- Astrea 8 is the latest issuance under the Astrea bond series.

- The bonds are backed by cashflows from private equity funds. Credit ratings for the Class A-1 and A-2 bonds are expected to be investment grade (A+sf by Fitch for Class A-1 and Asf by Fitch for Class A-2).

- Both A-1 (S$ Denominated) and A-2 bonds (US$ Denominated) are made available to retail investors for subscription via ATM.

- Astrea 8 possesses multiple structure safeguards that serve as an assurance and protection for its bondholders.

Background

Astrea 8 is the eighth issuance in the Astrea product line and offers two classes of investment-grade bonds which amount to US$585mn. It is issued by Astrea 8 Pte. Ltd., a subsidiary of Astrea Capital 8 Pte. Ltd. (Sponsor). Astrea Capital 8 Pte. Ltd. is an indirect wholly-owned subsidiary of Azalea Asset Management Pte. Ltd., which is indirectly wholly-owned by Temasek Holdings. These bonds are asset-backed securities that will be supported by the cashflows from a US$1.5bn portfolio invested across 38 private equity funds. The Astrea 8 portfolio comprises buyout funds (76%) and growth equity funds (24%).

For previous Astrea Issuance, please refer to our previous write-up here:

Highlights

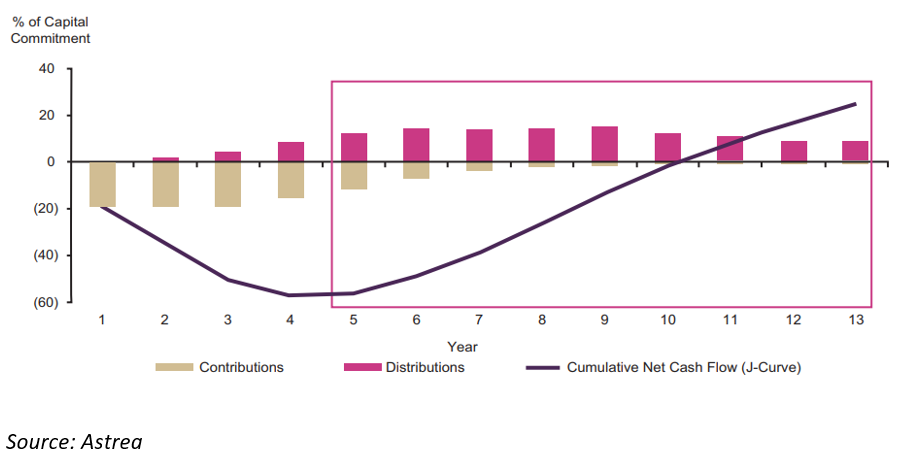

- Risk management: The Astrea 8 PE portfolio has a weighted average age of approximately 6.1 years and is diversified across a total of 38 funds managed by 27 GPs, with 1028 underlying investee companies. The portfolio is considered to be mature and cash generative as PE funds typically turn cashflow positive after 5 years due to divestments outpacing capital calls in the later years of the fund’s life. (Figure 1)

Figure 1: The Private Equity J-Curve

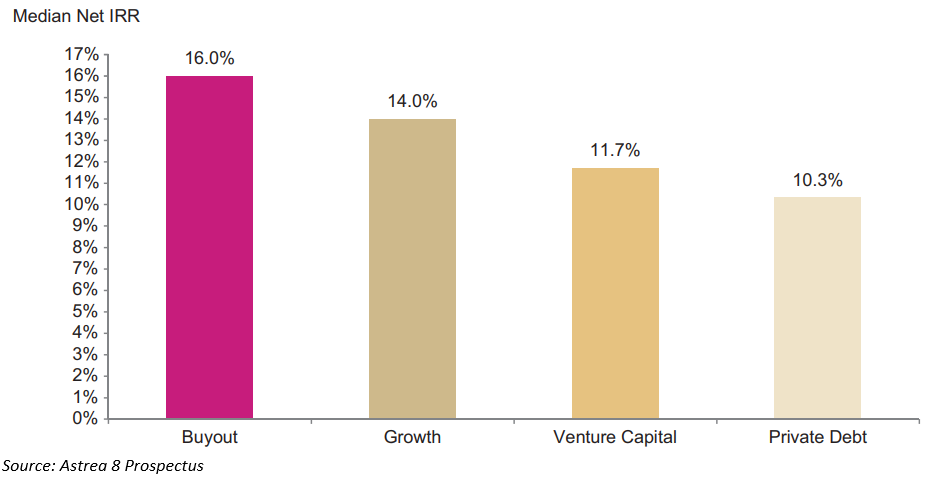

As mentioned above, 76% of the fund’s NAV is made up of buyout funds with the remaining 24% made up of growth equity funds. Historically, the buyout strategy has displayed more robust performance compared to other PE strategies which is illustrated in Figure 2. The strategy provides fund managers with greater control over investee companies, allowing managers to make operational improvements and remain responsive to the global macroeconomic environment. Some reputable fund managers in this portfolio include Insight Partners (8.1% of NAV), Permira (7.2% of NAV) and Silver Lake (6.7% of NAV). The portfolio is also highly diversified, with the largest investee company making up only 1.3% of the total portfolio’s NAV out of 1028 companies. The Class A-1 and Class A-2 bonds are also expected to obtain investment-grade ratings of A+sf and Asf by Fitch respectively.

