Buffer ETFs — What Are They and How Do They Work? December 16, 2025

Introduction to Buffer ETFs

Buffer ETFs are constructed using options and are also known as defined-outcome ETFs, offering investors a preset range of potential returns and risks over a typical one-year period. In other words, they’re designed to limit downside losses while still allowing you to stay invested in the market. Think of them as a way to smooth out volatility without completely giving up growth opportunities.

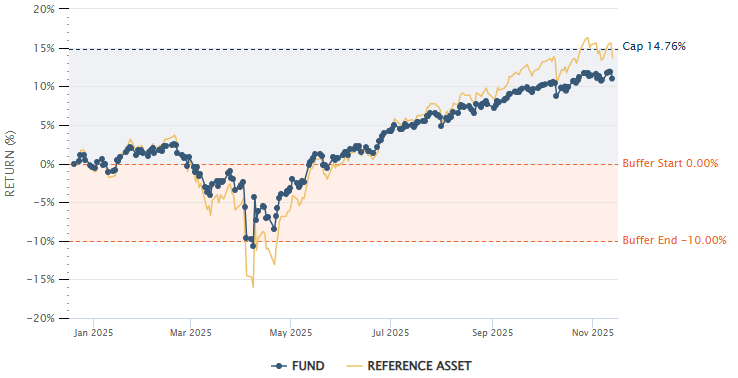

First Trust Vest US Equity Buffer ETF – December 2025 (FDEC)

First Trust Vest US Equity Buffer ETF – December 2025 (FDEC)

Here’s a quick illustration:

FDEC.US offers up to 14.76% potential upside while absorbing the first 10% of market losses. This allows investors to participate in potential growth with a built-in buffer. If SPY.US finishes the outcome period with returns between 0% and –10%, the investor would not incur losses (before fees).

Overview of MAS SIP Requirements

As Buffer ETFs use more complex structures, they fall under Specified Investment Products (SIPs). This means investors must demonstrate a certain level of knowledge before trading them.

Since 2012, in alignment with the Monetary Authority of Singapore’s efforts to enhance trading protections for retail investors, brokers are required to assess an investor’s relevant knowledge and experience before permitting investments in SIPs.

As a result, investors must complete the Customer Account Review (CAR) eligibility form before being allowed to invest in listed SIPs. If you’re new to these products, you can build your understanding by completing the SIP product knowledge module offered through the SGX Academy to become eligible to trade.

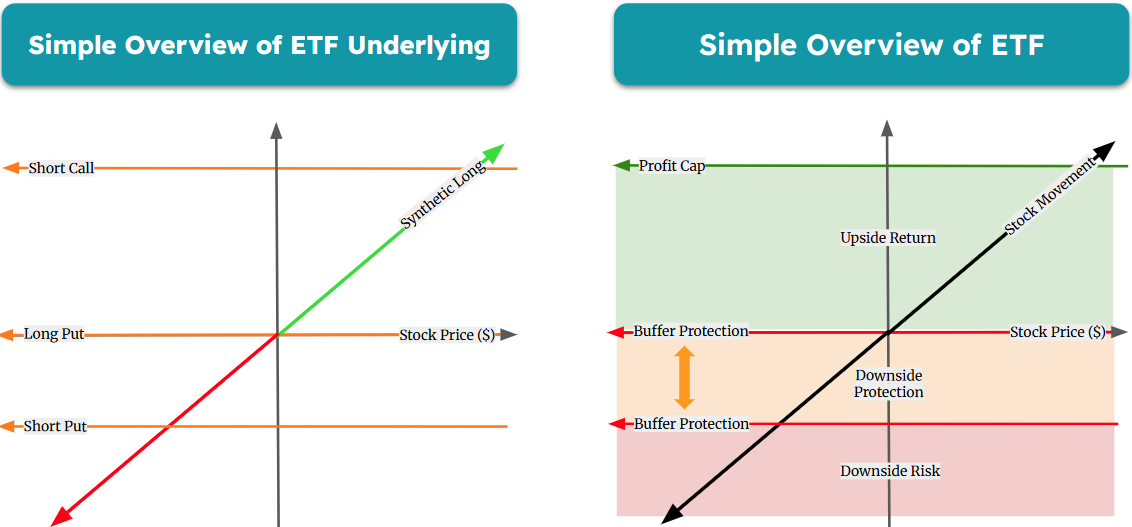

How does Buffer ETFs work?

Buffer ETFs achieve their defined outcomes through the use of options strategies, primarily by combining long and short options on market indices such as the S&P 500.

