Company Overview

ST Telemedia is a Singapore-headquartered strategic investor focused on investing in, operating and managing a portfolio of companies and investments in the Communications, Media and Technology (CMT) space globally. Its key business segments comprise Communications and Media Services, Data Centres and Infrastructure Technologies. With its portfolio of companies and STT Communication Ltd (STTC) being its wholly-owned subsidiary, ST Telemedia have established a global footprint across Asia Pacific, the UK and the United States, and has extensive experience investing and operating in both emerging and mature markets. In January 2020, ST Telemedia has acquired a majority stake in CloudCover, a cloud-native product and services company, which is based in Singapore and has a presence in India and in October 2020, GDS Holdings launched its public offering on the HKSE and is currently listed on NASDAQ and the HKSE

ST Telemedia is also a wholly owned subsidiary of Temasek, which is in turn wholly owned by the Government of Singapore through the Ministry for Finance. Temasek is an investment company headquartered in Singapore with a diversified investment portfolio. ST Telemedia is guided and managed by its Board and management and Temasek does not direct the commercial or operational decisions of the company.

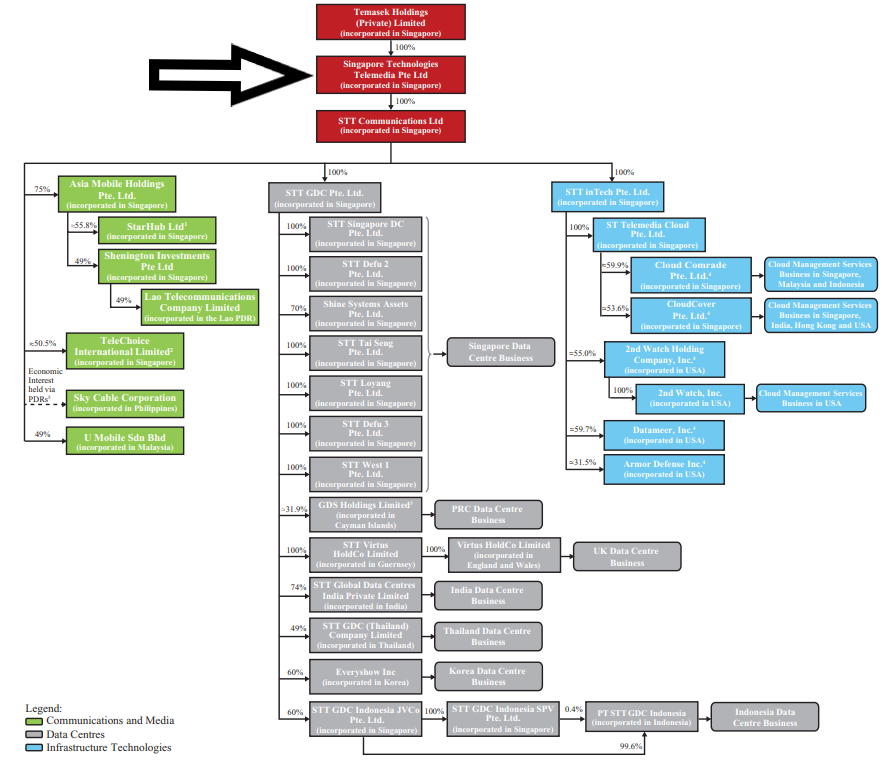

Corporate structure

Source: ST Telemedia

Financials

As there is no release of the latest financials data, figures used in this article are from FY2020. In FY2020, the total revenue amount to $3.953bn (a 4.33% reduction from the previous year at $4.132bn in FY2019). On the other hand FY2020 recorded an EBITDA of $915 million (this was 4.34% higher than the FY2019 EBITDA of $638 million). This was due to a reduction in finance expenditure and an increase in tax income in FY2020.

As for the credit position of the company, ST Telemedia has an interest coverage ratio of 3.16 times, leverage ratio of 44% and cash to debt ratio of 28.3%. Despite the fact that the company cash to debt ratio may appear to be low, the bulk of its borrowings are longer term debt. In FY2020, its cash and cash equivalent amounted to $1.737bn, while is current borrowings were only at $399 million. Thus ST Telemedia’s financial and credit profile is considered to be resilient. Additionally, with ST Telemedia being a wholly owned subsidiary of Temasek, investors may consider investing in its debt issuance.

ST Telemedia Outstanding bonds

- Singapore Tech Telemedia 4.05% 12Feb2025 (SGD)

- Singapore Tech Telemedia 5.00% Perpetual (SGD) – Next call date 17Jan2024

- Singapore Tech Telemedia 4.10% Perpetual (SGD) – Next call date 2Jul2027

- Singapore Tech Telemedia 4.20% Perpetual (SGD) – Next call date 3May2029