Company Overview

Tuan Sing is a Singapore-listed real estate and hospitality group with activities spanning real estate investment, hospitality operations, and property development, with key exposure to Singapore, Australia, and Indonesia. The group is majority owned by Nuri Holdings (S) Pte Ltd (54.5%), a family office for the Liem family, with Michelle Liem and William Liem as key decision-makers.

1H25 Credit Performance Highlights

Tuan Sing has meaningful assets backing, but leverage keeps balance-sheet buffers thin. Total assets were S$2.71bn with equity of about S$1.20bn as at 1H25, providing a base level of loss absorption and some refinancing flexibility. However, leverage remains elevated, with net debt to equity at 1.01x and total debt to total assets at 0.50x, while total debt of S$1.35bn compares with cash of S$143mn. This limits tolerance for valuation swings or earnings shocks and keeps credit comfort sensitive to liquidity headroom.

The near-term earnings drag is transition-driven, with improvement expected as assets stabilise and AEI benefits season through. 1H25 showed a clearer YoY improvement versus 1H24, supported by the completion of Dunearn Village, while Langley Park is expected to contribute higher recurring cash flows as leasing and operations normalise. Management is guiding for EBIT and cash flow to improve from 2026, implying a more resilient recurring earnings base that should gradually reduce reliance on episodic development outcomes.

However, execution risk remains front and centre, given the long-dated uplift from Melbourne Collins Street, even as liability management is improving. The group has secured the planning permit for the redevelopment of Collins Street in Melbourne, comprising Grand Hyatt Melbourne and retail, with completion targeted in 2028. Management also guiding for rental escalation above current in-place rents supported by premium and luxury tenanting and destination F&B, which is supportive for end-state valuation, but the credit impact is back-ended and depends on disciplined capex phasing and disruption control through the build period.

On the funding side, management indicated ongoing refinancing into a 3-4 year maturity bucket, which should reduce near-term maturity concentration and improve visibility during execution. Separately, the broader pipeline offers upside optionality, with Opus Bay in Batam supported by improving connectivity, including the Batam airport development, and Tuan Sing’s ownership of the Teluk Senimba Ferry Terminal strengthens ecosystem demand; with land cost effectively zero, development can be phased alongside take-up, supporting a more controllable cash investment profile.

Moving forward, the first watchpoint is whether coverage meaningfully rebuilds into 2026, through a sustained uplift in recurring EBIT or EBITDA that creates a durable interest buffer and reduces reliance on refinancing or asset sales. The second is Melbourne execution into 2028, specifically capex phasing, cost containment, disruption management, and leasing traction consistent with the rental escalation and premium-brand tenanting assumptions; any slippage would extend the period of tight liquidity and covenant sensitivity.

Credit view: We are cautiously positive on Tuan Sing’s outlook. Management’s guidance for earnings and cash flow to improve from 2026, alongside normalising transitions and AEI benefits, is credit supportive, and refinancing actions should reduce near-term maturity pressure. However, with leverage already elevated and the Melbourne uplift back-ended, credit comfort remains most sensitive to liquidity discipline and covenant buffers over the execution period, making delivery and funding management the key determinants of spread performance.

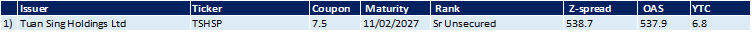

Overview of Tuan Sing’s Outstanding SGD Bonds