Figure 2: Median Net IRR Returns by Strategy

- Structural Safeguards: Astrea 8 possesses multiple safeguards for its investors, similar to Astrea 7. First would be its reserves account. These reserves are set in place to ensure that cash flows from the funds are being held for the redemption of the bonds at their scheduled call dates with Class A-1 bonds taking priority before Class A-2 bonds. A maximum LTV ratio of 40% will be maintained for the fund so long as any bonds remain outstanding. If exceeded, cash generated from the funds will be diverted into the Reserves Accounts to bring down the maximum LTV Ratio to 40% or below. Lastly, OCBC Bank will be providing a credit facility in the event of cash shortfalls which can be used to cover the bond interest payments, certain expenses and fees (e.g management fee and interest expense) and capital calls.

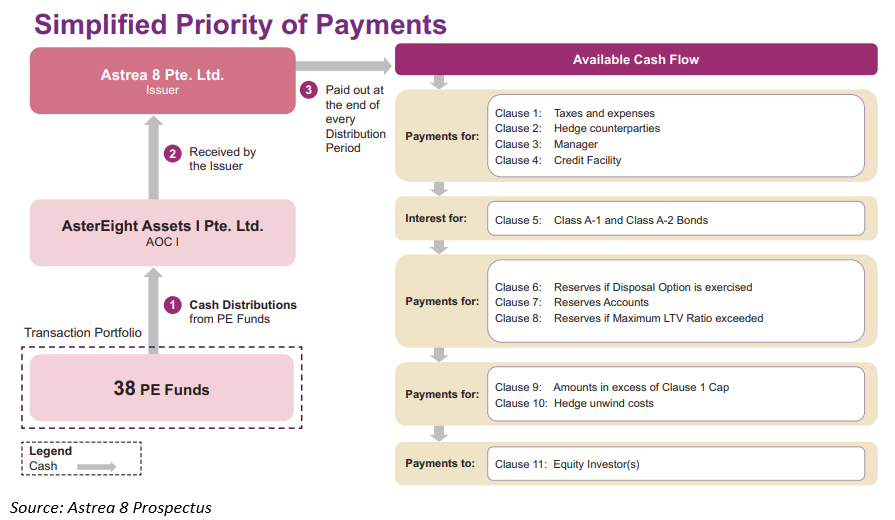

- Overcollateralization and alignment of interest: The Astrea 8 structure is overcollateralized with an LTV ratio of 39.8%. In other words, the portfolio value is more than double the amount of the debt issued. In terms of repayment for the bondholders, Astrea 8 follows a priority of payment feature (Figure 3) where bondholders are ranked above the Sponsor. The Sponsor also holds all of the equity, providing a strong alignment of interest with bondholders.

Figure 3: Priority of Payments

With the significant demand seen for previous Astrea bonds, given Astrea 7 aggregate offering was 3x subscribed, Astrea VI at 6x and Astrea V at more than 6x. Similar or higher levels of participation are expected as retail investors can now invest in both the Astrea 8 Class A-1 and A-2 bonds.

Astrea 8 Bond Classes Breakdown

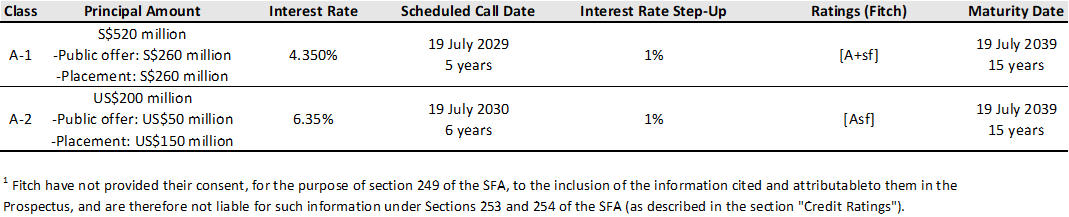

Astrea 8 has two tranches of bonds being issued namely: Class A-1 and Class A-2 (Figure 4). Only Class A-1 is denominated in S$ while Class A-2 will be denominated in US$. Both Class A-1 and A-2 bonds will be available for retail investors in Singapore.

