Artificial Intelligence: The Complete Overview (Part 3) March 18, 2025

AI Adoption Across Industries

Artificial Intelligence continues to transform industries, streamlining processes and driving innovation. Below, we explore key sectors leveraging AI, along with real-world applications and the improvements it has brought.

Healthcare: Predictive Diagnostics, Improved Medical Plans

AI has so far been able to improve diagnostic accuracy and create personalized treatment plans, breaking the mold of general treatment.

- Predictive Diagnostics

a. AI algorithms analyse medical data to identify diseases in their early stages, allowing for timely intervention.

- Personalised Medicine

a. AI customises treatments by analysing genetic and lifestyle data to better treat patients and increase recovery/remission rates.

Healthcare Adoption

Mayo Clinic & IBM Watson Health – Used IBM Watson to match cancer patients with clinical trials, increasing trial enrolment rates by 80%.

Butterfly Network – Developed handheld ultrasound devices with AI diagnostics, significantly reducing imaging time in rural and remote areas.

Tempus – Utilised AI models to predict patient outcomes in oncology, improving chemotherapy effectiveness.

Finance: Fraud Detection and Algorithmic Trading

The finance sector has come to realise the effectiveness of AI in detecting fraudulence and safeguarding transactions. It is also being used to optimize trading strategies.

- Fraud Detection

a. Machine learning identifies anomalies in financial transactions and is able to flag potentials frauds

- Algorithmic Trading

a. AI can be used to analyse market trends and execute trades in a split second

Finance Adoption

JPMorgan Chase’s COiN Platform

JPMorgan’s Contract Intelligence (COiN) platform processes over 12,000 commercial loan agreements annually, reducing human review time by approximately 360,000 hours in totality

Retail: Inventory Optimization and Customer Experience Enhancement

AI is being used to optimize supply chains, enhance the customer experience and improve profitability

- Inventory Optimisation

a. Prevents over or understocking by predicting demand

- Customer Experience

a. Peronalised chatbots and services to improve engagement

Retail Adoption

Walmart’s Shelf-Scanning Robots – Walmart deployed AI-powered robots to scan shelves for inventory management, reducing stockouts and improving restocking efficiency.

Amazon Recommends – Uses machine learning for personalised product recommendations and automated warehousing.

Alibaba Supply Chain – Implements AI in supply chain management and customer segmentation, optimising logistics and retail operations.

Manufacturing: Predictive Maintenance and Automation

AI plays a crucial role in reducing downtime and enhancing automation within the manufacturing sector.

Predictive Maintenance

AI anticipates equipment failures, allowing manufacturers to schedule proactive maintenance, thereby preventing costly downtime.

Automation

Robotics powered by AI can handle multiple repetitive tasks with precision

Manufacturing Adoption

Siemens Smart Factory – Siemens operates a fully automated AI-driven factory, producing over 15 million products annually with an exceptionally high defect-free rate.

Fanuc – Provides AI-enhanced robotics for automated manufacturing lines, improving efficiency and precision.

GE Digital – Develops digital twins to enable predictive analytics in manufacturing.

Logistics: Route Optimization and Demand Forecasting

AI can be used in the logistics industry for route optimisation, improvements in delivery efficacy and demand forecasting

- Route Optimisation

a. AI systems can calculate the most efficient routes based on traffic and delivery priorities, your GPS does this too!

- Demand Forecasting

a. Can predict shipment volumes to optimise resource allocation

Logistics Adoption

UPS ORION System

UPS implemented the On-Road Integrated Optimization and Navigation (ORION) system, saving 100 million miles annually and reducing CO2 emissions by 100,000 metric tons.

Flexport

Uses AI to provide real-time visibility in global supply chains.

JD Logistics

Automates warehouses and optimizes delivery using AI tools, and won an A.I award for it

