Disney Maintains Strong Growth Trajectory with IP-Driven Strategy February 13, 2026

Company Overview

The Walt Disney Company stands as a global entertainment conglomerate renowned for its integrated intellectual property ecosystem. The company operates across multiple segments including entertainment production, streaming services through Disney+, and world-class theme park experiences. Disney’s core strength lies in its ability to monetise beloved franchises across its diverse platform portfolio, creating a powerful flywheel effect that drives sustained revenue growth.

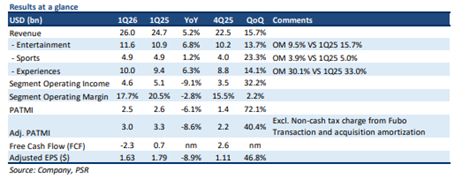

Strong Financial Performance Meets Expectations

Disney’s first quarter 2026 results demonstrated solid execution, with both revenue and adjusted profit after tax and minority interests aligning with analyst expectations. The quarter represented 25% of full-year revenue forecasts and 26% of profit projections for fiscal 2026. Revenue growth accelerated 16% year-over-year, propelled by robust performance across entertainment operations, which expanded 7% annually, and experiences division growth of 6.3%. However, the company reported negative free cash flow for the first time in three years, attributed to elevated capital investment levels and timing-related factors.

Investment Recommendation and Outlook

Phillip Securities Research has upgraded Disney to a BUY rating from ACCUMULATE, maintaining an unchanged target price of US$130. This upgrade reflects recent price performance while acknowledging the company’s fundamental strengths. The research firm’s fiscal 2026 forecasts, terminal growth assumptions, and weighted average cost of capital projections remain unmodified, indicating confidence in the underlying business model.

**Key Investment Merits Drive Long-Term Value**

Disney’s integrated IP flywheel continues to demonstrate exceptional monetisation capabilities across its ecosystem. The company generated over US$6.5 billion in global box office revenue during 2025, reinforcing its position as the leading global studio for nine of the past ten years.

Flagship releases including Zootopia 2, which achieved over US$1.7 billion in global box office receipts as Hollywood’s highest-grossing animated film, and Avatar: Fire and Ash with over IS$1 billion globally, exemplify

the effectiveness of this strategy.

The streaming business has reached a profitability inflection point, with the Direct-to-Consumer segment delivering 12% annual revenue growth and over 50% earnings expansion. Management projects achieving 10% streaming margins in fiscal 2026, up from approximately 5% in fiscal 2025, supported by strategic pricing actions and successful bundled offerings.

Key Takeaways

Q: What was Disney’s financial performance in Q1 2026?*

A: Disney’s Q1 2026 revenue and adjusted profit after tax met expectations, representing 25% of full-year revenue estimates and 26% of profit projections. Revenue grew 16% year-over-year driven by entertainment (+7%) and experiences (+6.3%) growth.

Q: Why did Disney experience negative free cash flow?

A: Disney reported negative free cash flow for the first time in three years due to elevated investment levels and timing effects, reflecting the company’s heavy ongoing investment in parks, cruises, and new IP-led attractions.

Q: What is Phillip Securities Research’s current recommendation for Disney?

A: Phillip Securities Research upgraded Disney to BUY from ACCUMULATE with an unchanged target price of US$130, citing recent price performance while maintaining confidence in the company’s long-term growth prospects.

Q: How successful was Disney’s box office performance in 2025?

A: Disney generated over US$6.5 billion in global box office revenue in 2025, maintaining its position as the #1 global studio for nine of the past ten years, with major successes including Zootopia 2 (US$1.7+ billion) and Avatar: Fire and Ash (US$1+ billion).

Q: What progress has Disney made in streaming profitability?

A: Disney’s Direct-to-Consumer business continued showing profitability with 12% revenue growth and over 50% earnings growth year-over-year, driven by pricing actions, improved plan mix, and successful bundled offerings.

Q: What are Disney’s streaming margin targets?

A: Management has guided towards achieving streaming margins of approximately 10% in fiscal 2026, up from around 5% in fiscal 2025.

Q: How does Disney’s IP strategy create value across platforms?

A: Disney monetises its franchises across theatrical releases, streaming platforms, and theme park attractions. Successful films drive streaming engagement and park visitation, with prior Zootopia and Avatar titles generating approximately one million first-time streams and hundreds of millions of viewing hours on Disney+.

Q: What factors are driving growth in Disney’s streaming business?

A: Streaming growth is driven by strategic pricing actions, improved plan mix, strong uptake of bundled offerings (Duo, Trio, and Max bundle), higher average revenue per user, lower customer churn, and scaling advertising revenue from growing ad-supported subscriber base.

This article has been auto-generated using PhillipGPT. It is based on a report by a Phillip Securities Research analyst.

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Helena Wang

Helena covers Hardware/Marketplaces/ETF. Helena graduated with a master's degree in Financial Technology from Nanyang Technological University.