- Home

- FAQs and T&Cs for Shares Builders Plan (YIG)

Shares Builders Plan Promo (Young Investor Programme)

- The Promotion Period is from 4 Oct 2025 (0000hrs) to 31 Dec 2025 (2359hrs), both dates inclusive.

- The first 100 Customers who sign up for Share Builders Plan (SBP) or Junior Share Builder Plan (JSBP) and invest in the eligible Hong Kong Singapore Depository Receipts (HK SDR) counters during the Promotion Period will receive a S$50 cash reward.

- Eligible Customers aged 18 to 30 years old will receive an additional S$50 cash reward (total S$100).

- Eligible Customers will receive the cash reward, subject to the following conditions:

- The Customer’s SBP or JSBP account must be opened and successfully linked to eGIRO.

- A minimum monthly investment of S$100 must be made for at least 6 consecutive months.

- Any failed GIRO deduction, or any suspension or termination of the SBP or JSBP account during the 6-month qualifying period will result in Customer being disqualified.

- The qualifying period begins from the date of the first successful monthly investment.

- The S$50 or S$100 cash reward will be credited to the Customer’s SBP or JSBP account within 30 business days after completing the 6-month qualifying period.

- Customers will receive an email confirming their eligibility within 7 business days of account opening.

- Each customer is limited to one reward under this promotion.

- The following Customers are NOT eligible for this promotion unless approved by the management of PSPL:

- Customers who engage the services of a representative from an external provider (B2B).

- Corporate Accounts and Institutional Accounts.

- All employees of PSPL’s entities and its partners (e.g., trading representatives, financial advisors) and their immediate families (e.g., spouse and children).

- PSPL reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete at any time of these Terms & Conditions without prior notice (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or to (ii) vary, withdraw, and/or cancel any items or the promotion itself without having to disclose a reason, and without any compensation or payment whatsoever. PSPL’s decisions on all matters relating to the promotion are final and binding on all participants.

- By taking part in the promotion, you agree and consent to PSPL sending relevant information to third-party service providers to facilitate the delivery and redemption of the Rewards.

- In the event of a dispute over the Customer’s eligibility to participate in this promotion, PSPL’s decision will be final.

- This advertisement has not been reviewed by the Monetary Authority of Singapore.

FAQs

This promotion is open to the first 100 Customers who sign up for Share Builders Plan (SBP) or Junior Share Builder Plan (JSBP) and invest in the eligible Hong Kong Singapore Depository Receipts (HK SDR) counters.

You’ll need a POEMS account to open an SBP account.

- If you don’t have a POEMS account yet, open a POEMS account HERE

- If you already have a POEMS account, follow the steps below to open an SBP account and apply for eGIRO:

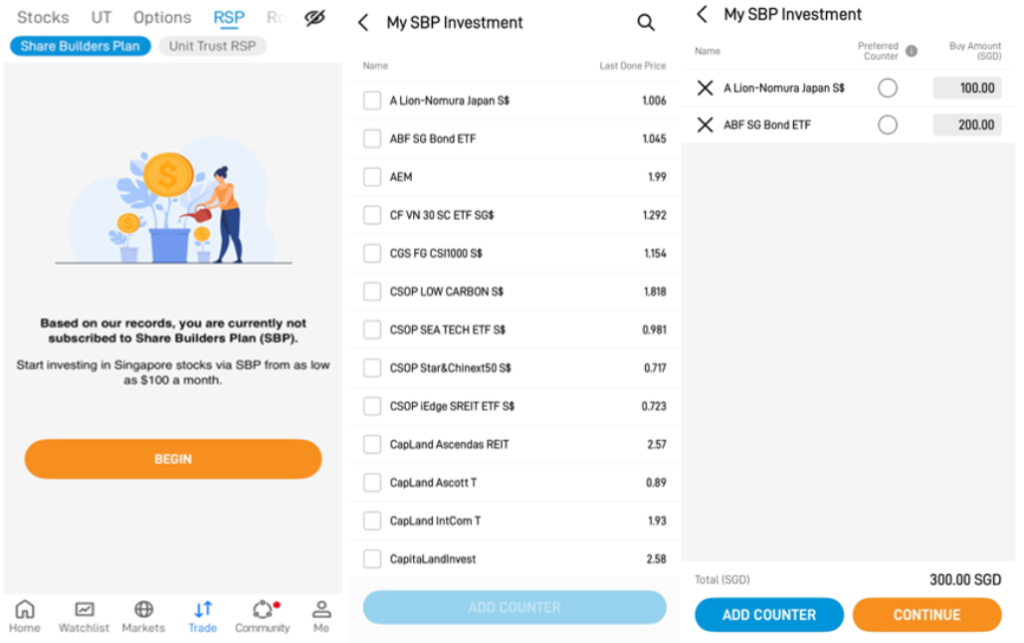

Via POEMS Mobile 3 App

- Login > Trade Tab > Regular Savings Plan (RSP) > Share Builders Plan > Tap Begin

- Select counter(s) > Tap “Add Counter” > Set monthly investment amount

- Review > Click on “Continue” to submit

After submitting, you’ll be prompted to apply for eGIRO, click on “Apply GIRO”.