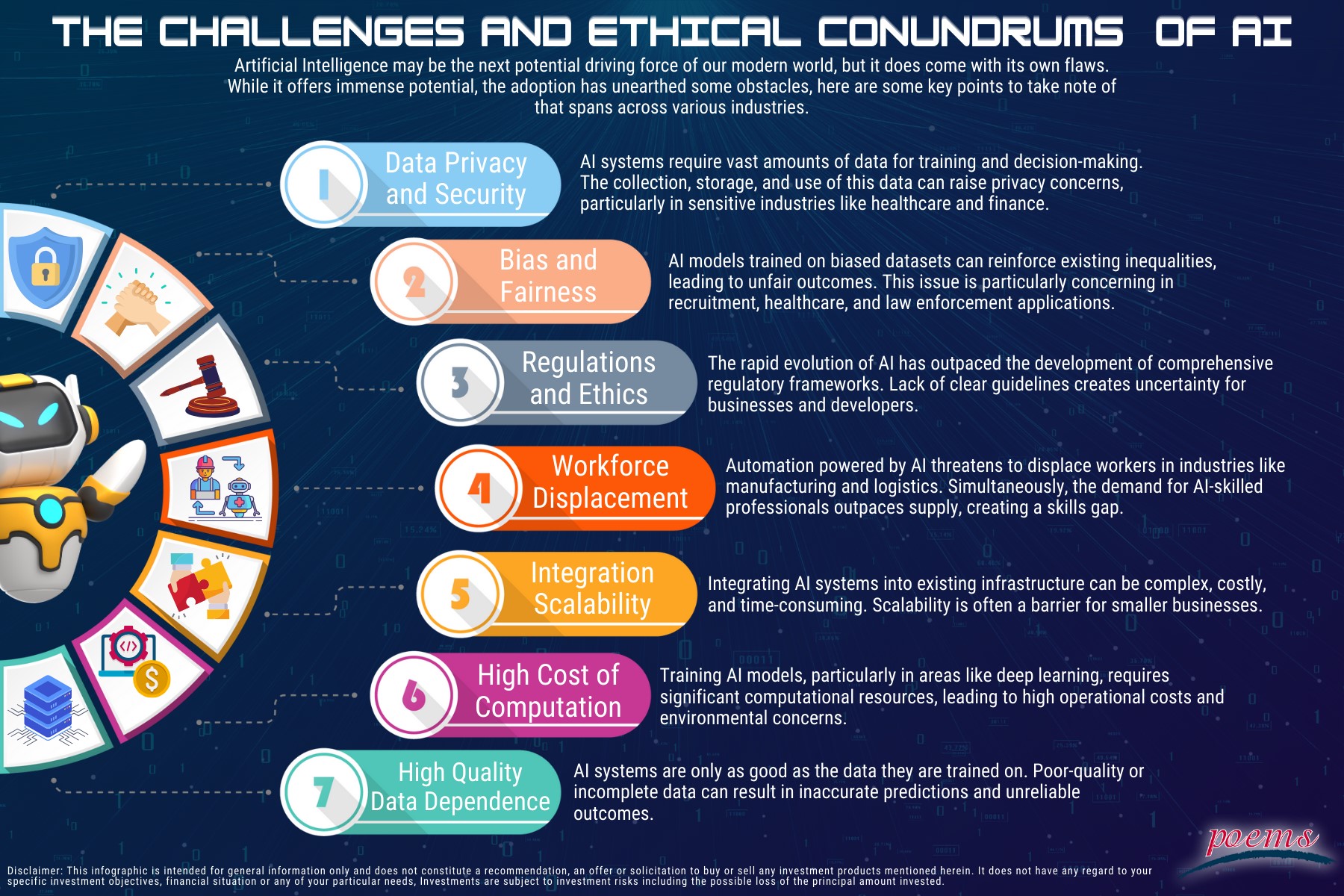

The Challenges and Ethical Conundrums

Data Privacy and Security

AI systems require vast amounts of data for training and decision-making. The collection, storage, and use of this data can raise privacy concerns, particularly in sensitive industries like healthcare and finance.

- Healthcare

a. Patient data used for predictive diagnostics and personalised medicine must comply with laws like HIPAA in the U.S. and GDPR in Europe. Non-compliance can lead to hefty fines and loss of consumer trust.

b. Google Health’s partnership with Ascension Health in 2019 faced backlash over its handling of patient data, prompting regulatory investigations.

- Finance

a. Fraud detection systems rely on real-time transaction data, increasing exposure to cybersecurity threats.

b. Capital One suffered a major data breach in 2019, exposing personal data of over 100 million customers.

Bias and Fairness in AI Models

AI models trained on biased datasets can reinforce existing inequalities, leading to unfair outcomes. This issue is particularly concerning in recruitment, healthcare, and law enforcement applications.

- Healthcare

a. A study found that an AI system used for prioritizing healthcare resources systematically favored white patients over Black patients due to biased training data.

- Recruitment

a. Amazon’s experimental recruitment AI tool was abandoned after it demonstrated bias against women, as it learned from historical hiring data that favored male candidates.

