Why ETFs Should Be at the Heart of Your Portfolio in 2025

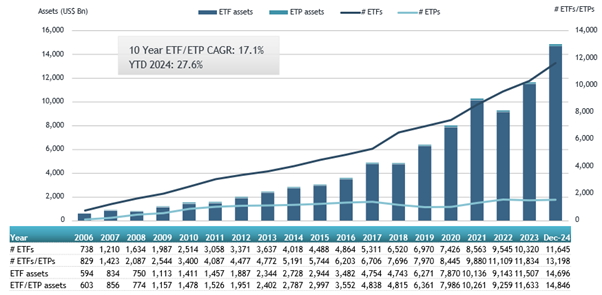

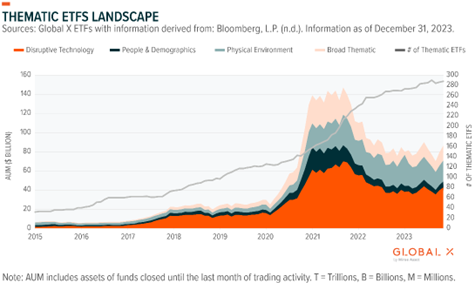

Exchange-Traded Funds (ETFs) have transformed the way retail investors access diversified portfolios. In Asia, ETF assets under management surpassed US$1.25 trillion in April 2025. This is a 8.4% gain year-to-date which highlights their explosive adoption.Locally, the STI Index delivered a 22.5% return over the past year, while REIT ETFs yielded nearly 6% in tax-advantaged distributions. Despite these attractive outcomes, only 28% of Singaporeans hold market-linked securities beyond mandatory schemes—an opportunity gap this playbook aims to bridge.

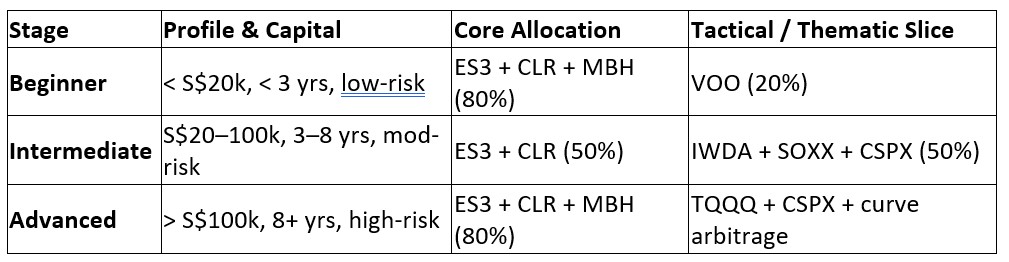

Anchored by Singapore’s core ETFs (ES3, CLR, MBH) and complemented by global staples such as VOO (S&P 500) and tactical growth tools like TQQQ (3× Nasdaq), this tiered guide tailors strategies for every experience level.

Source: https://etfgi.com/news/press-releases/2023/12/etfgi-reports-assets-invested-global-etfs-industry-reached-new

Source: https://etfgi.com/news/press-releases/2023/12/etfgi-reports-assets-invested-global-etfs-industry-reached-new

Part 1: Beginner Investors – Laying the Foundation

Core Philosophy: “Start small. Stay consistent. Let compounding work.”

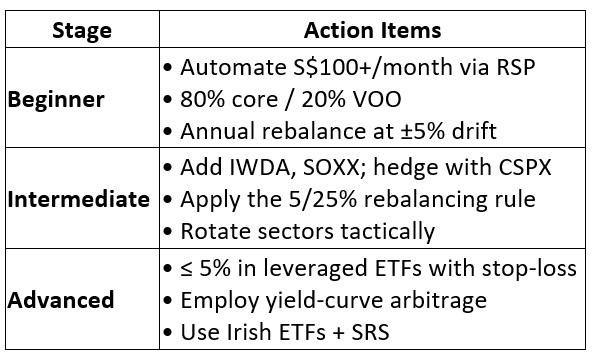

Many new investors struggle with time constraints and emotionally driven decisions. A mechanical, rules-based approach eliminates guesswork while harnessing the power of consistent investing. New investors should establish and adhere to a predetermined strategy, with automation through Regular Savings Plans (RSPs) being the most effective solution to prevent emotionally-driven deviations.

By maintaining a disciplined approach to their pre-selected portfolio, investors can avoid the need for frequent monitoring. Clear benchmarks should trigger portfolio reviews only when necessary, though scheduled rebalancing can alternatively occur at fixed quarterly, semi-annual, or annual intervals.

1. Automation Is Your Ally

- Emotional Risk: Trying to “time the market” often leads to buying high and selling low

- Dollar-Cost Averaging (DCA): Investing fixed sums monthly smooths purchase prices over different market cycles

2. Suggested Core ETF Portfolio

Singapore Anchors (80%)

- ES3 (STI ETF): Tracks 30 top local companies (DBS, SingTel) with a 4.4% yield and 7.2% annualized returns since 2002.

- CLR (Lion-Phillip S-REIT ETF): Holds Grade-A commercial and logistics properties, offering ~5.9% post-tax distributions.

- MBH (Nikko AM SGD IG Bond ETF): Invests in AA-rated corporate bonds (Temasek, UOB) with a 4.7-year duration to cushion equity dips.

Global Diversifier (20%)

- VOO (Vanguard S&P 500 ETF): Low fee (0.03%), gives exposure to U.S. large-caps, and has outperformed the STI by nearly 50% over five years.