If you accidentally close the tab, go to Me > Form > eGIRO > Apply GIRO.

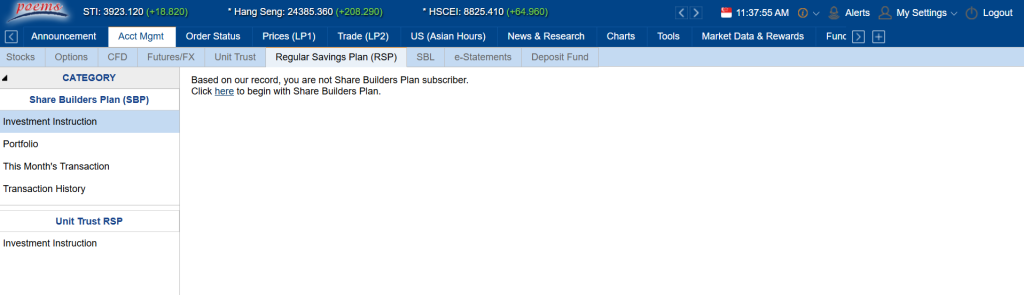

Via POEMS 2 Web

- Login > Acct Mgmt > Regular Savings Plan (RSP) > Share Builders Plan (SBP)

- Click “here” to apply for SBP

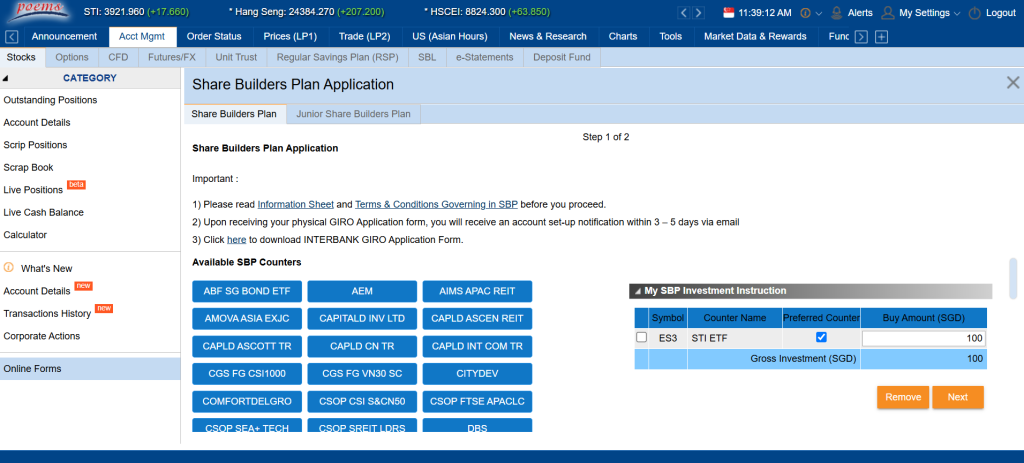

3. Select your counter(s) and set your Buy Amount

4. Review and submit

After submitting, you’ll be prompted to apply eGIRO, click on “Apply GIRO”.

If you accidentally close the tab, go to Stocks > Online Form > Account Application > GIRO > Apply GIRO.

To be eligible, your account must be successfully linked to eGIRO; this marks the start of your 6-month qualifying period.

Setting up eGIRO ensures your monthly investment is automatically funded, so you never miss a contribution.

Act fast! Open your SBP account, set up eGIRO, and start investing to be among the first 100 eligible customers to receive the S$50 reward!

No, each customer is eligible for only one reward under this promotion.

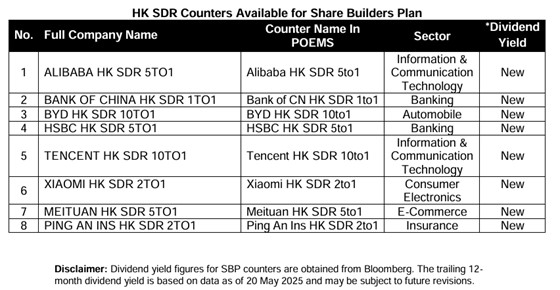

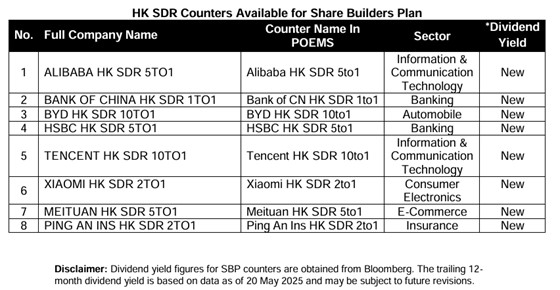

To participate in this promotion, you must invest in the HK SDR counter.

Considering adding other counters beyond HK SDR counters? View the full list here.

Eligible customers will receive the cash reward in their SBP account within 30 business days after completing the 6-month qualifying period.

You can view the reward in your SBP monthly statement.