under-performance. We maintain the portfolio holdings.