Why invest in the CSOP iEdge Southeast Asia+ Technology ETF?

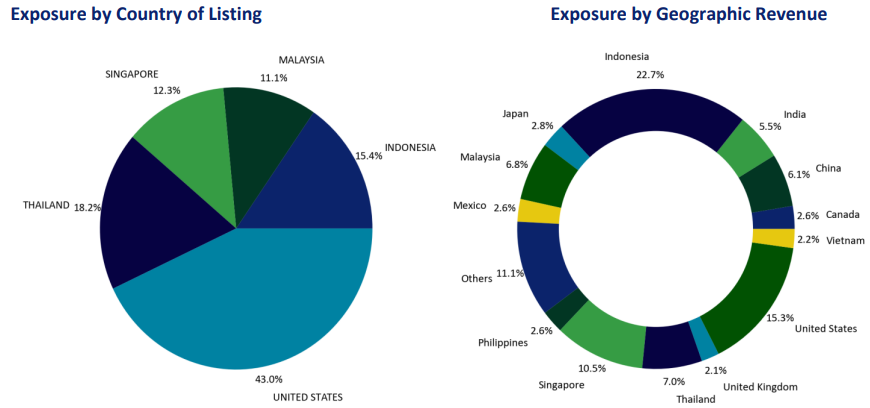

The Singapore-listed ETF offers a unique investment opportunity, providing exposure to 30 leading technology firms across 6 markets in Southeast Asia and India, covering sectors such as IT, software, retail, car manufacturing and electronic components and manufacturing etc., capturing the potential of emerging Asian markets.

Why invest in SEA+ India?

Southeast Asia and India are poised to become the fastest-growing regions globally over the next decade, amid the burgeoning internet industry and the rise of tech unicorn companies. On one hand, the relocation of the global industrial chain is set to catalyse the development of high-end manufacturing and electronic technology. On the other hand, the expanding middle class, spurred by urbanisation and increasing income level, is driving a growing diversity in internet services and digital consumption demands. This landscape has given rise to tech companies such as SEA Ltd and Grab.

Read more info here:

Exposures:

Webinar on CSOP iEdge Southeast Asia+ Technology ETF

| Date/Time | Title | Venue |

|---|---|---|

| 7 Jun, Wed 12:00pm-01:00pm |

Towards a SEA of Opportunities Mr. Adrian Chew | Senior Vice President | CSOP | Webinar |

| 10 Jun, Sat 10:00am-11:00am |

Towards a SEA of Opportunities Mr. Zhang Dinghai (Bruce) | Portfolio Manager (CFA)| CSOP | Webinar |

| 12 Jun, Mon 12:00pm-01:00pm |

Towards a SEA of Opportunities Adrian Chew | Senior Vice President | Sales and Marketing Strategy (S.E.A·CSOP Asset Management & Bruce Zhang | Portfolio Manager | (CFA)·CSOP Asset Management | Webinar |

| 20 Jun, Mon 7:30pm-8:30pm |

Towards a SEA of Opportunities Mr. Zhang Dinghai (Bruce) | Portfolio Manager (CFA)| CSOP | Webinar |

Subscribe to CSOP iEdge Southeast Asia + TECH Index ETF during the Initial Offering Period (IOP) via POEMS 2.0

- Using Google Chrome Browser – Login to your POEMS 2.0 account > Acct Mgt > Online Forms > IPO Subscription – Irrevocable Form

- Select the IPO that you wish to subscribe to

- Read and agree to the prospectus, terms and conditions before subscribing to the financial product

- Application closes on 13 June 2023 (Tuesday), 5pm

- Ensure sufficient cash is present in your POEMS 2.0 account to complete the application process (inclusive of subscription amount, commission, transfer fee and GST) by the settlement date on 13 June 2023 (Tuesday), 5pm

| Subscription Period: | 06 June 2023, 9am to 13 June 2023, 5pm |

| Listing Date: | 20 June 2023 |

| Subscription price: | SGD 1.00 per unit |

| Minimum Quantity: | Minimum of 1,000 units 1,000 units incremental subscription amount |

| Commission Fees: | Zero Commission |

| Transfer Fees: | SGD 10.00 (Subject to GST) for Cash Management Account Transfer fees will be waived for subscription of 5000 units and above. Other Phillip Investment Account Types will not be subject to transfer fee charge |

| Settlement Currency: | SGD |

| Trading Currency: | Primary: USD Secondary: SGD IOP application will be for the SGD units |

| Allotment: | Full allotment |

CSOP iEdge Southeast Asia + TECH Index ETF

The investment objective of the Sub-Fund is to replicate as closely as possible, before fees and expenses, the performance of the iEdge Southeast Asia+ TECH Index.

The Manager (CSOP Asset Management) employs a “passive management” or indexing investment approach designed to track the performance of the Index. There can be no assurance that the Sub-Fund will achieve its investment objective or will be able to fully track the performance of the Index.

The Manager aims to deliver an investment performance which closely corresponds to the performance of the Index.

| Instrument Type: | Exchange Traded Fund “ETF” |

| Tracked Index: | iEdge Southeast Asia+ TECH Index |

| Exchange Listing: | SGX-ST |

| Classification: | Excluded Investment Product (EIP)* |

| Trading Currency: | Primary: USD Secondary: SGD |

| Board Lot Size: | 1 Unit |

| Dividend Distribution Frequency: | NIL |

| Management Fee and Total Expense Ratio: | Currently: 0.99% per annum of the Net Asset Value of the Sub-Fund. Maximum: 1.50% per annum of the Net Asset Value of the Sub-Fund. |

| Manager: | CSOP Asset Management Pte. Ltd. |

*Please refer to the Prospectus for more information.