By understanding how these option combinations work, you can better appreciate how the ETF is constructed and how its risk-reward profile is designed. This makes it easier to evaluate whether a Buffer ETF aligns with your investment goals, especially in volatile market conditions.

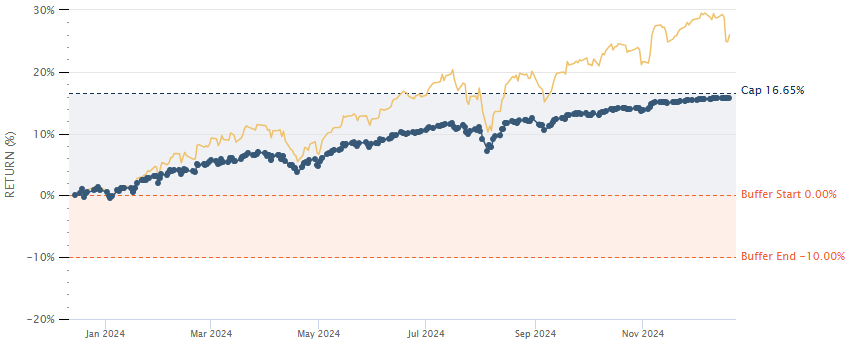

First Trust Vest US Equity Buffer ETF – December 2024 (FDEC)

First Trust Vest US Equity Buffer ETF – December 2024 (FDEC)

The payoff structure of FDEC.US can be visualised via the risk-return chart available on the First Trust website, as well as those of other Buffer ETF issuers. The diagram illustrates how the downside buffer and upside cap interact to shape investor outcomes over the defined outcome period.

According to the fund’s Objective/Strategy section, FDEC.US aims to deliver returns (before fees and expenses) that match the price return of the SPY ETF (which tracks the SP500 index), up to a predetermined upside cap of 14.76%, while providing a 10% buffer against the first losses of the reference asset for the outcome period from 23 December 2024 to 19 December 2025.

Buffer ETFs, such as FDEC.US, typically reset annually. The options contracts that underpin the buffer-cap structure expire at the end of the outcome period, after which a new outcome period begins with newly defined cap and buffer levels, based on prevailing interest rates and market volatility.

Investors can hold the ETF through the expiry of one period and into the next; however, it is essential to note that the cap and buffer terms may vary from one period to the next.

Why Buffer ETFs Are Designed for Long-Term Investors

Buffer ETFs work best when held for the entire outcome period, as this allows the built-in options strategy to fully deliver the intended balance between downside protection and capped upside participation. Entering or exiting mid-period can result in different outcomes from those originally designed.

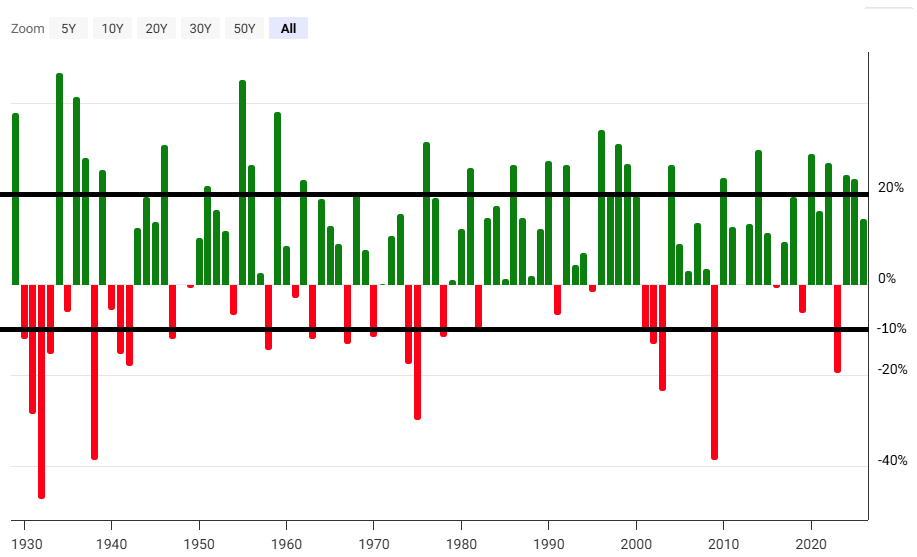

S&P 500 Historical Annual Returns (1927-2025)Source: Macrotrends

S&P 500 Historical Annual Returns (1927-2025)Source: Macrotrends

Looking at the historical data, the S&P 500 has delivered strong average returns over time. While positive years are more common, market downturns can still occur, and the index is typically down by around 10% during negative periods. Therefore, Buffer ETFs may serve as a useful tool for managing downside risk, given the built-in buffer.

