Company Overview

StarHub Ltd is a Singapore telecom operator providing Mobile, Broadband, Pay TV, Enterprise ICT, and Cybersecurity services. The shareholder base is anchored by Temasek (via ST Telemedia / STT Communications, ~56%) and NTT Group (~10%), which supports franchise stability and access to strategic partnerships.

3Q25 Credit Performance Highlights

StarHub’s consumer franchise remains the cash-flow anchor, with low churn supporting predictability despite ongoing pricing pressure. Mobile churn is 1.3%, and broadband churn is 1.0%, while subscriber additions (+50k QoQ to 2.187mn) help offset softer mobile ARPU (S$22). Broadband growth (+1.4% YoY) also points to steady upselling momentum, keeping the core subscription base a stabiliser for leverage and debt service.

The quality of revenues is gradually improving as Enterprise and Cybersecurity continue to scale, offering higher-margin, recurring B2B cash flows that reduce reliance on consumer cyclicality. Cybersecurity grew +17.0% YoY and Managed Services +3.2% YoY, supported by its Modern Digital Infrastructure platform. A +5.7% YoY increase in the orderbook and deeper regional Enterprise integration (SG–MY) strengthen visibility, which is credit-positive given it diversifies the earnings engine beyond consumer ARPU dynamics.

That said, the near-term credit narrative is increasingly about execution. EBITDA softened to S$105.9mn (–7.6% YoY) and service EBITDA margin compressed to 20.6%, reflecting weaker mobile/entertainment gross profit and higher operating costs. With DARE+ completed, management is now in the “harvest” phase, targeting ~S$60mn cost savings over FY26–FY28. Delivery will be key to rebuilding margins and restoring free cash flow. FCF remains tight: 3Q25 FCF was S$123.6mn, but 9M25 FCF turned negative (–S$48.2mn) once spectrum-related payments are included; even excluding spectrum, 9M FCF of S$139.8mn (–16.4% YoY) highlights pressure from elevated investment commitments and weaker operating cash generation.

Looking ahead, the main watchpoints are (i) whether EBITDA and margins stabilise, further slippage would narrow headroom within the current leverage range, and (ii) whether cost-out execution translates into real FCF recovery, particularly as spectrum and investment commitments continue to compete for cash. The risk is less about near-term solvency and more about buffer erosion: without a clearer rebound in operating cash generation, deleveraging becomes harder, and the credit story stays capped.

Credit view: StarHub’s credit profile remains stable on the back of a sticky subscription base and still-healthy interest coverage, but it is now more constrained by execution risk than balance-sheet stress. In our view, sustained margin repair, EBITDA stabilisation, and a credible improvement in free cash flow are the key requirements to preserve credit buffers and the path to any meaningful spread tightening will depend on demonstrating that these improvements are durable rather than one-off.

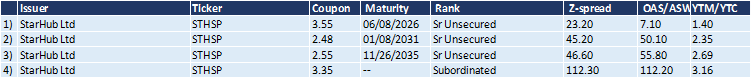

Overview of StarHub Ltd’s Outstanding SGD Bonds