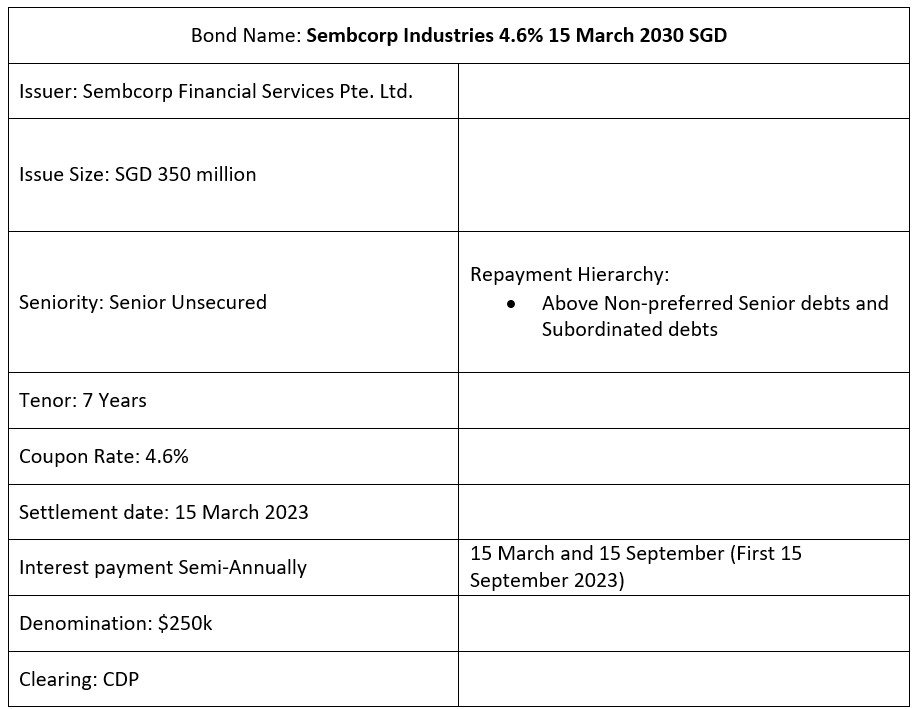

Sembcorp Industries (SCI) recently announced the issuance of its Senior unsubordinated Green bonds at a final price guidance of 4.6%. The bond is a plain vanilla bond that comes with a tenor of 7 years. As these bonds are ranked Senior, in terms of debt repayment they will be paid out before those of junior subordinated debts. The coupon payments for these bonds are paid out semi-annually and are scheduled on 15 March and 15 September each year, with the first coupon payment being disbursed on 15 September 2023. This bond is non-rated and because it is a green bond, the proceeds from this issuance will be used to finance/refinance its eligible green projects listed in Sembcorp Green Financing Framework.

Company Overview

Sembcorp Industries is an energy and urban development company with presence across 10 countries including Singapore. Its business comprises of 3 sectors “Renewable Energy, Integrated Urban Solutions, and Conventional Energy”, and it has an energy portfolio of 16.7GW and 9.8GW of renewable energy capacity comprising solar, wind and energy storage. Sembcorp is listed on the main board of the Singapore Exchange (SGX:U96) and it is a component stock of the Straits Times Index. As of 31 December 2022, Sembcorp had a market capital of $6bn and did not have a credit rating. 49.6% of Sembcorp’s shareholding is held by Temasek Holdings while the public holds the remaining.

FY2022 Financials

In FY2022, the group recorded its revenue at $9.39bn which is a 21% YoY increase on the previous financial year. However, this includes revenue of $1.57bn from Sembcorp Energy India Limited (SEIL) which was disposed as of 19 January 2023. SCI’s net profit jumped 204% YoY from $279 million in FY2021 to $848 million in FY2022. This was driven by completion of acquisitions in China and higher power prices within its Renewable business, which saw a net profit improvement of 150% YoY to $140 million. Its Conventional Energy business also contributed to the increase in group’s net profit through higher power prices. The net profit for its Conventional Energy improved by 105% YoY to $766 million.

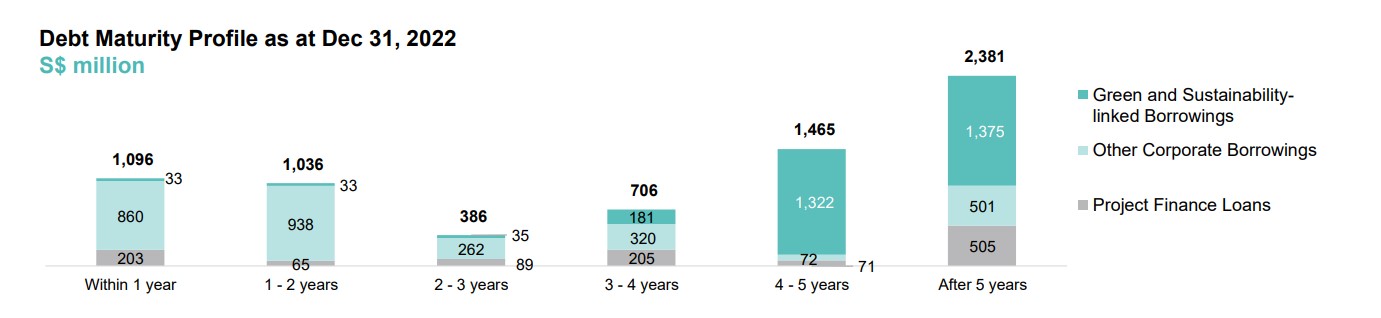

Debt Maturity

Source: Company’s Presentation

In terms of the group’s liquidity, approximately $1.09bn of debts will be maturing in less than a year. However, as of 31 December 2022, SCI’s cash and cash equivalent amounted to $1.25bn while also having approx. $4.96bn of borrowing facilities that have yet to be utilized. This shows that in the near term, SCI should not face any difficulty in repaying its short-term obligations. Currently, SCI has an average debt maturity of 4.5 years with a weighted average cost of debt of 4.1%. 66% of SCI’s debts are hedged to fixed rates to mitigate interest rate volatility.

As the initial offering has closed for subscription, investors who are interested in these notes will have to head onto the bond’s secondary market on our POEMS platform to get hold of them. These notes can be transacted in a minimum lot size of SGD$250K.

Bond Overview