The Drawbacks and Risks of Buffer ETFs

1. Limited Upside (Capped Returns)

Buffer ETFs offer downside protection but cap upside potential. If the market rallies strongly, investors will not fully participate, resulting in an opportunity cost compared to traditional index ETFs.

2. Protection Only Works Within a Specific Outcome Period

Each Buffer ETF operates within a defined outcome period (typically one year). The buffer and upside cap apply only when the ETF is held for the full period, due to the structure of the underlying options.

- Selling before the end of the outcome period may lead to unexpected losses or reduced gains.

- Buying mid-cycle may result in a partially utilised buffer or a lower effective cap.

3. The Buffer Can Be “Used Up”

If the underlying index declines more than the stated buffer (e.g., a 10% buffer versus a 20% market drop), the ETF will begin to experience losses beyond the protected range. The buffer does not eliminate all downside risk.

4. Potential Underperformance in Flat or Choppy Markets

When markets are sideways or mildly volatile, the combination of capped upside and embedded options costs can cause Buffer ETFs to underperform a standard index ETF tracking the same benchmark.

5. Higher Expense Ratios

Buffer ETFs generally carry higher management fees, typically around 0.5% to 1%, compared with traditional S&P 500 ETFs, which often charge less than 0.05%.

6. Return Lag in Volatile Markets

Because Buffer ETFs are constructed using options, sharp market movements can cause pricing lag due to changes in option premiums.

For example, if the S&P 500 (SPY.US) rises 5% during a volatile period, a corresponding Buffer ETF might rise only around 4.2%, depending on where it is in its outcome period and how its options are priced.

List of Buffer ETFs

Buffer ETFs are designed to provide downside protection while allowing investors to participate in market gains, making them an attractive choice for those seeking a more controlled approach to equity investing. Below is a list of popular Buffer ETFs available in the market:

| Issuer | Underlying | Offered | Buffer ETFs | Ticker Code |

| First Trust | SPY | Monthly | 10% Buffer | FJAN, FFEB, FMAR, FAPR, FMAY, FJUN, FJUL, FAUG, FSEP, FOCT, FNOV, FDEC |

| iShares | IVV | Quarterly | 10% Buffer | STEN, TEND, TENM, TENJ |

| First Trust | QQQ | Quarterly | 10% Buffer | QMAR, QJUN, QSPT, QDEC |

| First Trust | EFA | Quarterly | 10% Buffer | YMAR, YJUN, YSEP, YDEC |

These ETFs are suited to investors seeking strategic market exposure with controlled risk, particularly in volatile market environments.

Should You Invest in a Buffer ETF?

Buffer ETFs can be an attractive choice for investors looking to gain exposure to equity markets while actively managing risk. These ETFs offer built-in downside protection, which can help mitigate the impact of moderate market declines and provide clearly defined potential gains and losses over a fixed outcome period.

They are particularly suited for investors with a tactical investment approach who intend to hold the ETF for the full outcome period to fully benefit from the buffer structure. By tracking major indices such as the S&P 500 or the Nasdaq 100, Buffer ETFs also offer diversified exposure to both US and international equities.

However, investors should be aware that the upside returns are capped, meaning they may miss out on large market rallies, and that early exits or mid-cycle purchases can reduce the effectiveness of the protection. In addition, higher expense ratios and embedded option costs can slightly impact returns compared with traditional ETFs.

Overall, Buffer ETFs are best viewed as a complement to a broader investment portfolio, offering a balance between growth potential and controlled downside risk, particularly in uncertain or volatile market conditions.

Start Your Global Investment Journey Today! Open an account with POEMS and take the first step toward a diversified, globally-focused portfolio!

For more information about trading on POEMS, you can visit our website or reach out to our Night Desk representatives at 6531 1225.

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Global Markets Desk US Dealing Team

The Global Markets Desk US Dealing team specialise in handling the US Markets in the Global Markets Desk.

Their responsibilities and capabilities extend from managing and taking orders from clients trading in the US market, to content generation, Technical Analysis and providing educational content to POEMS clients.

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection  ETF Market Review: February Outlook Signals Strong Performance

ETF Market Review: February Outlook Signals Strong Performance  ETF Market Analysis: Oil & Hang Seng Set for January Gains

ETF Market Analysis: Oil & Hang Seng Set for January Gains  ETF Market Review: Most ETFs up in November; gold expected to extend recent gains

ETF Market Review: Most ETFs up in November; gold expected to extend recent gains