Source: Astrea, PSR

Class A-1 S$ bond – 26.2% of NAV, Interest Rate of 4.35%

In terms of seniority, Class A-1 bonds are ranked the highest with an issue size of S$520mn, of which S$260mn will be offered to the public. The remainder S$260mn will be issued to institutions and accredited investors. Interest payments for the bonds will be paid semi-annually.

Features:

- Dates: Mandatory call date in five years (2029) with a maturity date in fifteen years (2039).

- Credit Rating: Expected to be rated investment-grade of A+sf by Fitch. (Source from Astrea 8 Prospectus)

- Mandatory Reserves Accounts: A payment of US$46mn shall be made into the Reserves Accounts on each distribution date. The Reserve Accounts will then be used to redeem the Class A bonds (with A-1 taking priority) on the scheduled call date.

- Coupon step-up: If the bonds are not redeemed on the scheduled call date at the 5th year, a one-time step-up interest rate of 1% will be applied. The bonds will have to be redeemed by the issuer on the maturity date in the 15th year period.

How to purchase: For the public tranche, retail investors are able to apply through ATMs (DBS,OCBC,UOB) or Internet Banking (DBS,OCBC,UOB) or mobile banking (DBS,OCBC, UOB). The minimum subscription is $2,000 and an incremental $1,000 thereafter. Investors are not allowed to use their CPF or SRS to apply.

For the secondary trading of the placement tranche, investors can place an order over the counter through your broker’s bond desk. Phillip Securities Bond Desk is a distributor partner. To apply call 6212 1818 or email bonds@phillip.com.sg

Timeline:

- Opening date: 11 July 2024

- Closing date: 17 July 2024

- Trading date: 22 July 2024

Class A-2 US$ bond – 13.6% of NAV, Interest Rate of 6.35%

Class A-2 bonds are ranked pari passu with Class A-1 bonds. The bonds are denominated in US$ with an issue size of US$200mn. Class A-2 tranche will also be available to both retail investors and institutions/accredited investors of which US$50mn will be offered to the public and the remainder US$150mn will be issued to institutions and accredited investors. Interest payments for the bonds will be paid semi-annually.

Features:

- Dates: Mandatory call date in six years (2030) with a maturity date in fifteen years (2039).

- Credit Rating: Expected to be rated investment-grade of A+sf by Fitch. (Source from Astrea 8 prospectus).

- Mandatory Reserves Accounts: After Class A-1 Bonds are fully reserved or redeemed, whichever is earlier, 90% of available cash then will start to accumulate in the Reserves Accounts according to the Priority of Payments until there is sufficient cash to cater for the principal repayment of Class A-2 Bonds. (Refer to Figure 3)

- Coupon step-up: If the bonds are not redeemed on the scheduled call date at the 6th year, a one-time step-up interest rate of 1% will be applied. The bonds will have to be redeemed by the issuer on the maturity date in the 15th year period.

How to purchase: For the public tranche, retail investors are able to apply through ATMs (DBS,OCBC,UOB) or Internet Banking (DBS,OCBC,UOB) or mobile banking (DBS,OCBC, UOB). The minimum subscription is $2,000 and an incremental $1,000 thereafter. Investors are not allowed to use their CPF or SRS to apply.

For the secondary trading of the placement tranche, investors can place an order over the counter through your broker’s bond desk. Phillip Securities Bond Desk is a distributor partner. To apply call 6212 1818 or email bonds@phillip.com.sg

Timeline:

- Opening date: 11 July 2024

- Closing date: 17 July 2024

- Trading date: 22 July 2024

Key Risk

- Investment Risk: The distribution schedule and quantum of returns from the Fund Investments remain uncertain and there is no guarantee that these long-term investments will generate sufficient cash flow to service the Bonds. Due to the inherent nature of such long-term holdings, the timing of any distributions to the Asset-Owning Company and the Issuer is inherently unpredictable.

- Market Risk: A deterioration in macroeconomic conditions, including sustained inflation, rising interest rates, or market disruptions triggered by geopolitical events (armed conflicts), trade disputes, natural disasters, or global pandemics, could negatively impact private equity (PE) asset valuations and reduce deal activity. This, in turn, could lead to diminished distributions for the Asset-Owning Company from its Fund Investments if exits from underlying investments in Investee Companies coincide with a period of declining valuations or deal flow.

- Leverage Risk: The use of leverage is common in PE funds as it helps to achieve a higher return. However, the use of leverage may also increase the exposure of investee companies to adverse financial or economic conditions and impair their ability to finance operational and capital needs. In an unfavorable market, the use of leverage may deteriorate the cashflows to Astrea 8 and the cumulation of such leverage may compound and exacerbate the risks as well.

