Alphabet Posts Strong Q4 Results with Record Cloud Growth February 13, 2026

Company Overview

Alphabet Inc., the parent company of Google, operates as a leading technology conglomerate with core business segments spanning search advertising, YouTube, and cloud computing services. The company’s primary revenue drivers include Google Search, YouTube advertising, and Google Cloud Platform (GCP), positioning it as a dominant player in the digital advertising and cloud infrastructure markets.

Q4 2025 Financial Performance Exceeds Expectations

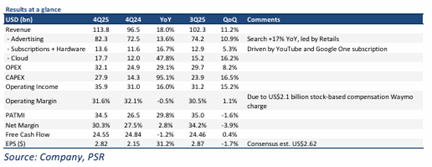

Alphabet reported impressive fourth-quarter 2025 results that surpassed analyst forecasts, with total revenue climbing 18% year-over-year to US$114 billion and net income surging 30% to US$34.5 billion. The robust performance was primarily driven by strong execution across both advertising and cloud segments, with full-year revenue and net income reaching 97% and 108% of forecasted levels, respectively.

Core Business Segments Drive Growth

The company’s advertising business demonstrated remarkable resilience, with Google Search revenue posting its fastest growth in four years at 17% year-over-year to US$63 billion. This acceleration was fuelled by retail vertical strength and enhanced ad efficiency through Gemini 3 integration. YouTube advertising revenue maintained solid momentum with 9% growth to US$11.4 billion, supported by increased political advertising spending during the election period and continued expansion of Shorts and Living Room monetisation.

Cloud Business Achieves Milestone Growth

Google Cloud delivered exceptional results, recording its fastest revenue growth since 2021 with a 48% year-over-year increase to US$17.7 billion, establishing an annual run rate exceeding US$70 billion. This outstanding performance was underpinned by a doubled client base, significant large-scale customer commitments with billion-dollar deals surpassing the previous three years combined, and existing customers expanding usage by over 30% beyond initial contracts. Revenue from GenAI-based products experienced explosive growth of nearly 400% year-over-year.

Research Recommendation and Outlook

Phillip Securities Research downgraded Alphabet to an ACCUMULATE rating following recent price appreciation but raised the DCF target price to US$395 from US$340. The revised valuation reflects confidence in Alphabet’s competitive positioning through continuous Gemini upgrades and AI integration capabilities. Looking ahead to fiscal 2026, analysts project advertising segment growth of approximately 16% year-over-year, while the cloud segment is expected to maintain strong momentum with anticipated 45% growth.

Key Takeaways

Q: What were Alphabet’s key financial highlights for Q4 2025?

A: Alphabet reported revenue of US$114 billion (up 18% YoY) and net income of US$34.5 billion (up 30% YoY), with performance exceeding expectations across both advertising and cloud segments.

Q: How did Google’s advertising business perform?

A: Google Search revenue grew 17% YoY to US$63 billion, marking the fastest growth in four years, while YouTube advertising revenue increased 9% YoY to US$11.4 billion, driven by retail vertical strength and election-related spending.

Q: What drove Google Cloud’s exceptional performance?

A: Cloud revenue surged 48% YoY to $17.7 billion, driven by a doubled client base, billion-dollar deals exceeding the previous three years combined, and existing customers expanding usage by over 30% beyond initial commitments.

Q: How significant was GenAI revenue growth?

A: Revenue from GenAI-based products grew nearly 400% year-over-year in Q4 2025, compared to 200% growth in the previous quarter, demonstrating strong monetisation of AI capabilities.

Q: What is Phillip Securities Research’s recommendation and target price?

A: The firm downgraded Alphabet to ACCUMULATE due to recent price performance but raised the target price to US$395 from US$340, citing confidence in the company’s AI integration and competitive positioning.

Q: What are the growth projections for fiscal 2026?

A: Analysts forecast advertising segment growth of approximately 16% year-over-year and cloud segment growth of 45% year-over-year for fiscal 2026.

Q: What factors support the cloud business outlook?

A: The cloud segment is supported by strong demand, Alphabet’s ability to monetise its GenAI portfolio, expanding operating margins, and a cloud backlog that grew 55% sequentially to US$240 billion.

This article has been auto-generated using PhillipGPT. It is based on a report by a Phillip Securities Research analyst.

This article has been auto-generated using PhillipGPT. It is based on a report by a Phillip Securities Research analyst.

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Serena Lim Yi Qi

Research Analyst

Serena is a Research Analyst covering the U.S. Technology sector at PSR. Prior to joining the firm, she worked as an Equity Dealer and held various roles across the insurance and banking industries. Serena holds a Bachelor's degree in Economics and a Postgraduate Diploma in Applied Finance from the University of Adelaide.

AMD Posts Strong Q4 Results on Clear GPU Roadmap, Rising CPU Demand

AMD Posts Strong Q4 Results on Clear GPU Roadmap, Rising CPU Demand  Singapore Exchange Posts Strong Performance Despite Treasury Headwinds

Singapore Exchange Posts Strong Performance Despite Treasury Headwinds  Singapore Equities Hit New Highs in Record Nine-Month Rally

Singapore Equities Hit New Highs in Record Nine-Month Rally  OUE REIT Posts Strong Performance as Prime CBD Assets Drive Growth

OUE REIT Posts Strong Performance as Prime CBD Assets Drive Growth