Introduction: What is a Regular Savings Plan (RSP)?

A Regular Savings Plan (RSP) is an investment service that automatically invests a fixed amount of the subscriber’s money at regular intervals (e.g. S$100 or S$500 per month) into selected assets, such as ETFs, stocks, or bonds.

Rather than invest a large lump sum all at once, RSPs allow you to spread out your investments over time—a method known as dollar-cost averaging (DCA) that helps to reduce the impact of market volatility and lowers the risk of poor market timing.

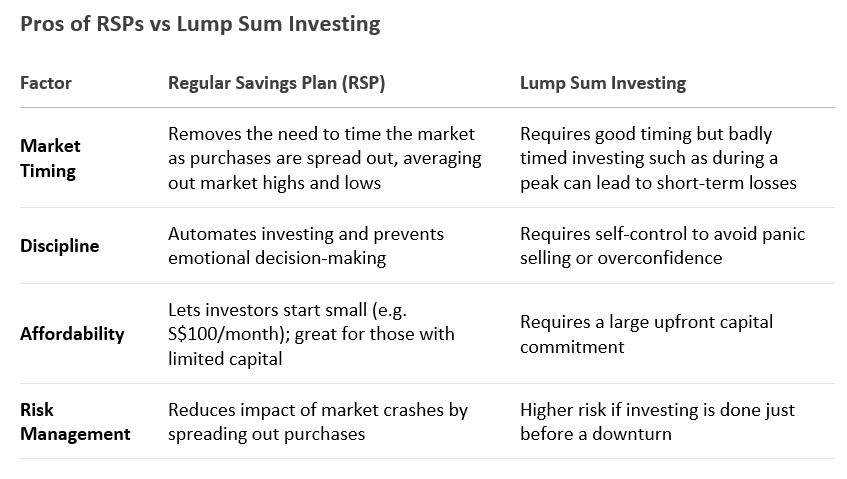

Pros of RSPs vs Lump Sum Investing

Cons of RSPs

- Transaction Fees: Some brokers charge fees by transactions, which can add up over time

- Slower Growth in Bull Markets: If markets are in a positive run, lump sum investing may outperform DCA

- Limited Flexibility: Some RSPs restrict the selection of ETFs or stocks you can invest in

Bottom Line: RSPs are ideal for beginners, busy professionals, and individuals who generally prefer a hands-off approach. Lump sum investing may be better for experienced investors with spare capital, time to research, and have a robust investment strategy.

Why Choose ETFs as the Foundation of Your Portfolio?

ETFs (Exchange-Traded Funds) are low-cost, diversified investment funds that trade like shares on the market. Here’s why they’re perfect for RSPs:

- Diversification – A single ETF can hold a basket of stocks or bonds (up to hundreds or even thousands of underlying assets), reducing concentration risks

- Low Fees – Most ETFs charge under 0.5% annually, compared to unit trusts (1-2%)

- Liquidity – ETFs trade on stock exchanges, so you can buy/sell anytime during market hours

- Transparency – Holdings and NAV of ETFs are disclosed daily, unlike some mutual funds

For example, instead of buying individual REITs (which requires individual research, selection process and higher capital), the Lion-Phillip S-REIT ETF (CLR) gives you instant exposure to 20+ Singapore REITs in one purchase. ETFs also benefit from smaller lot sizes. Singapore-listed ETFs start at lot sizes of 1 unit compared to 100 units for most REITs and individual company shares.

Analysing Singapore ETF Choices by Asset Class

Before selecting ETFs, understand the three main asset classes and how they fit into a portfolio:

- Equity ETFs (Growth Focus)

- What They Do: Gain exposure to the stock market via tracking an index (e.g., STI, S&P 500)

- Risk/Reward: Higher volatility but better potential long-term growth

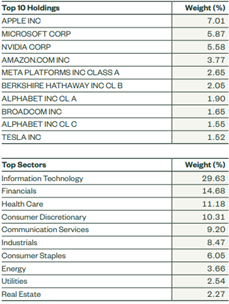

- Singapore Options:

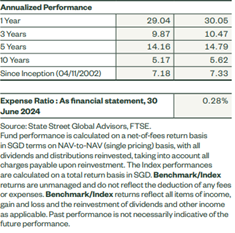

- SPDR STI ETF (ES3) – Tracks Singapore’s top 30 companies (DBS, SingTel, etc.)

