Earn While You Wait: A Guide to Cash-Secured Puts June 30, 2025

Options strategies can seem complex at first glance, but some are surprisingly straightforward and can complement a long-term investment approach. One such strategy is the cash-secured put—a method often used by investors who are open to owning a particular stock and want to generate income while they wait. Whether you’re new to options or seeking more efficient ways to deploy capital, understanding how cash-secured puts work can help you make more informed trading decisions.

Understanding cash-secured puts

A cash-secured put is an options strategy in which an investor sells a put option while setting aside enough cash to purchase the underlying stock if assigned. When a put option is sold, the seller agrees to buy a stock at a predetermined strike price if the buyer exercises the option before or upon expiration. By placing the trade with cash equivalent to the strike price multiplied by 100 shares (each options contract represents 100 shares), the seller ensures that the obligation can be met if assigned.

Cash-Secured Puts in Action

Scenario 1: Put expire worthless

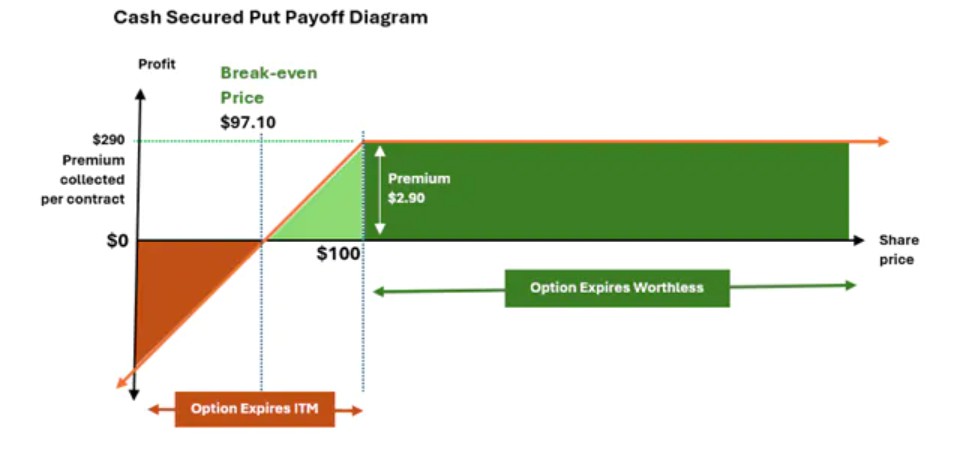

An investor sells a Microsoft (MSFT) $100 cash-secured put expiring on 18 Jan, based on a willingness to purchase MSFT stock at $100 per share. The investor collects a premium of $2.90 per share, or $290 total at the time of the sale. If MSFT remained above the $100 strike price at expiration, the put option would expire worthless. The investor retains the full premium without being obligated to purchase the stock.

Scenario 2: Assigned the stock

The same investor sells the Microsoft (MSFT) $100 cash-secured put for a $2.90 premium. If MSFT trades below $100 at expiration, the option is in the money, and the seller is assigned the stock. The investor must buy 100 shares at $100 each but keep the $290 premium received from selling the option, effectively lowering the purchased price to $97.10 per share.

Benefits of cash-secured puts

The primary benefit of selling cash-secured puts is generating income through the premium collected regardless if the option is exercised or not. Additionally, the strategy allows investors to potentially purchase stocks they already want to own at a discount. If the stock drops below the strike price, the investor is assigned the shares but acquires them at an effective cost that is lower than the market price at the time of the option sale, thanks to the premium received. Another key benefit is the defined and limited risk; since the trade is fully backed by cash, there’s no risk of a margin call.

Potential Trade-offs and Drawbacks

While cash-secured puts are considered a conservative and income-oriented strategy, they come with certain trade-offs. One of the primary limitations is the capped upside potential. The maximum profit is limited to the premium received. Unlike owning the stock directly, the seller does not benefit from any capital appreciation beyond the strike price. Additionally, the strategy requires the seller to set aside a substantial amount of cash to cover a potential stock purchase. This can lead to opportunity costs, particularly in strong bull markets. Suppose the stock falls significantly below the strike price. In that case, the seller may be assigned and required to purchase the shares at a price well above the market value, resulting in paper losses, although partially offset by the premium.

Conclusion

Cash-secured puts offer an attractive, lower-risk strategy for investors who are both income-oriented and open to acquiring shares at a discount. While the gains are capped and the capital tied up, the trade offers a defined risk profile, the potential for enhanced entry pricing and a way to earn passive income. Investors should weigh these trade-offs carefully, especially in volatile or strongly rising markets.

For more information on trading the US markets through POEMS, visit our website or contact our Night Desk representatives at 6531 1225(available from 2 PM onwards). Don’t wait—register your account today and take the first step toward accessing these exciting markets!

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Global Markets Desk US Dealing Team

The Global Markets Desk US Dealing team specialise in handling the US Markets in the Global Markets Desk.

Their responsibilities and capabilities extend from managing and taking orders from clients trading in the US market, to content generation, Technical Analysis and providing educational content to POEMS clients.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile