- Issuer profile: We are neutral on SPH REIT. As one of the lowest geared REITs in Singapore, SPH REIT is well poised to push through the subdued retail climate, while gradual phases reopening will be a tailwind for retail REITs.

- Bond recommendation: On a yield to worst basis, we are OVERWEIGHT the SPHRSP 4.1% perp (YTW 3.94%, 348bps spread) as it looks interesting not only compared to comparable SPHSP perps, offering a 29bps spread pick-up over the SPHSP 4% Perp (319bps spread, callable 255 days later) and a 20bps spread pick-up over the SPHSP 4.5% Perp (328bps spread, callable 84 days earlier), but also compared to the senior SPHSP 3.2% ‘30s, offering an attractive senior-sub spread pick-up of 112bps while callable 1971 days earlier.

CREDIT VIEW

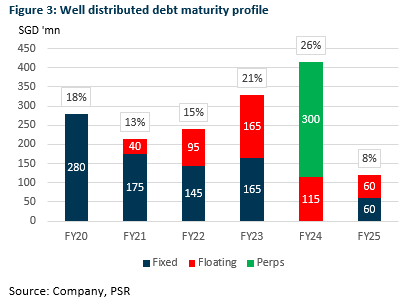

(+) Strong liquidity profile. No more than 21% of debt matures within the next 3 years, with S$300mn perpetual bond callable in 30 Aug 2024. We foresee low short-term liquidity needs, especially with SPH REIT’s leverage ratio at 29.5%, allowing a debt headroom of S$878mn (keeping asset values constant), while allowing asset values to fall 40% (keeping debt levels constant) before the MAS limit of 50% is breached. As a benchmark, retail asset prices fell roughly 11% in the GFC.

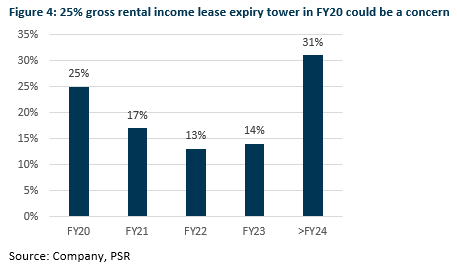

Lease expiry tower in FY20 may be a concern. With 25% of gross rental income (GRI) set to expire in FY20, SPH REIT may face challenges if tenants fail to renew during times of restriction. However, we note that the highest contributors of net property income (NPI), Paragon and The Clementi Mall, contributing 65% of NPI in 1H20, have low lease expiries of 2% and 10% respectively in FY20. The asset with the highest near-term lease expiry tower is Westfield Marion Shopping Centre in Australia, with 30% GRI expiring in FY20. We estimate Marion to contribute 15% NPI and 23% GRI in FY20.

(+) Up to 6 months of zero rental income before interest coverage falls below 1. Based on FY19 GRI, SPH REIT can forego 6 months of rental income before the year’s EBIT is unable to cover interest expenses and perpetual distributions. We note that this buffer is adequate as Singapore enters Phase 2 of reopening just 3 months after the start of circuit breaker measures on 7 April.