- Liquidity Risk: The secondary market for the Bonds may be limited, and investors should be prepared to hold them until maturity. The ability to sell the Bonds at a desired price, or even to sell them at all cannot be guaranteed and the timing of any potential early redemption for each Bond Class remains uncertain.

- Product Specific Risk: Investors will have limited access to current information regarding the underlying investments, the Portfolio PE Funds and the Investee Companies. Furthermore, the net asset value (NAV) used to assess these investments may not be reliable due to reliance on potentially outdated valuations from various managers. The Bonds are not guaranteed and repayment hinges solely on distributions from the underlying investments. A complex priority structure for payments may further limit or even eliminate potential returns. Credit ratings assigned to the Bonds are not investment recommendations and could negatively impact their marketability. In short, due diligence is crucial before investing in these bonds as this investment carries significant risks due to limited transparency and the potential for insufficient funds for bond repayment.

Appendix

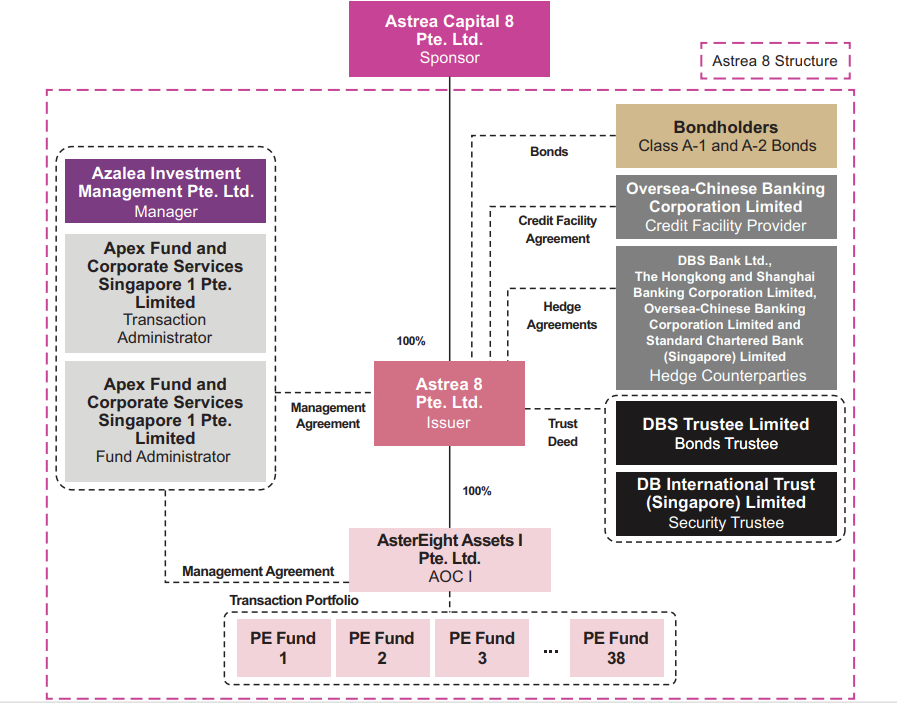

The issuer: Astrea 8 Pte. Ltd., a special purpose vehicle (SPV), is the issuer of the bond and also the holding company of the asset-owning company that holds the fund investments. The issuer is a wholly owned subsidiary of the sponsor and intends to use the gross proceeds from the Bonds issuance to repay part of the loans incurred in connection with the acquisition of the Fund Investments, as well as to pay fees and expenses incurred in connection with the issue and offering of the Bonds.

The sponsor: Astrea Capital 8 Pte. Ltd. is the sponsor for Astrea 8 bonds and was incorporated to initiate the transaction. The company is the sole shareholder of the issuer and the sole owner of the equity investments. It is also an indirect wholly owned subsidiary of Azalea.

The manager: Set up in 2015, Azalea is wholly owned by Seviora Holdings Pte. Ltd. and indirectly wholly owned by Temasek Holdings. Azalea is an investor, developer and manager of private assets, starting with private equity. As the manager, Azalea provides certain management services, such as approving capital calls, the monitoring of, and reporting to the board of directors of the issuer on, the performance of the portfolio, and supervising the performance of the transaction administrator and the fund administrator.

The transaction & fund administrator: Apex Fund and Corporate Services Singapore 1 Pte. Ltd., the transaction and also the fund administrator. Apex Fund and Corporate Services Singapore 1 Pte. Limited will be providing administrative services in respect of payments to be made in accordance with the priority of payments and other services, such as determining whether the Maximum Loan-to-Value Ratio has been exceeded. It also provides certain fund administration services in respect of each Fund Investment and the Portfolio, such as checking each distribution of each Fund Investment to ensure that such distribution is made in accordance with the applicable terms of such Fund Investment and determining periodically the Total Portfolio NAV and the aggregate of all Undrawn Capital Commitments

Astrea 8 Structure

Source: Astrea