- Home

- Lion Global Investors ETF IOP

Promotion Ended due to overwhelming response

Get Rewarded when you Subscribe to the LionGlobal Short Duration Bond Fund (Active ETF SGD Class)

From 8 Sep to 22 Sep 2025

| Requirement |

S$500*Cash Credit | Earn S$10 Cash Credit for every S$5,000 subscribed to the ETF,up to a maximum of S$500 per Customer |

*T&Cs Apply.

Fully Redeemed

| Requirement | |

S$500*Cash Credit | Subscribe every S$5,000 in the ETF to earn S$10,up to a maximum of S$500 per Customer. |

*T&Cs Apply.

Fully Redeemed

About the LionGlobal Short Duration Bond Fund (Active ETF SGD Class)

The LionGlobal Short Duration Bond Fund (Active ETF SGD Class) is the ETF version of the LionGlobal Short Duration Bond Fund, giving you access to the same portfolio while providing you liquidity to trade the ETF units on SGX.

This is Singapore’s first active bond ETF and first listed share class of an existing fund.

Key benefits of the ETF include:

Active Management

Managed by experienced professionals with a proven active management process.

Short Duration

Reduces sensitivity to interest rate fluctuations. Ideal in volatile market conditions

Broader Exposure

Includes both Singapore and global bonds, with flexibility to hold sub-investment grade securities

Total Return Focused

Focused on generating total return of capital growth and income over the medium to long term through an actively managed portfolio of Singapore and international bonds, high quality interest rate securities and other related securities.

Why Invest in the LionGlobal Short Duration Bond Fund (Active ETF SGD Class)?

Falling Interest Rates

Inflation has steadily declined to around 2.7% as of 30 Jun 2025^. To date, the Fed has only reduced rates to 4.5%, suggesting there is more room for rates to fall

^Source: Trading Economics as of 30 Jun 2025

Lower interest rate sensitivity

Short duration bonds have lower sensitivity to interest rates, and thus experience fewer price fluctuations

Stable Currency

SGD has been a stable currency, and this reduces exposure to currency fluctuations

How to Subscribe to the ETF During the IOP via POEMS 2.0

- Log in to your POEMS 2.0 , then navigate to ‘Account Management’ > ‘Online Forms’ > ‘IPO Subscription – Irrevocable Form’ or click here.

- Select the IPO you wish to subscribe to.

- Review and accept the prospectus, terms, and conditions before subscribing to the financial product.

- Applications close at 5pm on 22 Sep Mon 2025.

- Ensure sufficient funds are available in your POEMS Account to complete the application process (including the subscription amount, transfer fees, and GST) by 22 Sep Mon 2025 at 5pm.

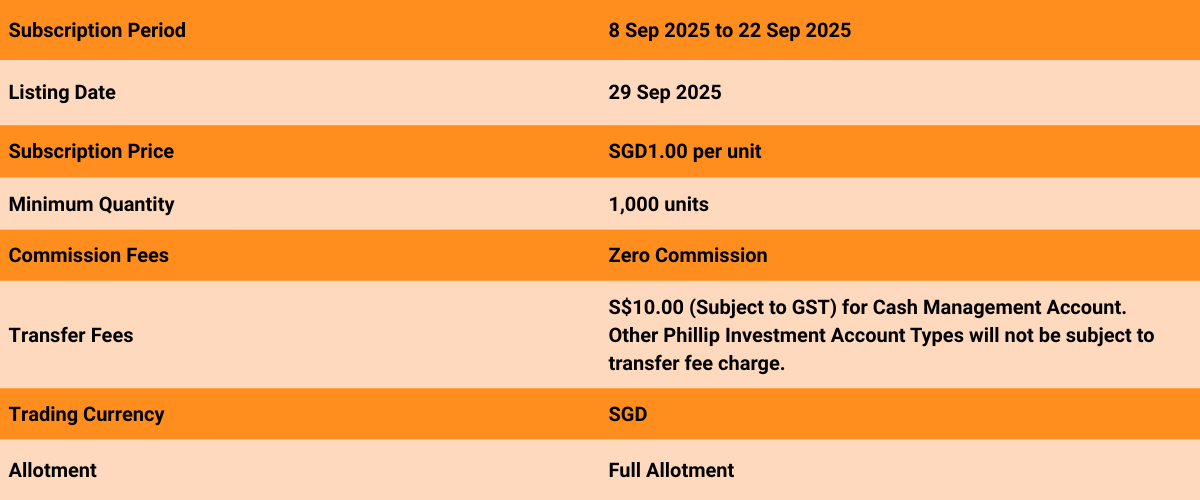

- The subscription period for LionGlobal Short Duration Bond Fund (Active ETF SGD Class) is from 8 September 2025, Monday at 9am to 22 September 2025, Monday at 5pm

- The online subscription will close on 22 September at 5pm. No new applications, amendments, or withdrawals are allowed after this deadline.

- Eligible Accounts to subscribe for the ETF includes Cash Plus, Margin (M), Custodian (C), Prepaid Custodian (CC), Cash Management (KC) and Share Financing (V) Accounts. Cash Trading Accounts (T) are not eligible to participate in this subscription.

- An additional transfer fee charge of S$10 (subject to GST) per application applies for Cash Management Accounts.

