Company Overview

Shangri-La Asia Ltd (SLHSP) is the Hong Kong–listed flagship of the Kuok Group, multinational conglomerate founded by Malaysian tycoon Robert Kuok. operating 90+ hotels and mixed-use properties under the Shangri-La, Kerry, and JEN brands. Earnings are concentrated in Mainland China and Hong Kong, with the remainder from Southeast Asia and other international markets. The group is unrated and majority-owned by the Kuok Group-related entity (63.1%)

1H25 Credit Performance Highlights

Operating performance continued to recover in 1H25, albeit at a subdued pace. Revenue increased marginally by 0.7% YoY to approximately US$1.06bn, as stronger investment property contributions were largely offset by softer hotel demand in China and Singapore. EBITDA was broadly flat at US$252mn (23.8% margin), supported by a ~2% YoY improvement in RevPAR, led by Hong Kong. However, EBITDA remains below pre-pandemic levels, suggesting that the earnings recovery has plateaued and has yet to translate into material balance-sheet repair.

As a result, leverage remains structurally elevated and coverage buffers thin. With earnings recovery constrained, gross debt remained high at around US$7.2bn in 1H25, translating into leverage of approximately 14× Debt/EBITDA, elevated for a hotel owner-operator. Interest coverage stood at a modest 2.3×, benefiting from a reduction in average funding costs to 3.98% from 4.45% in FY24. Nonetheless, coverage remains sensitive to earnings volatility, reinforcing the limited margin for operating underperformance.

Cash flow generation remains insufficient to meaningfully reduce leverage. The pressure on the balance sheet is further reflected in cash flow metrics. Operating cash flow in 1H25 was US$59.9mn, broadly flat YoY, while free cash flow amounted to US$35.8mn. Operating cash flow continues to be largely absorbed by recurring capital expenditure required to sustain the existing asset base, limiting cash available for debt reduction.

This funding reliance elevates the importance of asset quality and sponsor support.

In this context, Shangri-La’s franchise strength and ownership of prime hotel assets provide meaningful downside protection. Brand equity underpins continued access to funding and offers optionality for capital recycling, while geographic diversification across Greater China and overseas markets helps mitigate concentration risk. Importantly, Kuok Group sponsorship remains a key credit anchor, supported by long-standing banking relationships, capital-market access and a demonstrated track record of balance-sheet support during periods of weak earnings.

Strong liquidity mitigates near-term refinancing risk despite elevated leverage.

Liquidity therefore becomes the primary mitigating factor. As of 1H25, SLHSP held US$2.67bn of cash and US$0.73bn of undrawn committed facilities, providing total available liquidity of around US$3.4bn. Importantly, the liquidity is assessed against refinancing needs rather than total debt. Debt maturities are well-staggered at roughly US$0.7–1.6bn per annum through 2029, with available liquidity comfortably covering more than 24 months of maturities, supporting low near-term refinancing risk.

Credit View: SLHSP’s credit profile is characterized by a structurally weak balance, with high leverage and limited internal cash generation, partially offset by strong liquidity, valuable assets and Kuok Group sponsorship. While near-term refinancing risk is low, the balance sheet remains funding-dependent rather than earnings-supported, leaving the credit vulnerable to prolonged earnings weakness.

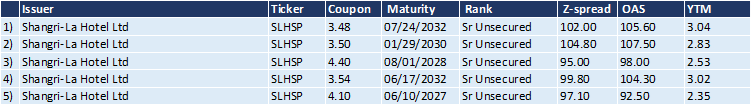

Overview of Shangri-La Hotel’s Outstanding SGD Bonds