Bank of America Shows Strong Growth Momentum with Record Net Interest Income January 29, 2026

Company Overview

Bank of America Corporation (BOA) stands as one of America’s largest financial institutions, operating across multiple segments including consumer banking, global markets, investment and brokerage services, and wealth management. The bank maintains a diversified revenue stream with its substantial investment and brokerage segment contributing approximately 18% of total revenue, positioning it well to capitalise on market volatility and capital markets activity.

Strong Fourth Quarter Performance

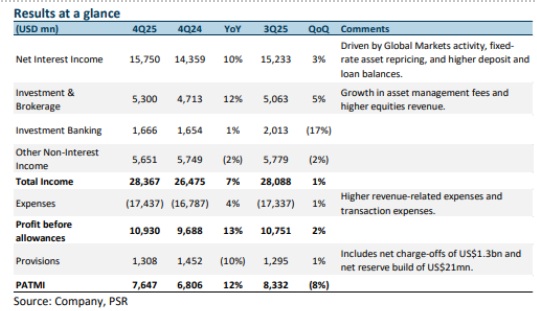

Bank of America delivered solid fourth quarter 2025 results with profit after tax and minority interests (PATMI) rising 12% year-over-year to US$7.6 billion. While earnings came in slightly below analyst estimates, full-year 2025 earnings reached 95% of forecasted levels. The bank demonstrated its commitment to shareholder returns by raising its dividend per share 8% year-over-year to US$0.28 and conducting US$6.3 billion in common stock net repurchases during the quarter, significantly higher than the US$3.5 billion repurchased in the same period last year.

Record Net Interest Income Drives Growth

The quarter’s standout performance came from record net interest income(NII), which surged 10% year-over-year, driven by robust Global Markets activity, fixed-rate asset repricing, and increased deposit and loan balances. This strong NII performance formed the foundation of the bank’s earnings growth, complemented by a 12% year-over-year recovery in investment and brokerage revenue and a 10% year-over-year decline in provisions.

Positive Outlook and Investment Thesis

BAC’s management has provided encouraging guidance for fiscal year 2026, projecting NII growth of 5-7% supported by continued fixed-rate asset repricing and deposit and loan growth. First quarter 2026 NII is expected to grow approximately 7% year-over-year, though expenses are anticipated to rise by around 4% year-over-year.

Research Recommendation

Phillip Securities Research maintains an ACCUMULATE recommendation on BAC with a raised target price of US$60, up from the previous US$56 target. The valuation assumes a 1.48x FY26e price-to-book value multiple and a 15.3% return on equity estimate. The research firm expects growth drivers to include higher NII from fixed-asset repricing and loan growth recovery, continued wealth management fee growth, higher global markets revenue from increased volatility, and a slower pace of expense growth.

Frequently Asked Questions

Q: What was Bank of America’s fourth quarter 2025 profit performance?

A: Bank of America’s PATMI rose 12% year-over-year to $7.6 billion in 4Q25, though it was slightly below estimates. Full-year 2025 earnings reached 95% of forecasted levels.

Q: What drove the bank’s earnings growth in the fourth quarter?

A: Earnings growth was primarily driven by record net interest income that increased 10% year-over-year, a 12% year-over-year recovery in investment and brokerage revenue, and lower provisions that declined 10% year-over-year.

Q: What is the bank’s guidance for 2026?

A: Bank of America expects FY26e NII growth of 5-7% and 1Q26e NII growth of approximately 7% year-over-year, with 1Q26e expenses expected to rise by around 4% year-over-year.

Q: What is Phillip Securities Research’s recommendation and target price?

A: Phillip Securities Research maintains an ACCUMULATE recommendation with a raised target price of US$60, up from the previous US$56 target, based on rolling valuations to FY26e.

Q: How did the bank return value to shareholders?

A: Bank of America raised its dividend per share 8% year-over-year to US$0.28 and conducted US$6.3 billion in common stock net repurchases in 4Q25, compared to US$3.5 billion in 4Q24.

Q: What are the expected growth drivers for 2026?

A: Expected FY26e growth drivers include higher NII from fixed-asset repricing and loan growth recovery, continued wealth management fee growth, higher global markets revenue from increased volatility, and slower expense growth.

Q: What makes Bank of America attractive as an investment?

A: The research house likes BAC for its substantial investment and brokerage segment representing approximately 18% of revenue and its ability to maintain stable NII during periods of market volatility.

This article has been auto-generated using PhillipGPT. It is based on a report by a Phillip Securities Research analyst.

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Glenn Thum

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.