- Only one application is allowed per Account.

- Each ETF unit is priced at SGD 1 and the minimum order quantity is 1,000 units, with an incremental order size of 1,000 units.

- There are Zero Commission Fees.

- The total amount payable is denominated in SGD. The settlement currency will also be in SGD.

- Sufficient funds (including transfer fee and GST) must be present in the Customer’s Account by 22 September 2025 at 5pm

- Applications will be rejected if the Account does not have or reflect sufficient funds after 22 September 2025 at 5pm.

- ETF units will be credited to the clients’ CDP or clients’ sub-account with Phillip Securities Pte Ltd by 29 September 2025.

- Customers will receive the full allotment of the number of ETF units that they subscribe to.

- Customers can start trading the ETF units when the ETF is listed on SGX on 29 September 2025 at 9am.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add and/or delete any time of these Terms & Conditions without prior notification (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute over the client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obliged to give any reason on any matter concerning the Promotion and no correspondence or claims will be entertained.

- By taking part in this promotion, the customer acknowledges that he/she has read and consented to these Terms & Conditions.

- Customers will receive S$10 cash credit for every S$5,000 subscription into LionGlobal Investors ETF, provided that they hold their subscription from 29 September 2025, the listing date of the fund, to 31 October 2025 (the Minimum Holding Period”).

- The Campaign period is from 8 September, Monday at 9am to 22 September 2025, Monday at 5pm.

- The Cash Credit is capped at S$500 per POEMS account.

- The Cash credits is to be provided to the first 500 eligible clients of PSPL who invest in the ETF during the IOP.

- The Cash Credit will be credited to your Account within one month after the holding period.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add and/or delete any time of these Terms & Conditions without prior notification (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute over the client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obliged to give any reason on any matter concerning the Promotion and no correspondence or claims will be entertained.

- By taking part in this promotion, the customer acknowledges that he/she has read and consented to these Terms & Conditions.

Disclaimer

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. It is for information only, and is not a recommendation, offer or solicitation to deal in any capital markets products or investments and does not have regard to your specific investment objectives, financial situation, tax position or particular needs.

The LionGlobal Short Duration Bond Fund (the “Fund”) is not like a typical unit trust offered to the public in Singapore. The Fund comprises both classes of units listed and traded on the Singapore Exchange (“SGX-ST”) and classes of units which are neither listed on the SGX-ST nor any other stock exchange.

You should read the prospectus and Product Highlights Sheet for the Fund, which is available and may be obtained from Lion Global Investors Limited (“LGI”) or any of the appointed Participating Dealers (“PDs”), agents or distributors (as the case may be) for further details including the risk factors and consider if the Fund is suitable for you and seek such advice from a financial adviser if necessary, before deciding whether to purchase units in the Fund. Applications for units in the listed or unlisted classes of the Fund must be made in the manner set out in the prospectus. Investments are subject to investment risks including the possible loss of the principal amount invested.

Investments in the Fund are not obligations of, deposits in, guaranteed or insured by LGI or any of its affiliates and are subject to investment risks including the possible loss of the principal amount invested. The performance of the Fund is not guaranteed and the value of units in the Fund and the income accruing to the units, if any, may rise or fall. Past performance, payout yields and payments as well as any predictions, projections, or forecasts are not necessarily indicative of the future or likely performance, payout yields and payments of the Fund. Any extraordinary performance may be due to exceptional circumstances which may not be sustainable. Any dividend distributions, which may be either out of income and/or capital, are not guaranteed and subject to LGI’s discretion. Any such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value of the Fund. Any references to specific securities are for illustration purposes and are not to be considered as recommendations to buy or sell the securities. It should not be assumed that investment in such specific securities will be profitable. There can be no assurance that any of the allocations or holdings presented will remain in the Fund at the time this information is presented. Any information (which includes opinions, estimates, graphs, charts, formulae or devices) is subject to change or correction at any time without notice and is not to be relied on as advice. You are advised to conduct your own independent assessment and investigation of the relevance, accuracy, adequacy and reliability of any information or contained herein and seek professional advice on them. No warranty is given and no liability is accepted for any loss arising directly or indirectly as a result of you acting on such information. The Fund may, where permitted by the prospectus, invest in financial derivative instruments for hedging purposes or for the purpose of efficient portfolio management. LGI, its related companies, their directors and/or employees may hold units of the Fund and be engaged in purchasing or selling units of the Fund for themselves or their clients.

The Fund is an actively managed fund. Please refer to the Prospectus for further details, including a discussion of certain factors to be considered in connection with an investment in the listed units of the Fund on the SGX-ST.

The listed units of the Fund are listed and traded on the Singapore Exchange (“SGX”), and may be traded at prices different from their net asset value, suspended from trading, or delisted. Such listing does not guarantee a liquid market for the units. You cannot purchase or redeem listed units in the Fund directly with the manager of the Fund, but you may, subject to specific conditions, do so on the SGX or through the PDs.

© Lion Global Investors Limited (UEN/ Registration No. 198601745D). All rights reserved. LGI is a Singapore incorporated company and is not related to any corporation or trading entity that is domiciled in Europe or the United States (other than entities owned by its holding companies).