- Current dividend yield: 4.55% (as of 02 May 2025)

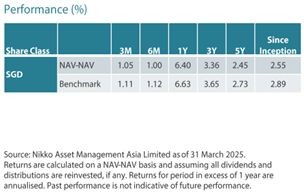

- Nikko AM STI ETF (G3B) – Similar to ES3 but slightly different fees

- Singapore-listed Foreign ETFs – Like S27 (S&P 500) for US exposure

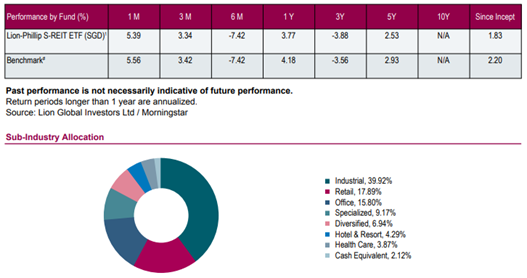

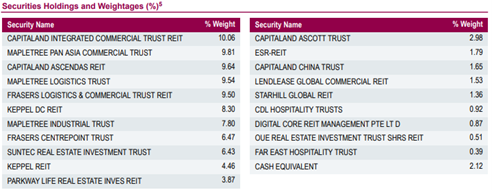

- REIT ETFs (Income Focus)

- What They Do: Invest in real estate (malls, offices, industrial properties). Dividends from such REIT ETF are like collecting rent from the underlying properties

- Risk/Reward: Moderate risk with steady dividends (5-6% yields)

- Singapore Options:

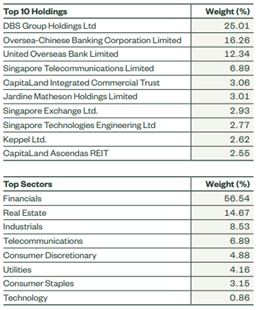

- Lion-Phillip S-REIT ETF (CLR) – Diversified Singapore REITs

- Dividend yield ~5.9% (as of 05 May 2025), semi-annual distribution

- Nikko AM Asia ex-Japan REIT ETF (CFA) – Provides broader Asia exposure

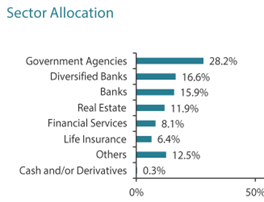

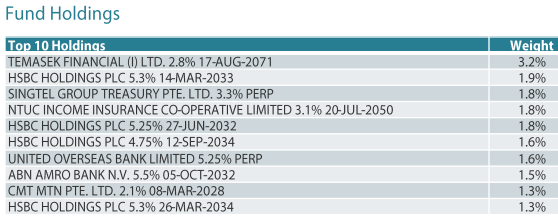

- Bond ETFs (Stability Focus)

- What They Do: Invest in government/corporate bonds for fixed income holdings and stable dividend distributions

- Risk/Reward: Lower returns but stable, especially during market downturns

- Singapore Options

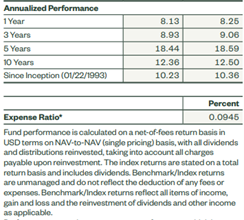

- Nikko AM SGD IG Bond ETF (MBH) – High-quality corporate bonds (Temasek, UOB, etc.).

- ABF Singapore Bond ETF (A35) – Singapore government bonds (Very low risk)

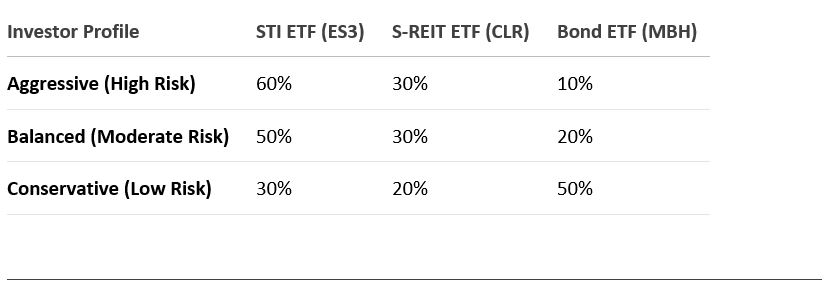

- ES3 (SPDR STI ETF): Core exposure to Singapore equities for long-term growth.

- CLR (Lion-Phillip S-REIT ETF): Reliable dividend income from a diversified basket of real estate assets.

- MBH (Nikko AM SGD IG Bond ETF): Bond exposure for stability and downside protection during market volatility.

- Ignore short-term market noise: RSPs work best over a long horizon, ideally 5 years or more

- Reinvest dividends: Let compounding boosts returns significantly

- No market timing needed—DCA smooths out volatility

- Dividends + growth + stability—A balanced trio for long-term success

- Start small, scale up—Even S$100/month can compound into meaningful wealth

Recommended ETF Portfolio for RSP Investors

Final Tip: Stay Consistent!

Start Smart, Stay Disciplined, and Let Time Work for You

Building wealth doesn’t require perfect timing or complex strategies. With consistency, diversification, and automation, RSPs allow you to build a strong foundation for your financial future.

Consider a simple balanced portfolio using STI ETF (ES3), S-REIT ETF (CLR), and Bond ETF (MBH), you create a hands-off portfolio that grows steadily while managing risk:

Stay tuned for our next article, where we’ll dive deeper into how to optimise your ETF portfolio, when to rebalance, and advanced strategies for better returns.

Remember, the best time to invest was yesterday; the next best time is now.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.