Regulatory and Ethical Hurdles

The rapid evolution of AI has outpaced the development of comprehensive regulatory frameworks. Lack of clear guidelines creates uncertainty for businesses and developers.

- Autonomous Vehicles

a. Regulations around liability in accidents involving AI powered vehicles remain unclear, slowing adoption.

b. Uber suspended its self-driving car program after a fatal accident in 2018, highlighting the need for stricter safety standards.

- Facial Recognition

a. Bans and restrictions on facial recognition technology in regions like the EU and California reflect growing concerns over surveillance and misuse.

Workforce Displacement and Skill Gaps

Automation powered by AI threatens to displace workers in industries like manufacturing and logistics. Simultaneously, the demand for AI-skilled professionals outpaces supply, creating a skills gap.

- Displacement

- An Oxford study predicts that 47% of U.S. jobs are at risk of automation in the coming decades. Manufacturing workers are particularly vulnerable as robotics adoption grows.

- Foxconn replaced 60,000 factory workers with AI-powered robots in 2016, sparking debate over the societal impact of automation.

- Skills Gap

- The shortage of AI talent increases operational costs for companies trying to adopt these technologies.

- IBM reported that the lack of AI expertise among mid-sized enterprises delayed their digital transformation plans.

Integration and Scalability

Integrating AI systems into existing infrastructure can be complex, costly, and time-consuming. Scalability is often a barrier for smaller businesses.

- 1. Manufacturing

- Predictive maintenance systems require IoT sensors, robust data infrastructure, and skilled operators, which may not be feasible for all manufacturers.

- A PwC study highlighted that only 9% of manufacturers have fully implemented scalable AI solutions.

- 2. Retail

- Smaller retailers struggle to adopt recommendation engines due to high upfront costs and limited technical expertise.

High Computational Costs

Training AI models, particularly in areas like deep learning, requires significant computational resources, leading to high operational costs and environmental concerns.

1. Cost

- >OpenAI’s GPT-3 model reportedly cost US$12 million to train. This financial burden is prohibitive for most companies.

2. Environmental Cost

- A study found that training a single AI model can emit as much carbon dioxide as five cars over their lifetimes.

Dependence on High-Quality Data

AI systems are only as good as the data they are trained on. Poor-quality or incomplete data can result in inaccurate predictions and unreliable outcomes.

- Healthcare (Again)

- A Stanford study found that 80% of healthcare AI applications fail to scale due to fragmented data sources.

- Finance

- Financial fraud detection systems often face challenges in identifying new types of fraud due to insufficient training data.

Investment Perspective: Opportunities, Risks, and Long-Term Trends

This is to summarise what we have discussed so far into AI as a whole from an investment perspective. Artificial Intelligence presents a wealth of opportunities for investors across various sectors, but it also comes with notable risks and challenges.

Hardware

The backbone of AI systems lies in advanced hardware, particularly semiconductors. Demand for GPUs, TPUs, and edge-computing chips is skyrocketing as AI models become more complex. The global AI chip market is projected to grow from $8 billion in 2020 to $200 billion by 2030. Top companies include but are not limited to:

- Nvidia (NVDA.US)

- Dominates the GPU market, essential for training large AI models.

- NVIDIA’s A100 chips are widely used in data centers for deep learning tasks.

- TSMC (TSM.US, 2330.TT)

- A critical supplier of semiconductors for companies like Apple, AMD, and NVIDIA.

- TSMC’s 3nm chips are optimized for AI workloads

Software

AI algorithms and platforms are crucial for implementation across industries. There is much demand for SaaS platforms and AI tools for automation, natural language processing, and analytics. Top Companies include but are not limited to:

- Microsoft (MSFT.US)

- Azure offers AI-powered services like machine learning, speech recognition, and more.

- Microsoft’s OpenAI partnership integrates GPT-based models into Azure, creating new enterprise solutions.

- Palantir Technologies (PLTR.US)

- Focuses on AI-driven data analytics for government and enterprise customers.

- Accenture (ACN.US)

- Provides end-to-end AI adoption strategies.

- C3.ai (AI.US)

- >Specializes in industry-specific AI applications

Long-Term Trends and Potential Opportunities

As AI tools become more user-friendly and affordable, adoption will accelerate across smaller enterprises and startups. A good way to benefit from this would be to focus on companies offering AI platforms for SMEs, like Snowflake (SNOW.US) or HubSpot (HUBS.US).

