- Home

- Lion-China Merchants CSI Dividend Index ETF

Lion-China Merchants CSI Dividend Index ETF

Initial Offering Period (IOP) from 10 to 21 March 2025

More About the Lion-China Merchants CSI Dividend Index ETF

The Index comprises 100 Shanghai-listed or Shenzhen-listed A shares with (i) high cash dividend yields, (ii) stable dividends and (iii) a certain scale and liquidity, weighted based on their dividend yields to reflect the overall performance of the high-dividend stocks in the A-share market.

Why Invest in the Lion-China Merchants CSI Dividend Index ETF

Consistent

The index focuses on companies with a proven track record of consistent dividend payments for at least the past three years

Steady

Companies are selected based on their robust financial health. These companies typically have strong cash flows and high free cash flow to dividend coverage ratios.

Income

This ETF provides investors with access to a diversified portfolio of dividend-paying stocks, creating a passive income stream

Why Invest in China?

China is too big to ignore

- As of 2024, China is the world’s second largest economy and the largest economy in the Asia-Pacific

- China’s real GDP continues to grow faster than US’ and is projected to outpace both global and Asia-Pacific economies

China equities currently look attractive

- China’s 10-year yield is at an all-time low of 1.67% as of 31 Dec 2024

- A low risk-free rate is driving up the equity risk premium, making Chinese equities more attractive than bonds and US stocks

China’s commitment to stimulate economy

- The government is implementing proactive measures, stimulating the economy through monetary, housing, and fiscal policies

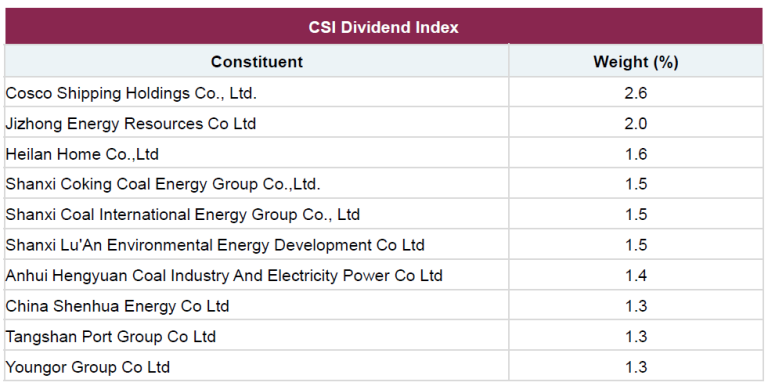

Top 10 Index Constituents

How to Subscribe to the ETF During the IOP via POEMS 2.0

- Log in to your POEMS 2.0 , then navigate to ‘Account Management’ > ‘Online Forms’ > ‘IPO Subscription – Irrevocable Form’ or click here.

- Select the IPO you wish to subscribe to.

- Review and accept the prospectus, terms, and conditions before subscribing to the financial product.

- Applications close at 5pm on 21 March Fri 2025.

- Ensure sufficient funds are available in your POEMS Account to complete the application process (including the subscription amount, transfer fees, and GST) by 21 March Fri 2025 at 5pm.

Seminars Lineup

| IOP Subscription Details | |

|---|---|

| Subscription Period | 10 March 2025 to 21 March 2025 |

| Listing Date | 28 March 2025 |

| Subscription Price | SGD 1.00 per unit |

| Minimum Quantity | 1,000 units |

| Commission Fees | Zero Commission |

| Transfer Fees | S$10.00 (subject to GST) for Cash Management Account. Other Phillip Investment Account Types will not be subject to transfer fee charge. |

| Trading Currency | SGD |

| Allotment | Full Allotment |

| Key Information | |

|---|---|

| ETF Name | Lion-China Merchants CSI Dividend Index ETF |

| Underlying Index | CSI Dividend Index |

| Issue Price | SGD 1.00 per unit |

| Initial Offer Period (IOP) | 10 March 2025 to 21 March 2025 |

| Listing Date | 28 March 2025 |

| Base Currency | SGD |

| Trading Currency | SGD, CNH |

| SGX Code | INC (SGD), ICH (CNH) |

| Trading Board Lot Size | 1 unit |

| Management Fee | 0.50%per annum^ ^Up to a maximum of 0.99% per annum of the Net Asset Value of the Fund |

| Distribution Policy | Annual |

| Replication Strategy | Direct Replication or Representative Sampling |

| Classification Status | Excluded Investment Product |

- The subscription period for Lion-China Merchants CSI Dividend Index ETF (“ETF”) is from 10 March 2025, Monday at 9am to 21 March 2025, Friday at 5pm

- The online subscription will close on 21 March 2025 at 5pm. No new applications, amendments, or withdrawals are allowed after this deadline.

- Eligible Accounts to subscribe for the ETF must be Cash Plus, Margin (M), Custodian (C), Prepaid Custodian (CC), Cash Management (KC) and Share Financing (V) Accounts. Cash Trading Accounts (T) are not eligible to participate in this subscription.

- An additional transfer fee charge of S$10 (subject to GST) per application for Cash Management Accounts will be applicable.

- Only one application is allowed per Account.

- Each ETF unit is priced at SGD 1 and the minimum order quantity is 1,000 units, with an incremental order size of 1,000 units.

- There are zero commission fees.

- The total amount payable is denominated in SGD. The settlement currency will be in SGD.

- Sufficient funds (including transfer fee and GST) must be present in the Customer’s Account by 21 March 2025 at 5pm.

- Applications will be rejected if the Account does not have or reflect sufficient funds after 21 March 2025 at 5pm.

- ETF units will be credited to the clients’ CDP or clients’ sub-account with Phillip Securities Pte Ltd by 28 March 2025.

- Customers will receive the full allotment of the number of ETF units that they subscribe to.

- Customers can start trading the ETF units when the ETF is listed on SGX on 28 March 2025 at 9am.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add and/or delete any time of these Terms & Conditions without prior notification (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute over the client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obliged to give any reason on any matter concerning the Promotion and no correspondence or claims will be entertained.

- By taking part in this promotion, the customer acknowledges that he/she has read and consented to these Terms & Conditions.

- Customers will receive a S$12 cash credit for every S$5,000 subscribed into the Lion-China Merchants CSI Dividend Index ETF, provided they successfully fulfill a one-month holding period after the listing date.

- The Campaign Period runs from 10 March 2025, Mon at 9.00am to 21 March 2025, Fri at 5.00pm.

- The Cash Credit is capped at S$600 per POEMS account.

- The Cash credits is to be provided to the first 500 eligible clients of PSPL who invest in the ETF during the IPO.

- The Cash Credit will be credited to your account within one month following the one-month holding period from the listing date (Listing Date: 28 March 2025).

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to:

- (i) Amend, add, or delete any of these Terms & Conditions without prior notice (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected; or

- (ii) Vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute regarding a client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obligated to give any reasons on any matter concerning the Promotion, and no correspondence or claims will be entertained.

- By taking part in this promotion, the customer acknowledges that he/she has read, understood, and consented to these Terms & Conditions.

Events Lineup

Riding China’s Rise: Unlocking Dividends as a Staple

10 Mar, Mon 2025 07:00 PM - 08:00 PM

Mr Ong Xun Xiang | Head of ETFs | Lion Global Investors

Phillip Investor Centre @ Raffles City Tower

Riding China’s Rise: Unlocking Dividends as a Staple

10 Mar, Mon 2025 07:00 PM - 08:00 PM

Mr Ong Xun Xiang | Head of ETFs | Lion Global Investors

Zoom