Source: Prospectus

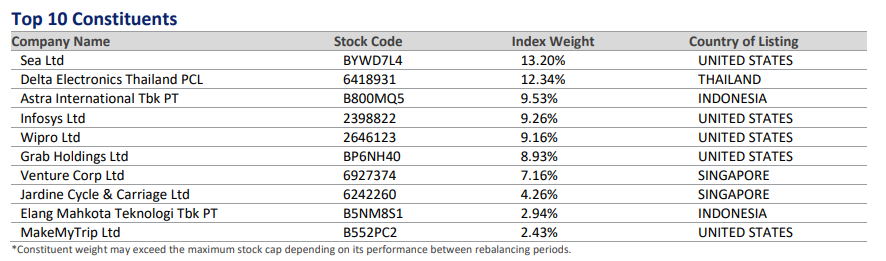

| Key Attributes of the Index | iEdge Southeast Asia+ TECH Index (the “Index”) |

| Index Objective* | The iEdge Southeast ASIA+ TECH Index aims to track the performance of the largest 30 technology companies domiciled in Southeast Asia and Emerging Asia markets. Securities captured within this index include companies primarily in technology related sectors such as Information Technology, Software and Consulting, Car Manufacturing, Electronic Components and Manufacturing, Retail, and Media Services. |

| Number of Constituents* | 30 |

| Geographical Region* | Constituents are domiciled in Southeast Asia and Emerging Asia markets – namely India, Singapore, Indonesia, Thailand, Vietnam, and Malaysia. |

| Top 5 Holdings in the Index* | No. Stock Name Weighting 1. Astra International Tbk PT (11.59%) 2. Delta Electronics Thailand PCL (11.04%) 3. Wipro Ltd (10.65%) 4. Sea Ltd (10.18%) 5. Grab Holdings Ltd (9.83%) |

*Extracted as of May 2023, Source: SGX Factsheet

Call your trading representative or visit your nearest Phillip Investor Centres for further assistance.

Alternatively, you can email us at etf@phillip.com.sg to find out how you can participate in this initial offer.

For more information on how to transfer funds to your POEMS account, please visit https://www.poems.com.sg/payment/

For more information about ETFs, please visit https://www.poems.com.sg/products/etf/

Terms and Conditions

- The subscription period for this ETF is from 06 June 2023, 9am to 13 June 2023, 5pm

- The online subscription will close on 13 June 2023, 5pm. No new application, amendment, or withdrawal is allowed after this deadline.

- Six types of accounts namely Cash Plus, Cash Management (KC), Prepaid (CC), Custodian (C), Margin (M) and Share Financing (V) accounts are allowed to subscribe for this ETF.

- The additional transfer fee charge of SGD 10 (Subject to GST) per application for Cash Management Accounts will be waived for subscriptions 5,000 units and above.

- Cash Trading Accounts (T) is are not eligible to participate in this subscription.

- Only one application is allowed per account.

- Each ETF unit priced at SGD1 and the minimum order quantity is 1,000 units, at incremental order size of 1,000 units.

- There is zero commission fee.

- The total amount payable is denominated in SGD. Settlement currency will be in SGD.

- Sufficient funds (transfer fee and GST) must be in the client’s trading account by 13 June 2023, 5pm

- Application will be rejected if the account does not have/ reflect sufficient funds after 13 June 2023, 5pm.

- ETF units will be credited to the clients’ CDP or clients’ sub-account with Phillip Securities Pte Ltd by 20 June 2023, 9am.

- Clients will receive the full allotment of the number of ETF units that they subscribe to.

- Clients can start trading the ETF units when the ETF is listed on SGX on 20 June 2023, 9am.

Investments are subject to investment risks including the possible loss of the principal amount invested. You should read the ETFs’ prospectus and the accompanying product highlights sheets for key features and key risks and seek advice from a financial adviser (“FA”) or you should assess and consider whether the ETFs are suitable for you before proceeding to invest in the ETFs. Listing on SGX does not guarantee a liquid market for the units of the ETFs, which may be traded at prices above or below its net assets value or may be suspended or delisted. Unlike unlisted unit trusts, investors cannot create/subscribe or redeem ETF units directly with the fund manager of the ETFs. Please refer to the Prospectus of the ETFs for more details.

Disclaimer

This material and the information herein is provided for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in the product (“REITs ETF”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. The information is subject to change at any time without notice. The value of the units and the income accruing to the units may fall or rise. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for disclosure of key features, key risks and other important information of the REITs ETF (which is available on websites of the issuers) and obtain advice from a financial adviser (“FA”) before making a commitment to invest in REITs ETF. In the event that you choose not to obtain advice from a FA, you should assess whether the REITs ETF is suitable for you before proceeding to invest.

The REITs ETF is not like a typical unit trust as it is intended for the units of the REITs ETF (the “Units”) to be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its net asset value (“NAV”) or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Please refer to the Prospectus for more details.

Investments are subject to investment risks including the possible loss of the principal amount invested, and are not obligations of, deposits in, guaranteed or insured by Phillip Securities Pte Ltd (“PSPL”) or any of its subsidiaries, associates and affiliates. Past performance is not necessarily indicative of the future or likely performance of the REITs ETF. There can be no assurance that investment objectives will be achieved.

Any regular dividend distributions, either out of income and/or capital, are not guaranteed and subject to the fund manager’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the NAV of the ETF. Upon launch of the ETF, please refer to the fund manager’s website for more information in relation to the dividend distributions.

The information does not constitute and should not be used as a substitute for tax, legal or investment advice.

This information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PSPL to any registration or licensing requirement in such jurisdiction or country. The REITs ETF is not offered to U.S. Persons.

This advertisement has not been reviewed by the Monetary Authority of Singapore.