Moving AI processing closer to devices (e.g., IoT and smartphones) will reduce latency and improve performance. There are companies that focus on edge AI hardware that makes this possible such as Qualcomm (QCOM.US) and Marvell Technology (MRVL.US)

Energy-efficient AI systems will gain prominence as environmental concerns grow. ESG focused companies and companies that prefer the use of “green AI” such as Google (GOOGL.US), which uses renewable energy to power their AI data centers, could be the advantageous position especially since green focus will be almost inevitable given the consumption of energy AI development entails.

In the future, Industries like healthcare, agriculture, and education will benefit from tailored AI applications. It will be good to diversify across industries to capitalize on niche AI advancements, some ETFs that do this are:

- iShares Robotics and Artificial Intelligence ETF (IRBO.US)

- Global X Artificial Intelligence & Technology ETF (AIQ.US)

- ARK Autonomous Technology & Robotics ETF (ARKQ.US)

- First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT.US)

- VanEck Semiconductor ETF (SMH.US)

- SPDR S&P Kensho New Economies Composite ETF (KOMP.US)

Conclusion

Artificial Intelligence is reshaping industries and driving economic growth, with the global AI market projected to exceed $1 trillion by 2030.

To capitalise on AI’s potential, investors must:

- Stay informed about evolving trends, opportunities, and risks.

- Diversify across the AI ecosystem (hardware, software, applications).

- Prioritise ethical and sustainable AI investments.

The AI revolution presents unparalleled investment potential. By investing wisely and responsibly, investors can shape the future while achieving meaningful returns.

Start trading on POEMS! Open a free account here!

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

Sources/References (For all 3 parts)

- [1] Goodfellow, I., Bengio, Y., & Courville, A. (2016). Deep Learning. MIT Press.

- [2] LeCun, Y., Bengio, Y., & Hinton, G. (2015). Deep Learning. Nature.

- [3] Russell, S., & Norvig, P. (2020). Artificial Intelligence: A Modern Approach. Pearson.

- [4] Newell, A.; Shaw, J.C.; Simon, H.A. (1959). Report on a general problem-solving program. Proceedings of the International Conference on Information Processing. pp. 256–264.

- [5] Silver, D., et al. (2016). “Mastering the game of Go with deep neural networks and tree search.” Nature.

- [6] DeepMind’s official AlphaGo webpage: https://deepmind.com/research/highlighted-research/alphago

- [7] Brown, T., et al. (2020). “Language Models Are Few-Shot Learners.” arXiv.

- [8] OpenAI’s official GPT webpage: https://openai.com

- [9] Vaswani, A., et al. (2017). “Attention Is All You Need.” arXiv.

- [10] Devlin, J., et al. (2018). “BERT: Pre-training of Deep Bidirectional Transformers for Language Understanding.” arXiv.

- [11] 11. https://blogs.microsoft.com/blog/2023/01/23/microsoftandopenaiextendpartnership/

- [12] 12. https://azure.microsoft.com/en-us/blog/category/ai-machine-learning/

- [13] https://www.tensorflow.org/

- [14] https://responsible-ai-developers.googleblog.com/

- [15] https://www.apollo.auto/apollo-self-driving

- [16] https://ai.baidu.com/

- [17] https://c3.ai/

- [18] https://www.uipath.com/

- [19] https://blogs.nvidia.com/blog/category/generative-ai/

- [20] https://www.amd.com/en/solutions/ai.html

- [21] https://investor.tsmc.com/english

- [22] https://aws.amazon.com/sagemaker-ai/

- [23] https://www.clouddefense.ai/glossary/aws/elastic-inference

- [24] https://docs.aws.amazon.com/sagemaker/latest/dg/whatis.html

- [25] https://azure.microsoft.com/en-us/solutions/ai/

- [26] https://ai.google/

- [27] https://www.usenix.org/system/files/conference/osdi16/osdi16-abadi.pdf

- [28] https://cloud.google.com/vertex-ai

- [29] https://openai.com/news/research/

- [30] https://www.ebi.ac.uk/training/online/courses/alphafold/an-introductory-guide-to-its-strengths-and-limitations/what-is-alphafold/

- [31] https://bostondynamics.com/atlas/

- [32] https://www.nxp.com/

- [33] https://www.tempus.com/oncology/

- [34] https://newsnetwork.mayoclinic.org/discussion/mayo-clinics-clinical-trial-matching-project-sees-higher-enrollment-in-breast-cancer-trials-through-use-of-artificial-intelligence/#:~:text=In%20the%2011%20months%20after,compared%20with%20traditional%20manual%20methods.