3. Automate with Regular Savings Plans (RSPs)

- Mechanics: Allocate S$500/month (e.g., S$200 ES3, S$125 CLR, S$75 MBH, S$100 VOO).

- Benefits: – DCA smooths volatility.

4. Annual Portfolio Check-Up

- Rebalance: If ES3 grows to 55% of your portfolio, redirect new contributions into underweight ETFs instead of selling—reducing transaction costs.

- Dividend Reinvestment: Enable auto-reinvestment to compound returns alongside new contributions.

Part 2: Intermediate Investors – Selective Diversification

Core Philosophy: “Diversify with intention, not by happenstance.”

This approach suits investors with portfolios exceeding S$20,000 and three to eight years of experience, who seek purpose-built allocations to enhance returns while actively managing risk. Those who began with Singapore-focused blue-chips or domestic ETFs should now explore global ETFs to mitigate home-market and sector concentration.

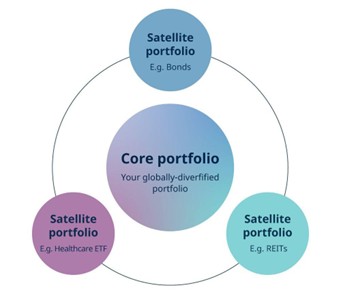

Building upon the core portfolio, sector-specific ETFs enable targeted exposure to capitalise on thematic opportunities and asset rotation. Given increased volatility, closer performance monitoring becomes essential, with more frequent rebalancing required to correct over- or under-weighting from thematic positions

1. Bridging Home Bias

Singapore’s STI is ~45% banks. Adding IWDA (iShares MSCI World) spreads risk across 1,600+ global companies in tech, healthcare, and consumer staples.

2. Capturing Thematic Growth

- SOXX (Semiconductor ETF)

- – Purpose: Underlying chips power AI, data centers, and 5G.

- CSPX (Ireland Domiciled S&P 500)

- – Purpose: U.S. large-cap exposure with 15% dividend withholding tax compare to 30% from SPY/VOO.

3. Sector Rotation and Timing

When rate cuts loom, REITs like CLR typically rally as borrowing costs fall. Conversely, in rising-rate environments, shifting capital into shorter-duration bond ETFs (e.g., IBND) helps preserve principal.

4. The 5/25 Rebalancing Rule

- Rebalance if any core ETF category drifts more than 5% off its target allocation.

- Rebalance if a single holding exceeds 25% of your total portfolio.

- Cost-efficient hackUse new contributions to buy underweight ETFs rather than selling winners.

Model Intermediate Portfolio

- Singapore Core (50%): ES3 + CLR

- U.S. Growth (25%): VOO + SOXX

- Global Bonds (15%): MBH + IBND

- Emerging Markets (10%): EEMA (ASEAN/India focus)

Part 3: Advanced Investors – Tactical Alpha Generation

Core Philosophy: “Innovate boldly, but anchor firmly.”

Seasoned investors with portfolios surpassing S$100,000 and over eight years of experience can now dedicate their allocations to high-conviction strategies while maintaining a stable core.

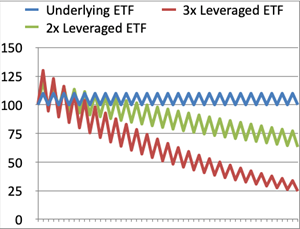

Leveraged or inverse ETFs enable amplified market exposure or strategic hedging with limited capital, including potential bear-market opportunities – though full comprehension of associated risks is imperative.

To optimise efficiency, utilise tax-advantaged instruments (like Irish-domiciled ETFs) and dynamically adjust bond duration exposure based on yield curve forecasts.

1. Leveraged & Inverse ETFs

- TQQQ (3× Nasdaq-100): Triples daily index moves—great in a clear uptrend, perilous if markets wobble.

- Rules of Engagement:

- Limit exposure to 5%

- Set a 15% trailing stop-loss

- Hold only during sustained trends (e.g., a tech-led bull run)

2. Yield Curve Arbitrage

- Concept: When short-term yields exceed long-term yields (inversion), buy short-dated government bonds (A35) and short long-duration corporate bonds (MBH).

- Outcome: Historically, such strategies captured 7–9% in returns for investments in inverted cycles when central banks decide to pivot.

3. Tax-Efficiency Structuring

- Ireland-Domiciled ETFs (CSPX) incur a 15% U.S. withholding tax versus 30% on U.S.-domiciled funds.

- SRS Accounts: Allow investors to grow their investment portfolio while reducing individual taxable income.

Part 4: The Tiered Evolution Framework

Key Insight: Treat your portfolio as a symphony—core ETFs set the rhythm while tactical and thematic instruments add dynamic solos.

Part 5: Conclusion & Evergreen Principles

- Stability First: Maintain at least 50% in Singapore’s core ETFs (ES3, CLR, MBH) for resilience.

- Purposeful Diversification: Expand into global equities, themes, and hedged funds only after securing your base.

- Discipline Over Emotion: Rebalance on schedule; reinvest dividends automatically to compound returns.

- Size with Prudence: Let risk tolerance—not FOMO—dictate position sizes, especially for leveraged instruments.

“Investment success is built one disciplined step at a time.”

Part 6: Quick Reference – Action Items by Stage

Coming Up Next: Our follow-up article, we will look at how to form a more diversified portfolio blending Singapore and global ETFs, as well as how to reduce potential dividend withholding tax on foreign ETFs.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.