- [35] https://www.nytimes.com/2019/04/15/health/medical-scans-butterfly-iq.html

- [36] https://www.butterflynetwork.com/?srsltid=AfmBOorjVWuADVe-oEe1EH2q5mqEsgFgCLctu_aR5b6b3LsmkQIwJqqu

- [37] https://pmc.ncbi.nlm.nih.gov/articles/PMC9786074/

- [38] https://www.independent.co.uk/news/business/news/jp-morgan-software-lawyers-coin-contract-intelligence-parsing-financial-deals-seconds-legal-working-hours-360000-a7603256.html

- [39] https://tech.walmart.com/content/walmart-global-tech/en_us/blog/post/walmarts-ai-powered-inventory-system-brightens-the-holidays.html

- [40] https://www.alibabacloud.com/en/solutions/supply-chain/dchain?_p_lc=1

- [41] https://hbr.org/sponsored/2021/12/how-ai-is-enabling-self-learning-factories

- [42] https://press.siemens.com/global/en/pressrelease/generative-artificial-intelligence-takes-siemens-predictive-maintenance-solution-next

- [43] https://www.gevernova.com/software/products/asset-performance-management/asset-reliability?utm_source=google_g&utm_medium=paid-search&utm_campaign=PGOG-PG&OG-APM_Reliability-GLOB-Search&utm_content=Digital%20Twin%20Brand&utm_term=ge%20digital%20twin_p&ad=719707646594&placement=&device=c&location=2702&gad_source=1&gclid=Cj0KCQiAs5i8BhDmARIsAGE4xHxNkTWqVP9jABm_4Ht1WgSrkqsiwhcomLeekoTcjAHeitsBpP0CBIsaArLvEALw_wcB

- [44] https://www.productmonk.io/p/aws-success-secrets-from-startup-to-titan-473d04d0b889a9d0

- [45] https://jdcorporateblog.com/jd-logistics-won-an-ai-innovation-award/

- [46] https://www.cnbc.com/2019/11/12/google-project-nightingale-hospital-data-deal-raises-privacy-fears.html

- [47] https://www.wsj.com/articles/google-s-secret-project-nightingale-gathers-personal-health-data-on-millions-of-americans-11573496790

- [48] https://cams.mit.edu/wp-content/uploads/capitalonedatapaper.pdf

- [49] https://postgraduateeducation.hms.harvard.edu/trends-medicine/confronting-mirror-reflecting-our-biases-through-ai-health-care#:~:text=For%20example%2C%20an%20AI%20used,cost%20data%2C%20not%20care%20needs.

- [50] https://www.reuters.com/article/world/insight-amazon-scraps-secret-ai-recruiting-tool-that-showed-bias-against-women-idUSKCN1MK0AG/

- [51] https://www.bbc.com/news/business-43459156

- [52] https://pmc.ncbi.nlm.nih.gov/articles/PMC8320316/

- [53] https://www.bbc.com/news/technology-67022005

- [54] https://www.oxfordmartin.ox.ac.uk/blog/automation-and-the-future-of-work-understanding-the-numbers

- [55] https://www.bbc.com/news/technology-36376966

- [56] https://newsroom.ibm.com/2025-01-07-ibm-study-ai-spending-expected-to-surge-52-beyond-it-budgets-as-retail-brands-embrace-enterprise-wide-innovation

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Global Markets Desk (Asia Market)

The Global Markets Desk Asia Market Dealing team specializes in managing Asia Markets, covering key regions like Greater China, Malaysia, Japan, Thailand, and others. In addition to executing client orders, they also provide educational content through market journals and webinars, offering insights into macroeconomics, stock picks, and technical analyses for the Asia market landscape.

Shopify Inc. Upgraded to Buy on Strong AI-Powered Growth Prospects

Shopify Inc. Upgraded to Buy on Strong AI-Powered Growth Prospects  Singapore Budget 2026 Signals Strategic AI Pivot, Equity Boost

Singapore Budget 2026 Signals Strategic AI Pivot, Equity Boost  DBS Group Holdings Ltd Upgraded to Accumulate Despite Earnings Decline

DBS Group Holdings Ltd Upgraded to Accumulate Despite Earnings Decline  Elite UK REIT Shows Strong Performance with Successful Lease Regearing

Elite UK REIT Shows Strong Performance with Successful Lease Regearing